Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔥 Big Shift Today: The Fed Just Ended QT - What This Means For Overall Liquidity according to Goldman 🔥

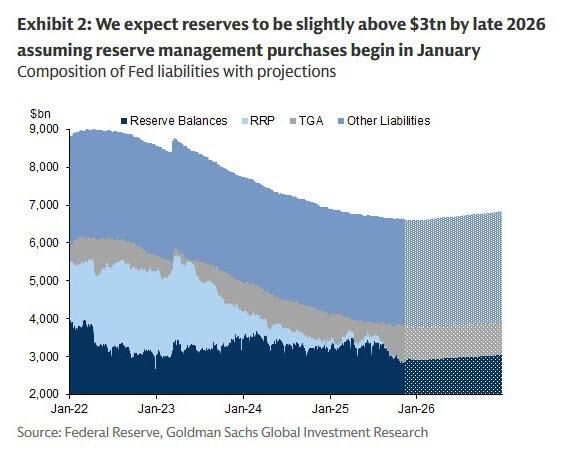

After months of draining liquidity and a one-month delay that tightened markets, the Fed’s quantitative tightening officially ends today. Here’s what Wall Street is watching: 💧 Reserves Are Scraping Bottom Fed reserves hit a low in October, but should end 2025 around $2.9T - still uncomfortably close to “not enough.” Repo markets have already shown stress, with Standing Repo Facility usage hitting its 2nd-highest level since COVID. 🏦 Goldman’s Call: QT Ends, Balance Sheet Growth Returns Fast Goldman expects the Fed to start buying ~$20B/month in T-bills starting Jan 2026, plus reinvesting MBS runoff - together adding ~$40B/month back into the system. Reserves could climb back above $3T by late 2026. 💣 Why the Pivot? Liquidity Is Too Tight Repo rates (TGCR, SOFR) are trading well above where they “should” be. Funding markets keep flashing red. The Fed is quietly preparing to reflood the pipes. 📈 Treasury Supply Stays Heavy - But the Fed Becomes a Buyer Again With massive deficits ahead, Treasury issuance remains huge. But thanks to the shift in policy: Fed is expected to absorb ~$480B of next year’s T-bill issuance Non-Fed buyers only take ~$390B — the lowest since 2023 🍃 But There’s a Catch… The Fed will let $2T of MBS roll off, pushing a wave of mortgage-backed supply into markets. That means: ➡️ More pressure on housing and mortgage rates ➡️ A slow-motion shift from MBS → Treasuries in the system ⚠️ Bottom Line: QT ends today, but the liquidity story is far from over. Funding markets are strained, repo is volatile, MBS supply is surging - and the Fed may be forced to restart balance sheet expansion faster than anyone expected. The next big test? April tax season. If liquidity cracks again, the Fed’s “reserve management purchases” may turn into something much bigger. Source: Goldman Sachs, zerohedge

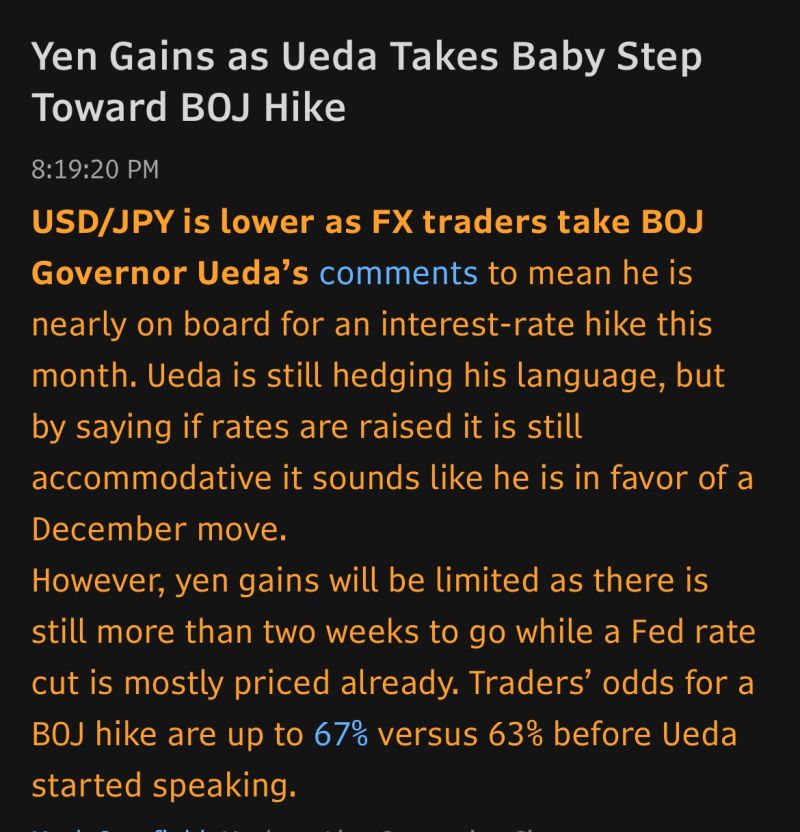

So what's going on in markets this morning? Why are Cryptos tumbling again?

A ris-off signal to start December? Well, it seems that the spike in Japanese bonds yields is the culprit... Indeed, Japanese bonds are puking on renewed expectations of rate hike, as the 2Yr JGB yield is above 1% for the first time since 2008. The yen is firming and the Nikkei 225 index is tumbling. And since nowadays Bitcoin always correlates with anything that's down, we have a 5% dump in Bitcoin in Asian trading to $85k.... In the middle of Asian session, BoJ Governor Ueda said he was consider the "pros and cons" of raising interest rates at the BoJ's December and idea that the market got hold of last week as the odds of a BoJ Dec rate hike increased from 30% to 50%. Source: Bloomberg, zerohedge

As a remainder, The FED ends QT tomorrow !

For years, they've been pulling money out of the system Tomorrow, that drain stops... Source: @PaulGoldEagle

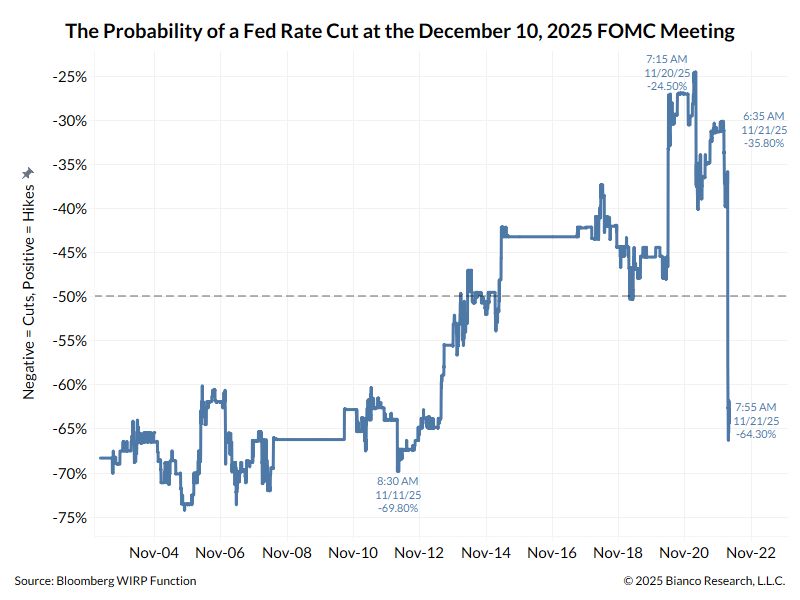

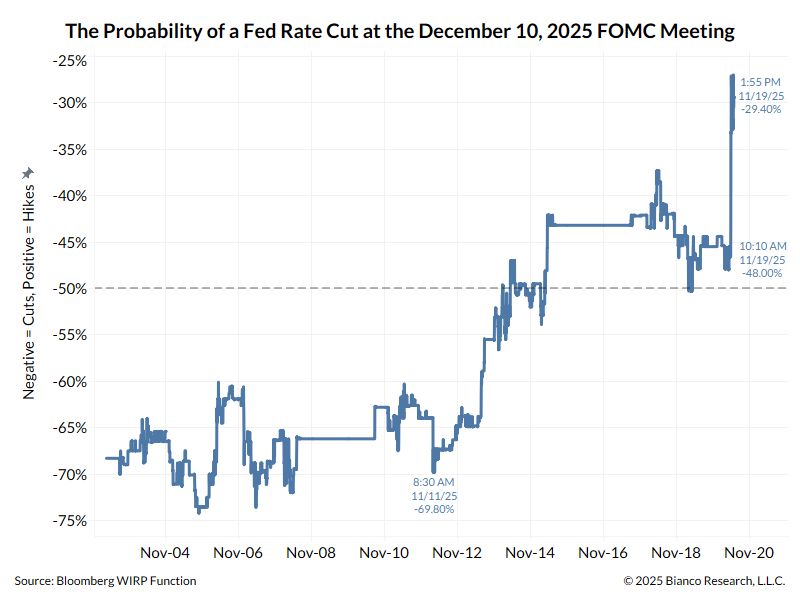

Fed Rate-cut odds for December are on the rise...

Hopes of another rate cut in December were initially boosted by Fed's Williams dovish comments on Friday and then encouraged by Goldman over the weekend. Yesterday, San Francisco Fed's Daly added to the sudden dovish pivot (from the rampant hawkish pivot mid-last week): "On the labor market, I don't feel as confident we can get ahead of it," she said in an interview on Monday. "It's vulnerable enough now that the risk is it'll have a nonlinear change." An inflation breakout, by contrast, is a lower risk given how tariff-driven cost increases have been more muted than anticipated earlier this year, she said. Daly's comments pushed the odds of a December cut back above 80%... Source: zerohedge, Bloomberg

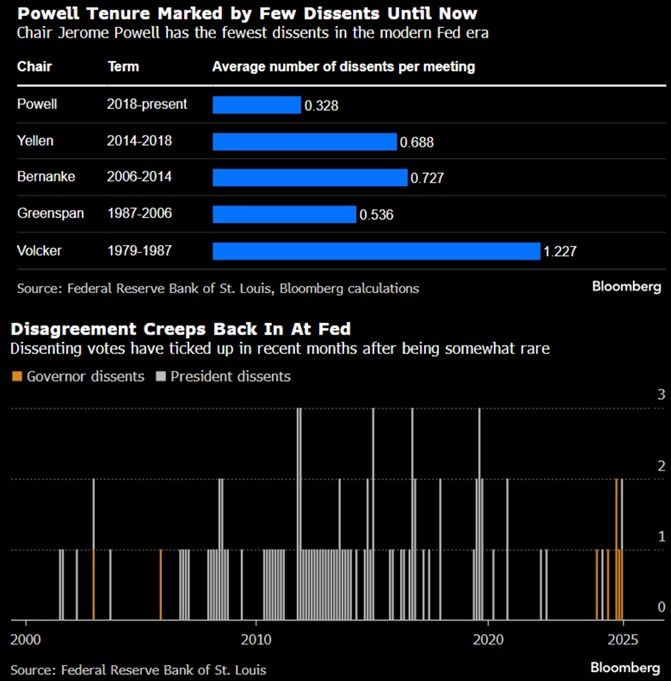

Powell tenure has been marked by few dissents... until now.

Dissenting votes have ticked up in recent months after being somewhat rare. Source: Bloomberg, RBC

Fed Williams's speech this morning dramatically changed the outlook for the December 10 FOMC meeting.

As highlighted by Jim Bianco, the current tally looks like this: * 5 Voters have strongly signaled they do not want to cut rates next month (Barr, Musalem, Schmid, Goolsbee, Collins) * 5 Voters signaled they want to cut rates (Miran, Waller, Bowman, Williams, Cook) * 2 Voters are unknown (Powell and Jefferson) If the Fed is truly becoming independent, then it should be a 7-5 vote ... either way. Time will tell...

Reaction to the release of the FOMC minutes: the probability of a rate cut is down to less than 30%...

➡️ Many participants stated that it would be appropriate to hold interest rates steady for the rest of the year, in line with their expectations. 📌 Most participants supported the October rate cut, while some said they would not support any changes. 📌Almost all participants stated that ending the balance sheet reduction program on December 1st would be appropriate. 📌Many participants said a December cut would be appropriate. 📌Many participants noted the possibility of a disorderly decline in stock prices, particularly if expectations regarding artificial intelligence were suddenly reassessed. 📌Most participants preferred the Fed's portfolio to match the composition of its outstanding Treasury bonds. 📌Some participants preferred a larger proportion of Treasury bonds, stating that it provided more flexibility. 📌Many participants believed the December rate cut was inappropriate. The Fed's economic outlook, released at its October meeting, suggests that real GDP growth through 2028 will be slightly stronger than the September forecast Source: Bianco Research, @EcoPulseStreet

Reserves are in deep "scarce" territory with reverses zero.

But reserves would go back to "ample" once $300BN in Treasury cash is drained in a few days. Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks