Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

As a remainder, The FED ends QT tomorrow !

For years, they've been pulling money out of the system Tomorrow, that drain stops... Source: @PaulGoldEagle

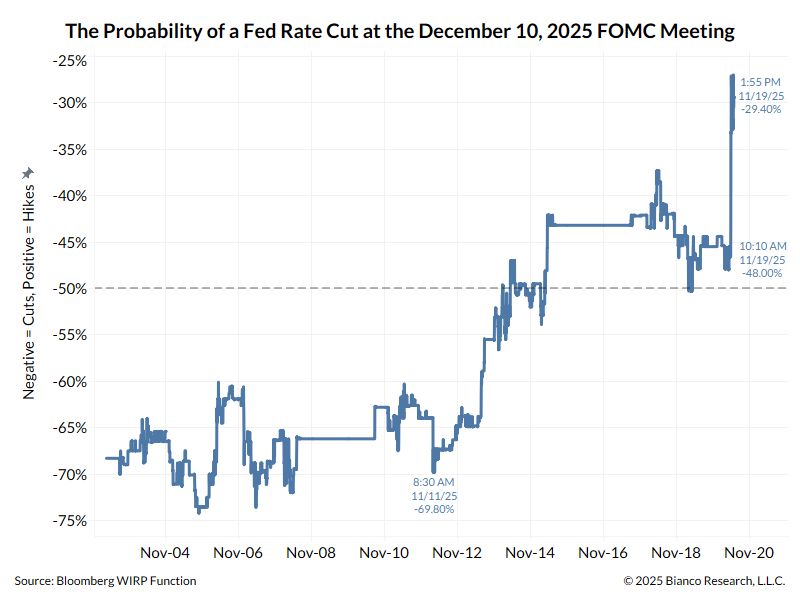

Fed Rate-cut odds for December are on the rise...

Hopes of another rate cut in December were initially boosted by Fed's Williams dovish comments on Friday and then encouraged by Goldman over the weekend. Yesterday, San Francisco Fed's Daly added to the sudden dovish pivot (from the rampant hawkish pivot mid-last week): "On the labor market, I don't feel as confident we can get ahead of it," she said in an interview on Monday. "It's vulnerable enough now that the risk is it'll have a nonlinear change." An inflation breakout, by contrast, is a lower risk given how tariff-driven cost increases have been more muted than anticipated earlier this year, she said. Daly's comments pushed the odds of a December cut back above 80%... Source: zerohedge, Bloomberg

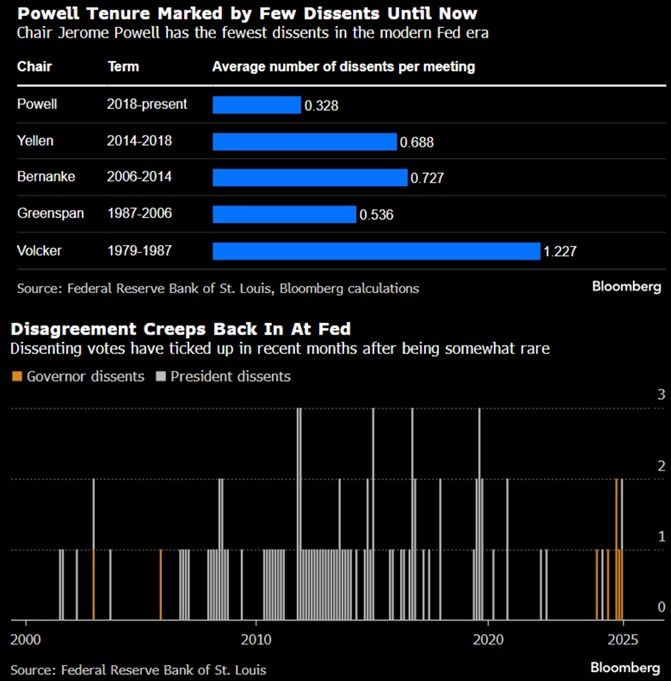

Powell tenure has been marked by few dissents... until now.

Dissenting votes have ticked up in recent months after being somewhat rare. Source: Bloomberg, RBC

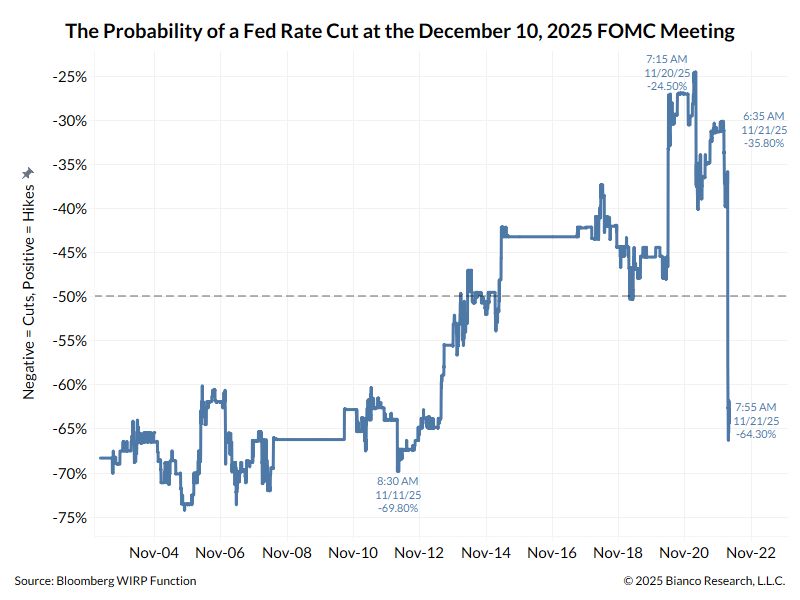

Fed Williams's speech this morning dramatically changed the outlook for the December 10 FOMC meeting.

As highlighted by Jim Bianco, the current tally looks like this: * 5 Voters have strongly signaled they do not want to cut rates next month (Barr, Musalem, Schmid, Goolsbee, Collins) * 5 Voters signaled they want to cut rates (Miran, Waller, Bowman, Williams, Cook) * 2 Voters are unknown (Powell and Jefferson) If the Fed is truly becoming independent, then it should be a 7-5 vote ... either way. Time will tell...

Reaction to the release of the FOMC minutes: the probability of a rate cut is down to less than 30%...

➡️ Many participants stated that it would be appropriate to hold interest rates steady for the rest of the year, in line with their expectations. 📌 Most participants supported the October rate cut, while some said they would not support any changes. 📌Almost all participants stated that ending the balance sheet reduction program on December 1st would be appropriate. 📌Many participants said a December cut would be appropriate. 📌Many participants noted the possibility of a disorderly decline in stock prices, particularly if expectations regarding artificial intelligence were suddenly reassessed. 📌Most participants preferred the Fed's portfolio to match the composition of its outstanding Treasury bonds. 📌Some participants preferred a larger proportion of Treasury bonds, stating that it provided more flexibility. 📌Many participants believed the December rate cut was inappropriate. The Fed's economic outlook, released at its October meeting, suggests that real GDP growth through 2028 will be slightly stronger than the September forecast Source: Bianco Research, @EcoPulseStreet

Reserves are in deep "scarce" territory with reverses zero.

But reserves would go back to "ample" once $300BN in Treasury cash is drained in a few days. Source: zerohedge

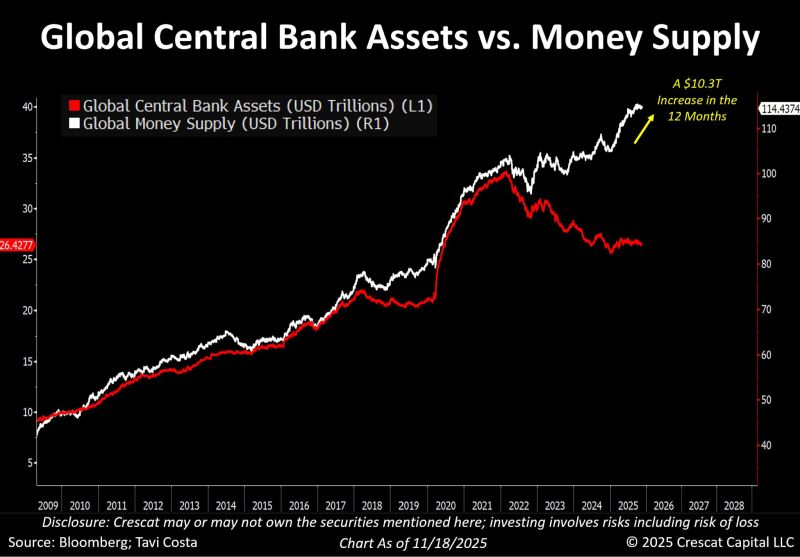

Very interesting to see money supply expanding this aggressively even as global central bank balance sheets have been contracting.

What will happen once central banks inevitably need to expand their balance sheets again? Source: Tavi Costa, Bloomberg

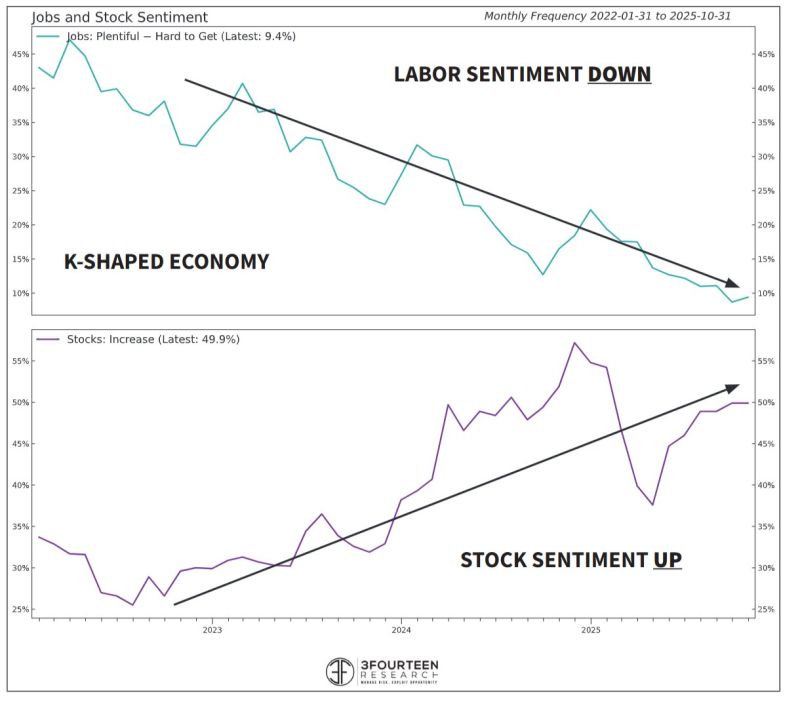

WALLER: Supports a December cut...citing "a weak labor market and mon pol that is hurting low and middle-income consumers."

Waller has been a Fed leader and, whether his view of a Dec cut prevails, the Fed will eventually be forced to respond to the lower-K. Source: 3fourteenresearch

Investing with intelligence

Our latest research, commentary and market outlooks