Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

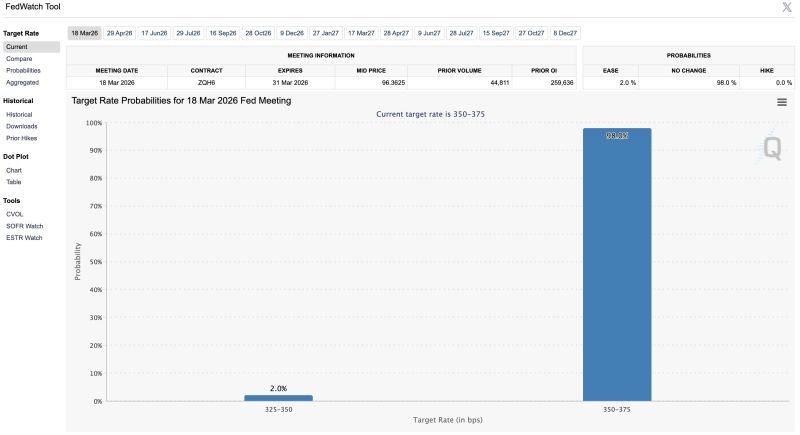

The odds of a March interest rate cut have fallen to just 2%

Source: Barchart @Barchart

Christine Lagarde is expected to leave the ECB before her term ends in 2027, aiming to give Emmanuel Macron and Friedrich Merz the opportunity to choose her successor.

With the French presidential election approaching, Lagarde may step down early to let Macron and Merz influence her ECB successor. Key stakes: filling the power vacuum, deciding among top contenders like Hernández de Cos, Knot, Schnabel, and Nagel, and shaping the ECB’s post-crisis legacy.

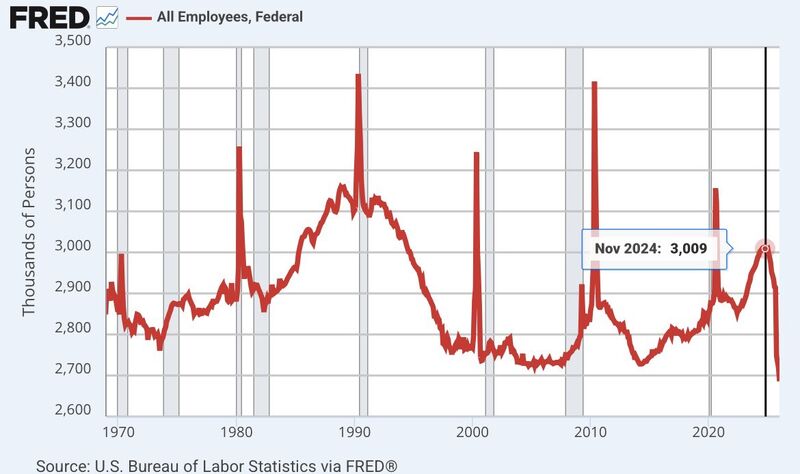

The number of federal government employees is now at it’s lowest level in 50+ years.

Dropped off a cliff after Trump was elected. Source: FRED, Geiger Capital

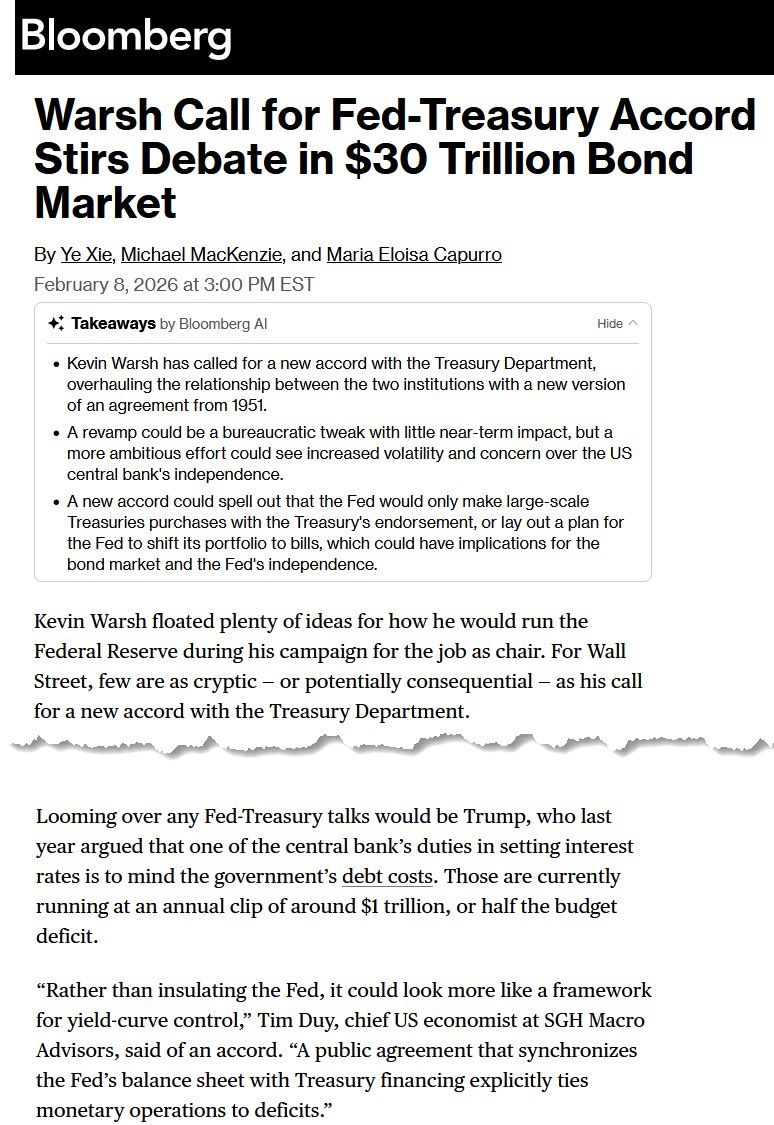

So much for a hawkish incoming Fed chair.

Kevin Warsh, nominee for Fed Chair, has proposed a “New Fed-Treasury Accord” inspired by the 1951 agreement that granted Fed independence. The plan aims to restore Fed independence, shrink its $6.6 trillion balance sheet, and clarify roles between the Fed and Treasury. The Fed would focus on short-term rates and price stability, while the Treasury manages bond markets. Warsh also favors less forward guidance, letting the Fed react to data rather than constantly signaling. The goal is to prevent the Fed from becoming a tool for cheap government borrowing, modernize its balance sheet, and protect its ability to fight inflation.

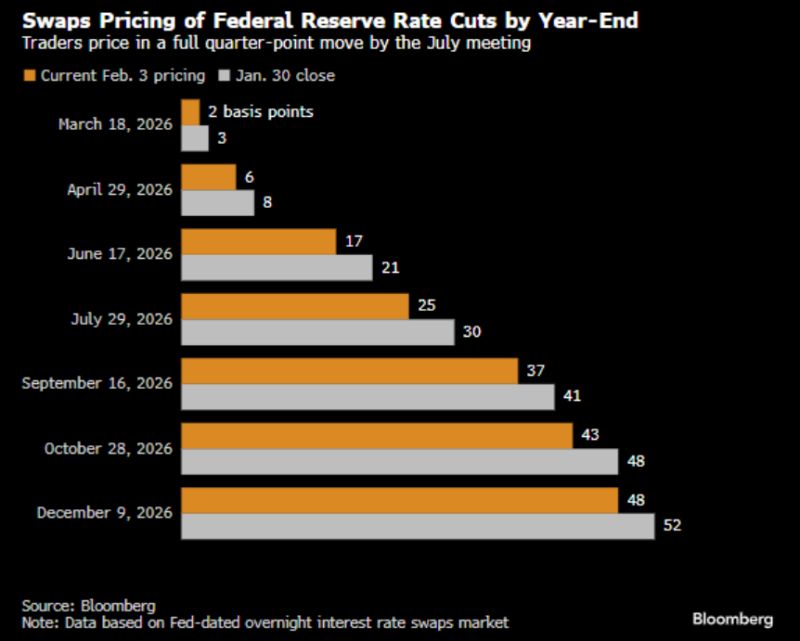

Rates Traders Target Dovish Policy Shift Under a Warsh-Led Fed

➡ Since Trump’s Friday announcement, flows in options linked to the Secured Overnight Financing Rate — which closely tracks the central bank’s path — have reflected bets on a more dovish tilt once Warsh takes his post in time for the Fed’s June meeting. Source: Christophe Barraud @C_Barraud on X, Bloomberg

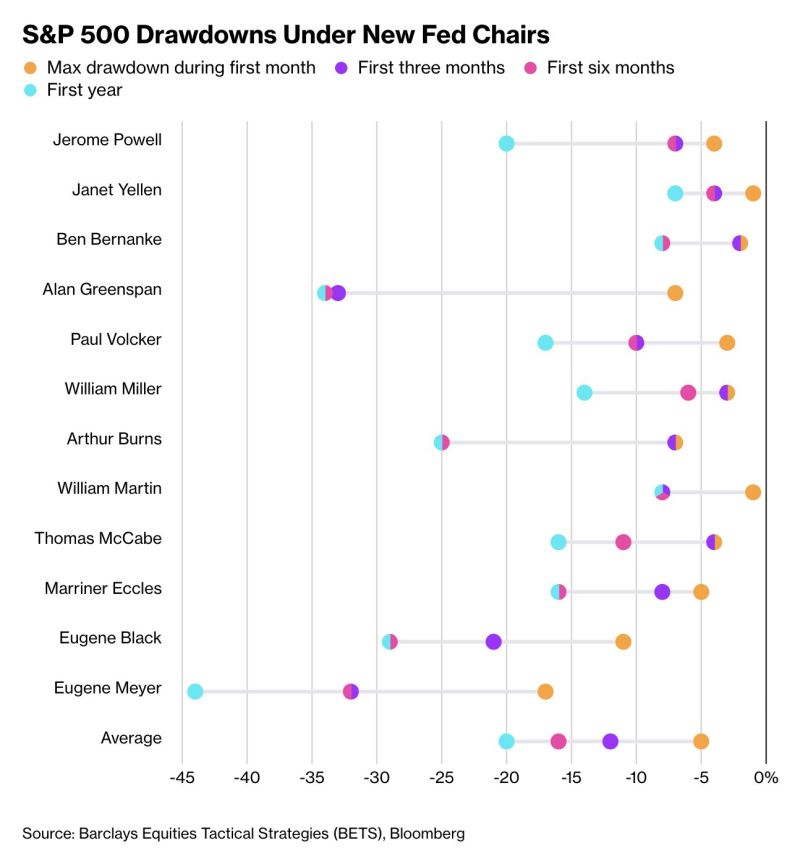

S&P 500 Drawdowns Under New Fed Chairs

Source: Bloomberg, Sam Ro, alexandraandnyc

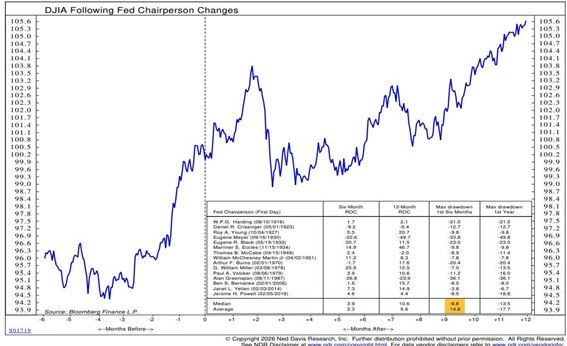

The average drawdown in the first 6 months of a new Fed Chair is 15%.

The market likes to test them... Source: NDR, RBC

IS KEVIN WARSH A DOVE OR A HAWK ?

Interestingly, since his name came up yesterday, markets have been pricing in more his hawkish reputation than his more recent dovish tilt: - Risk assets lower: equities down, bitcoin / cryptos down, gold down and silver in bear market! - Steeper yield curve: could be related to the fact that he is in favour of a smaller Fed balance sheet - Stronger dollar So how should we interpret market erratic moves over the last two days? Stop labeling Kevin Warsh as just a "Hawk." 🦅❌ The social media "chattering class" loves a simple label, but the reality of the next Fed Chair is far more nuanced. If you’re building a strategy based on the idea that Warsh is purely a rate-hiker, you’re missing the bigger picture. Here is the "Warsh Playbook" that the headlines are missing: 1. The "Productivity Boom" Pivot 🚀 Warsh isn't looking to keep rates high for the sake of it. He believes the U.S. is in a massive productivity surge. If that’s true, the Fed can actually lower rates without sparking inflation. It’s a growth-friendly view that most "hawks" wouldn't touch. 2. The Policy Mix: Lower Rates + Tighter Balance Sheet ⚖️ This is the sophisticated play. Warsh wants to shrink the Fed’s massive balance sheet while simultaneously keeping interest rates manageable. It’s a "tighter but lower" approach that aims for long-term stability rather than short-term sugar rushes. 3. Pragmatism Over Ideology 🛠️ History check: During the COVID-19 onset, Warsh was weeks ahead of Jay Powell in calling for an aggressive response. When the alarm bells ring, he’s shown he’s a practical crisis manager, not a rigid academic. The Bottom Line: Calling him a hawk is a convenient narrative for his confirmation hearings—it shows independence from the White House. But in practice? Expect a Fed Chair who is data-driven, productivity-focused, and ready to move fast when the situation demands it.

Investing with intelligence

Our latest research, commentary and market outlooks