Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

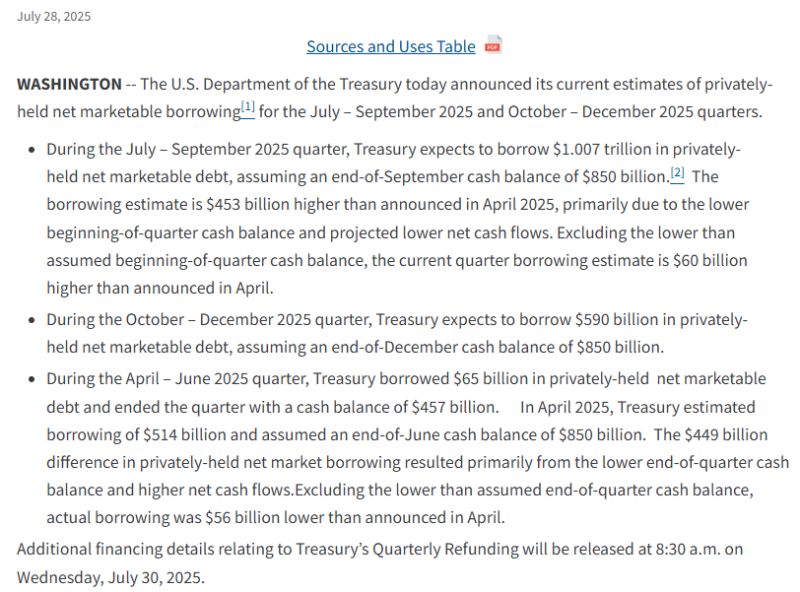

LIQUIDITY ALERT >>> The Treasury released their borrowing estimates.

$1.6T in net new debt issuance over the next two quarters. About $500B of it is the TGA refill. Source: Lyn Alden

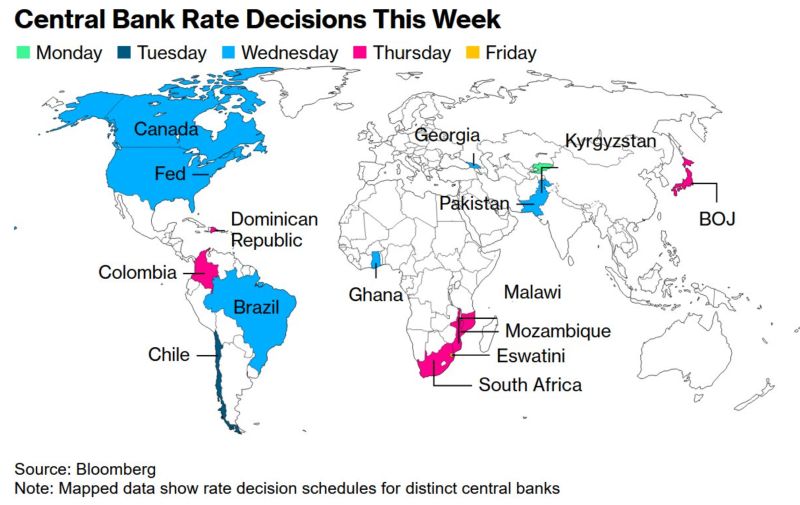

‼️ Pretty BIG week ahead in terms of central bank rate decisions

➡️ The Fed and the Bank of Canada are both expected to hold rates steady on Wednesday at 4.50% and 2.75%, respectively. ➡️The Bank of Japan is also anticipated to hold its rate unchanged at 0.5% on Thursday. Source: Bloomberg, Global Markets Investor

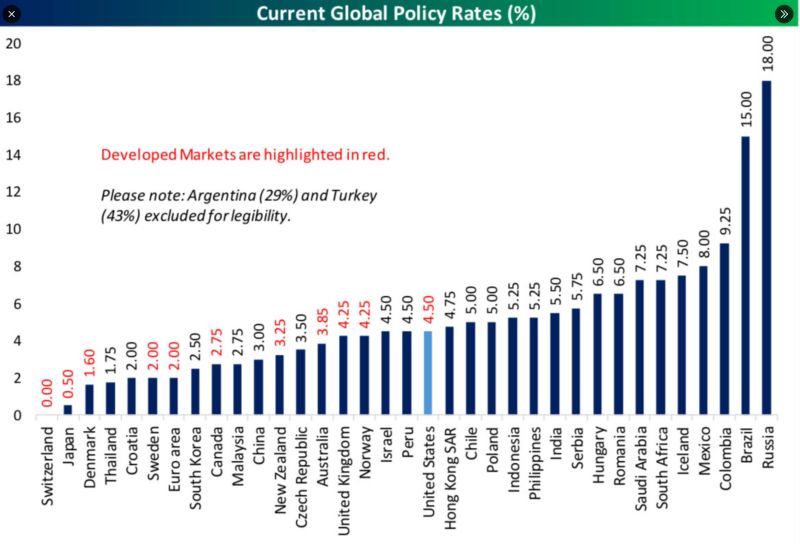

The US has the highest central bank rate of any developed market.

Here’s a detailed look at current global policy rates: Source: bespokeinvest

BREAKING >>> Trump spars with Powell over renovation costs during Fed visit, but says not ‘necessary’ to fire chairman

Trump: It looks like it’s about $3.1 billion Powell: I’m not aware of that. Trump: It just came out Powell: You just added in a third building Trump: It’s a building that’s being built Powell: It was built five years ago. Source: @SpencerHakimian

The US president will spend about an hour at the central bank, as he looks to pressure its chair Jay Powell to cut interest rates more aggressively.

Source: FT

Goldman:

"Market participants seem to agree that the risk to Fed independence is rising, as 5-year 5-year forward inflation swaps have recently decoupled higher from their prior close relationship with the 2-year note yield." Source: Nick Timiraos

US Treasury Secretary Scott Bessent has called for an inquiry into the “entire Federal Reserve institution”

In the latest sign of how top Trump administration officials are cranking up pressure on the central bank. “What we need to do is examine the entire Federal Reserve institution and whether they have been successful,” Bessent told CNBC on Monday. Bessent’s comments come as Donald Trump and his lieutenants have sharply criticised the Fed and its chair Jay Powell for refraining to cut borrowing costs this year. Trump last week asked a group of Republican lawmakers whether he should sack Powell, but later clarified that he had no plans to do so unless he needed to “leave for fraud”. Trump’s government has also recently opened a new front in their campaign against the Fed, with the president’s budget director Russell Vought repeatedly alleging that a $2.5bn renovation of the central bank’s headquarters has been grossly mismanaged. Bessent amped up his criticism of the Fed on Monday, saying that if the Federal Aviation Administration had made as many mistakes, “then we would go back and look at why this has happened”. The Fed inspector general is reviewing the renovation of its headquarters, which involves an overhaul of two buildings that overlook the National Mall and is $700mn over budget. Powell has also written to senior senators to explain how the US central bank is reining in costs. Source: FT

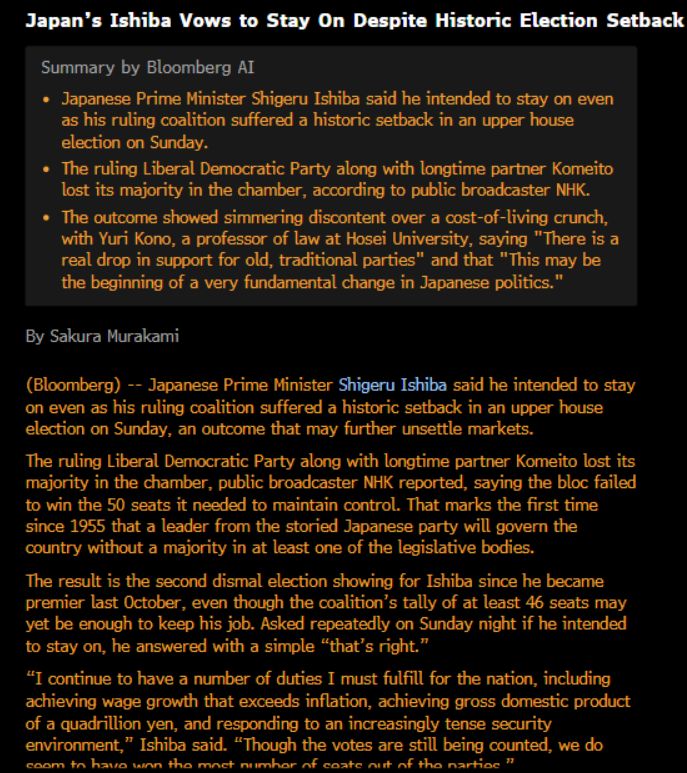

⚠️ Japan House of Councillors Election – Key Takeaways for Markets & Policy

▶️ Political Setback: PM Shigeru Ishiba’s LDP-led coalition failed to secure a majority, increasing political uncertainty and likely altering fiscal and monetary trajectories. ▶️ Market Impact: Greater opposition influence may push for looser monetary policy, pressuring the BOJ to delay rate hikes. This could weaken the Yen further (note that this is NOT market's first reaction as the yen is strengthening today) and push JGB yields higher ▶️Fiscal Concerns: Opposition-backed tax cuts and cash handouts could deepen Japan’s already high public debt burden, risking credit rating downgrades and higher borrowing costs. ▶️ Geopolitical Risks: A weakened coalition may delay or derail a U.S.-Japan trade agreement ahead of the August 1st deadline, worsening trade tensions. 👉Investor Outlook: Expect a more fragmented & uncertain policy landscape. This could mean higher JPY & JGB volatility during the Summer.

Investing with intelligence

Our latest research, commentary and market outlooks