Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

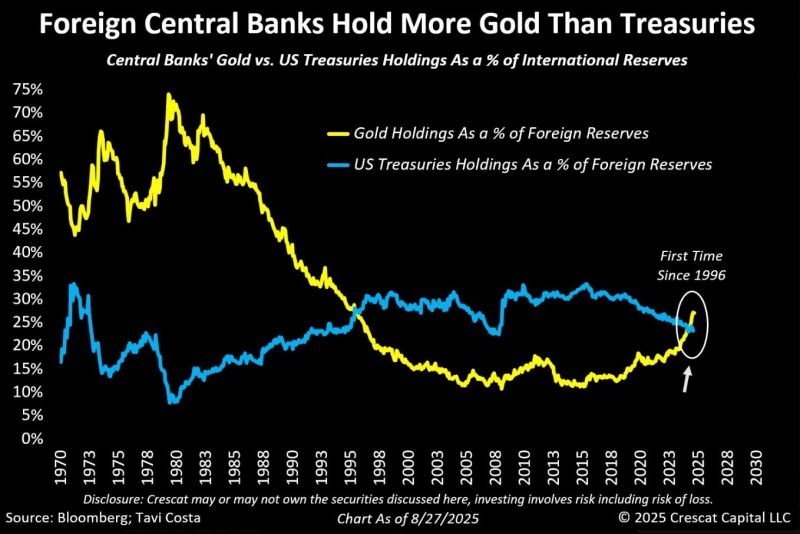

Foreign central banks now officially hold more gold than US Treasuries — for the first time since 1996.

We might be witnessing one of the most significant global rebalancing we've experienced in recent history, in my view. Source: Tavi Costa, Crescat Capital, Bloomberg

There are 3 sure things in life: 1) death; 2) taxes and; 3) printing money...

Source: Charlie Bilello

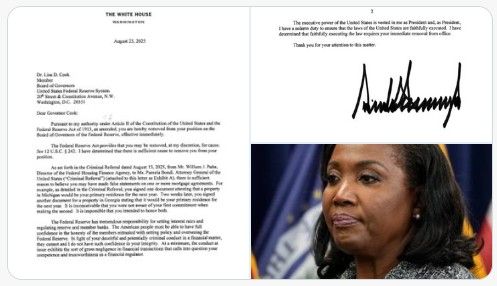

President Trump has officially FIRED Federal Reserve Governor Lisa Cook after Bill @Pulte exposed her for MORTGAGE FRAUD. Cook was appointed by Biden in 2022.

President Trump cited Article II of the Constitution and the Federal Reserve Act of 1913 to justify firing Cook over alleged mortgage fraud. He claimed, via a Truth Social post, that Cook’s dual declaration of primary residences and false statements on mortgage documents meet the broad, historically strict “cause” standard required for removal under the Federal Reserve Act. ➡️ The Federal Reserve Board is undergoing a transition and is increasingly influenced by Trump. If Cook’s removal stands and Powell steps down after his term as chair, Trump could appoint up to five of the seven governors, securing a lasting majority ➡️ “I will not resign,” said Cook, who hired high-profile attorney Abbe Lowell to challenge her purported termination; she says ‘he has no authority to do so. “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so,” said Cook in a statement late Monday. “I will not resign.” Abbe Lowell, a lawyer for Cook, said Trump’s move “is flawed and his demands lack any proper process, basis or legal authority. We will take whatever actions are needed to prevent his attempted illegal action.” 👉 This development introduces significant uncertainty for markets regarding the Fed's independence, forward guidance, and interest rate policy. After the initial reaction, attention will likely shift to the nomination process. If Trump moves quickly to appoint candidates favouring looser monetary policy, the likelihood of earlier and steeper rate cuts could rise materially, though potential legal challenges and political pushback may moderate expectations

So Lisa Cook is fighting Trump by using his own rules

1) Attack; 2) Deny: 3) Never Show Defeat Will it work?

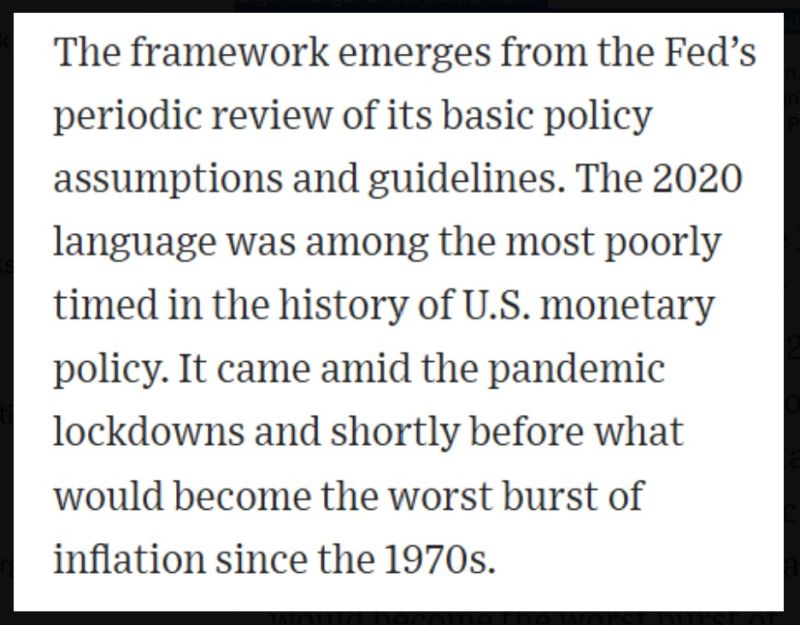

"The disappointment is that Mr. Powell and the Fed ignored the need for larger changes at the central bank."

This and the passage below are from the Wall Street Journal's editorial on Federal Reserve Chair Powell's Jackson Hole speech. Source: WSJ, Mo El Erian on X

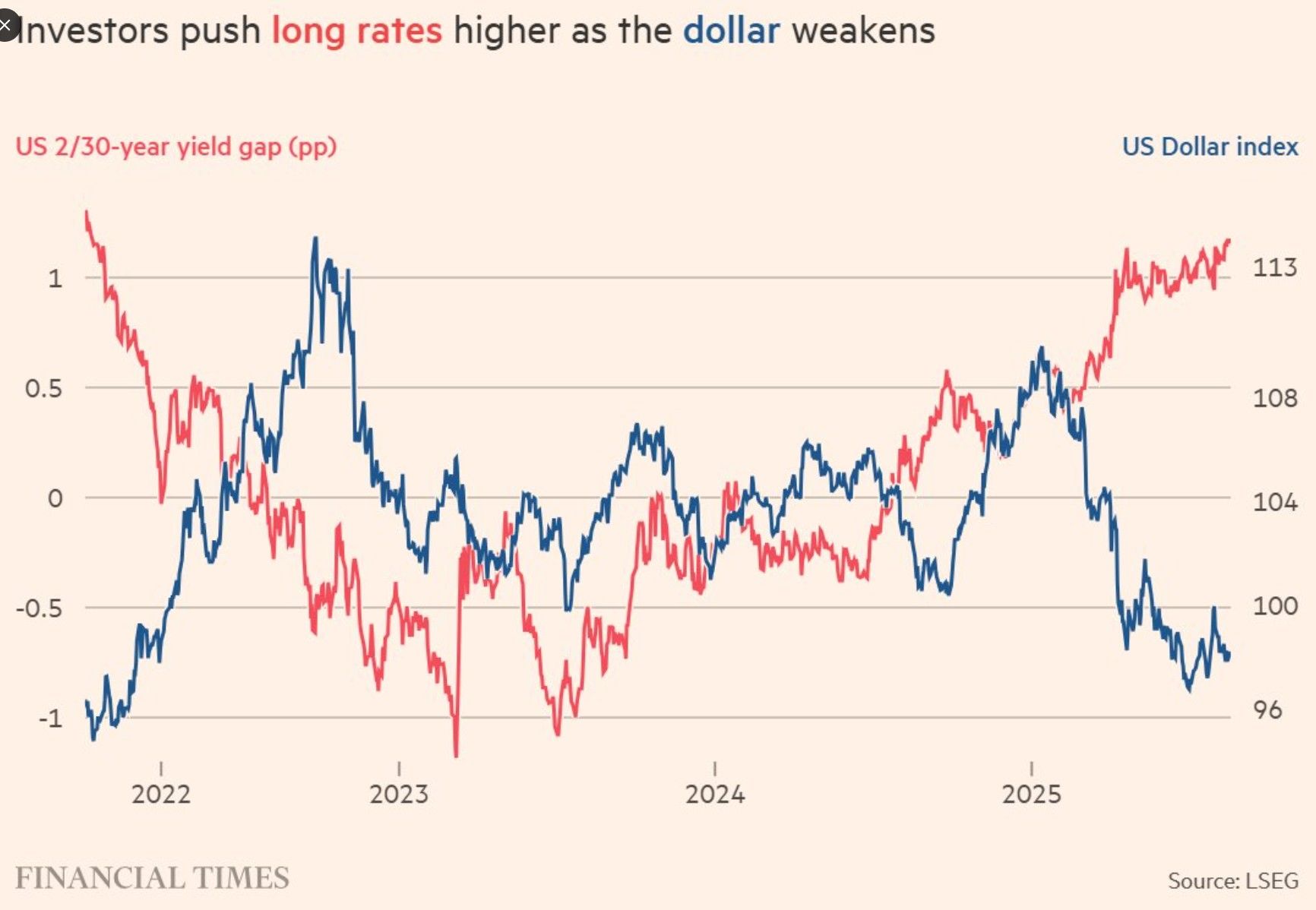

"Investors warn of ‘new era of fiscal dominance’ in global markets: Combination of record government debt and rising borrowing costs puts central banks under pressure."

Source: Mo El Erian, LSEG, FT

September rate cut odds have plunged to 57% on Polymarket over the past few days—did Powell’s speech leak?

Source: Tom @TradingThomas3

🔴 Donald Trump calls on Federal Reserve governor Lisa Cook to resign ‼️

The demand comes hours after Bill Pulte, a staunch ally of the US president, published a letter claiming the central bank official had ‘falsified bank documents and property records to acquire more favorable loan terms. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks