Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

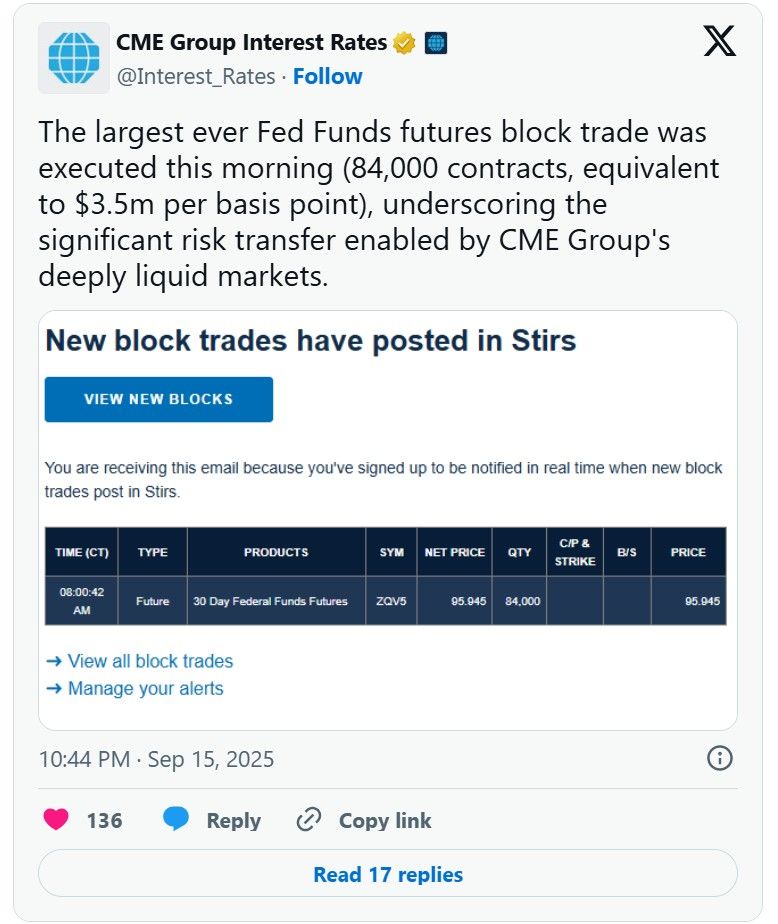

Mystery Trader Makes Record Bet On 50bps Rate Cut Today

The trade took place in the October fed funds, for an amount of 84,000 contracts which is equivalent to $3.5 million per basis point in risk. the price and timing of the trade was consistent with a buyer, potentially indicating a hedge against a half-point rate cut at Wednesday’s policy meeting, given a quarter-point cut is now fully baked into the swaps market. The CME confirmed this was the largest ever block trade in Fed Funds Futures... Source. zerohedge

From the FT article "Switzerland’s US tech ‘whale’"

>>> https://lnkd.in/e5ctdeTq "Switzerland’s conservative Central Bank has quietly become one of the world’s biggest tech investors, amassing a stock portfolio that is equivalent in value to nearly a fifth of the national economy’s annual output. The Swiss National Bank has US equity holdings amounting to $167bn, spread across more than 2,300 positions, according to US Securities and Exchange Commission filings from June. More than $42bn is invested in just five companies, Amazon, Apple, Meta, Microsoft and Nvidia, making it a major Silicon Valley investor. Its stake in Apple alone is worth nearly $10bn and its stake in Nvidia is more than $11bn. Though not a sovereign wealth fund, the SNB’s $855bn balance sheet of assets, including its tech holdings, put it in a similar league as some of the world’s largest state investment vehicles, including those of Singapore and Qatar". Source: FT, IMD

Happy FOMC day.

Stocks: all-time high Home Prices: all-time high Gold: all-time high Money Supply: all-time high National Debt: all-time high CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" Time for the Fed to cut rates. Let's get this party started. Source: Trend Spider

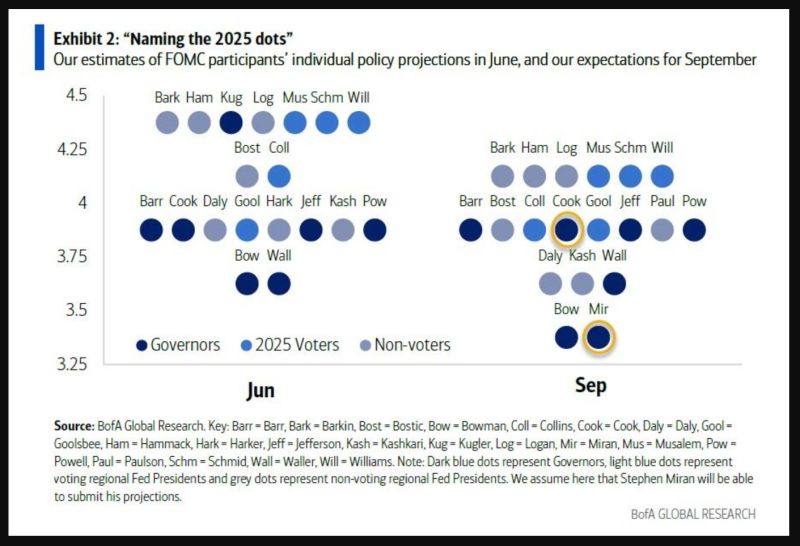

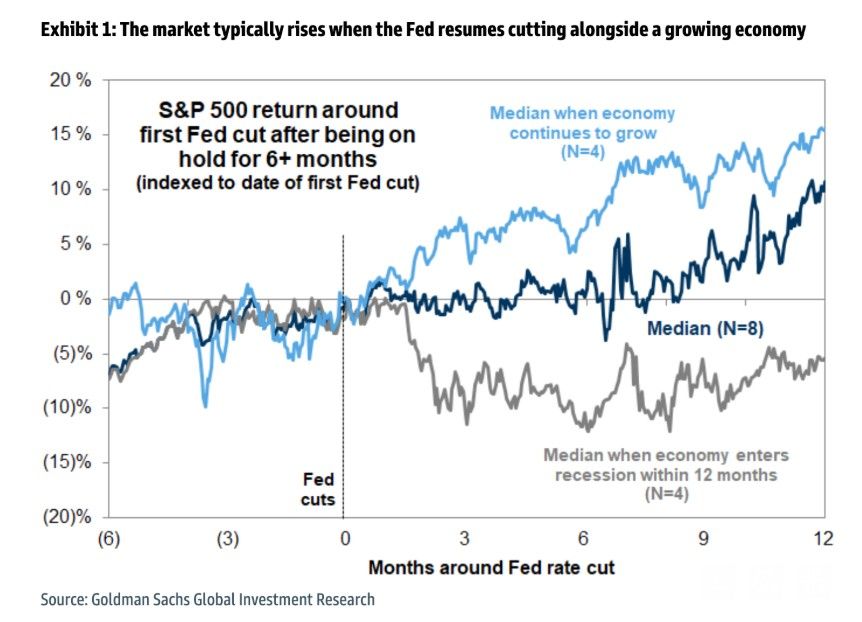

Since a 25bps rate cut is fully priced in, the main focus for markets will be whether the median 2025 dot shows 50bp or 75bp of cuts

With little change in the macro forecasts - for now - Bank of America thinks the 2025 median will continue to show 50bp of cuts, even as the distribution of dots moves down. Alternatively, Goldman now expects 75bps of rate cuts this year and another 50 next year. Clearly, it's all a close call for now. The dot plot should then show one more 25bp cut in 2027, although with Powell on his way out in May 2026 all bets are off regarding the longer horizon. The longer-run median is likely to stay at 3.0%. With that in mind, here is what Bank of America thinks the names behind tomorrow's dots will look like. Of particular interest will be the Lisa Cook and Stephen Miran dots. Source: BofA

Senate votes 48-47 to confirm Stephen Miran to Fed board

Source: Kevin Gordon @KevRGordon, Blomberg

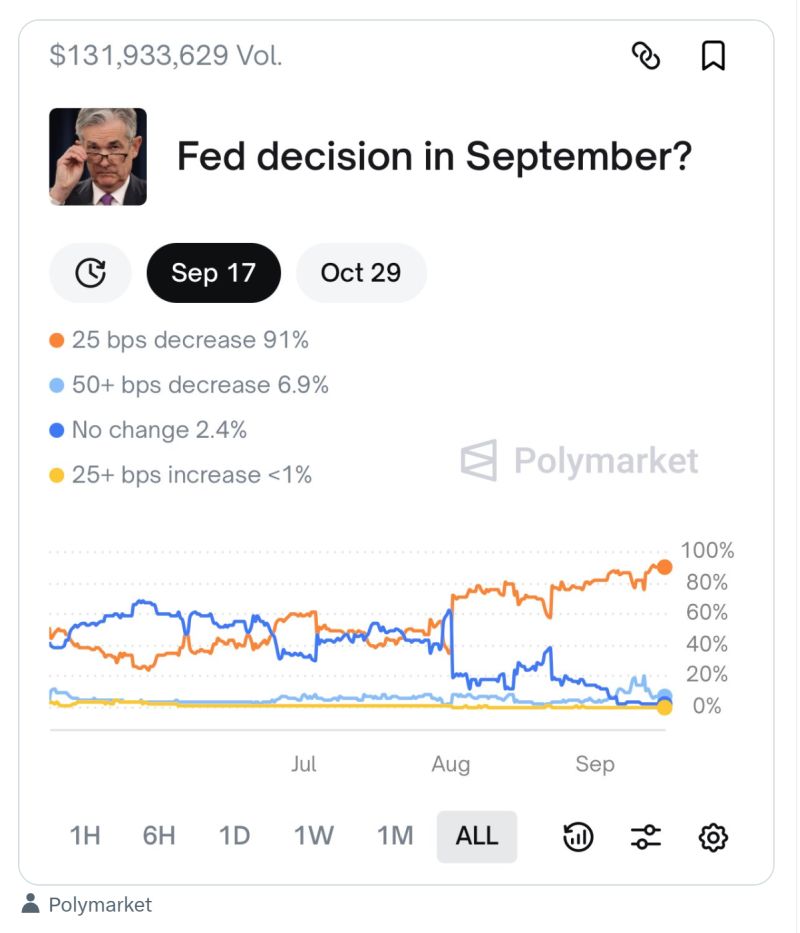

September FOMC: odds on the Fed’s rate decision

Source: Polymarket

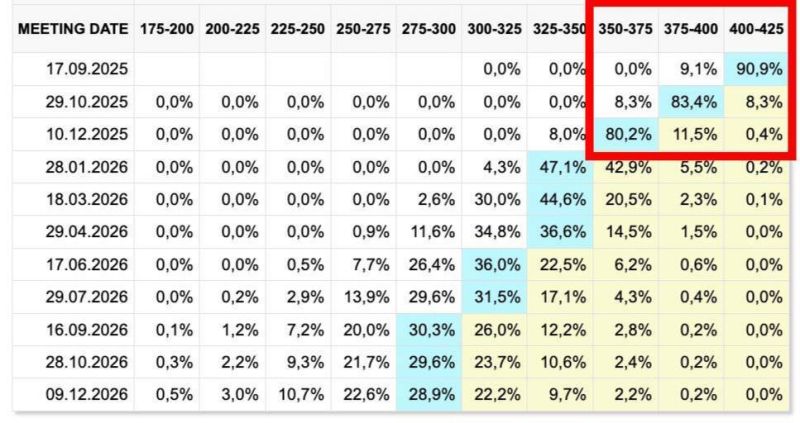

UPDATE:

According to the CME FedWatch tool, markets see a ~93% chance of one rate cut in September 2025 (to 4.00–4.25%) and a ~92% chance of two cuts by December (to 3.50–3.75%). Source: cointelegraph

Investing with intelligence

Our latest research, commentary and market outlooks