Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

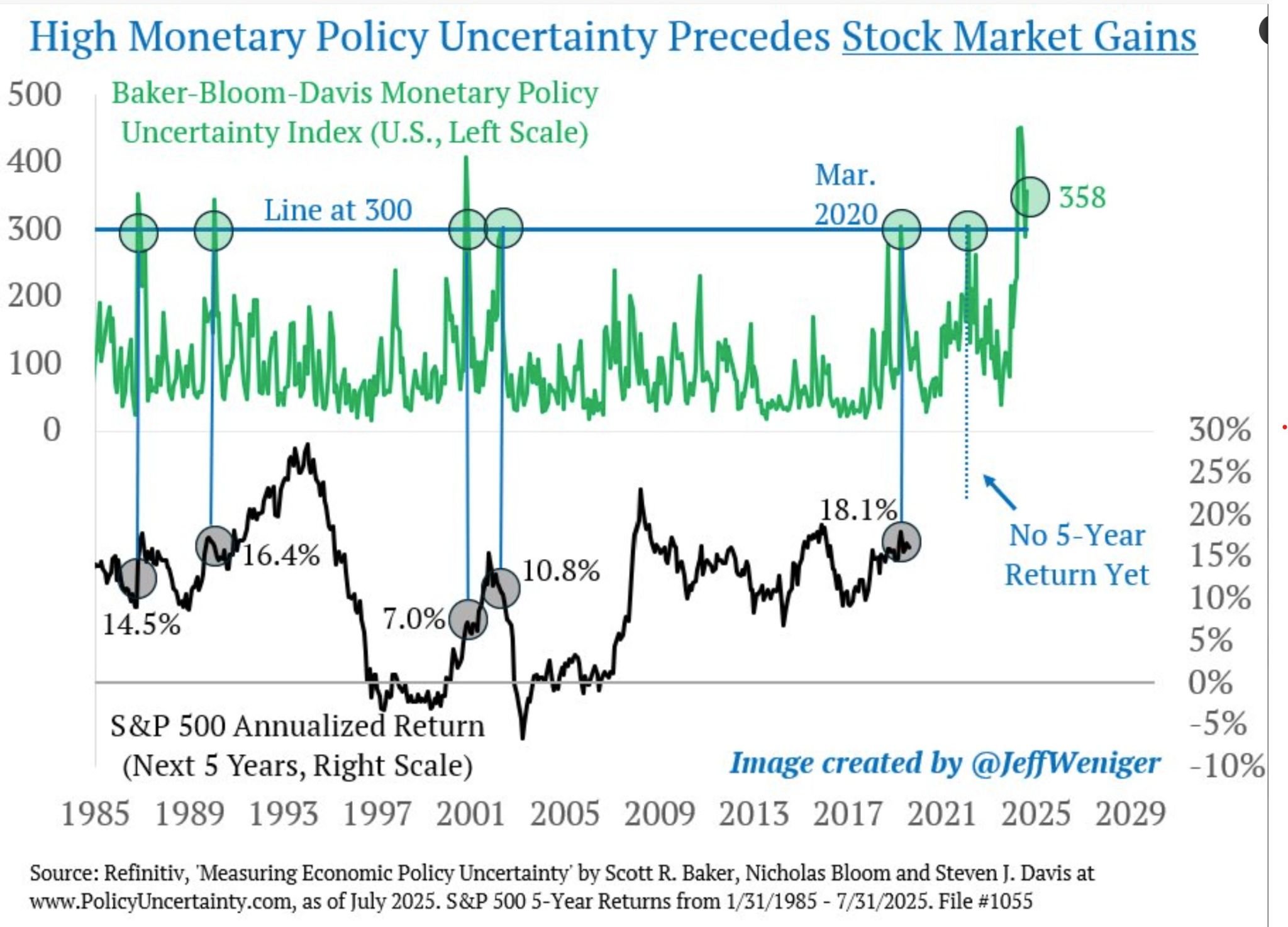

Periods of acute monetary policy uncertainty are Buy Signals.

October 1987, the Iraq-Kuwait recession, September 11th, the 2003 "jobless recovery," Covid lockdowns. These are times to buy the US stock market, not sell it. At 358, the MPU index is about as high as ever. Bullish. Source: Jeff Weniger @JeffWeniger

Stocks and rate-cut expectations have decoupled significantly since the start of the Summer... will they start to move in sync after Jackson Hole ?

Source: zerohedge

🚨 JPMorgan now expects the Fed to cut rates four times in 2025, starting as early as September and bringing the benchmark down to 3.25%–3.5%.

Source: CryptosRus @CryptosR_Us

Over the last few weeks, markets have been moving higher partly due to the fact that investors have been pricing in more rate cuts.

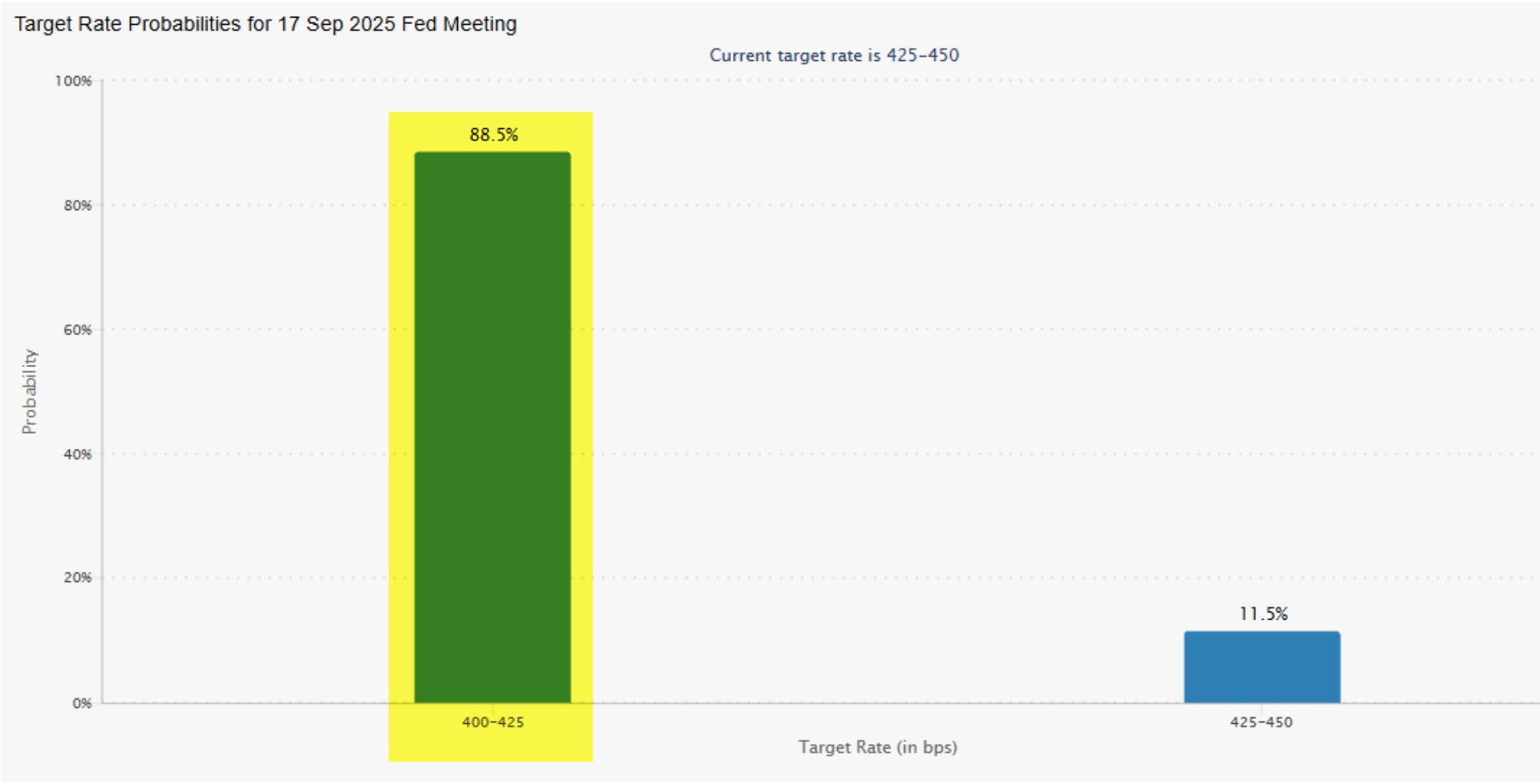

With July PPI and core CPI prints surprising on the upside this week, odds of rate cuts in September and beyond are moving lower. Could it trigger a decent market correction? Source image: @RealStockCats

September rate-cut odds of 99.9% yesterday have now fallen down to 88.5%.

From "guaranteed" to "not so fast." Source: Bespoke

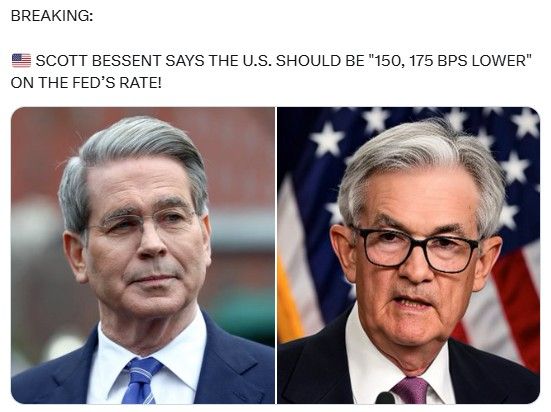

🔴 Scott Bessent says the U.S. should be "150, 175 bps lower" on the Fed's rate ‼️

😨 Vows to cut 50 bps at next Fed meeting. ⚠️ Bashes critics saying he can't be head of treasury and Fed at the same time - “If Elon can run two things at once, why can't I?” 🚀 🚀 🚀 Source: Coinvo

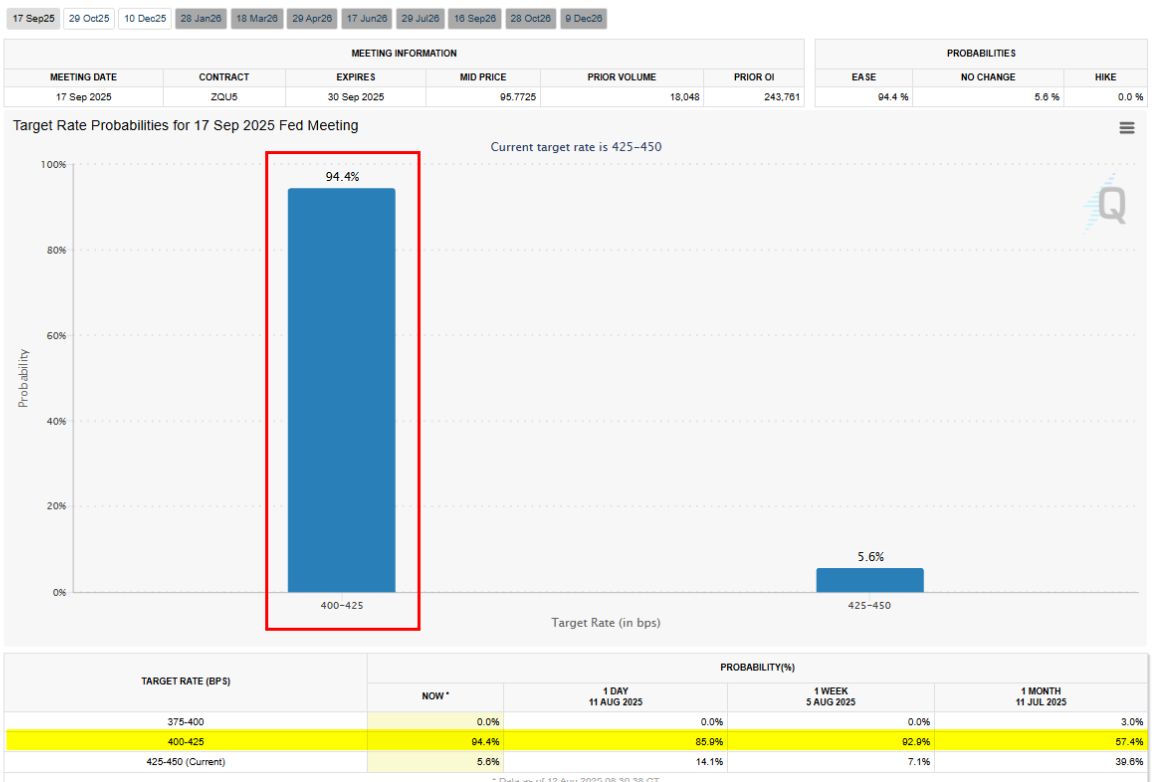

Markets see the US CPI report as a dovish one.

September rate cut odds (based on Fed funds futures) have jumped to 95% probability (from 82% pre-July CPI print). Source: Bespoke

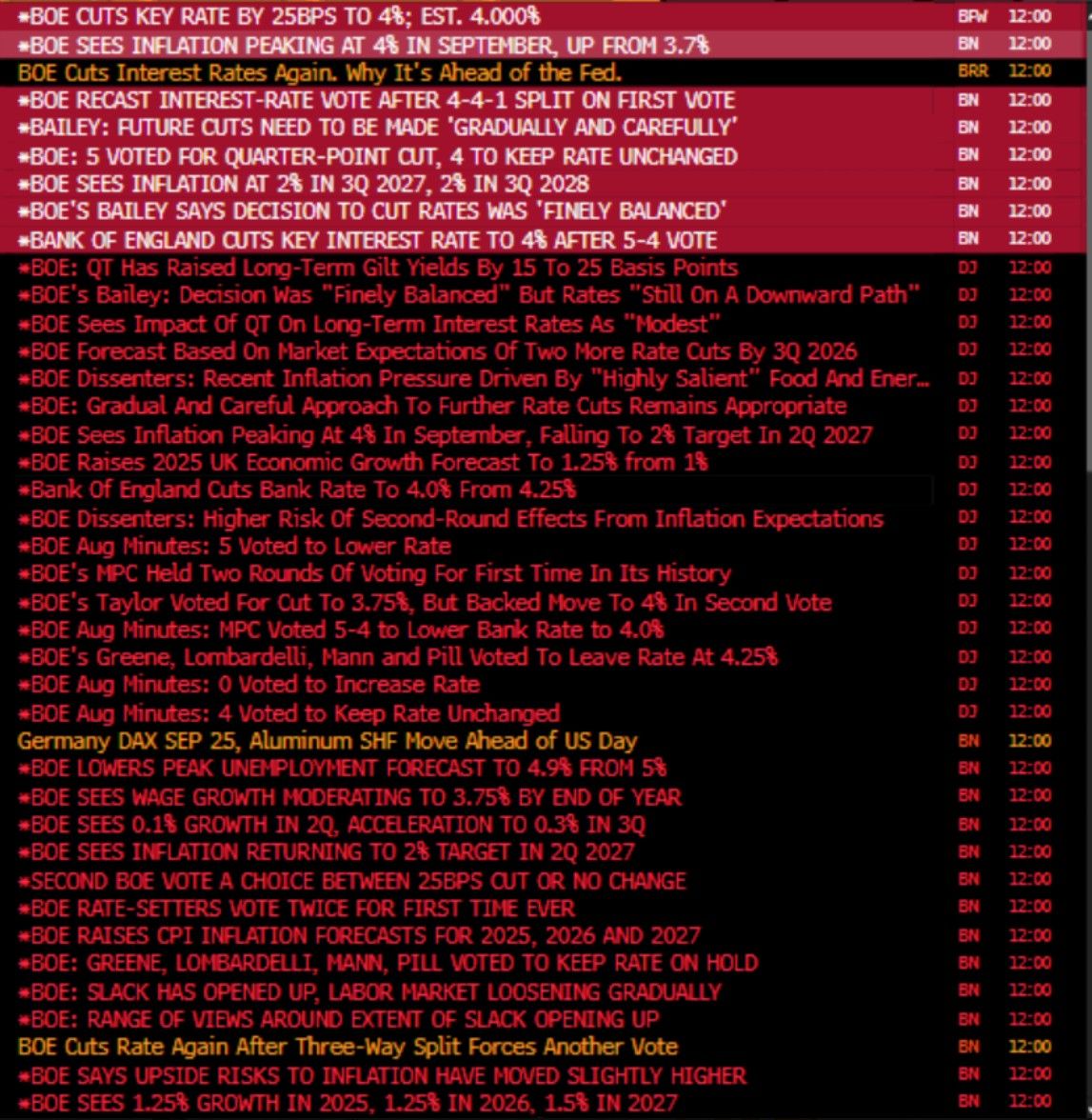

The Bank of England cut interest rates by 25 basis points to 4%, the lowest since March 2023, as it balances persistent inflation with mounting concerns over economic growth and the labor market.

BOE’s is front-running a deeper economic slowdown. They’re not cutting because things are good BUT they’re cutting because the cracks are showing. BOE cut = policy makers globally may follow ⚠️ BoE vote was recast after split! It probably NEVER happened. Taylor voted originally to cut 50 and then went 25. But it was finely balanced - but it shows that this was a HAWKISH 25bps cut. This most likely rules out a September cut unless substantial miss in jobs/CPI in Aug $GBP Source: Viraj Patel 2VPatelFX, Ananta @AnantaSumantera

Investing with intelligence

Our latest research, commentary and market outlooks