Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it... As of July 1, 2025, gold will officially be classified as a Tier 1, high-quality liquid asset (HQLA) under the Basel III banking regulations.

That means U.S. banks can count physical gold, at 100% of its market value, toward their core capital reserves.

Top 10 largest central banks in the world

The World Rnking @worldranking_ on X

Majority of Fed Officials Leaning Against July Interest-Rate Cut -

Bloomberg

The next Fed Chair is going to be the biggest dove the world has ever seen...

Source: Spencer Hakimian on X

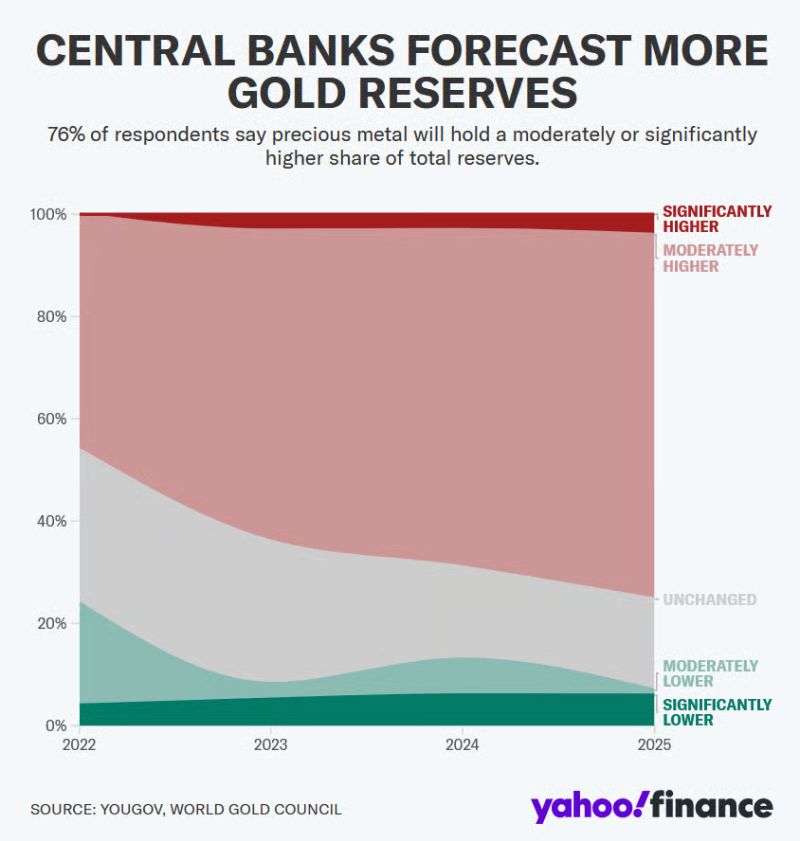

Central banks continue to DUMP the US Dollar for Gold:

95% of central banks expect global gold reserves to rise in the next year, according to a World Gold Council survey. A record 43% plan to boost their holdings. 73% expect USD reserves to decline over the next 5 years. Source: Global Markets Investor, Yahoo Finance

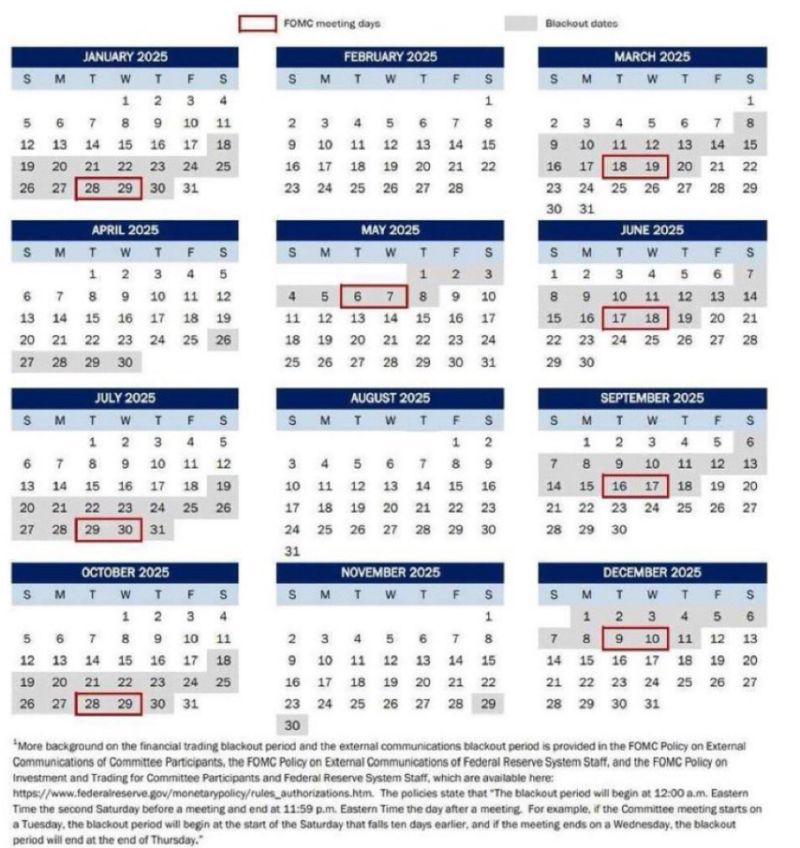

Blackout Period

Watch out for Jerome Powell's remarks this Wednesday.Then — the Fed enters a new phase:The blackout period ends Thursday, meaning Fed officials will be free to speak again starting Friday. source : evan

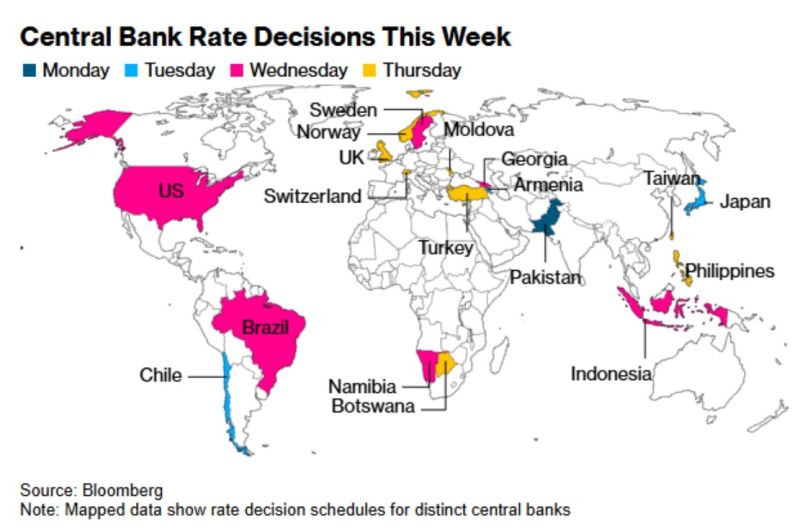

Central Bank Rate Decisions This Week

source : Bloomberg

On the back of lower than expected CPI (May) numbers, President Trump calls for the Fed to cut interest rates by "one full point." (i.e 4 rate cuts)

Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks