Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

By FT >>> Donald Trump cannot fire Lisa Cook for now, according to a US judge, in a major win for the Federal Reserve governor fighting the president over efforts to remove her from the central bank

Jia Cobb, the federal judge presiding over the case in Washington, late on Tuesday held that Cook may not be fired while litigation is pending. “Cook has made a strong showing that her purported removal was done in violation of the Federal Reserve Act,” Cobb wrote. A provision of that act allows a president to remove a Fed governor only “for cause”, which according to Cobb would involve failing to fulfil statutory duties. The ruling will allow Cook to attend the Fed’s policy-setting committee meeting next week, when it is widely expected to cut interest rates for the first time this year. It marks a setback for Trump, who last month announced he was sacking Cook for alleged mortgage fraud, amid a campaign to pressure the US central bank into lowering borrowing costs. Source: FT https://lnkd.in/exQeKfwY

The U.S. Justice Department has launched a criminal mortgage fraud probe into Federal Reserve Governor Lisa Cook

It has issued grand jury subpoenas out of both Georgia and Michigan, according to documents seen by Reuters and a source familiar with the matter. The investigation followed a criminal referral from Federal Housing Finance Agency Director Bill Pulte, and is being conducted by Ed Martin, who was tapped by Attorney General Pam Bondi as a special assistant U.S. attorney to assist with mortgage fraud investigations involving public officials, along with the U.S. Attorneys' offices in the Northern District of Georgia and the Eastern District of Michigan, according to the person, who spoke anonymously since the matter is not public. Source: Reuters

🚨 Goldman Sachs has doubled down on its optimistic forecast for gold, maintaining a structural bullish view on the precious metal

The investment bank predicts gold will reach $3,700 per ounce by the end of 2025 in its base case scenario, with further growth to $4,000 by mid-2026. Goldman’s analysis indicates that a recession could accelerate ETF inflows and drive prices even higher to $3,880. More dramatically, extreme risk events such as challenges to Federal Reserve independence or shifts in U.S. reserve policy could potentially catapult gold prices to $4,500 by year-end 2025. Source: www.goldsilver.com https://lnkd.in/eCau26HP

With the Fed’s reverse repo facility nearly drained, the system now leans on reserves as the main buffer.

Right now, they sit at ~$3.2T, which the Fed still calls “ample.” Governor Waller has suggested ~$2.7T is a safe floor, while Barclays sees end-September reserves sliding closer to that line. The problem? Treasury bill issuance and QT are still pulling cash out each month. With no RRP cushion left, every dollar matters more and once reserves fall into the danger zone, stress tends to show up fast in repo markets, auctions, and short-term funding. Source: StockMarket.News @_Investinq on X

The US just sold $70 billion of 5-year Treasuries.

The Bid-to-Cover ratio was 2.36. Foreign buyers pulled back but US buyers stepped up in record size. Here's the breakdown: • Foreign accounts (called “Indirects”) bought 60.5%. • Domestic institutions (called “Directs”) bought a record 30.7%. • Dealers (big banks) bought only 8.8%, the lowest ever. Now here’s the twist: even though the auction was definitely a poor one, the bond market rallied afterwards. 10-year Treasury yields actually dropped. Why? Because traders were braced for worse. “Not awful” was good enough to spark a rally. Source: StockMarket.news

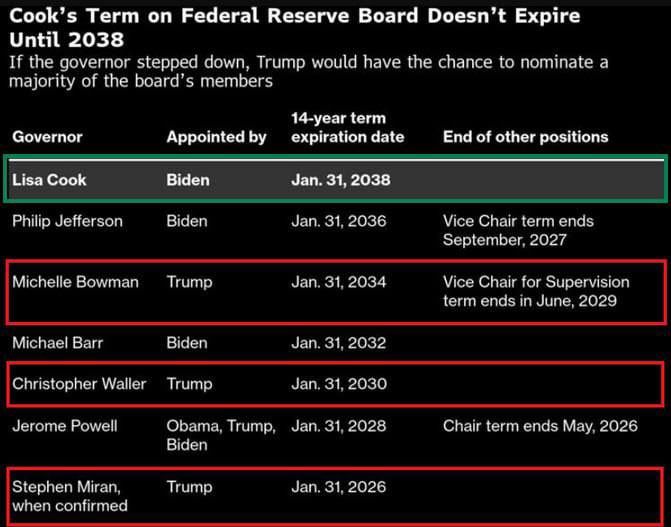

Trumps Fed power shift in play

➡️ Trump’s push to remove Fed Governor Lisa Cook, could flip the balance of power inside the Fed. If Cook is out, Trump-appointed Governors would hold 4 of 7 seats (excluding Powell). That would give Trump the majority on the board for the first time in history. This shift could open the door to aggressive easing. Cook’s term runs until 2038, making this challenge unprecedented. The Fed has never faced a political reshuffle like this, and the outcome could define the next chapter for US rates and markets. Source: MartyParty @martypartymusic

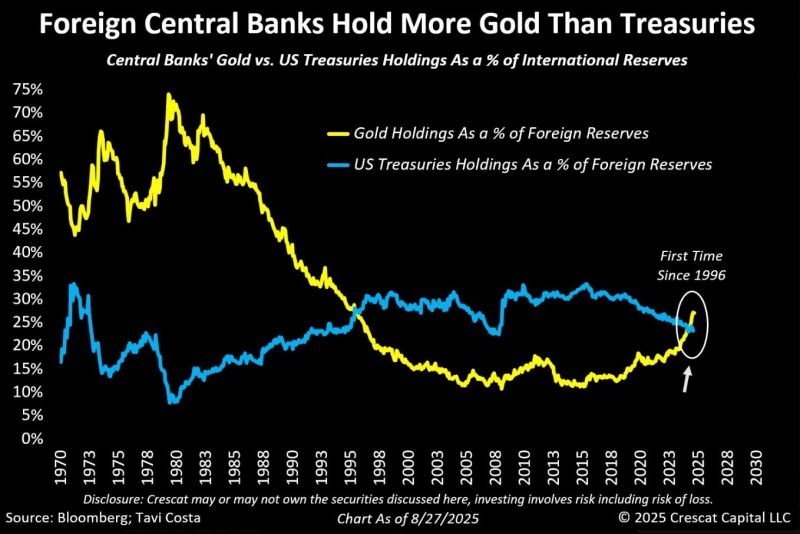

Foreign central banks now officially hold more gold than US Treasuries — for the first time since 1996.

We might be witnessing one of the most significant global rebalancing we've experienced in recent history, in my view. Source: Tavi Costa, Crescat Capital, Bloomberg

There are 3 sure things in life: 1) death; 2) taxes and; 3) printing money...

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks