Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 HUGE Week Ahead for Global Markets! 🚨

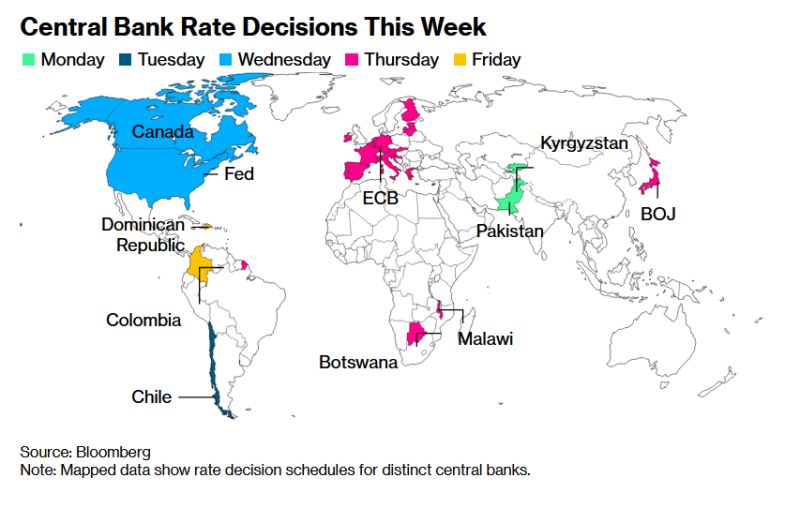

Four major central banks. One defining week. Here’s what’s coming 👇 💵 Federal Reserve — Expected to cut rates by 0.25% on Wednesday, and all eyes are on what comes next for its Quantitative Tightening (QT) program. 🇨🇦 Bank of Canada — Also forecasted to trim rates by 0.25%, signaling growing concern over slowing growth. 🇪🇺 European Central Bank — Likely to hold steady, keeping the focus on inflation trends across the Eurozone. 🇯🇵 Bank of Japan — Expected to stay the course, balancing yen weakness with cautious optimism. This week could set the tone for global liquidity, currencies, and market sentiment heading into year-end. 🌍.

Yesterday we saw another $3 billion FED pump into the banking system.

The use of the facility is now a daily occurrence; the regional banking sector obviously has a liquidity issue. That's a total of $21 billion in 4 weeks. Source: The Great Martin on X

Interesting comment on X by @Andreas Steno on X about a worrying development that took place yesterday.

As financials and regionals are getting hammered with signs of stress in USD money market, the SOFR - Fed funds spread keeps widening… Maybe the Fed will be involved earlier than they think on the QT ending stuff...

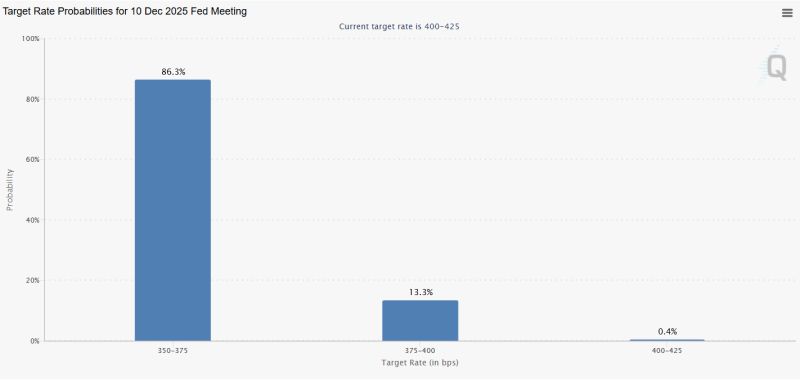

LATEST: December has an 86.3% of another rates cut.

That would make it 2 rates cuts before 2026. Source: Cointelegraph, CME Fed Watch

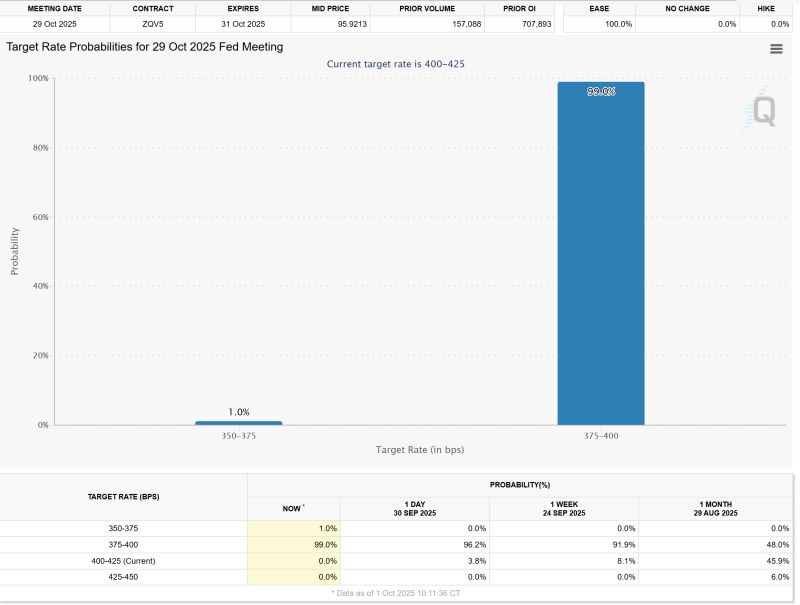

According to CME Fed watch tool, odds of a Fed rate cut in October are now 99%...

So done deal after the poor ADP payrolls numbers...

‼️Global central banks RATE CUT RUSH:

Central banks have slashed rates 168 times over the last 12 months, the fastest pace since the 2020 crisis. This is also the third-quickest pace over the last 25 years, behind the 249 rate cuts seen in the Great Financial Crisis. Source: Global Markets Investors, BofA

FedWatch shows a 92.5% chance of a 25 bps Fed rate cut in October.

Source: CME FedWatch

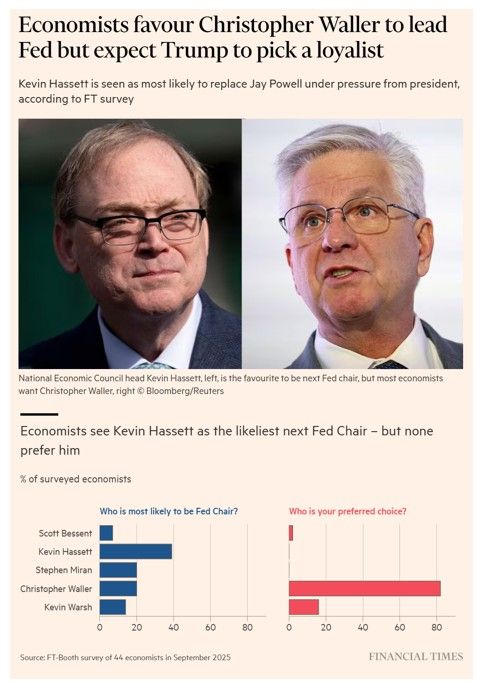

Very interesting FT article "Economists favour Christopher Waller to lead Fed but expect Trump to pick a loyalist"

>>> https://lnkd.in/ewBs4dUv Academic economists overwhelmingly want Federal Reserve governor Christopher Waller to succeed Jay Powell as chair of the central bank next year — but few think he will get the job. In a FT poll, 82% of the economists surveyed chose Waller as their favourite to Fed Chair. However, just a fifth of the academics polled think he will succeed Powell in 2026. Instead, Kevin Hassett is seen as the man most likely to head the Fed. The split between who economists want to get the job and who they think will become the next chair reflects the fierce pressure the Fed has come under from US President Donald Trump.

Investing with intelligence

Our latest research, commentary and market outlooks