Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 Is the market misreading the next potential Fed Chair? 🚨

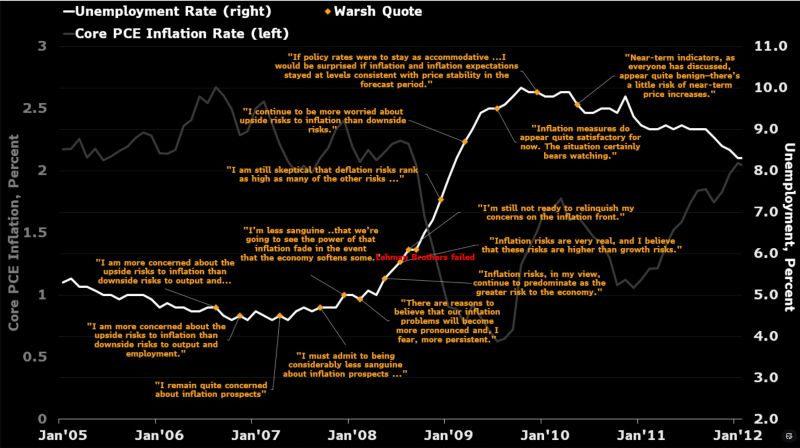

If the goal is "easy on inflation," the history books tell a very different story about Kevin Warsh. Looking back at the FOMC transcripts from 2006-2011, one moment stands out that should make every investor pause. 📍 The Setting: April 2009. The world was still reeling 7 months after the Lehman Brothers collapse. - Unemployment: 9% - Core PCE Inflation: A mere 0.8% - Despite a crashing economy and deflationary pressure, Warsh’s stance was clear: "I continue to be more worried about upside risks to inflation than downside risks." The Takeaway: Warsh has historically been an "inflation hawk," even when the data suggested the opposite. If he takes the helm, we might be looking at a much more aggressive Fed than the "dovish" transition many are currently pricing in. Source: Bloomberg, Anna Wong @AnnaEconomist

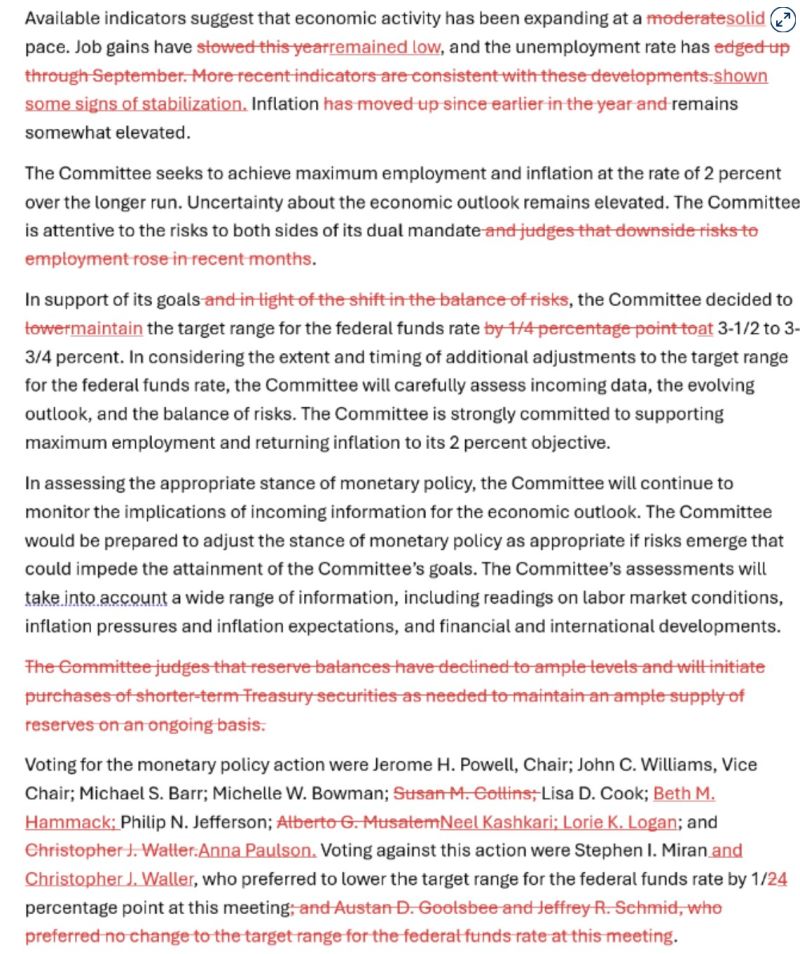

The Fed just hit the "Pause" button. 🛑

After three straight cuts, the FOMC is holding rates at 3.5%–3.75%. But the real story isn't the percentage—it’s the pressure. Here is what you need to know about the shift in DC today: 🔹 The "Labor Scare" is over: The Fed removed the language suggesting they're worried about the job market. They now see risks as "balanced." 🔹 Inflation is sticky: With growth tracking at a massive 5.4%, the Fed is worried about a second wave of price hikes. 🔹 A House Divided: Two Trump-appointed governors (Miran and Waller) dissented, pushing for more cuts despite the hold. 🔹 The End of an Era: Jerome Powell has only two meetings left. Between DOJ subpoenas over office renovations and a Supreme Court battle over firing governors, the Fed’s independence is being tested like never before. The big question for the markets: Who takes the wheel next? 🏎️ Prediction markets are currently betting on BlackRock’s Rick Rieder to succeed Powell. Below is the Fed statement with changes in red Source: CNBC

Historically, Treasury Yields Rise After Fed Chair Nominations

With the time until the next Fed chair arrives at the Marriner Eccles building fast approaching, BofA Hartnett reminds us that 3 months following seven nominations for Fed Chair since 1970 (Burns, Miller, Volcker, Greenspan, Bernanke, Yellen, Powell), yields were up every time (2-year +65bps, 10-year +49bps)... Source: BofA, zerohedge

The Federal Reserve's 420 Billion Dollars Wall Street Bailout

The Fed has quietly delivered nearly HALF A TRILLION DOLLARS of no-strings-attached bank bailouts in the last few months, according to documents & data reviewed by @LeverNews . In all, the new bailouts are already 60% of the amount of the financial crisis TARP bailout. Source: David Sirota @davidsirota

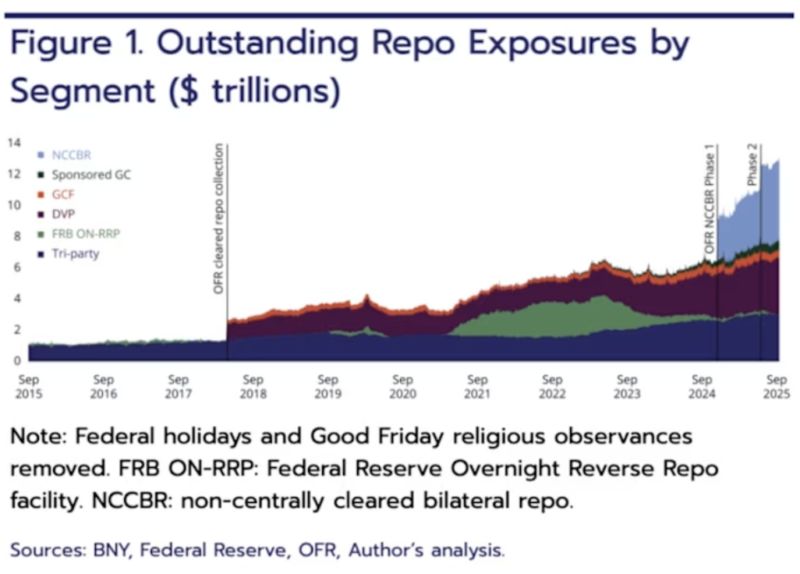

Total Repo Exposure has reached an all-time high of $12.6 Trillion

Source: barchart

Treasury Secretary Scott Bessent goes full fire on Powell

Sec. Bessent says the probe into Fed Chair Jerome Powell is 100% justified, “NOBODY is above the law!” “There NEEDS to be some accountability!” “The Fed is now LOSING $100B a year! $100B! With NO accountability!” Jerome should RESIGN, NOW. The Fed’s bleeding billions under Powell’s watch, time for real oversight and America First monetary sanity. No more excuses! Source: @GuntherEagleman

Global Central Bankers in "Full solidarity" with Fed's Powell

Claims that the Fed is “losing independence” are being reframed by James E. Thorne as misleading. According to this view, Chair Powell publicly suggested the DOJ was threatening a criminal indictment over his testimony on costly Fed building renovations—despite the DOJ never using that term. The U.S. Attorney’s Office had repeatedly sought clarification on cost overruns and testimony accuracy, but those requests were ignored until grand jury subpoenas were issued, after which Powell framed the situation as retaliation. Monetary policy independence remains intact, but it does not imply immunity from fiscal or legal oversight. Invoking “central bank independence” in this context is seen as an attempt to shield the Fed from accountability rather than a genuine threat to rate-setting autonomy. Source: Bloomberg, James E. Thorne @DrJStrategy

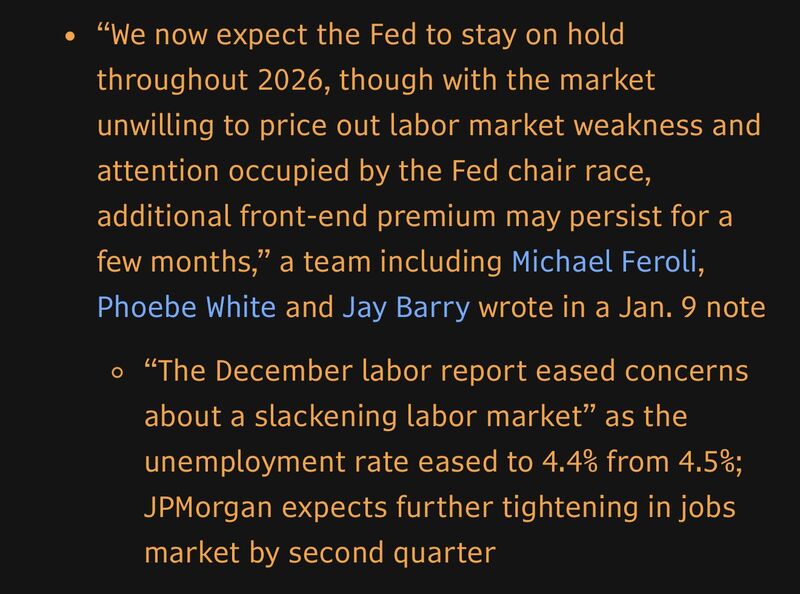

Strategists and economists at JPMorgan no longer expect the Fed to cut interest rates this year and see a rate hike next year

A forecast change made in response to December employment data released Friday. Source: Annmarie Hordern, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks