Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Fed Chair Powell says he’s under criminal investigation, won’t bow to Trump intimidation

Jerome Powell just dropped a bombshell. Federal prosecutors are officially investigating the Fed Chairman over a $2.5 billion renovation project. But according to Powell, this isn't about construction costs. It’s about independence. Here is what you need to know: The Charges: Grand jury subpoenas have been served regarding the $2.5B HQ renovation and Powell’s related testimony to Congress. The Conflict: Powell explicitly linked the probe to President Trump’s frustration over interest rate decisions. The Stakes: This isn't just a legal battle; it’s a fight for the soul of the central bank. Powell warns that if political pressure wins, evidence-based policy loses. The Market Reaction: Stock futures are already sliding as investors digest the news. Gold, Silver and Cryptos are up. The dollar is slightly down Why this matters for every professional: Central bank independence is the bedrock of global financial stability. If monetary policy becomes a political tool, the rules of the game change for everyone—from Wall Street to Main Street. Powell’s message is clear: Is the Fed driven by data or intimidation? The outcome of this investigation won't just impact Powell’s career—it will redefine the future of the Fed independence.

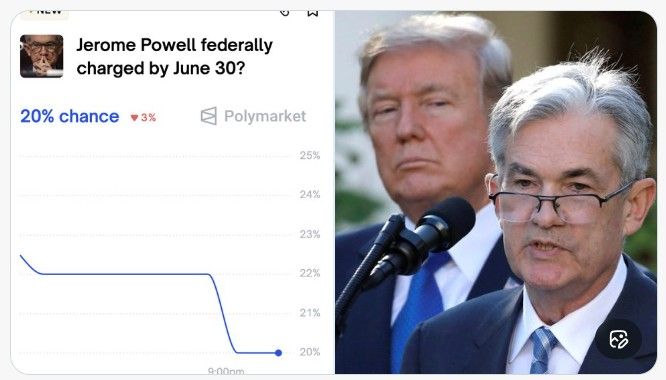

NEW POLYMARKET: JPow charged?

Will Trump follow through? Source : Polymarket

Powell has the highest approval rating of any “political leader” in the country.

Source: Joe Weisenthal @TheStalwart Gallup

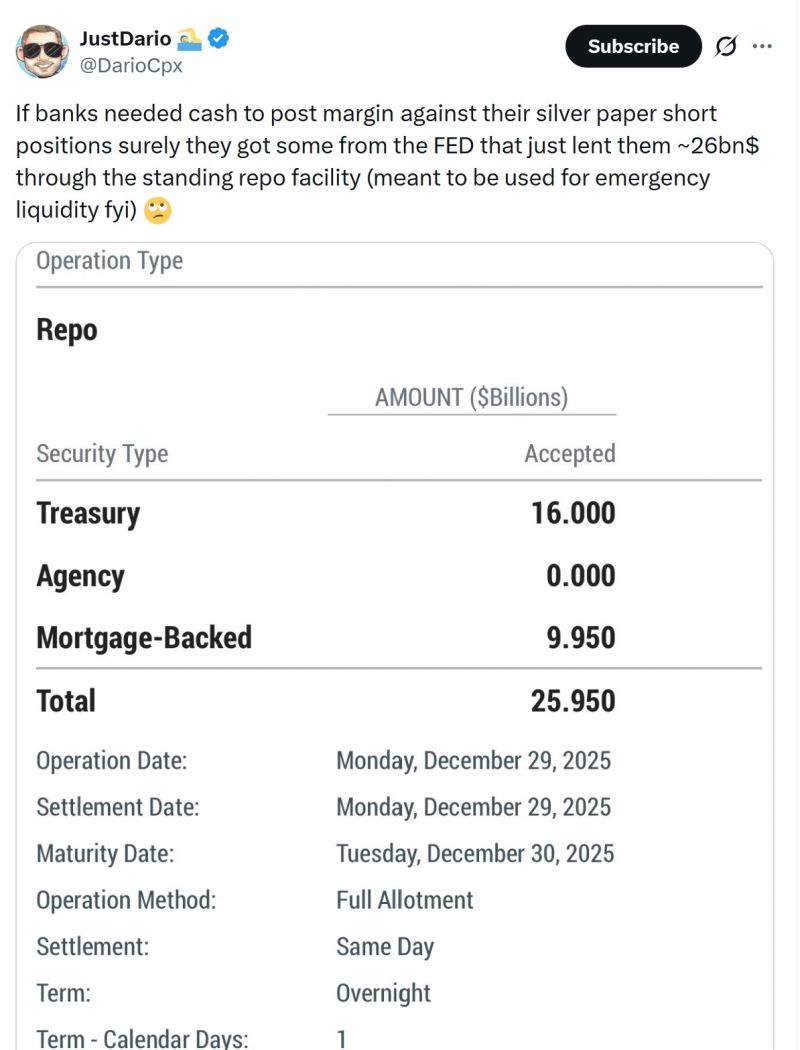

Fed to the rescue of banks again ???

REPO $26B on Monday 8:30 am

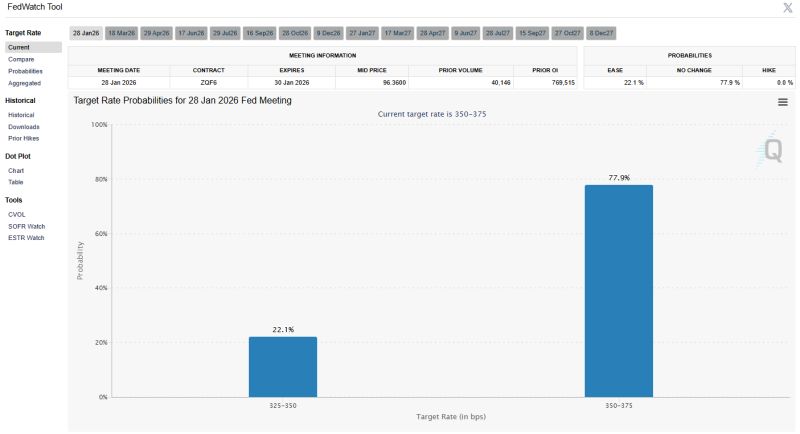

The odds of a January rate cut have fallen to just 22% 🚨

Source: Barchart @Barchart

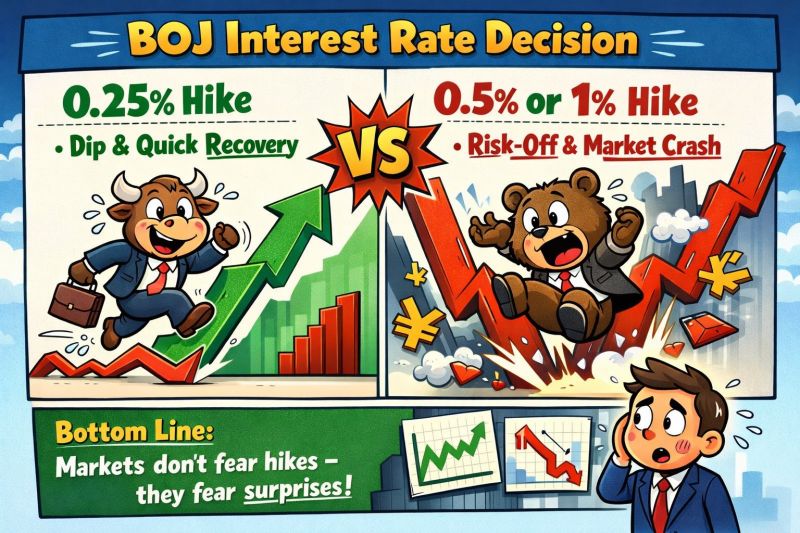

The Bank of Japan just threaded the needle. 🧵

Rate hike? Yes. Market crash? No. In fact, it’s the exact opposite. Here is why the "Carry Trade Collapse" everyone feared just got cancelled (for now). The Headline: The BOJ raised rates by 25 bps to 0.75%. It was priced in, expected, and delivered with a heavy dose of "don't panic." Why the markets are rallying: The BoJ basically told the world: "We’re raising rates, but we aren't pulling the rug." Real Rates stay LOW: The BOJ explicitly stated that real interest rates will remain at significantly low levels. This is classic Financial Repression. Accommodative Stance: Even with the hike, the monetary environment remains "supportive." They are still cheering for the economy. The Stimulus Paradox: While the BOJ lifts rates, the Japanese government is simultaneously releasing a massive stimulus package. The "Risk-On" Reaction: Usually, a rate hike strengthens a currency. But today? The Yen is weakening. 📉 This is the "Green Light" for risk assets. If the Yen doesn't spike, the Yen Carry Trade doesn't unwind. The result: Equities: UP 📈 Bitcoin: UP 🚀 Bond Yields: UP 📊 (10 year ABOVE 2%) Yen: DOWN (156) The Takeaway: Governor Ueda is playing a dangerous game of balance, but for today, he’s the market's best friend. Liquidity is still flowing, the "cheap money" isn't disappearing overnight, and the global carry trade lives to see another day. Is this the "Goldilocks" scenario for the end of 2025, or is the market ignoring a looming Yen spike? Source: FinancialJuice @financialjuice SWING BLASTER 🥷🕉️🔱 @swing_blaster

🚨 REMINDER: Bank of Japan expected to hike rates 25 bps Friday

Nobody knows when the real consequences will materialize, but after a prolonged period of extremely low rates, this continued shift will likely drain liquidity from markets, potentially causing a ripple effect through margin calls and other forced deleveraging. Rates will probably rise to 0.75%, which is still low by global standards. However, what matters most here is the rate of change, rather than the absolute level of rates. Higher Japanese rates = stronger yen → yen carry trade unwinds → investors sell foreign assets (U.S. Treasuries) → upward pressure on U.S. yields → global liquidity contracts Will it happen? Or is it already priced by the market? Source: Guillaume Tavares, Bitcoin Archive

UK Inflation Just Gave the Bank of England a Green Light

UK inflation fell sharply to 3.2% in November, well below expectations. 📉 Forecast: 3.5% 📉 October: 3.6% 📉 Actual: 3.2% Even more important: Core inflation also cooled to 3.2% Unemployment just rose to 5.1% This combo changes the game. 💷 What it means: The Bank of England is now widely expected to cut rates by 25 bps to 3.75% at its meeting this Thursday. 👀 Inside the decision room: Likely a tight 5–4 vote Governor Andrew Bailey expected to be the deciding swing vote 📌 Big takeaway: Inflation is easing. The labor market is softening. The UK may be on the brink of its first rate cut cycle, and markets are watching closely. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks