Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

From "Hawks and Doves" to "Red and Blue"?

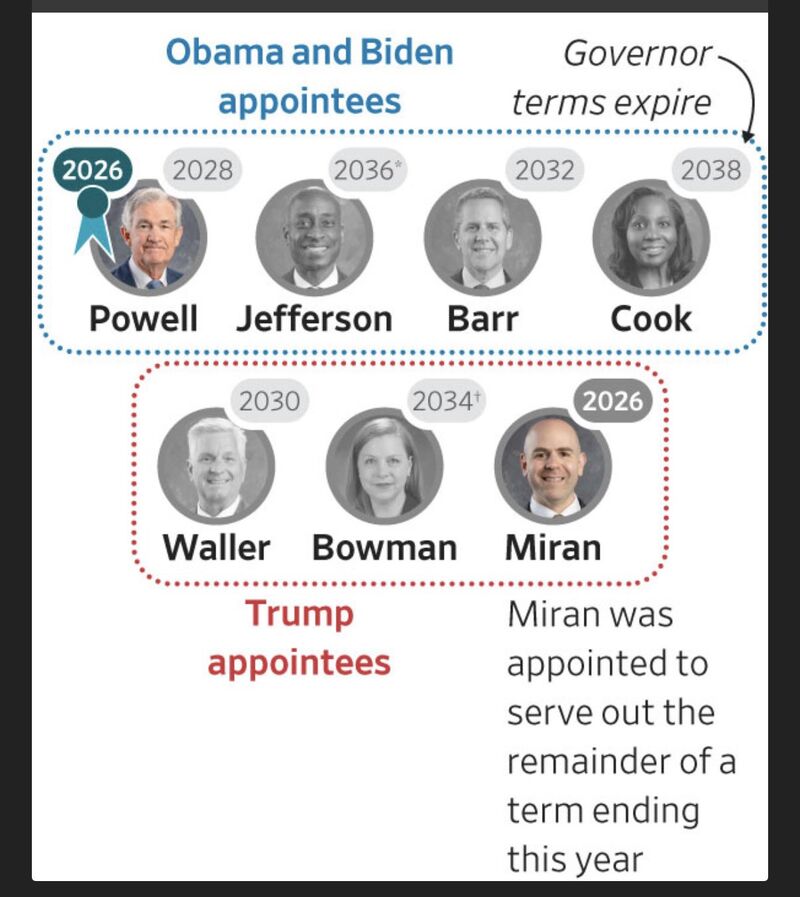

In a sign of the times, this Wall Street Journal chart characterizes members of the Federal Reserve Board by their political nominations rather than their expertise, experience, or hawkish/dovish inclinations. Source: Mo El Erian

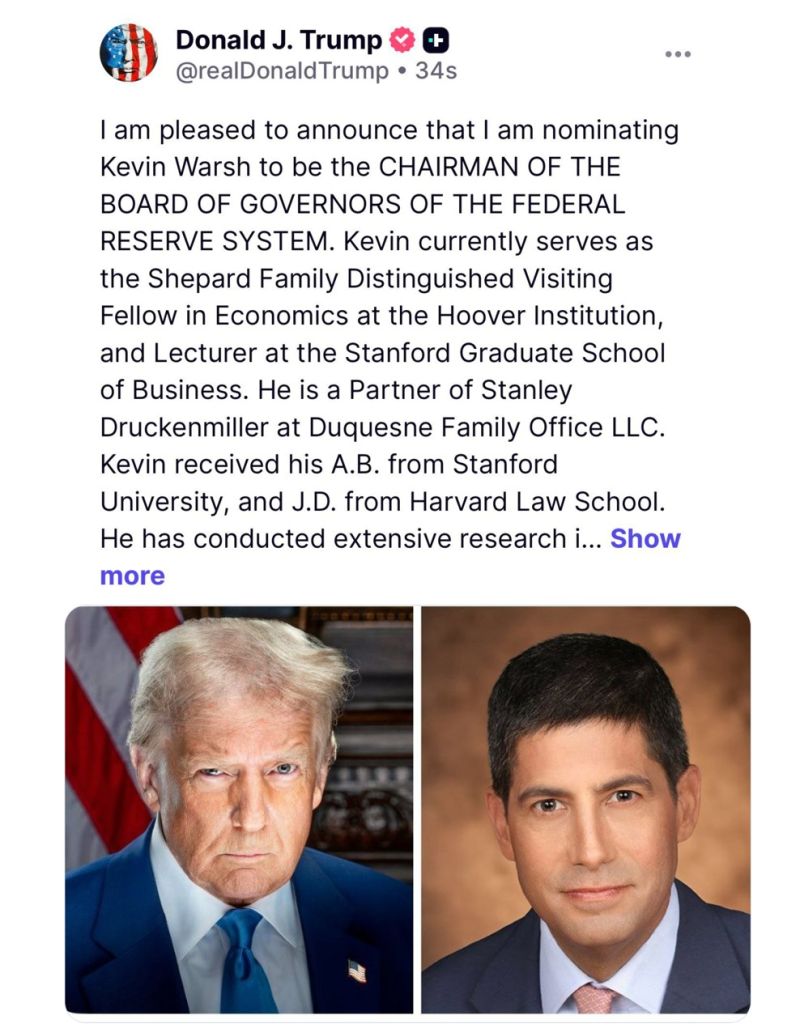

Trump nominates Kevin Warsh for Federal Reserve chair to succeed Jerome Powell

After months of speculation, President Trump has officially named Kevin Warsh to succeed Jerome Powell as Fed Chair. This isn't just another personnel move. It’s a seismic shift for the U.S. economy. Here is why every professional needs to be paying attention: 1. The End of an Era (and a Feud) 🥊 The tension between Trump and Powell has been no secret since 2018. By picking Warsh, the President is looking for what he calls a "GREAT" chairman to lead a new direction. 2. Credibility is the Currency 💎 Wall Street is breathing a sigh of relief. Why? Because Warsh has been there before. As David Bahnsen noted, he has the "respect and credibility" of the markets. He’s seen as a pro who understands the plumbing of the financial system. 3. The Fight for Independence 🛡️ The big question: Can the Fed stay independent? With debates swirling about White House oversight and interest rate consultations, Warsh will be walking a tightrope between political pressure and economic reality. 4. A "No-Fire, No-Hire" Economy 📉 Inflation isn't at 2% yet, and the labor market is cooling. Warsh inherits a "precarious" moment where the margin for error is razor-thin. The Bottom Line: Kevin Warsh called for "regime change" at the Fed last summer. Now, he’s the one holding the keys. 🔑 Markets are pricing in stability for now, but with Jerome Powell potentially staying on as a Governor to protect Fed independence, the boardroom in D.C. is about to get very interesting.

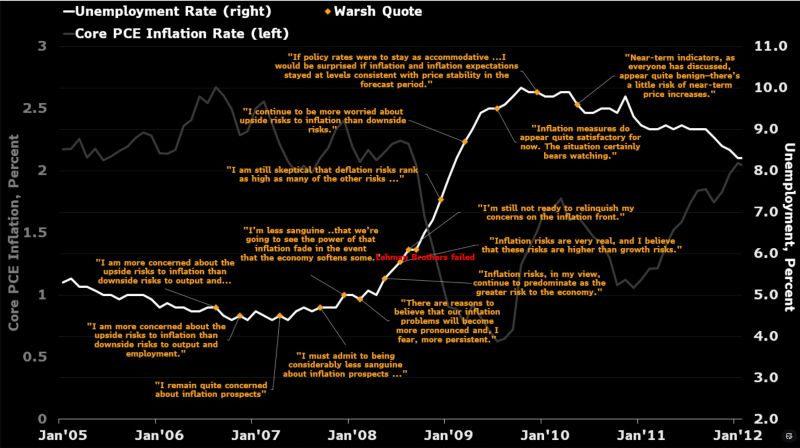

🚨 Is the market misreading the next potential Fed Chair? 🚨

If the goal is "easy on inflation," the history books tell a very different story about Kevin Warsh. Looking back at the FOMC transcripts from 2006-2011, one moment stands out that should make every investor pause. 📍 The Setting: April 2009. The world was still reeling 7 months after the Lehman Brothers collapse. - Unemployment: 9% - Core PCE Inflation: A mere 0.8% - Despite a crashing economy and deflationary pressure, Warsh’s stance was clear: "I continue to be more worried about upside risks to inflation than downside risks." The Takeaway: Warsh has historically been an "inflation hawk," even when the data suggested the opposite. If he takes the helm, we might be looking at a much more aggressive Fed than the "dovish" transition many are currently pricing in. Source: Bloomberg, Anna Wong @AnnaEconomist

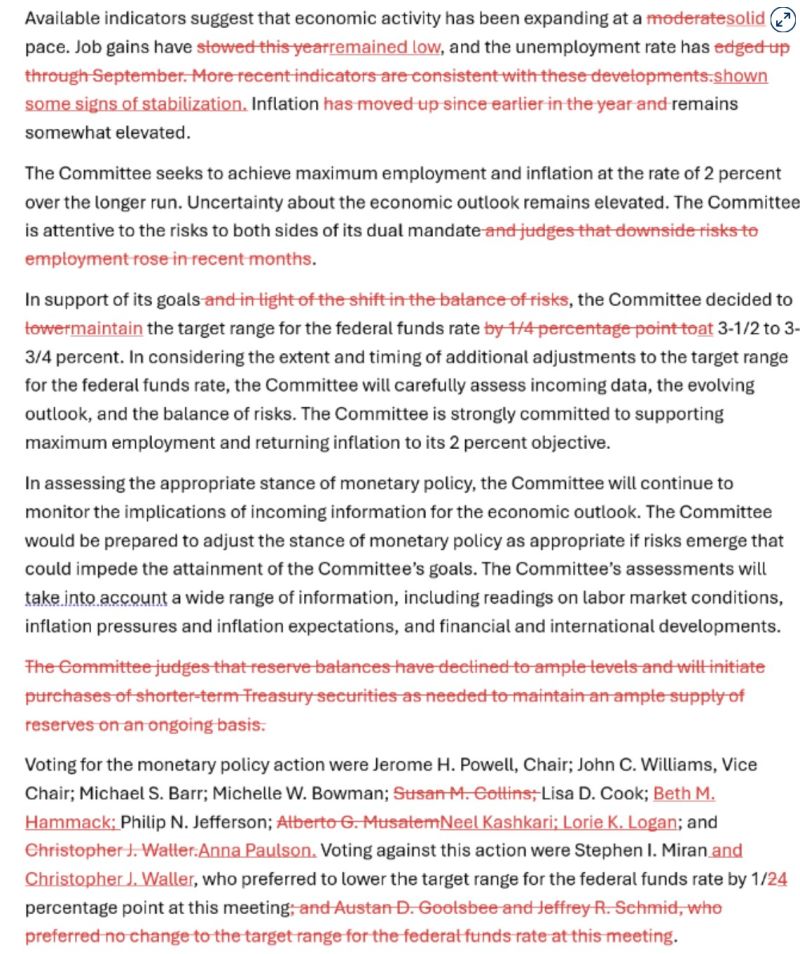

The Fed just hit the "Pause" button. 🛑

After three straight cuts, the FOMC is holding rates at 3.5%–3.75%. But the real story isn't the percentage—it’s the pressure. Here is what you need to know about the shift in DC today: 🔹 The "Labor Scare" is over: The Fed removed the language suggesting they're worried about the job market. They now see risks as "balanced." 🔹 Inflation is sticky: With growth tracking at a massive 5.4%, the Fed is worried about a second wave of price hikes. 🔹 A House Divided: Two Trump-appointed governors (Miran and Waller) dissented, pushing for more cuts despite the hold. 🔹 The End of an Era: Jerome Powell has only two meetings left. Between DOJ subpoenas over office renovations and a Supreme Court battle over firing governors, the Fed’s independence is being tested like never before. The big question for the markets: Who takes the wheel next? 🏎️ Prediction markets are currently betting on BlackRock’s Rick Rieder to succeed Powell. Below is the Fed statement with changes in red Source: CNBC

Historically, Treasury Yields Rise After Fed Chair Nominations

With the time until the next Fed chair arrives at the Marriner Eccles building fast approaching, BofA Hartnett reminds us that 3 months following seven nominations for Fed Chair since 1970 (Burns, Miller, Volcker, Greenspan, Bernanke, Yellen, Powell), yields were up every time (2-year +65bps, 10-year +49bps)... Source: BofA, zerohedge

The Federal Reserve's 420 Billion Dollars Wall Street Bailout

The Fed has quietly delivered nearly HALF A TRILLION DOLLARS of no-strings-attached bank bailouts in the last few months, according to documents & data reviewed by @LeverNews . In all, the new bailouts are already 60% of the amount of the financial crisis TARP bailout. Source: David Sirota @davidsirota

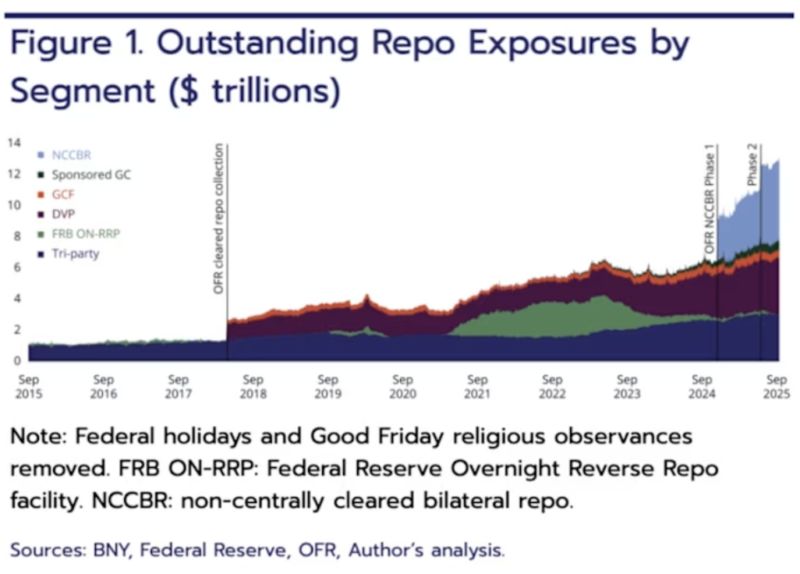

Total Repo Exposure has reached an all-time high of $12.6 Trillion

Source: barchart

Treasury Secretary Scott Bessent goes full fire on Powell

Sec. Bessent says the probe into Fed Chair Jerome Powell is 100% justified, “NOBODY is above the law!” “There NEEDS to be some accountability!” “The Fed is now LOSING $100B a year! $100B! With NO accountability!” Jerome should RESIGN, NOW. The Fed’s bleeding billions under Powell’s watch, time for real oversight and America First monetary sanity. No more excuses! Source: @GuntherEagleman

Investing with intelligence

Our latest research, commentary and market outlooks