Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 REMINDER: Bank of Japan expected to hike rates 25 bps Friday

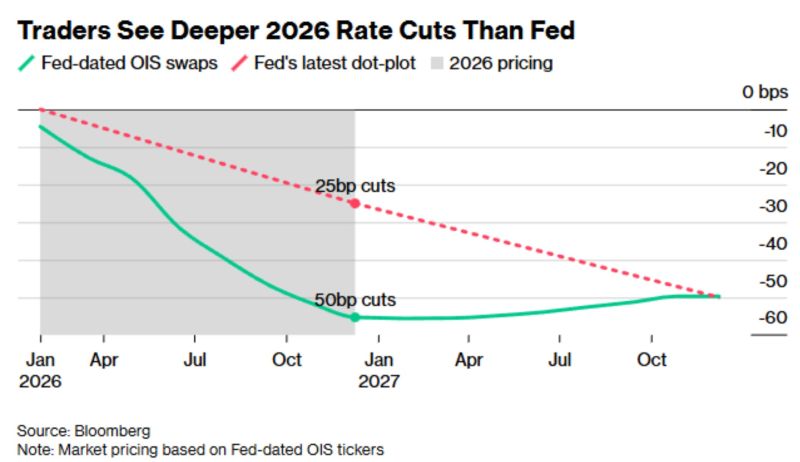

Nobody knows when the real consequences will materialize, but after a prolonged period of extremely low rates, this continued shift will likely drain liquidity from markets, potentially causing a ripple effect through margin calls and other forced deleveraging. Rates will probably rise to 0.75%, which is still low by global standards. However, what matters most here is the rate of change, rather than the absolute level of rates. Higher Japanese rates = stronger yen → yen carry trade unwinds → investors sell foreign assets (U.S. Treasuries) → upward pressure on U.S. yields → global liquidity contracts Will it happen? Or is it already priced by the market? Source: Guillaume Tavares, Bitcoin Archive

UK Inflation Just Gave the Bank of England a Green Light

UK inflation fell sharply to 3.2% in November, well below expectations. 📉 Forecast: 3.5% 📉 October: 3.6% 📉 Actual: 3.2% Even more important: Core inflation also cooled to 3.2% Unemployment just rose to 5.1% This combo changes the game. 💷 What it means: The Bank of England is now widely expected to cut rates by 25 bps to 3.75% at its meeting this Thursday. 👀 Inside the decision room: Likely a tight 5–4 vote Governor Andrew Bailey expected to be the deciding swing vote 📌 Big takeaway: Inflation is easing. The labor market is softening. The UK may be on the brink of its first rate cut cycle, and markets are watching closely. Source: CNBC

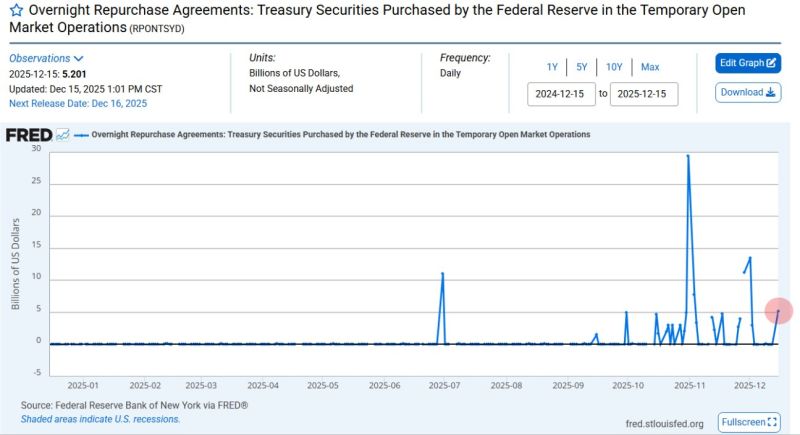

Federal Reserve just pumped $5.2 Billion into the U.S. Banking System through overnight repos

This is the 6th largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble 👀 Source: Barchart @Barchart

This monetary policy cycle is much less synchronized than it used to be

Source: Mo El-Erian

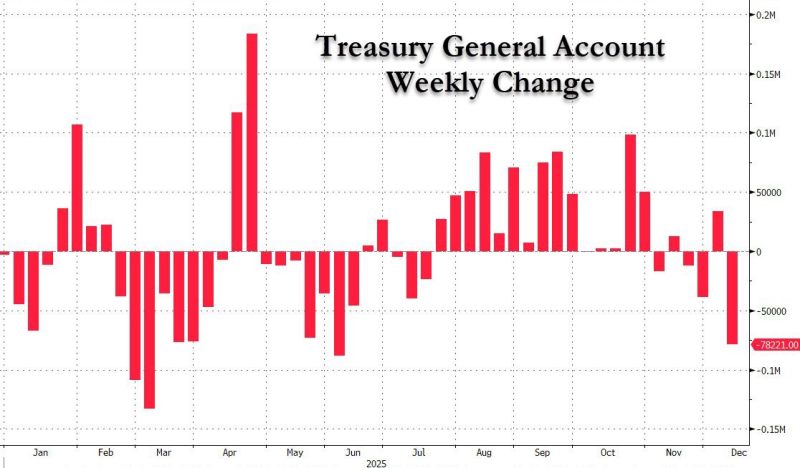

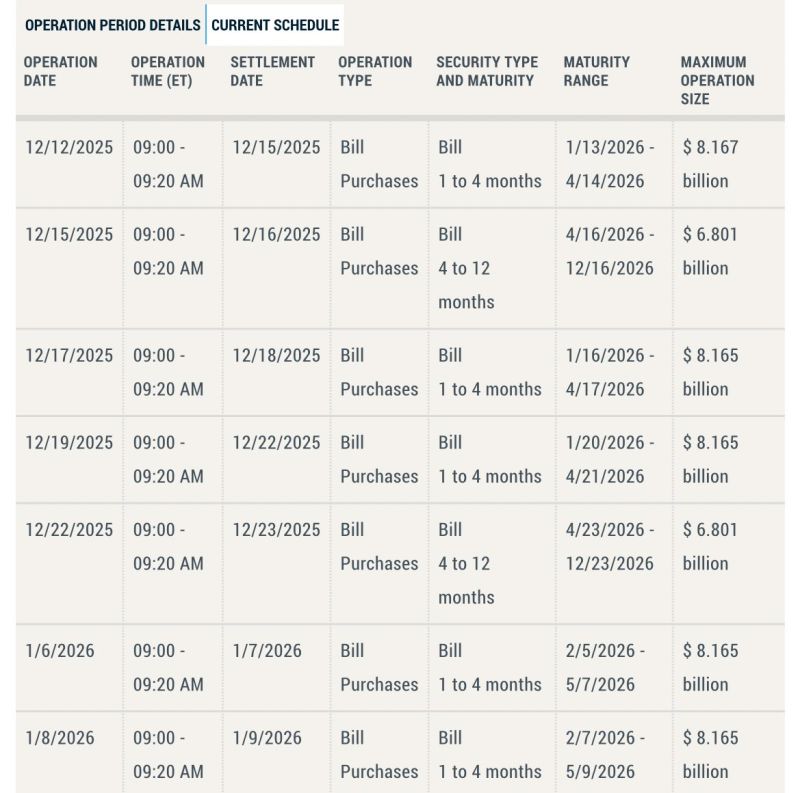

1) Repo fixed ✔️ : Fed launches Reserve Management Purchases (liquidity injections)

2) Treasury cash flood begins ✔️ : TGA balance down $78BN in one week (3rd biggest liquidity injection of 2025) 3) Meltup ✔️: stocks close at all time high Source: zerohedge

Here it is…

Fed’s first month of T-Bill purchases. $40 BILLION over the next month. Starts today at 9am.

SUMMARY OF FED CHAIR POWELL'S COMMENTS:

1. Downside risks to employment have risen 2. Inflation in the US "remains somewhat elevated" 3. Interest rates are now in a "plausible range of neutral" 4. GDP growth forecast for 2026 has been revised up 5. Readings on inflation are higher as goods inflation has "picked up" 6. Three Fed members dissented today's decision The Fed is divided (but less than many feared). Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks