Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

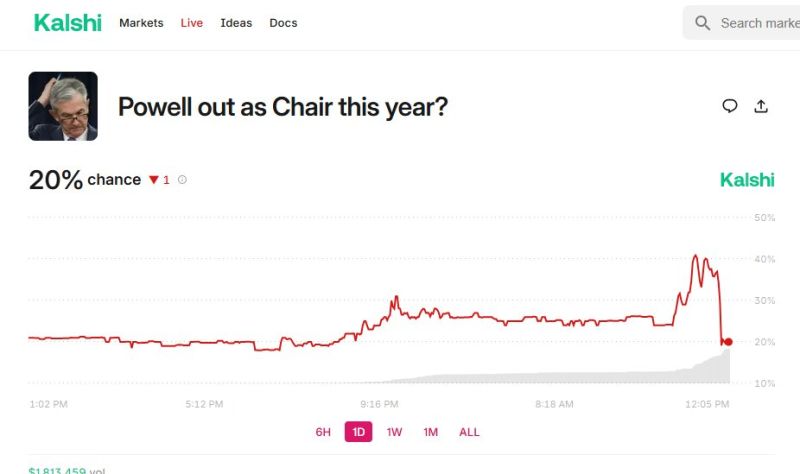

Pop n drop... Powell canned odds from 20% to 40% to 20%

Source: Mike Zaccardi, CFA, CMT, MBA

What a mess... 🤡

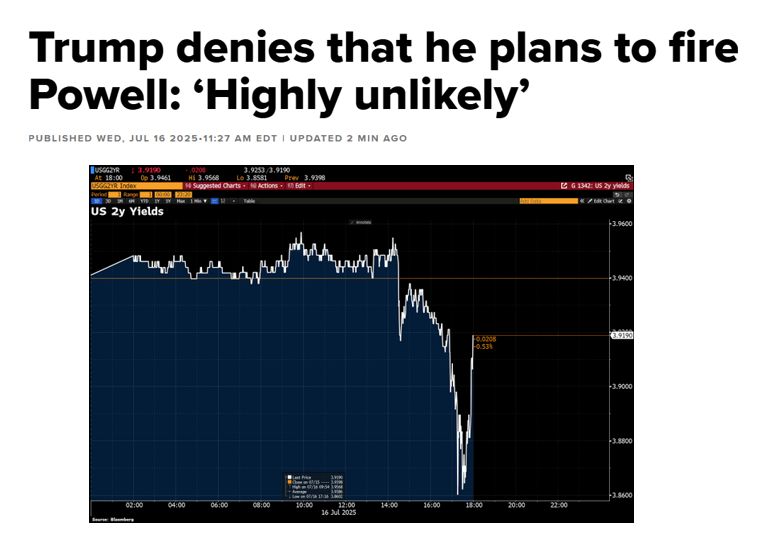

*TRUMP ON FED CHAIR POWELL: WE ARE NOT PLANNING ON DOING ANYTHING *TRUMP ON POWELL: WE GET TO MAKE A CHANGE IN 8 MONTHS US 2-year hashtag#yields bounced back after President Trump says his administration is “very concerned”, but “not planning on doing anything” about Fed Chair Jerome Powell. Source: CNBC, Bloomberg, HolgerZ

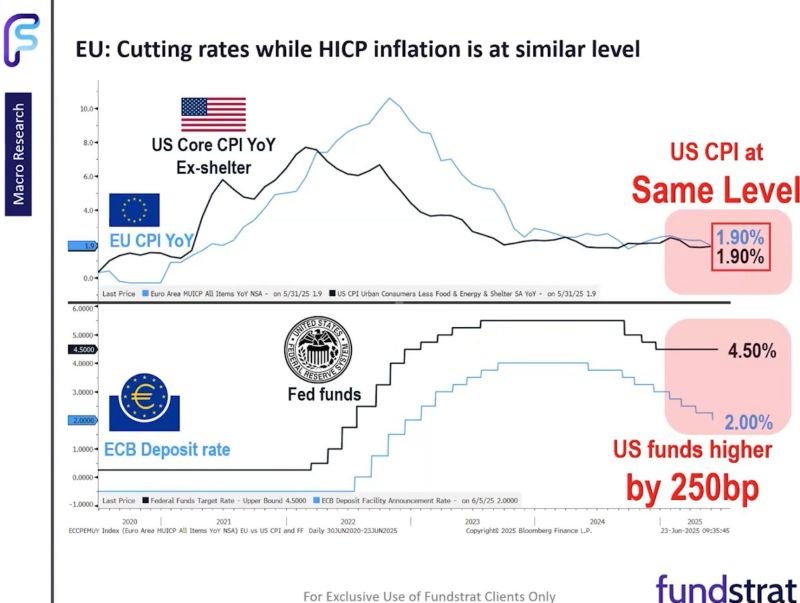

This is probably what Trump doesn't like with the latest US inflation reports and subsequent inaction by the fed.

The EU inflation rate excludes shelter, do the same with US CPI, and they match. Yet Fed Funds is 250bps higher than the ECB rate. What Trump does not take into account is that the inflationary effects of tariffs might soon hit. Source: Mike Zaccardi, CFA, CMT, MBA, Fundstrat

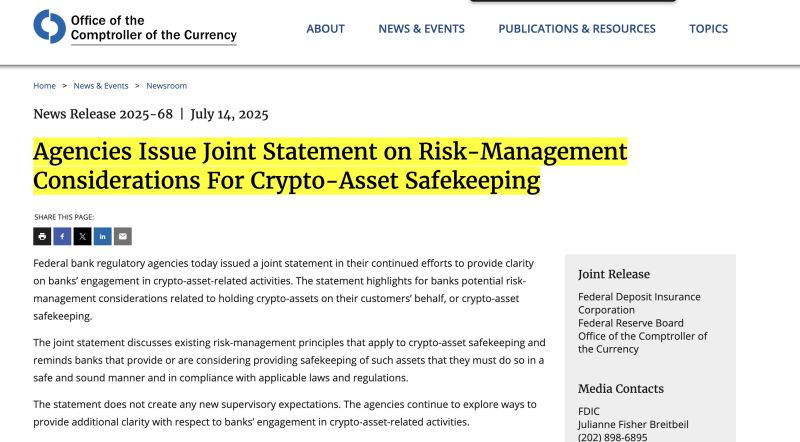

Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody.

Source: Bitcoin archive

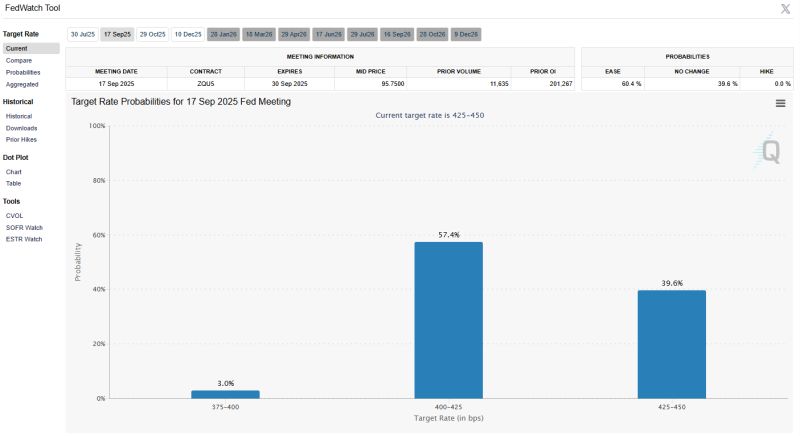

The odds of a Fed rate cut by September have fallen to just 60%. A few weeks ago, the odds were 94%

Source: Barchart

If Canada raises their tariffs, it will be whatever that rate is PLUS 35%. "Thank you for your attention to this matter." Source: Eric Daugherty on X

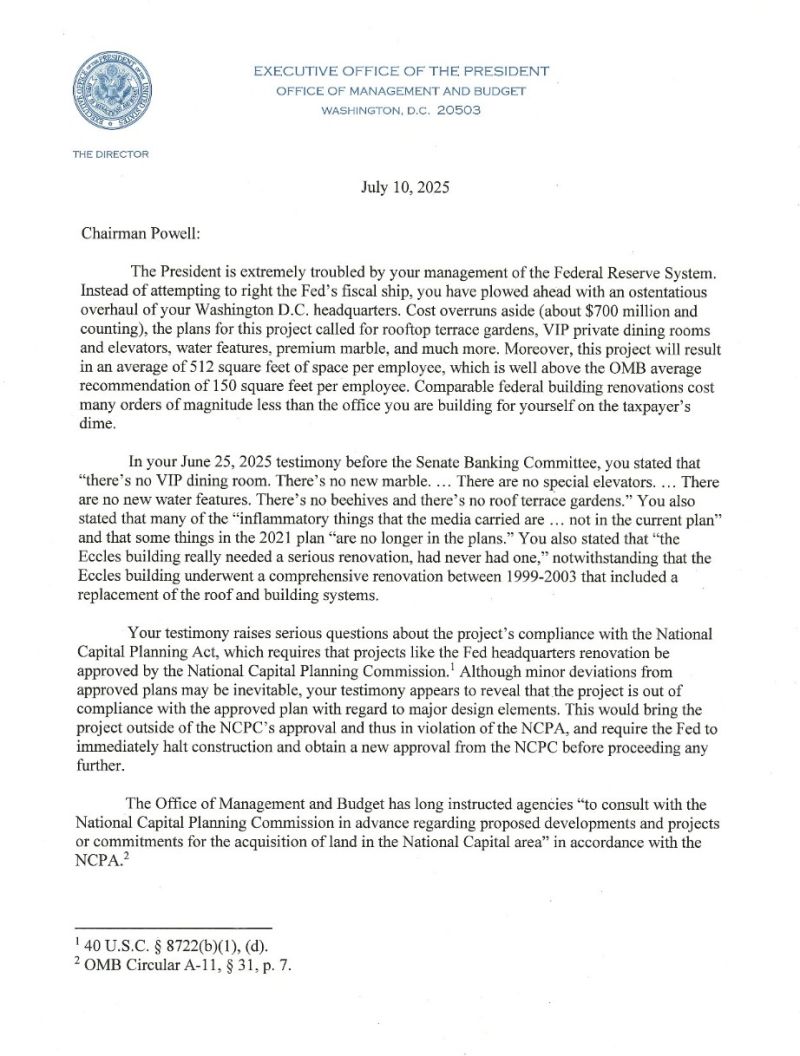

⚠️ Office of Management and Budget Director Russell Vought also suggested Powell had misled Congress about a pricey renovation of the central bank’s headquarters. ‼️ Vought’s broadside opens up a new front in the Trump administration’s war on the Fed chief. ➡️ Russ Vought: "Chairman Jerome Powell has grossly mismanaged the Fed. "While continuing to run a deficit since FY23 (the first time in the Fed's history), the Fed is way over budget on the renovation of its headquarters. Now up to $2.5 billion, roughly $700 million over its initial cost. These renovations include terrace rooftop gardens, water features, VIP elevators, and premium marble. The cost per square foot is $1,923--double the cost for renovating an ordinary historic federal building. The Palace of Versailles would have cost $3 billion in today's dollars! Unfortunately, Powell's recent testimony to Congress has led to serious questions that now require additional oversight from OMB, in conjunction with the National Capital Planning Commission. Today, I sent the letter below to Chairman Powell to get to the bottom of this largesse".

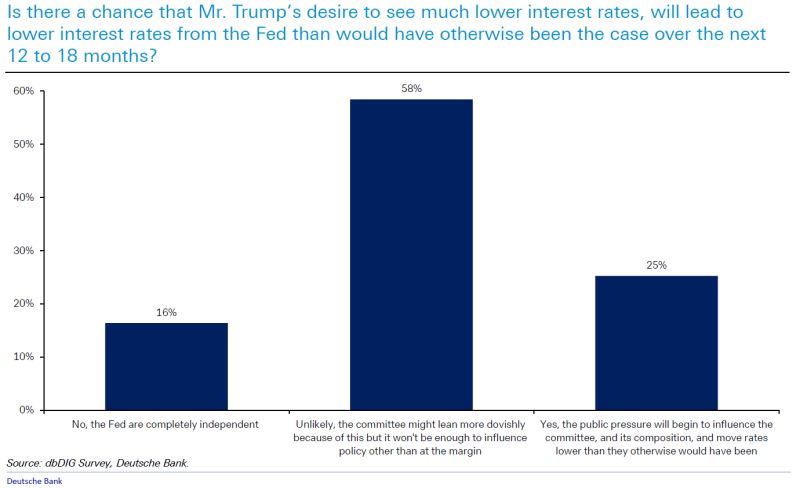

Only 16% of respondents in a recent Deutsche Bank survey believe the Fed is completely independent, with 25% seeing political pressure leading to lower rates.

Source: DB thru Liz Abramowicz

In case you missed it... As of July 1, 2025, gold will officially be classified as a Tier 1, high-quality liquid asset (HQLA) under the Basel III banking regulations.

That means U.S. banks can count physical gold, at 100% of its market value, toward their core capital reserves.

Investing with intelligence

Our latest research, commentary and market outlooks