Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

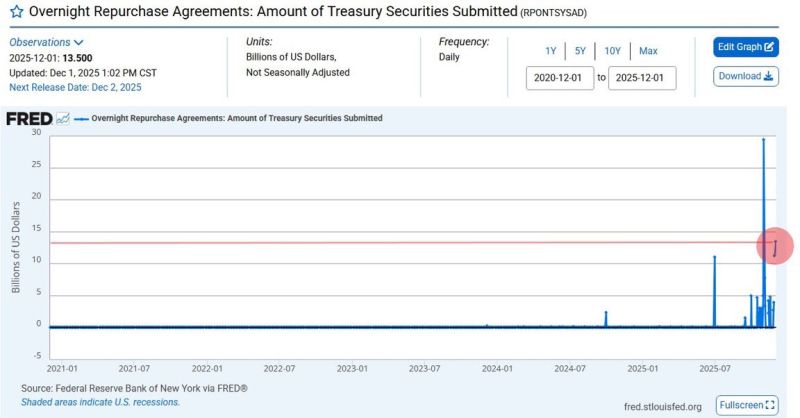

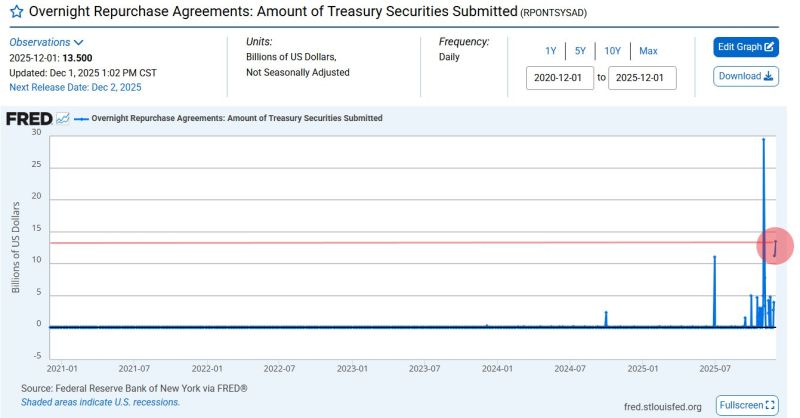

⚠️ The $13.5 Billion Fed Repo Operation: Ignore the Noise, Understand the Signal

The headlines are running wild, calling the massive overnight liquidity injection "The Biggest Since COVID!" and predicting the return of Quantitative Easing (QE). Here is the objective truth: ➡️ The Problem: Banks ran into simultaneous, acute, and unexpected shortfalls of overnight cash. This created an immediate, sharp spike in inter-bank borrowing rates (liquidity stress). ➡️ The Fed's Role: The Federal Reserve stepped in not as an asset purchaser (QE), but as the essential backstop. The $13.5B was a tactical operation to stabilize the overnight lending market and prevent a systemic spike in financing costs. ➡️ The Historical Precedent: This scenario is not a predictor of a new bull cycle. It happened in 2019 after Quantitative Tightening (QT) ended. It's a structural issue in the funding markets, not a macroeconomic pivot. 👉 Conclusion: This is not QE. This happened when QT ended in 2019 as well. This is a clear indication of financial plumbing stress. Treat it as a warning light within the system, signaling potential underlying friction. Source: FRED, Brett

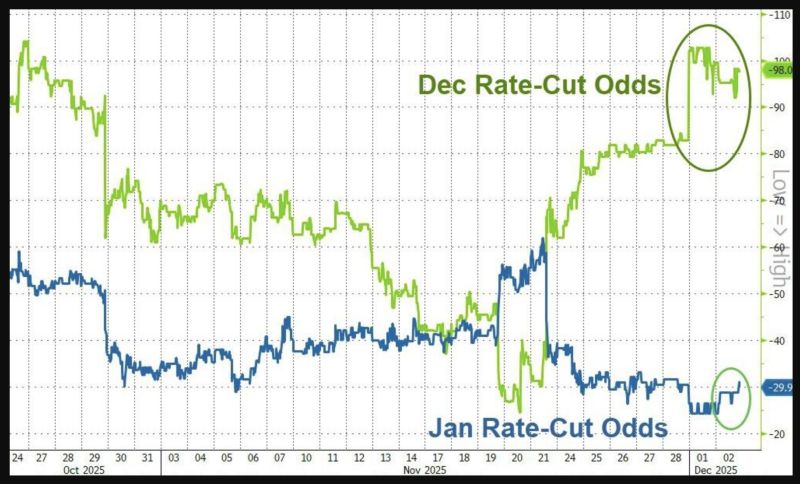

Rate-cut odds seem to indicate December meeting is a done deal.

But we also note that January odds are rising... Source: zerohedge

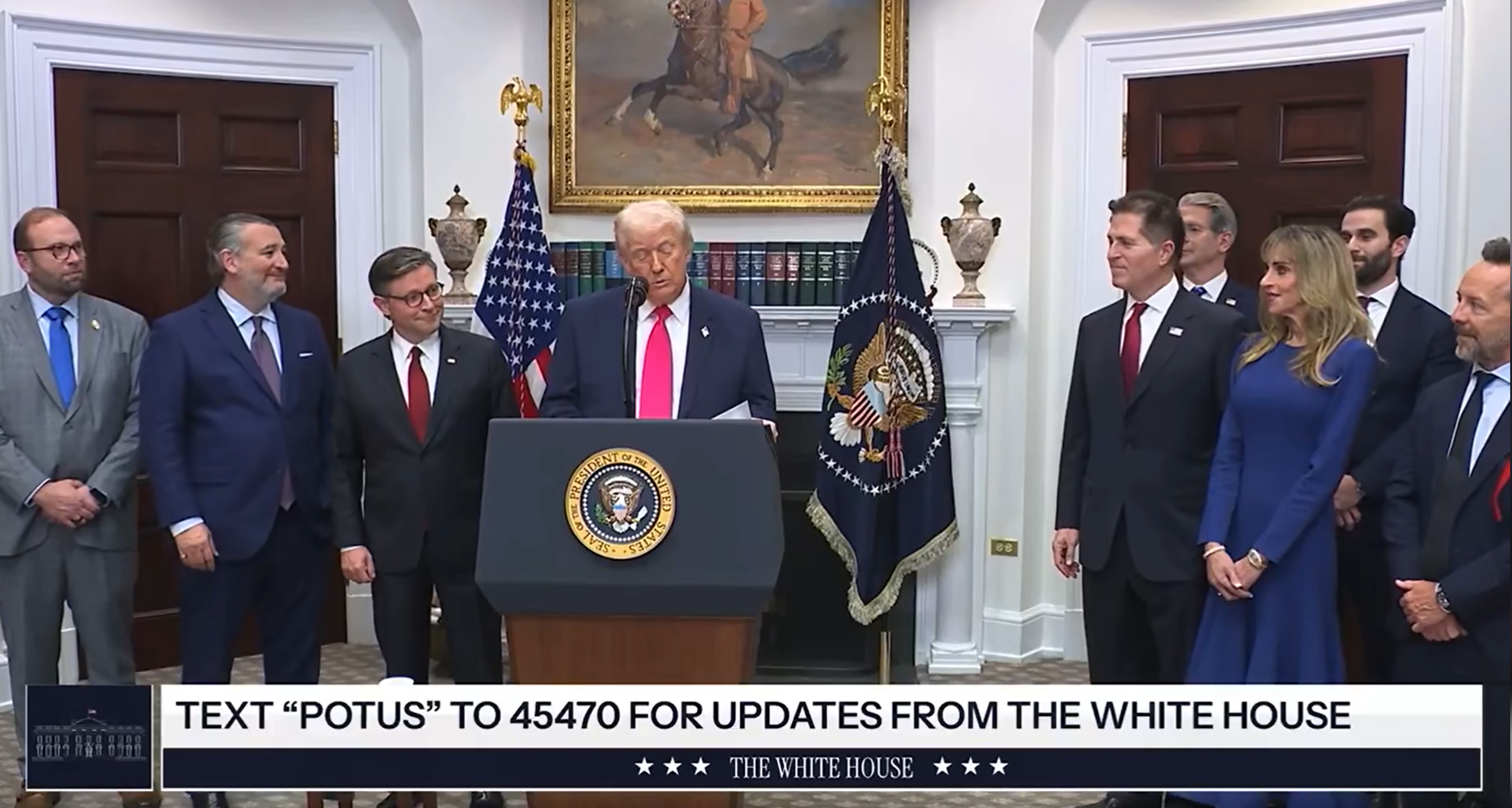

TRUMP: “I guess a potential Fed Chair is here too…I don’t know, are we allowed to say that? Thank you Kevin.”

It looks like the next Fed Chair will be Kevin Hasset, who is obviously very close to Donald Trump. At many occasions, Kevin Hassett has emphasized the need for lower interest rates to stimulate economic growth and criticize the Federal Reserve (Fed) for being too slow to ease monetary policy. Here are some of his key dovish sentiments: ➡️ Advocacy for Immediate Rate Cuts: Hassett told Fox News that he would be "cutting rates right now" if he were Fed chair. ➡️Call for Aggressive Easing: He advocates faster and deeper rate cuts than the current Fed leadership. ➡️Focus on Lower Borrowing Costs for Consumers: He has emphasized the importance of “cheaper car loans and easier access to mortgages,” framing lower rates as a tool to support middle-class financial health. ➡️Criticism of Current Policy as Too Restrictive: He has consistently argued that interest rates in the United States are too high and risk constraining investment, hiring, and household borrowing. He has warned that staying too restrictive for too long could undermine growth just as the economy is showing signs of cooling. ➡️Alignment with Presidential Preferences for Lower Rates: Hassett has publicly aligned himself with the view that interest rates in the United States are too high. He has also said Americans should expect the President to pick a chair who will help deliver lower borrowing costs.

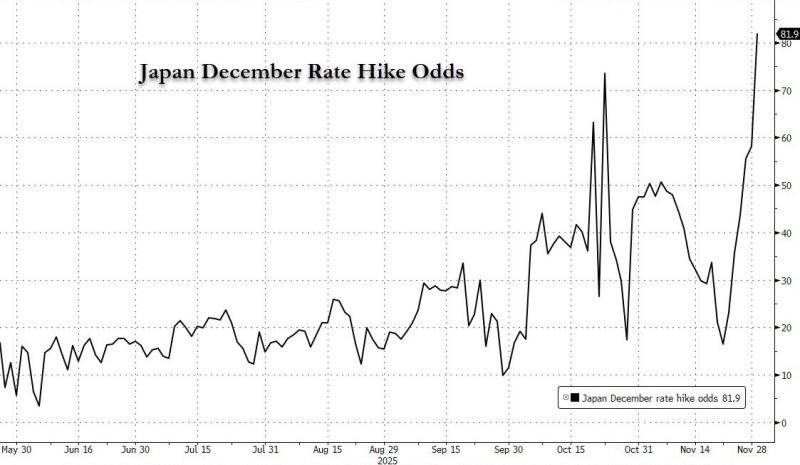

Central banks have completely messed up market messaging.

First Fed's schziophrenic communications sent Dec rate cut odds from 80% to 30% to 100%, and now the BOJ just send Dec rate hike odds to 80% from 20% ten days ago! Source: zerohedge

This might force the hand of the Fed...

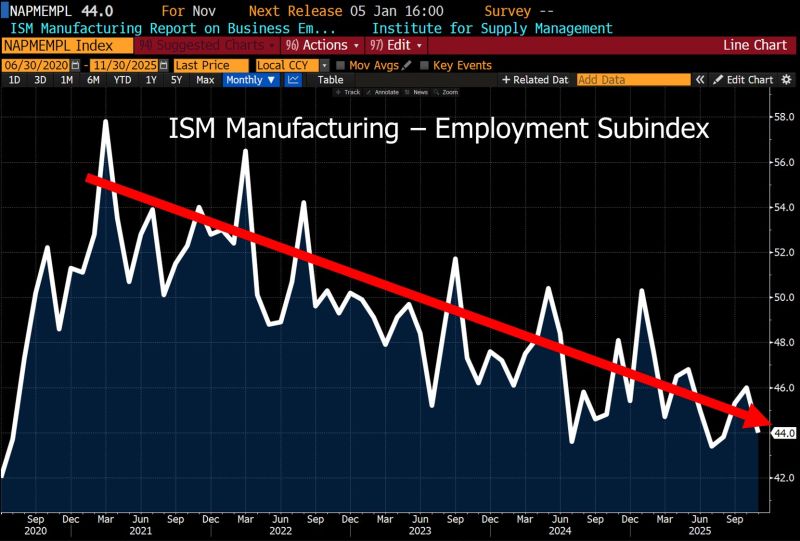

Powell may have floated the idea of a pause, but the cooling U.S. labor market tells a different story — and it’s opening the door to lower policy rates. Here’s the twist: Inflation is holding around 3.0%, dipped to 2.3%, and is averaging 2.7% for the year. GDP? Still strong. Demographics? Warping the job market. And yet… rate cuts are coming. Why? Because the other half of the Fed’s mandate is screaming for it. Lower rates conveniently support: Debt sustainability Financial-sector stability Liquidity across the system Central banks want lower rates — and their messaging shows it. That’s why we’re hearing nonstop about financial-sector risks, bond-market volatility, and liquidity needs… and far less about headline inflation.

Fed Reserve just pumped $13.5 Billion into the U.S. Banking System through overnight repos.

This is the 2nd largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble Source. Barchart

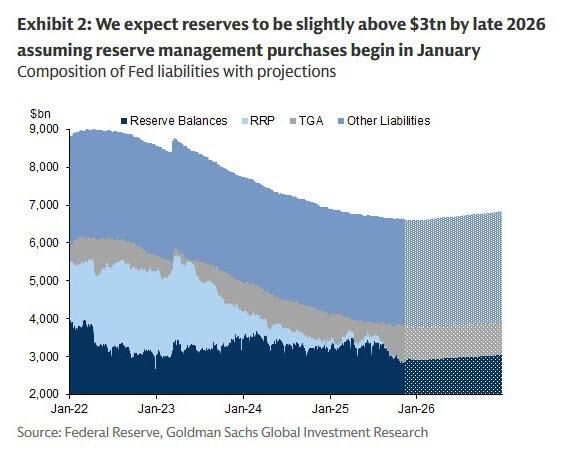

🔥 Big Shift Today: The Fed Just Ended QT - What This Means For Overall Liquidity according to Goldman 🔥

After months of draining liquidity and a one-month delay that tightened markets, the Fed’s quantitative tightening officially ends today. Here’s what Wall Street is watching: 💧 Reserves Are Scraping Bottom Fed reserves hit a low in October, but should end 2025 around $2.9T - still uncomfortably close to “not enough.” Repo markets have already shown stress, with Standing Repo Facility usage hitting its 2nd-highest level since COVID. 🏦 Goldman’s Call: QT Ends, Balance Sheet Growth Returns Fast Goldman expects the Fed to start buying ~$20B/month in T-bills starting Jan 2026, plus reinvesting MBS runoff - together adding ~$40B/month back into the system. Reserves could climb back above $3T by late 2026. 💣 Why the Pivot? Liquidity Is Too Tight Repo rates (TGCR, SOFR) are trading well above where they “should” be. Funding markets keep flashing red. The Fed is quietly preparing to reflood the pipes. 📈 Treasury Supply Stays Heavy - But the Fed Becomes a Buyer Again With massive deficits ahead, Treasury issuance remains huge. But thanks to the shift in policy: Fed is expected to absorb ~$480B of next year’s T-bill issuance Non-Fed buyers only take ~$390B — the lowest since 2023 🍃 But There’s a Catch… The Fed will let $2T of MBS roll off, pushing a wave of mortgage-backed supply into markets. That means: ➡️ More pressure on housing and mortgage rates ➡️ A slow-motion shift from MBS → Treasuries in the system ⚠️ Bottom Line: QT ends today, but the liquidity story is far from over. Funding markets are strained, repo is volatile, MBS supply is surging - and the Fed may be forced to restart balance sheet expansion faster than anyone expected. The next big test? April tax season. If liquidity cracks again, the Fed’s “reserve management purchases” may turn into something much bigger. Source: Goldman Sachs, zerohedge

So what's going on in markets this morning? Why are Cryptos tumbling again?

A ris-off signal to start December? Well, it seems that the spike in Japanese bonds yields is the culprit... Indeed, Japanese bonds are puking on renewed expectations of rate hike, as the 2Yr JGB yield is above 1% for the first time since 2008. The yen is firming and the Nikkei 225 index is tumbling. And since nowadays Bitcoin always correlates with anything that's down, we have a 5% dump in Bitcoin in Asian trading to $85k.... In the middle of Asian session, BoJ Governor Ueda said he was consider the "pros and cons" of raising interest rates at the BoJ's December and idea that the market got hold of last week as the odds of a BoJ Dec rate hike increased from 30% to 50%. Source: Bloomberg, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks