Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

The IEA’s “historic oil glut” narrative is collapsing in real time.

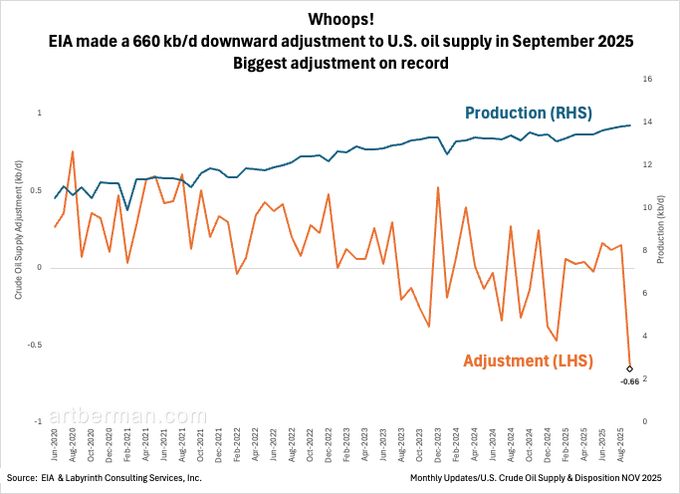

US production, the foundation of their entire forecast, has now been quietly revised downward. And not by a small amount. This is the largest US supply revision in the IEA’s entire history. 660,000 kbpd just for the month of September The reason: - US shale, the only global source of meaningful growth for 15 years, is peaking. - Tier 1 acreage is drilled out - Gas-to-oil ratios are exploding - Water cuts are rising across every major basin - Decline rates are accelerating as sweet spots exhaust Shale’s boom phase gave the world a decade of easy barrels, masking the fact that the rest of the world wasn’t investing. Its bust phase will do the opposite... leave a supply hole the world cannot fill in the short term.

