Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Federal Reserve delivered 25bps, as expected. So why are Dow, Nasdaq surging, Russell 2000 skyrocketing, cryptos soaring while bond yields are plummeting?

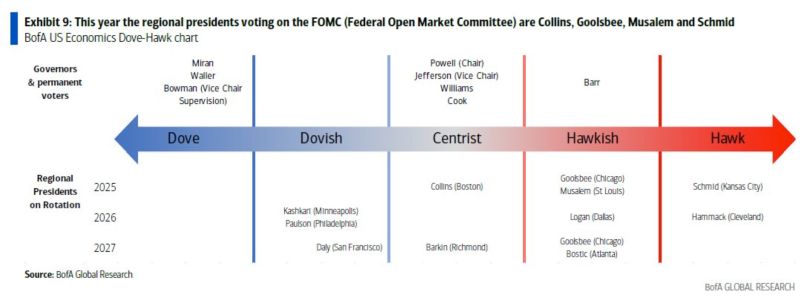

The real story is the "packaging" which turned out LESS HAWKISH than the markets expected. This became evident starting with the Statement, and was amplified by Chair Jerome Powell's remarks at the Press Conference. Should we call it a DOVISH CUT ??? 🚀🚀🚀

The main takeaways from the Federal Reserve’s updated forecasts:

- Economic growth was revised up (1.9% for 2025 and 2.1% for 2026 when adjusted for the effects of the shutdown, per Chair Powell) but still looks low overall given other indicators. - “Somewhat elevated” inflation is persisting, which Chair Powell attributes to tariffs, with upside risk in the short term. - Weakening labor market with an unclear balance between demand and supply side influences. - Expected decoupling of growth from employment. - Relatively upbeat on productivity but not willing to attribute this to any large extent to AI. Side note: Yes it sounds weird that the Fed is cutting rates while upgrading economic growth forecasts. But their target is mainly the weakening job market. Source: El Erian

Powell the Provider.

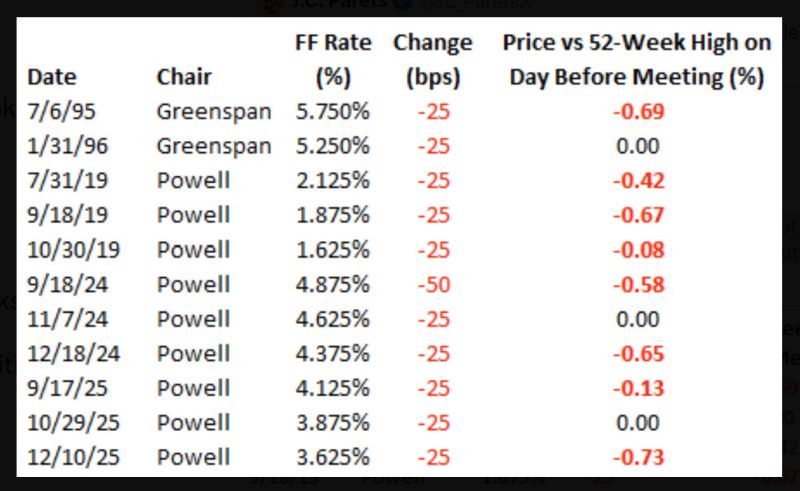

Today was the 11th time since 1994 that the Federal Reserve cut rates when the S&P 500 was within 1% of a 52-week high. Nine of those cuts have occurred under Powell. Source: Bespoke @bespokeinvest

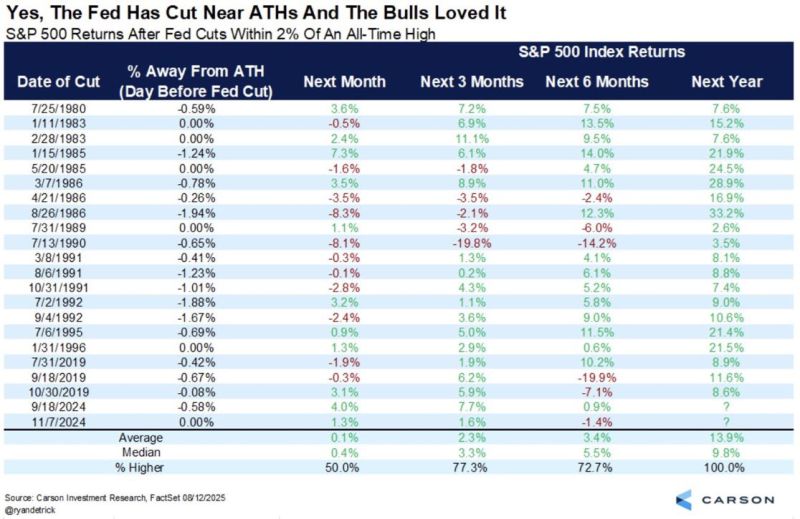

When the Fed cuts interest rates within 2% of stock market all-time highs, the S&P 500 has gone on to finish higher over the next 12 months 20 out of 20 times (100% hit rate) 🚨🚨🚨

Note however that the market reaction in the 3 to 6 months is mixed Source: Carson, Barchart

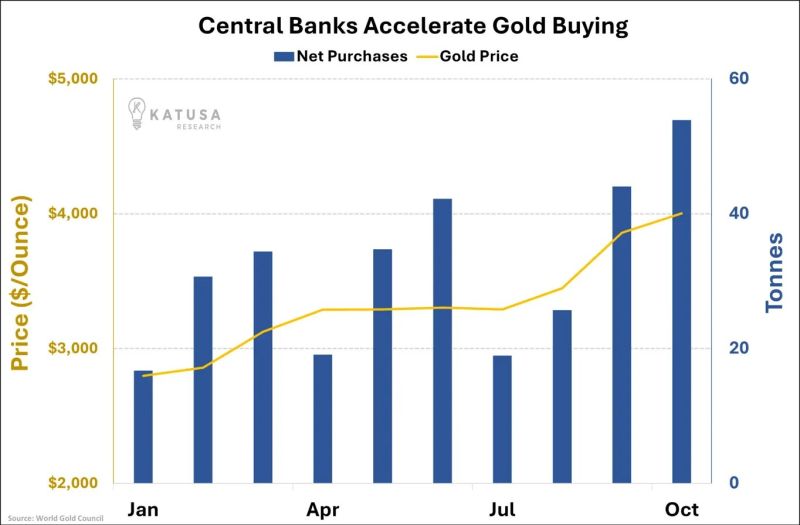

This chart destroys every "gold is too expensive" argument

They were buying 20 tonnes when gold was at $3,000. Now they're buying 55 tonnes at $4,000. Source: Katusa Research @KatusaResearch

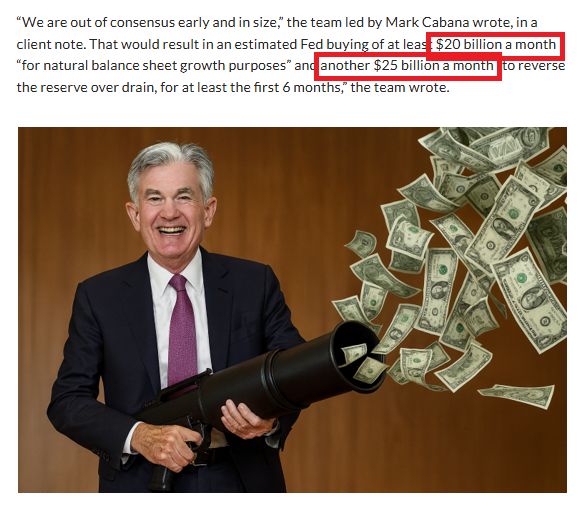

Federal Reserve expected to begin buying back an all-time high $45 billion of debt each month beginning in January 🤯👀

Source: Barchart

The Fed rate cut odds in December jumps to 95% on Polymarket.

Source: Ash Crypto

Investing with intelligence

Our latest research, commentary and market outlooks