Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 JPMorgan now expects the Fed to cut rates four times in 2025, starting as early as September and bringing the benchmark down to 3.25%–3.5%.

Source: CryptosRus @CryptosR_Us

Over the last few weeks, markets have been moving higher partly due to the fact that investors have been pricing in more rate cuts.

With July PPI and core CPI prints surprising on the upside this week, odds of rate cuts in September and beyond are moving lower. Could it trigger a decent market correction? Source image: @RealStockCats

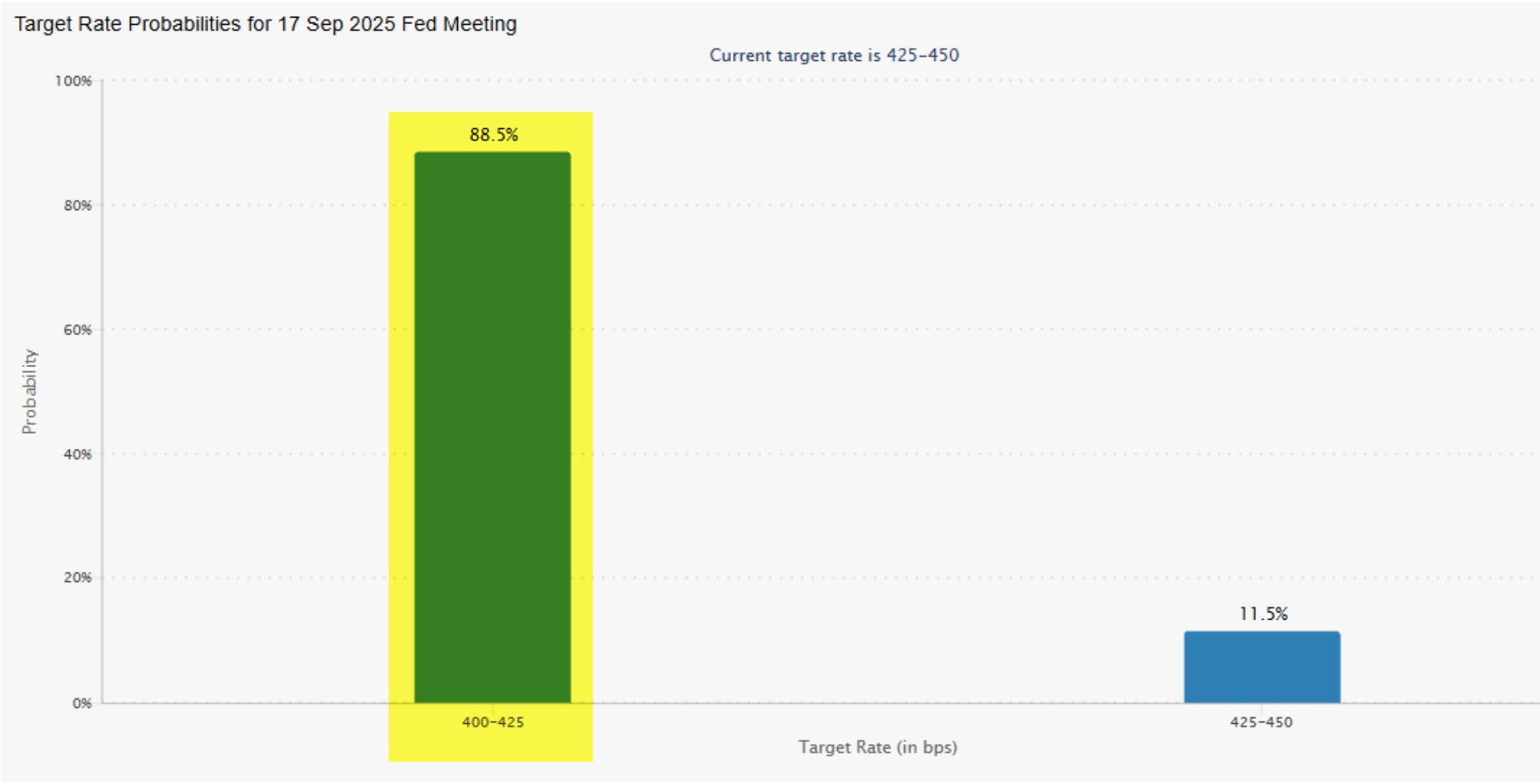

September rate-cut odds of 99.9% yesterday have now fallen down to 88.5%.

From "guaranteed" to "not so fast." Source: Bespoke

🔴 Scott Bessent says the U.S. should be "150, 175 bps lower" on the Fed's rate ‼️

😨 Vows to cut 50 bps at next Fed meeting. ⚠️ Bashes critics saying he can't be head of treasury and Fed at the same time - “If Elon can run two things at once, why can't I?” 🚀 🚀 🚀 Source: Coinvo

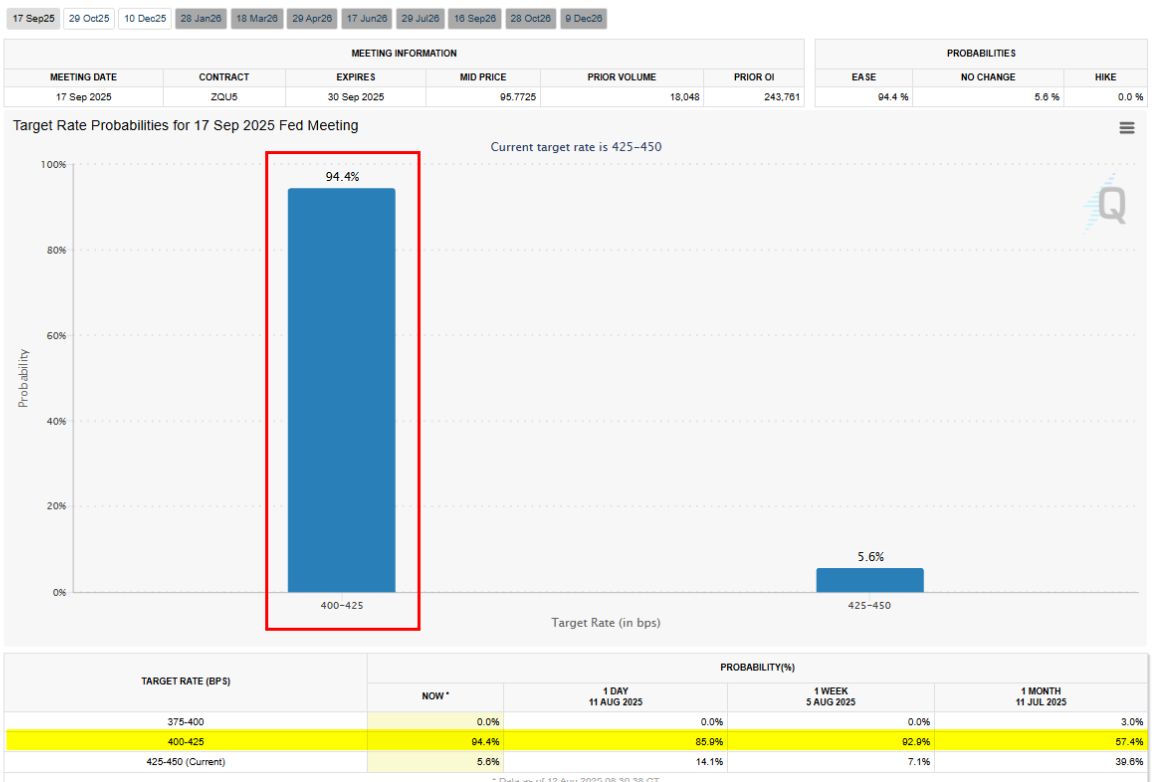

Markets see the US CPI report as a dovish one.

September rate cut odds (based on Fed funds futures) have jumped to 95% probability (from 82% pre-July CPI print). Source: Bespoke

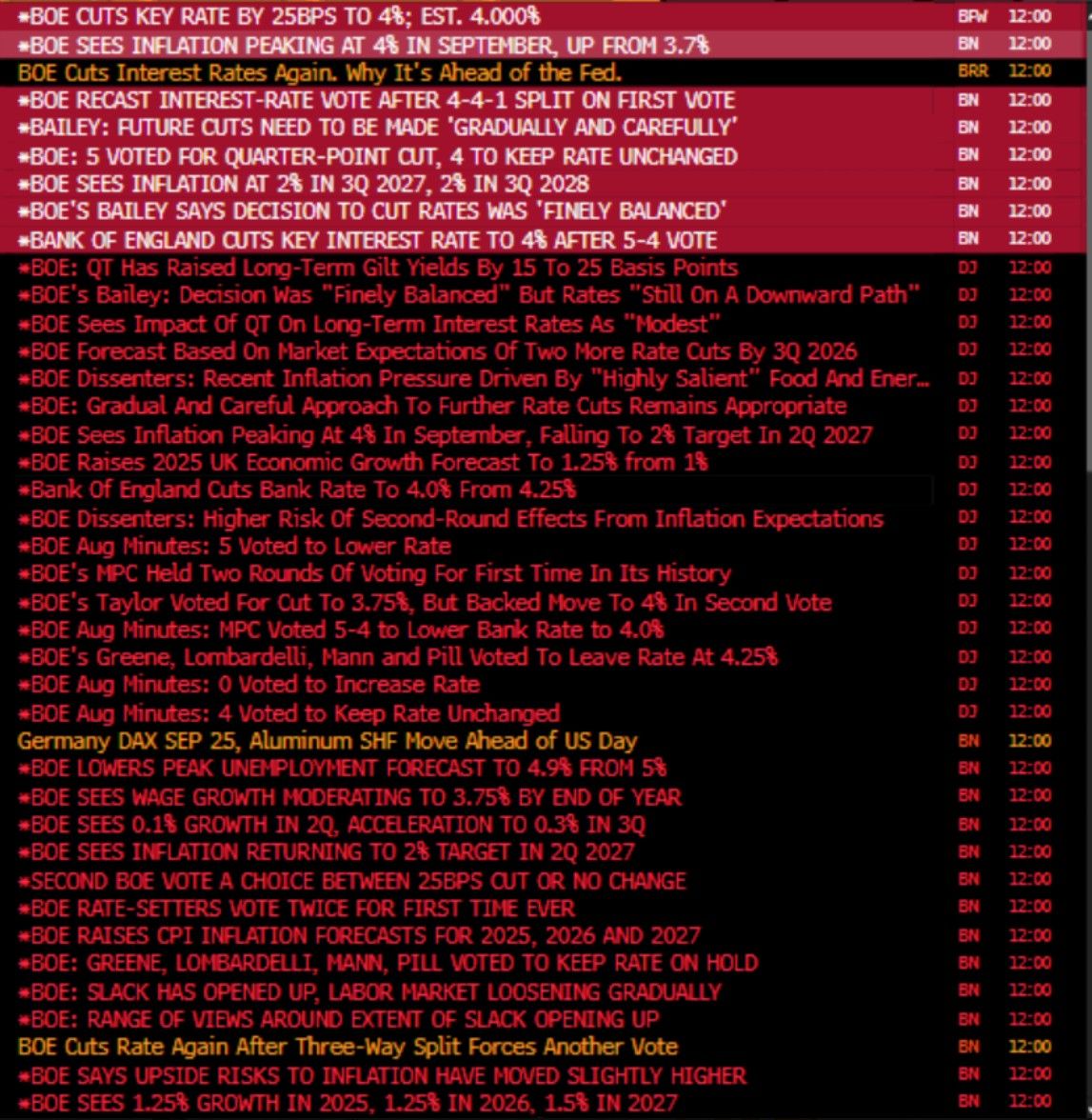

The Bank of England cut interest rates by 25 basis points to 4%, the lowest since March 2023, as it balances persistent inflation with mounting concerns over economic growth and the labor market.

BOE’s is front-running a deeper economic slowdown. They’re not cutting because things are good BUT they’re cutting because the cracks are showing. BOE cut = policy makers globally may follow ⚠️ BoE vote was recast after split! It probably NEVER happened. Taylor voted originally to cut 50 and then went 25. But it was finely balanced - but it shows that this was a HAWKISH 25bps cut. This most likely rules out a September cut unless substantial miss in jobs/CPI in Aug $GBP Source: Viraj Patel 2VPatelFX, Ananta @AnantaSumantera

Donald Trump has nominated Stephen Miran to fill a soon-to-be vacant seat on the Federal Reserve’s board of governors.

Miran, chair of the White House’s Council of Economic Advisers, will take the seat vacated by Adriana Kugler, who is leaving the central bank on Friday, months before her term was set to end in January. The president said in a Truth Social post on Thursday that Miran would serve through to the end of January as the administration continues its search for a “permanent replacement” to fill the seat. The seat would give Miran a vote on the rate-setting Federal Open Market Committee, where he is seen as likely to support Trump’s calls for aggressive interest rate cuts. It is expected that Trump will eventually use the seat to nominate a replacement for Jay Powell, whose term as Fed chair ends in May 2026, but who could serve as a governor until the end of January 2028. Miran will need to be confirmed by the Senate for the role. The Senate approved his appointment to the CEA by 53 votes to 46. The hashtag#Fed declined to comment. Source: FT

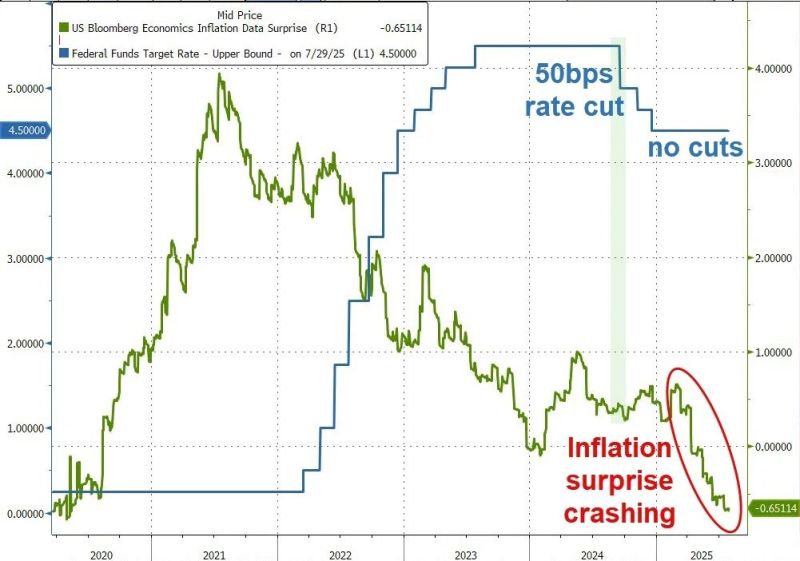

As expected, the fed leaves rates unchanged despite some of the positive developments observed on the inflations side (see below Inflation surprise index versus Fed Funds rate).

We note that this decision was met with opposition from Governors Michelle Bowman and Chris Waller, both of whom have advocated for the Fed to start easing. This is the first time since 1993 that multiple governors cast no votes on rate decision. Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks