Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

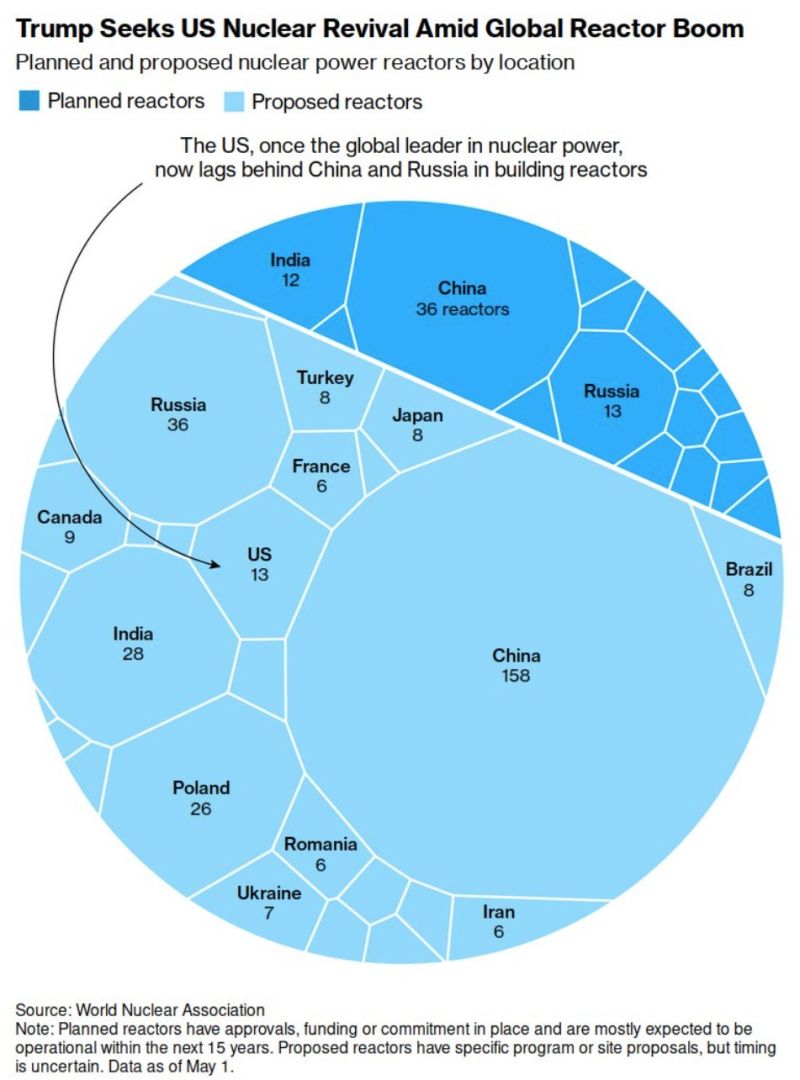

Bullish for the nuclear power sector and uranium producers

Source: Markets & Mayhem

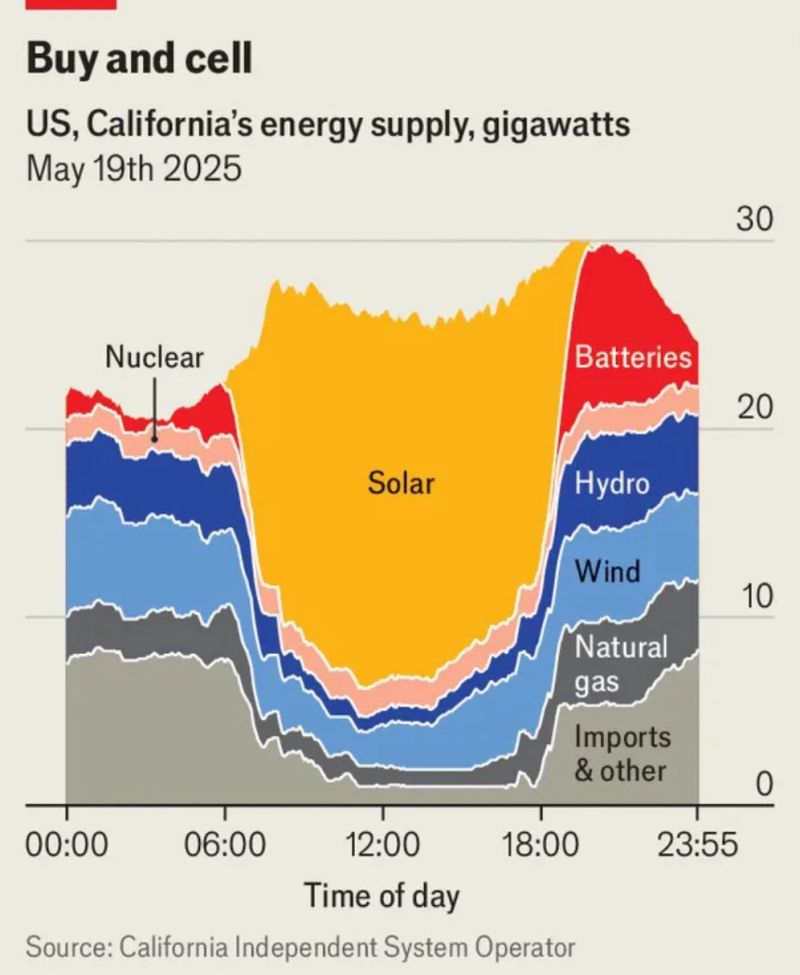

The Economist: The solar+battery model is working.

California gets 75% of its power from solar midday. Batteries now kick in for 30% at night. Battery capacity jumped 32x since 2018. Source: @jason on X

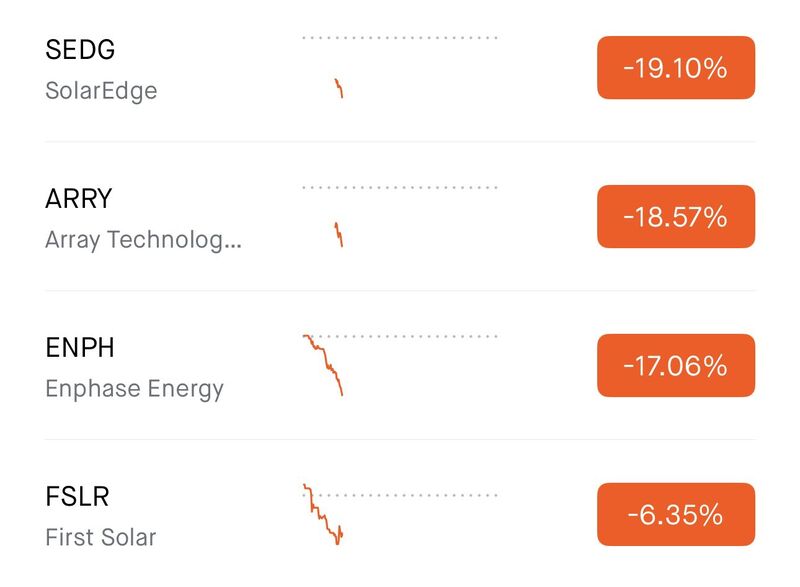

SOLAR STOCKS CRASH AFTER HOUSE PASSES TRUMP TAX BILL ENDING 30% ROOFTOP CREDIT

$SEDG -19%, $ARRY -19%, $ENPH -17%, $FSLR -6% 😳 Source: Shay Boloor @StockSavvyShay

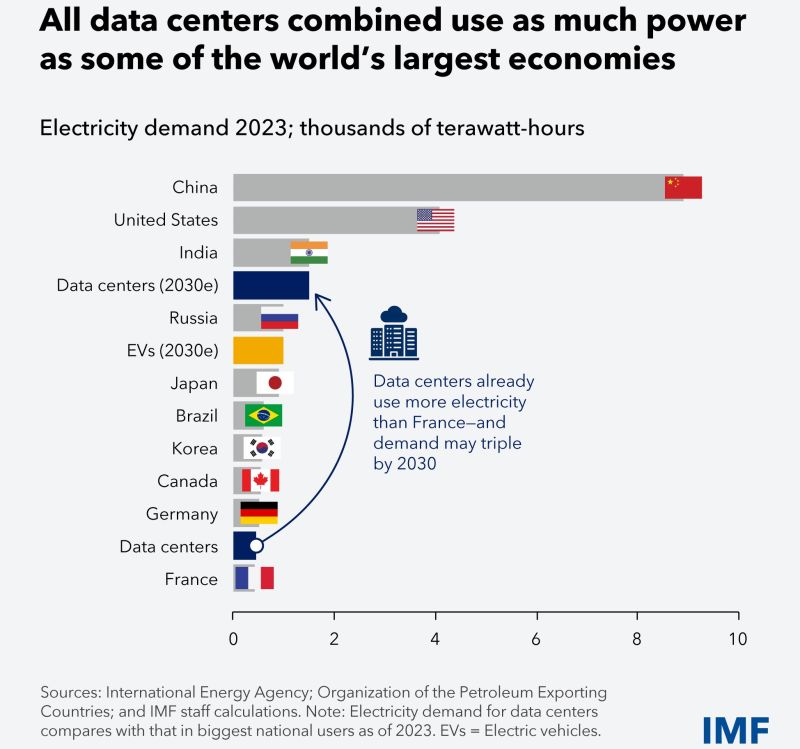

All data centers combined use as mich power as some of the world's largest econnomies

Source: IMF

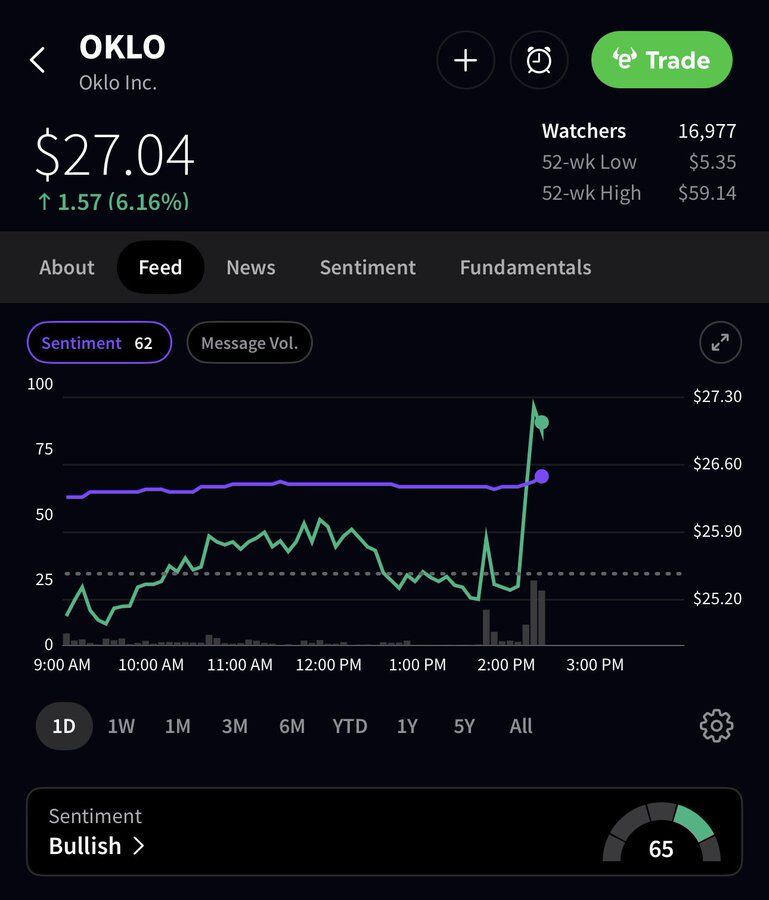

The White House is considering an executive action to speed up the development of nuclear reactors…

$OKLO is soaring on the news, went from flat on the day to up 6% 👀 ➡️ Oklo Inc. is a Santa Clara, California-based advanced nuclear technology company founded in 2013. The company focuses on designing and deploying compact fast reactors, specifically the Aurora powerhouse, to provide clean, reliable, and affordable energy. These reactors, ranging from 15 to 75 MWe, use high-assay low-enriched hashtag#uranium (HALEU) and recycled nuclear waste as fuel, offering inherent safety features like self-stabilizing and self-controlling mechanisms. Oklo aims to sell power directly to customers, including data centers, industrial sites, and defense facilities, through power purchase agreements. Source: Stocktwitt, Grok

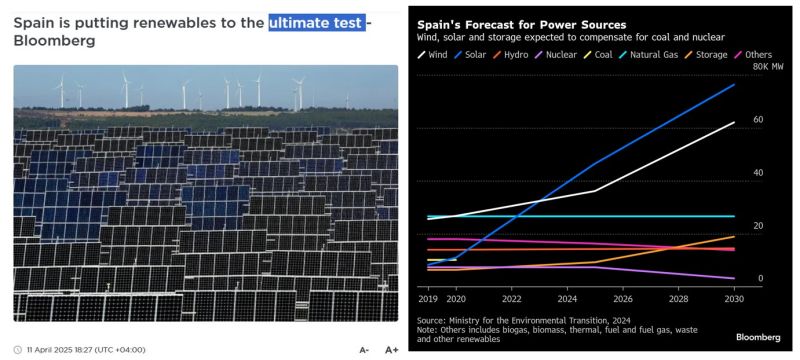

It remains unclear what caused the power outage in Spain and Portugal but this Bloomberg article published on Energy connects from the 11th of April is worth reading.

https://lnkd.in/e3rivJrV Here's an extract >>> Bloomberg) -- Spain is ignoring calls to reconsider its nuclear decommissioning plans, betting renewables and battery storage will make up for the upcoming energy shortfall. The country is plowing ahead with plans to shut down its seven nuclear reactors, which currently contribute 20% of its power mix, over the next decade. It’s also set to close its last coal plant this year. While it’s already only second to Germany in terms of renewable capacity in Europe, Spain is looking to fill the energy gap with more wind turbines, solar panels and giant batteries. The strategy isn’t completely fossil fuel free — as it would rely on natural gas plants as a backup for the foreseeable future. Yet it is a substantial wager on clean power: It depends on a still nascent energy storage industry in Spain to rapidly expand from just 3 gigawatts of capacity today to a target of 20 gigawatts by 2030. It also requires an unprecedented roll-out of wind and solar over the next five years. Spain is targeting 81% power generation from renewables by the end of this decade — from just above 50% in the past two years.“

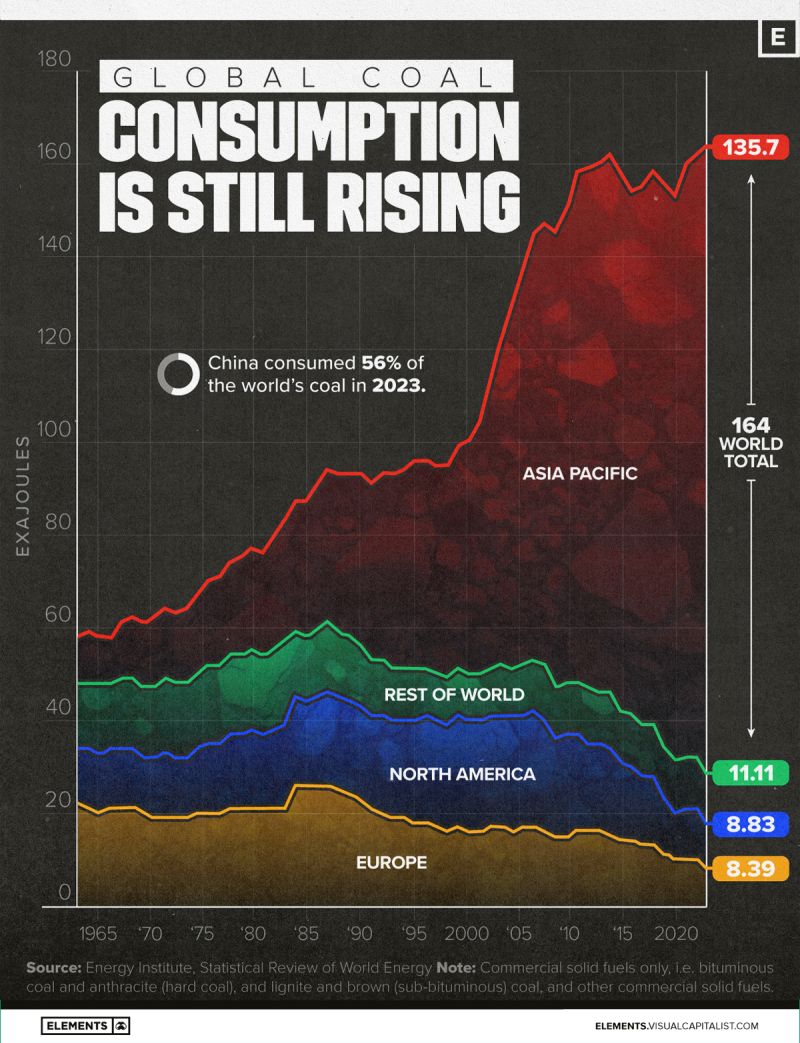

Visualizing the Rise in Global Coal Consumption ⚡️

Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks