Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

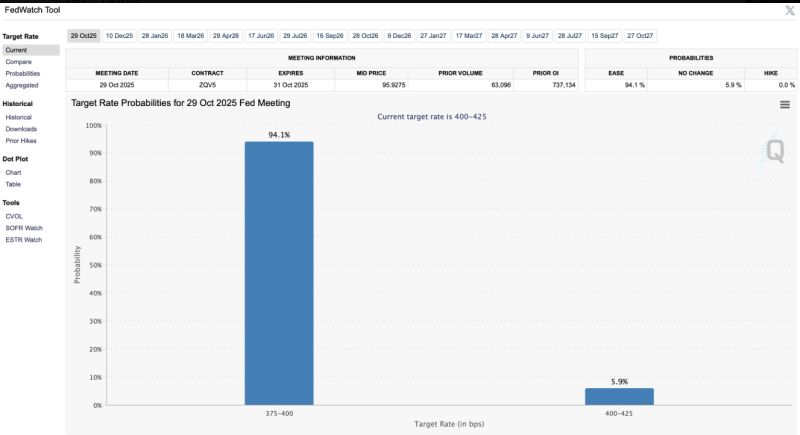

The odds of an October rate cut have jumped to 94% 🚨🚨🚨

Source: CME Fed Watch tool, Barchart

The Fed has cut rates by 25bps 47 times since 2000

Here’s how $SPY usually reacted the next week, month, quarter, and year. Source: Trend Spider

BREAKING: The Bank of Japan announced that it will leave its benchmark interest rate on hold

The decision was widely expected amid political uncertainty stemming from the resignation of PM Shigeru Ishiba. BUT HERE'S THE BIG NEWS: The Bank of Japan has decided to begin SELLING its ETF holdings. The BOJ is the largest shareholder of ~70% of large listed stocks in Japan; if it really does this, it will put downside pressure on Japanese stocks. The planned pace of sales is based on an annual book value of ¥330 billion. As of June 2025, the BOJ’s ETF balance stood at a book value of ¥37.1861 trillion. The stock market is already asking the BOJ: “are you sure bro?” - see chart below. Best of luck to the BOJ plan to sell stocks when the BOJ IS THE MARKET.

🚨Jerome Powell and the Fed just cut rates by 0.25% down to between 4%-4.25%. Here's a high level summary 👇

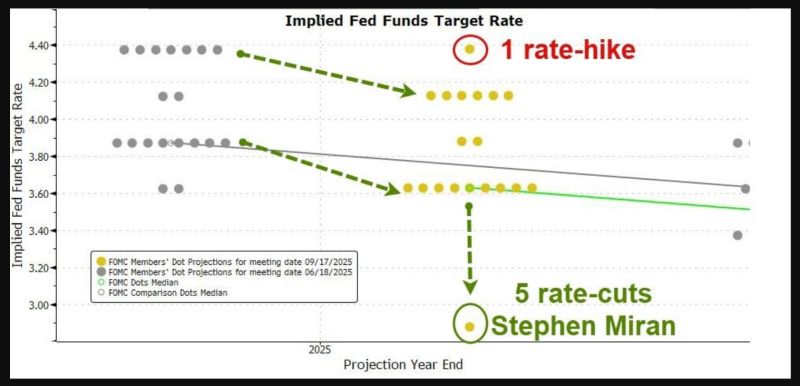

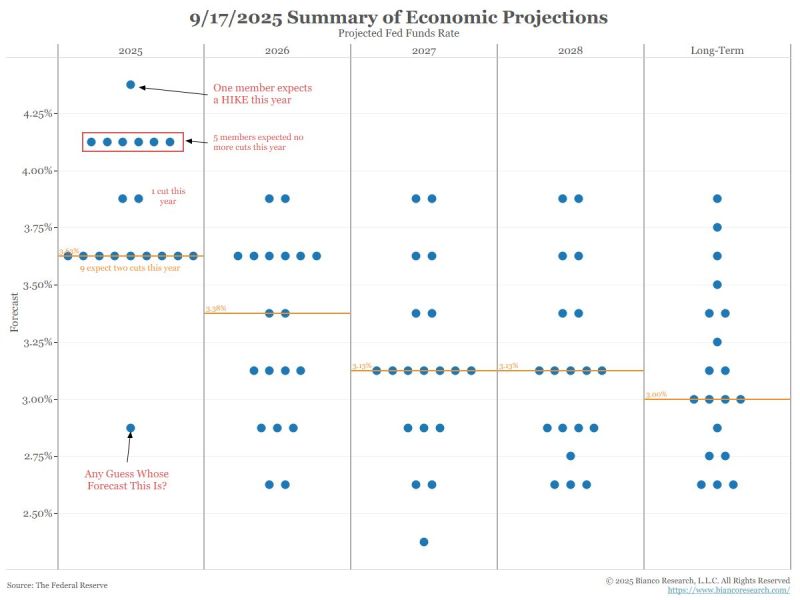

➡️ RATES: The Fed cuts key overnight interest rate by 25bps to 4.00-4.25% range Fed projections show additional 50bps of cuts by year end, another 25 bps of cuts in each of the next two years. Fed says it is attentive to both sides of dual mandate ➡️VOTE SPLIT: New governor Miran dissented on policy decision, favoring 50bps cut. So only 1 dissent is positive. The Fed is remaining unified under Powell 😊 POWELL: "There wasn't widespread support at all for a 50 bps cut today." ➡️LABOUR MARKET: Says downside risks to employment have risen Job gains have slowed, unemployment has edged up but remains low ➡️INFLATION: Inflation has moved up and remains 'somewhat elevated' ➡️ECONOMY: Economic growth moderated over first half of this year ➡️ BALANCE SHEET: Fed maintains current pace of balance sheet drawdown ➡️SUMMARY ECONOMIC PROJECTIONS: GDP forecasts raised for 2025, 2026 and 2027 Unemployment rate forecast for 2025 unchanged, lowered for 2026 and 2027 PCE forecast for 2025 unchanged, raised for 2026, unchanged for 2027 Core PCE forecast for 2025 unchanged, raised for 2026 and unchanged for 2027 ➡️DOTS: The dots for 2025 were massively shifted lower with one member calling for 5 cuts in 2025. 7 of the 19 members see no more rate-cuts this year... 9 of 19 see 2 more cuts 2 of 19 see 1 more cuts 6 of 19 see no more cuts 1 sees 1 rate hike 1 sees 5 cuts (this is Stephen Miran) ⚠️Fed Funds rate forecast cut for 2025 from 3.9% to 3.6% or another 2 rate cuts. ⚠️The central bank gave a more hawkish outlook for rates in 2026, where officials are predicting only one more rate cut in the new year, slower than the current market pricing of two-to-three. The median forecast for 2026 pencils in just one more rate cut, after the two further moves this year. ⚠️ And then another cut in 2027 to 3.1% That would mean 125 basis points of cutting from September 2025 until the end of 2027. This way short of the 300 basis points Trump has wanted for, like, now. 📌 In a nutshell: The Fed is cutting rates, and projecting more rate cuts, at the same time as upgrading its growth forecast and nudging up its inflation outlook too... And now the HAWKISH 🤢 side of today's decision and ensuing press conference >>> Powell just said during his press conference after the decision he sees the move as a “risk-management cut.” Powell’s comments suggest this move was more of an insurance cut in case the economy dramatically slowed. Source: zerohedge, CNBC

11 of 12 members voted in agreement with this decision.

One fed official (Stephan Miran) penciled in 150 bps of rate cuts for 2025.

"THE MOST IMPORTANT FOMC OF OUR LIFETIME"

$SPY S&P500 is completely flat

Despite some hawkish comments during the Press conference (the "risk management cut"), the Fed now seems more worried about the job market than inflation.

Next job data will be key. Source: zerohedge

As highlighted by Jim Bianco, isn't the "Fed consensus" just an illusion?

See the labels in the dot plot below: one member of the FOMC thinks the Fed is going to HIKE rates this year. One (Stephen Miran) thinks it is going to cut 1.25% this year (5 cuts over two meetings). And see the spread of dots above (from highest to lowest), the FOMC is showing little to no agreement on what they should do. So on one hand there is an 11-1 vote On the other hand they published a wide dot plot... Add to this is Powell using the term "Risk Management" to describe this cut... It could thus be that "Risk Management" cut is a political decision. As Jim Bianco said "he wants to get Trump off his back". Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks