Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The number of federal government employees is now at it’s lowest level in 50+ years.

Dropped off a cliff after Trump was elected. Source: FRED, Geiger Capital

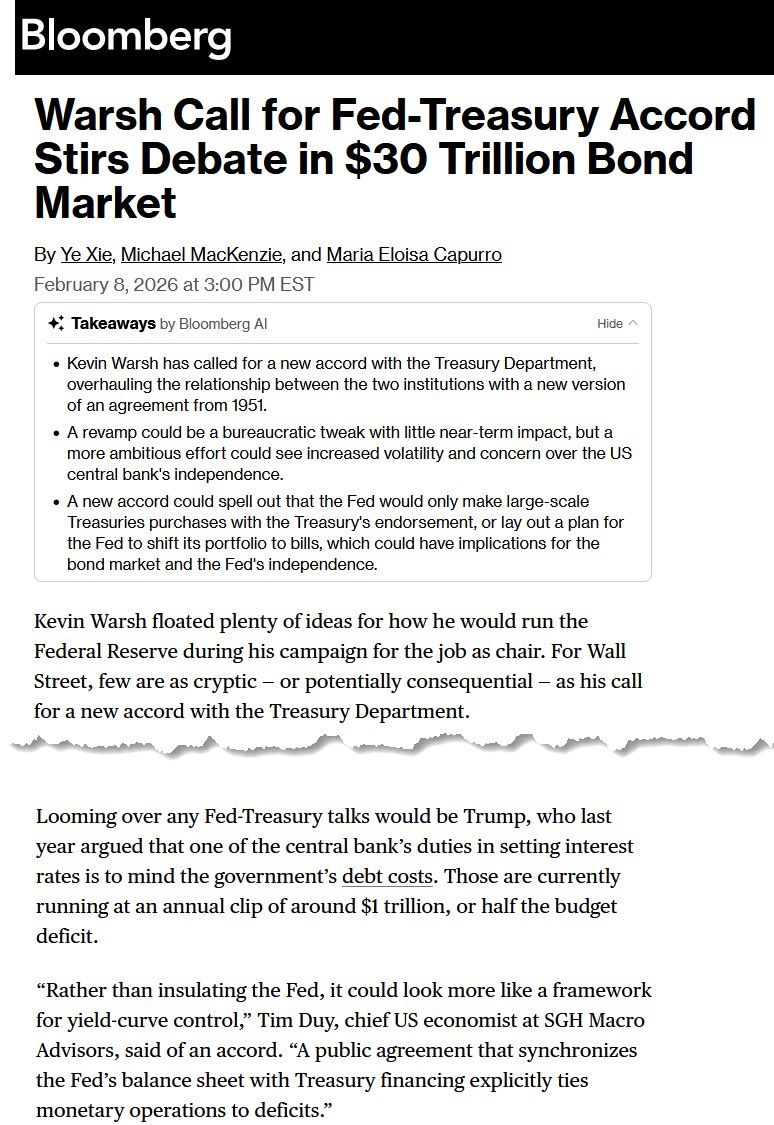

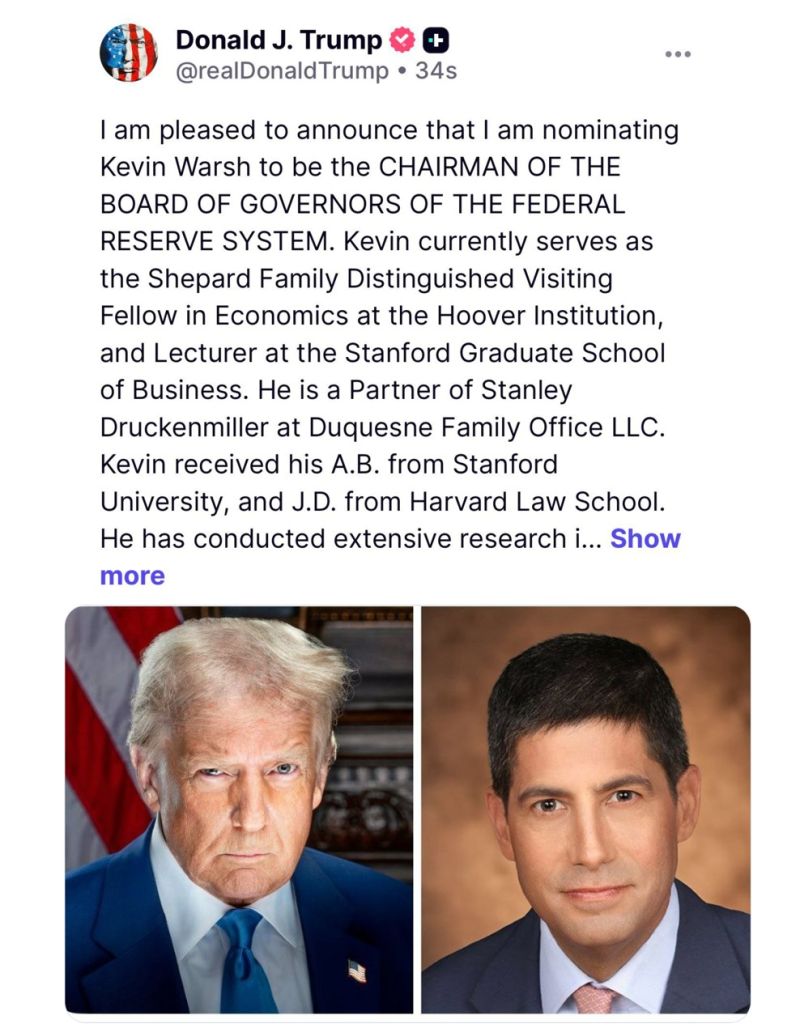

So much for a hawkish incoming Fed chair.

Kevin Warsh, nominee for Fed Chair, has proposed a “New Fed-Treasury Accord” inspired by the 1951 agreement that granted Fed independence. The plan aims to restore Fed independence, shrink its $6.6 trillion balance sheet, and clarify roles between the Fed and Treasury. The Fed would focus on short-term rates and price stability, while the Treasury manages bond markets. Warsh also favors less forward guidance, letting the Fed react to data rather than constantly signaling. The goal is to prevent the Fed from becoming a tool for cheap government borrowing, modernize its balance sheet, and protect its ability to fight inflation.

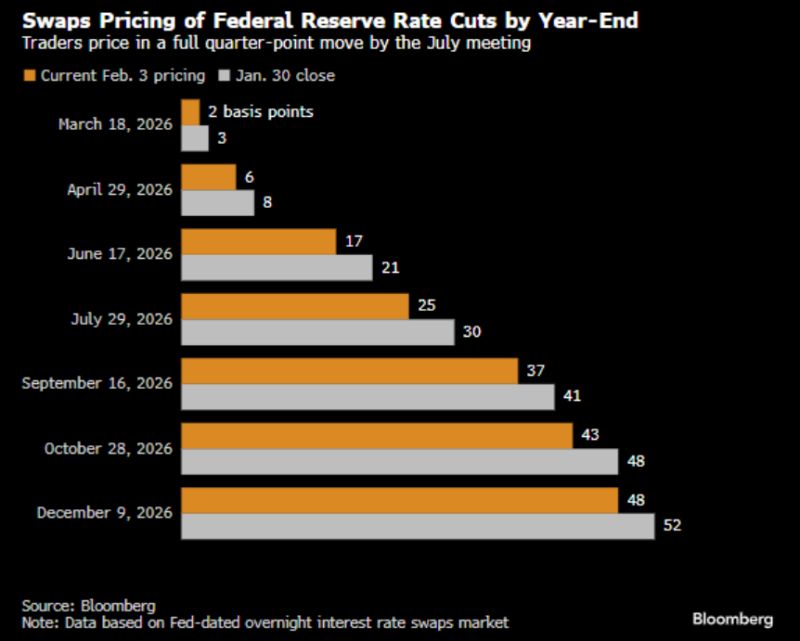

Rates Traders Target Dovish Policy Shift Under a Warsh-Led Fed

➡ Since Trump’s Friday announcement, flows in options linked to the Secured Overnight Financing Rate — which closely tracks the central bank’s path — have reflected bets on a more dovish tilt once Warsh takes his post in time for the Fed’s June meeting. Source: Christophe Barraud @C_Barraud on X, Bloomberg

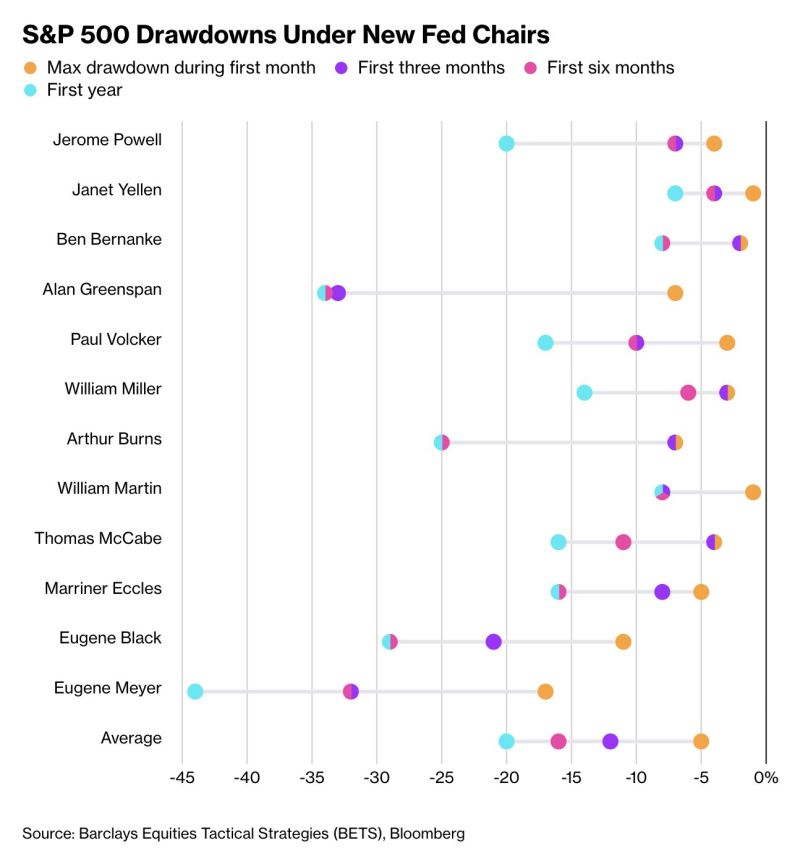

S&P 500 Drawdowns Under New Fed Chairs

Source: Bloomberg, Sam Ro, alexandraandnyc

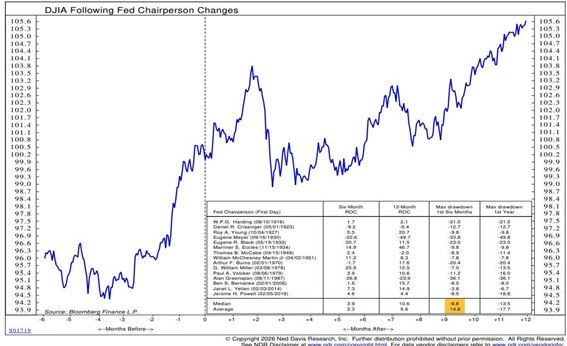

The average drawdown in the first 6 months of a new Fed Chair is 15%.

The market likes to test them... Source: NDR, RBC

IS KEVIN WARSH A DOVE OR A HAWK ?

Interestingly, since his name came up yesterday, markets have been pricing in more his hawkish reputation than his more recent dovish tilt: - Risk assets lower: equities down, bitcoin / cryptos down, gold down and silver in bear market! - Steeper yield curve: could be related to the fact that he is in favour of a smaller Fed balance sheet - Stronger dollar So how should we interpret market erratic moves over the last two days? Stop labeling Kevin Warsh as just a "Hawk." 🦅❌ The social media "chattering class" loves a simple label, but the reality of the next Fed Chair is far more nuanced. If you’re building a strategy based on the idea that Warsh is purely a rate-hiker, you’re missing the bigger picture. Here is the "Warsh Playbook" that the headlines are missing: 1. The "Productivity Boom" Pivot 🚀 Warsh isn't looking to keep rates high for the sake of it. He believes the U.S. is in a massive productivity surge. If that’s true, the Fed can actually lower rates without sparking inflation. It’s a growth-friendly view that most "hawks" wouldn't touch. 2. The Policy Mix: Lower Rates + Tighter Balance Sheet ⚖️ This is the sophisticated play. Warsh wants to shrink the Fed’s massive balance sheet while simultaneously keeping interest rates manageable. It’s a "tighter but lower" approach that aims for long-term stability rather than short-term sugar rushes. 3. Pragmatism Over Ideology 🛠️ History check: During the COVID-19 onset, Warsh was weeks ahead of Jay Powell in calling for an aggressive response. When the alarm bells ring, he’s shown he’s a practical crisis manager, not a rigid academic. The Bottom Line: Calling him a hawk is a convenient narrative for his confirmation hearings—it shows independence from the White House. But in practice? Expect a Fed Chair who is data-driven, productivity-focused, and ready to move fast when the situation demands it.

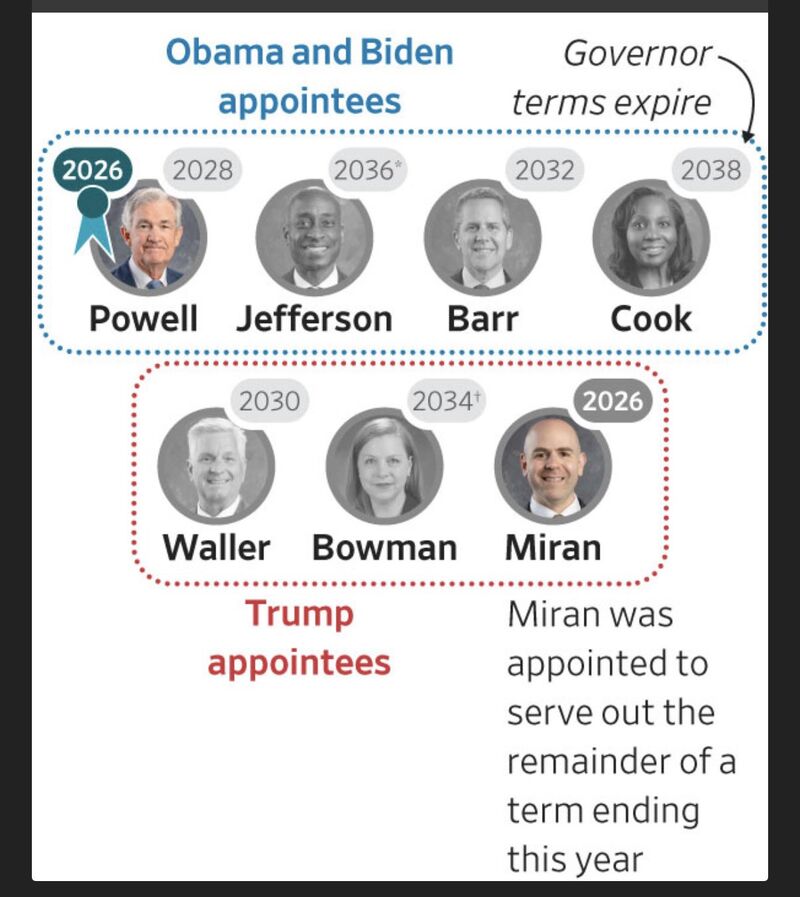

From "Hawks and Doves" to "Red and Blue"?

In a sign of the times, this Wall Street Journal chart characterizes members of the Federal Reserve Board by their political nominations rather than their expertise, experience, or hawkish/dovish inclinations. Source: Mo El Erian

Trump nominates Kevin Warsh for Federal Reserve chair to succeed Jerome Powell

After months of speculation, President Trump has officially named Kevin Warsh to succeed Jerome Powell as Fed Chair. This isn't just another personnel move. It’s a seismic shift for the U.S. economy. Here is why every professional needs to be paying attention: 1. The End of an Era (and a Feud) 🥊 The tension between Trump and Powell has been no secret since 2018. By picking Warsh, the President is looking for what he calls a "GREAT" chairman to lead a new direction. 2. Credibility is the Currency 💎 Wall Street is breathing a sigh of relief. Why? Because Warsh has been there before. As David Bahnsen noted, he has the "respect and credibility" of the markets. He’s seen as a pro who understands the plumbing of the financial system. 3. The Fight for Independence 🛡️ The big question: Can the Fed stay independent? With debates swirling about White House oversight and interest rate consultations, Warsh will be walking a tightrope between political pressure and economic reality. 4. A "No-Fire, No-Hire" Economy 📉 Inflation isn't at 2% yet, and the labor market is cooling. Warsh inherits a "precarious" moment where the margin for error is razor-thin. The Bottom Line: Kevin Warsh called for "regime change" at the Fed last summer. Now, he’s the one holding the keys. 🔑 Markets are pricing in stability for now, but with Jerome Powell potentially staying on as a Governor to protect Fed independence, the boardroom in D.C. is about to get very interesting.

Investing with intelligence

Our latest research, commentary and market outlooks