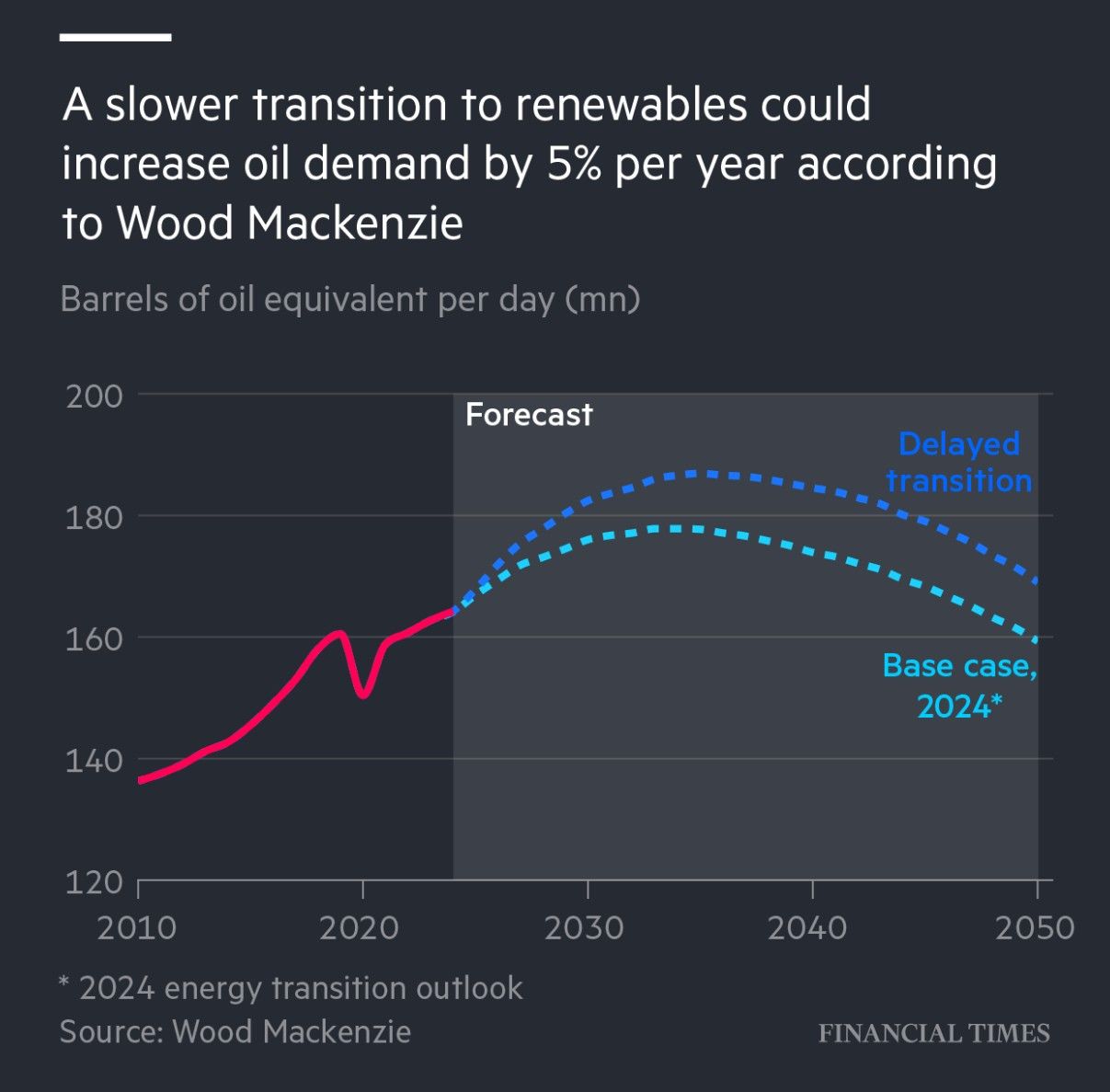

🌍 The IEA just dropped a bombshell:

If the world stays on its current path, oil and gas demand will keep rising for the next 25 years. That’s right — no peak this decade, no major drop in CO₂ emissions, and likely no chance of keeping global warming below 1.5°C. 🔥 2024 was the hottest year on record. Yet the International Energy Agency says “climate change is rapidly declining on the global energy agenda.” Why? Governments are prioritizing energy security and affordability over climate goals. Growth of electric vehicles is slowing. Demand for energy from AI, air conditioners, and manufacturing is exploding. 📈 Under the IEA’s new “Current Policies” scenario: Oil demand grows from 100M → 113M barrels/day by 2050 EV adoption plateaus around 40% by 2035 Gas demand continues to climb Coal finally peaks — but still lingers 💡 Even so, renewables will shoulder most of the new electricity demand — especially in India, SE Asia, Latin America, and Africa. ⚠️ Translation: The clean energy revolution is real… …but fossil fuels aren’t going anywhere unless policies change fast. Source: FT

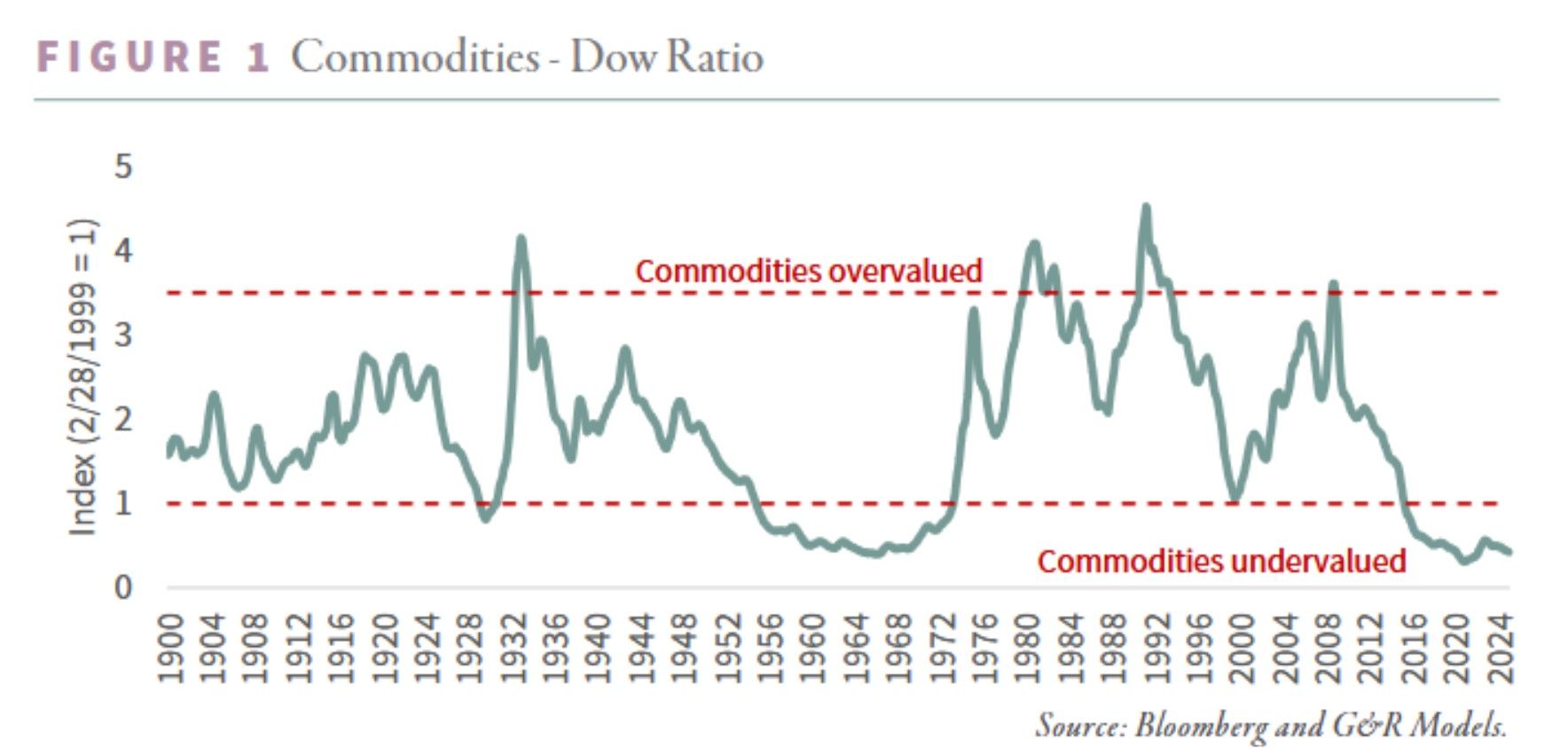

Not much improvement for the commodities-to-dow ratio

Dow Jones hit new all-time high while oil stays in a down trend. Source: Bloomberg, Finding Value Finance on X

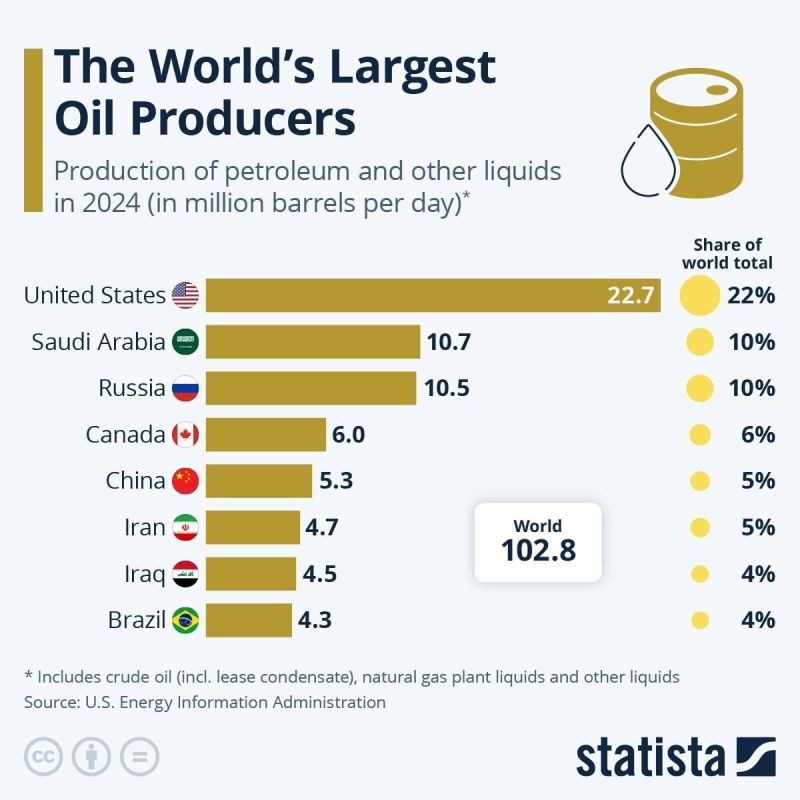

WHO RUNS THE OIL WORLD?

The US isn’t just flipping burgers - it's pumping 22.7 million barrels of oil a day, more than double Saudi Arabia or Russia. That’s 22% of the world’s supply. Saudi Arabia and Russia trail with 10.7 and 10.5 million barrels/day. Canada’s in 4th (6.0), followed by China (5.3), Iran (4.7), Iraq (4.5), and Brazil (4.3). Total world production? 102.8 million barrels a day. Which means the U.S. alone is doing over a fifth of the heavy lifting. Source: Statista thru Evan on X

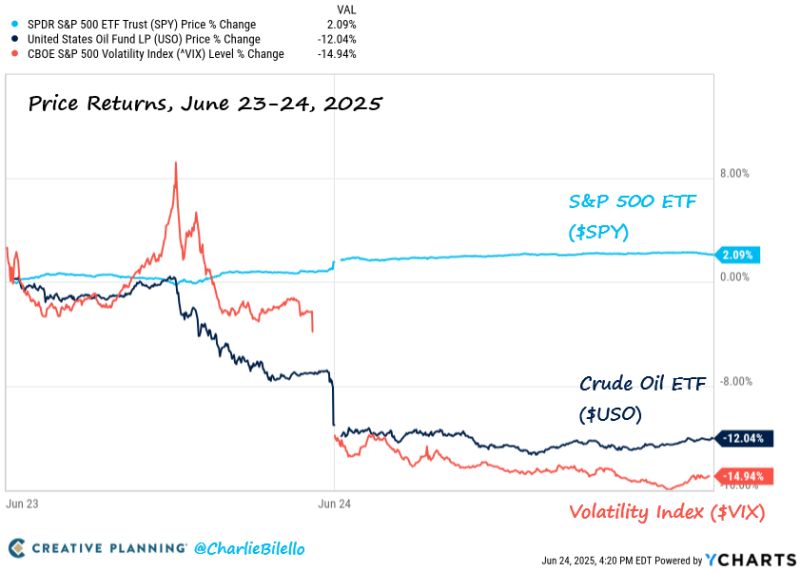

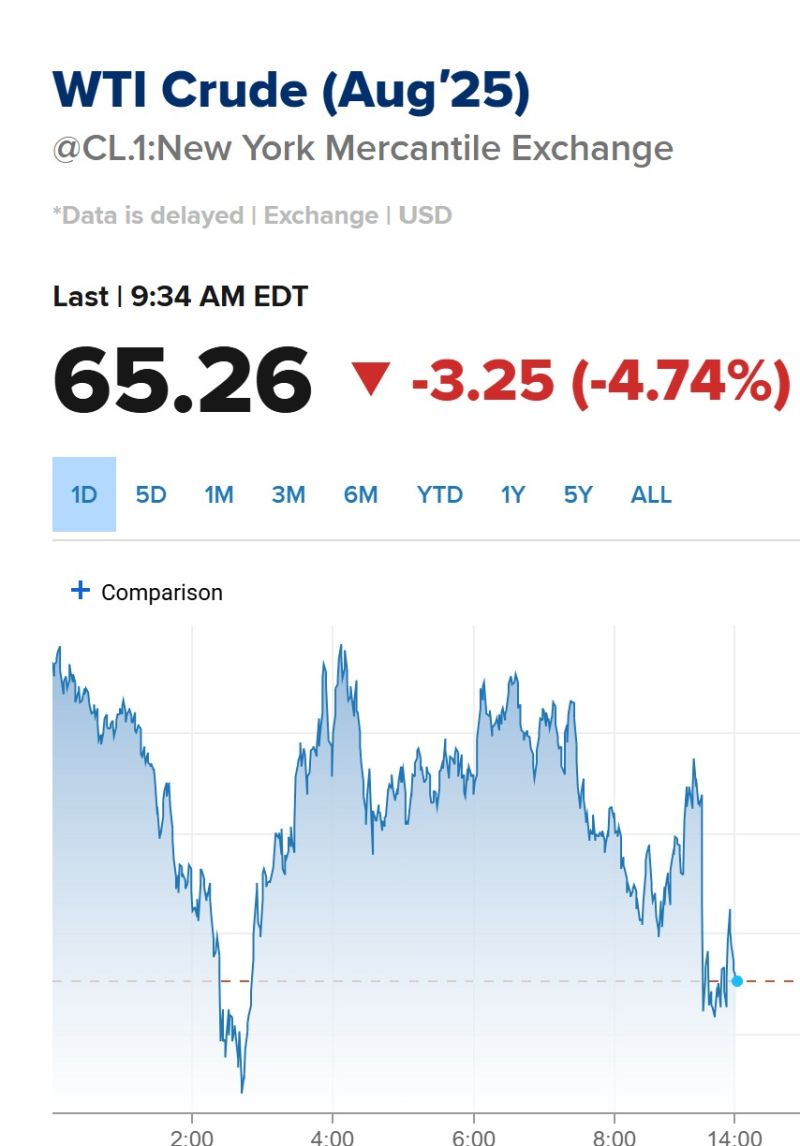

Oil prices fall 5% after Trump says China can continue buying oil from Iran.

“China can now continue to purchase Oil from Iran,” Trump said in a post on his social media platform Truth Social. “Hopefully, they will be purchasing plenty from the U.S., also. It was my Great Honor to make this happen!” Trump threatened in May to ban any country that buys Iranian oil from doing business with the U.S. China purchases the vast majority of Iran’s oil exports. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks