Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

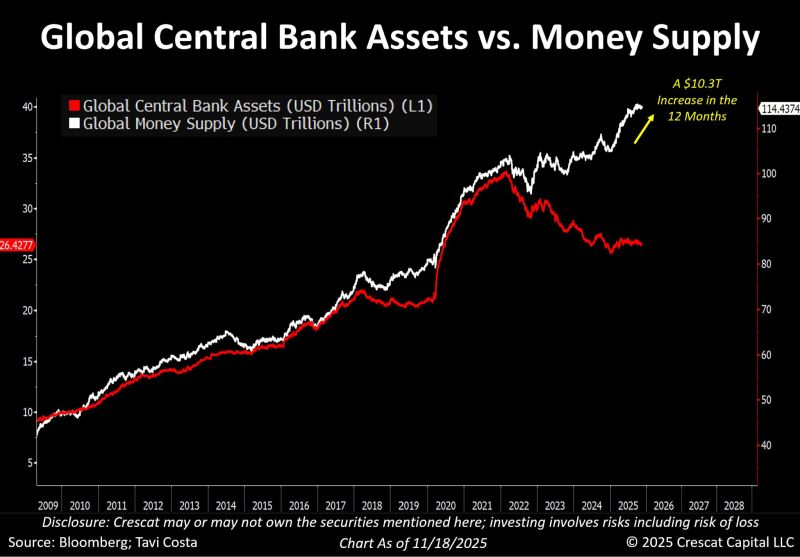

Very interesting to see money supply expanding this aggressively even as global central bank balance sheets have been contracting.

What will happen once central banks inevitably need to expand their balance sheets again? Source: Tavi Costa, Bloomberg

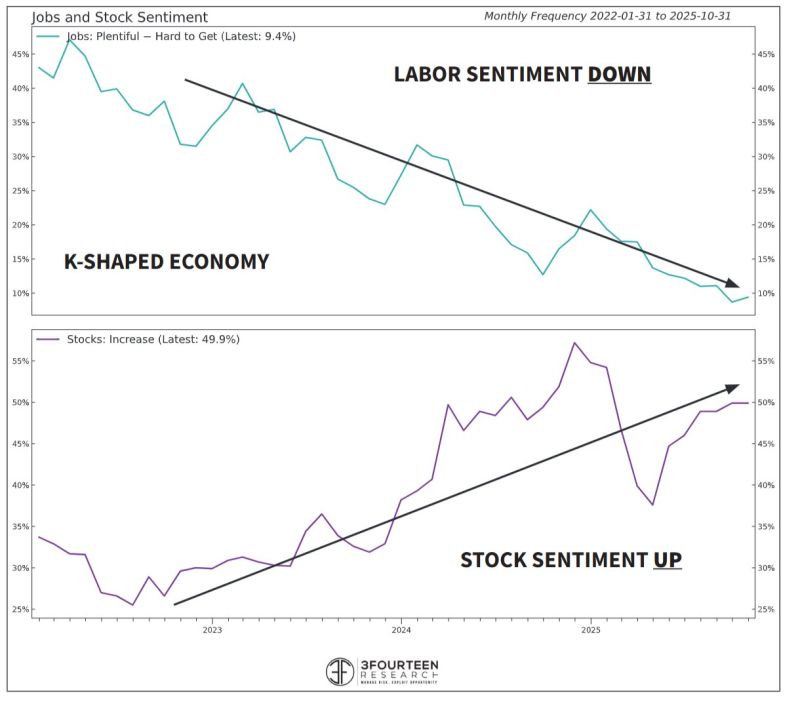

WALLER: Supports a December cut...citing "a weak labor market and mon pol that is hurting low and middle-income consumers."

Waller has been a Fed leader and, whether his view of a Dec cut prevails, the Fed will eventually be forced to respond to the lower-K. Source: 3fourteenresearch

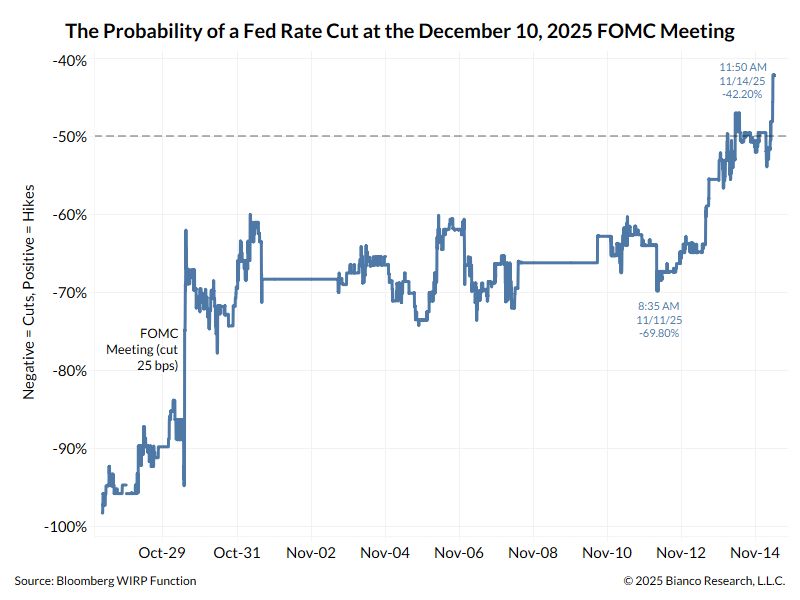

According to Jim Bianco, significant change is now underway at the Fed.

Last week, the probability of a Fed rate cut at the December 10th meeting went from 70% on Monday to 42% on Friday. However: - There were no major government data releases, as the Government was still closed until Wednesday - The Federal Reserve chairman did not speak this past week. So what drove this shift in the outlook for policy? Here's an explanation by Jim Bianco: * 4 Fed voters are arguing for another rate cut (with Miran arguing for at least a 50 bps cut). * 5 voters are arguing for holding rates steady * 3 voters are either neutral or unclear (so far) on how they will vote. This includes Chair Powell. For 40 years, Fed policy was effectively set by one person, the chair. The monetary policy vote was typically 12-0 or 11-1. The Fed justified this unified front by saying it reduced market uncertainty, thereby making it more effective. Now this is changing, and so is the market’s view of the Fed. With higher-than-normal uncertainty, the market is pricing a 50/50 chance of a cut. Normally, these odds are much closer to 0% or 100% when a meeting is less than a month away. What Changed? We would argue Trump’s constant bashing of the Fed/Powell and Fed Governor Miran’s vocal arguments for a 50 bps cut appear to be breaking the 40-year stranglehold the Fed chair has had over committee voting. No longer are the 12 FOMC voters going to fall in line with the chair’s desires. They are quickly considering themselves truly independent voters and will vote as they see fit. Maybe Fed Governor Stephen Miran is leading the way. If he can ignore the Fed groupthink and act completely independently, publish blog posts explaining his rationale, and do numerous interviews to explain his opinion, then why can’t everyone else? The result is 12 truly independent voters. This is how every other major central bank and the Supreme Court operate. If this is truly happening, it marks the end of the Fed’s unanimous voting.

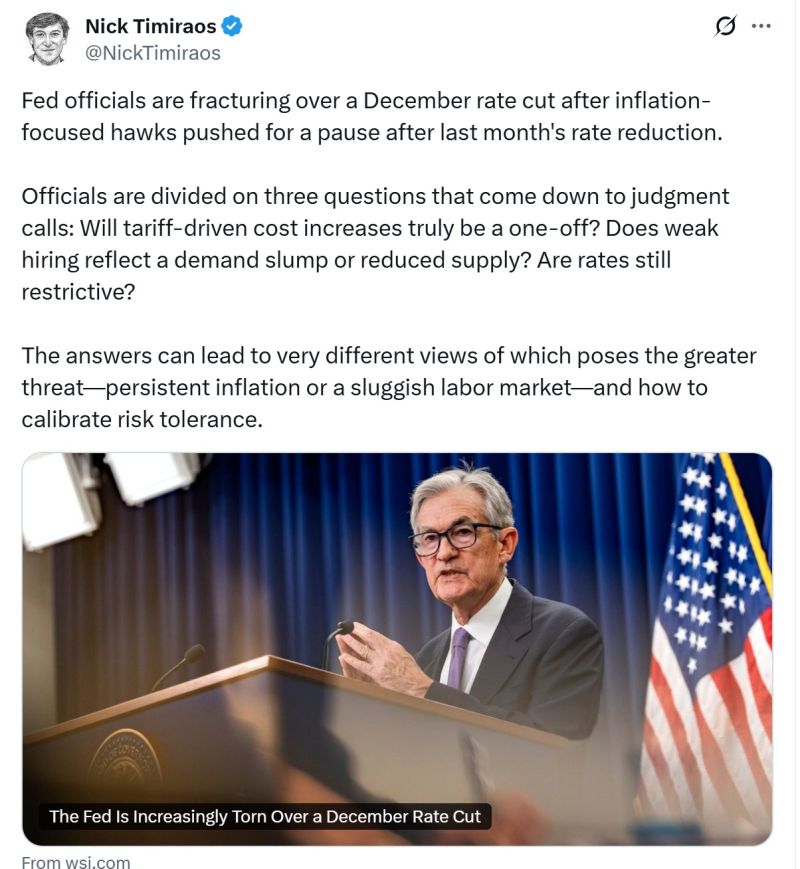

Odds of a rate cut at Fed December meeting have increased again (70%+) but Fed officials remain divided on three questions that come down to judgment calls:

1. Will tariff-driven cost increases truly be a one-off? 2. Does weak hiring reflect a demand slump or reduced supply? 3. Are rates still restrictive?

BREAKING: U.S. Banks

FED just did it again! Another $24 Billion injection into the U.S. Banking system Make that $125 Billion over the last 5 days Source: zerohedge

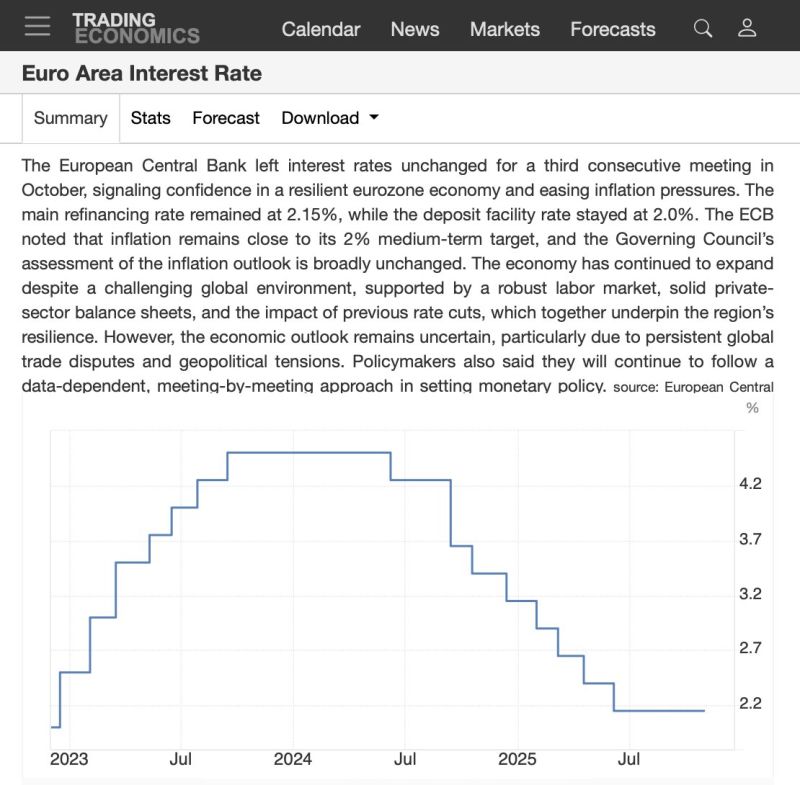

🚨 ECB hits pause again as economy shows resilience

The European Central Bank kept rates on hold at 2% for the third straight meeting. 💶 Inflation is right on target at 2% 📉 Rates down from last year’s 4% peak 💪 Growth still holding up The ECB says Europe’s economy is proving resilient — supported by strong labor markets and healthy private balance sheets. But beneath the calm? ⚠️ Uncertainty from global trade tensions and geopolitics still clouds the outlook.

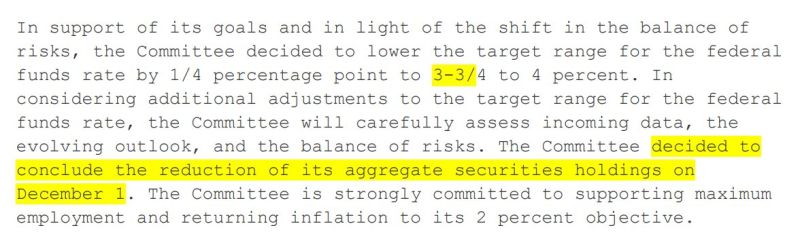

For 35 minutes, today’s FOMC meeting was painfully boring

The Fed cut rates ✅ Ended QT ✅ A few dissenters ✅ Markets? Totally unfazed. S&P flat. Yields steady. Commodities and crypto asleep. And then — 2:35 PM. Powell drops one line that flips everything: “December cut is not for sure, far from it.” Boom 💥 Rate-cut odds crash from 95% → 65% in minutes. Stocks wobble. Yields jump. Traders scramble. Moral of the story? In markets, boredom never lasts long — and one sentence from the Fed can move trillions.

THE FED WILL END QT ON DECEMBER 1ST

Moving from restrictive → supportive balance sheet policy. This is not QE, but it is definitely a positive development that provides a mild liquidity tailwind for markets. Source: Joe Consorti @JoeConsorti

Investing with intelligence

Our latest research, commentary and market outlooks