Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Powell the Provider.

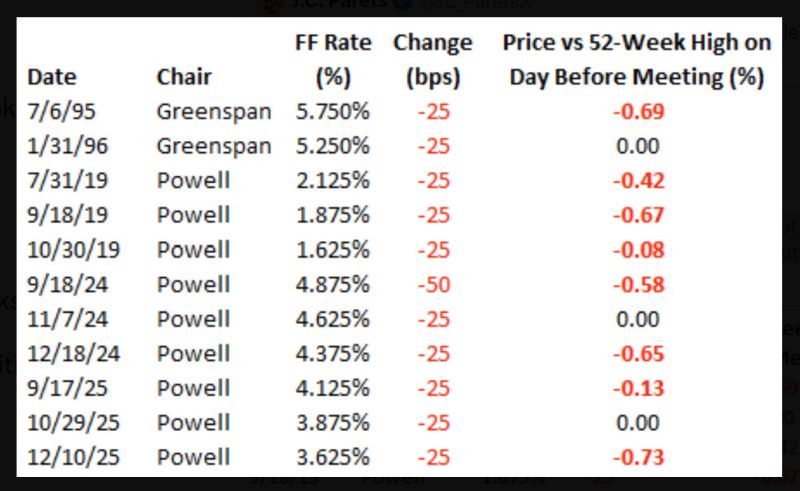

Today was the 11th time since 1994 that the Federal Reserve cut rates when the S&P 500 was within 1% of a 52-week high. Nine of those cuts have occurred under Powell. Source: Bespoke @bespokeinvest

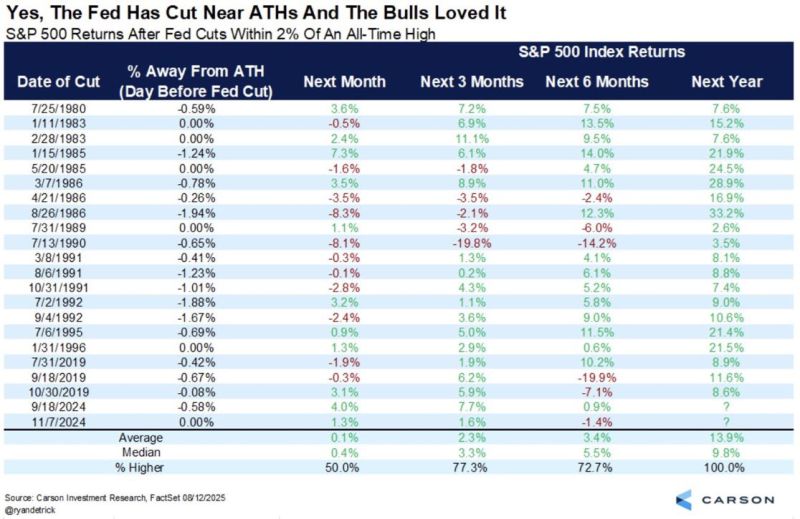

When the Fed cuts interest rates within 2% of stock market all-time highs, the S&P 500 has gone on to finish higher over the next 12 months 20 out of 20 times (100% hit rate) 🚨🚨🚨

Note however that the market reaction in the 3 to 6 months is mixed Source: Carson, Barchart

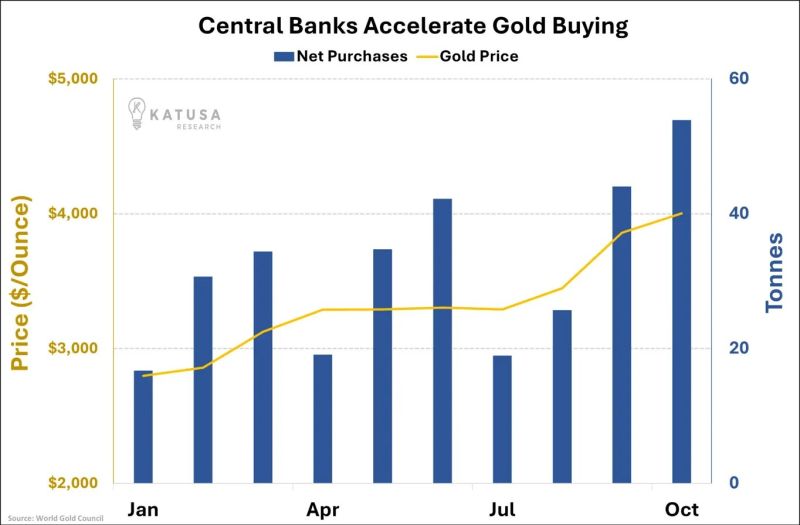

This chart destroys every "gold is too expensive" argument

They were buying 20 tonnes when gold was at $3,000. Now they're buying 55 tonnes at $4,000. Source: Katusa Research @KatusaResearch

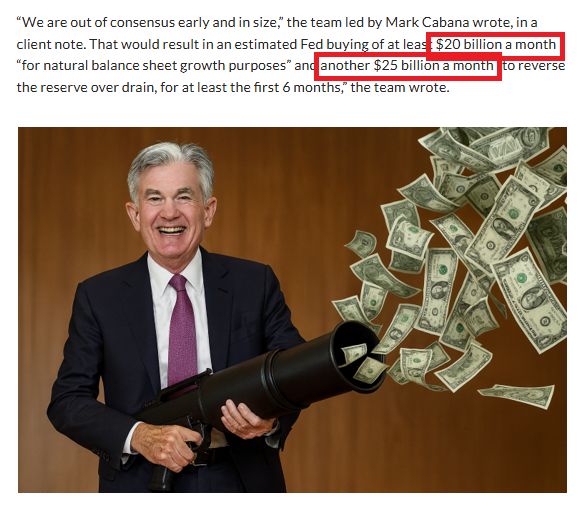

Federal Reserve expected to begin buying back an all-time high $45 billion of debt each month beginning in January 🤯👀

Source: Barchart

The Fed rate cut odds in December jumps to 95% on Polymarket.

Source: Ash Crypto

Another strong tailwind for the US economy as we head into 2026...

The price of gas at the pump has tumbled to $3.00 - the lowest since May 2021... If you add to this Fed cutting rates (and soon re-launching QE), fiscal stimulus and financial deregulation, that's a lot of stimulus! Source: Zerohedge

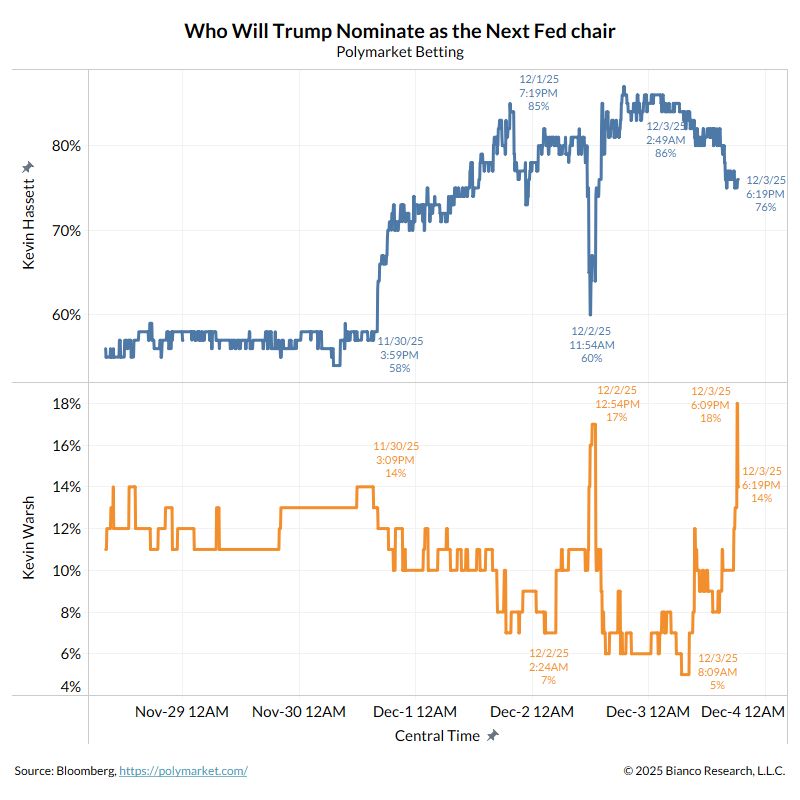

As shown by Jim Bianco on X, Hassett (blue) has been wildly gyrating the last 48 hours (85% to 60% to 86% to 76%).

Warsh (orange) has been trading inversely (7% to 17% to 5% to 18%). Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks