Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Europe has a massive electricity problem...

According to a FT article, thousands of businesses and households are waiting to connect to the Dutch grid, forcing network operators to ration power in an early indicator of what other European countries are likely to suffer as the speed of electrification increases. More than 11,900 businesses are waiting for electricity network connections, according to Netbeheer Nederland, the association of Dutch grid operators. On top of that are public buildings such as hospitals and fire stations as well as thousands of new houses. Dutch officials and companies said lengthy waits for connections were holding up economic growth and could force businesses to rethink their investment plans. Despite efforts to invest in new cables and substations, new connections in some areas of the country will only become available in the mid-2030s, according to network operators. Although the bottlenecks in the Netherlands are particularly acute, analysts say it is a harbinger of what is likely to occur in other EU countries, as the speed of electrification increases to meet the bloc’s ambitious decarbonisation targets.

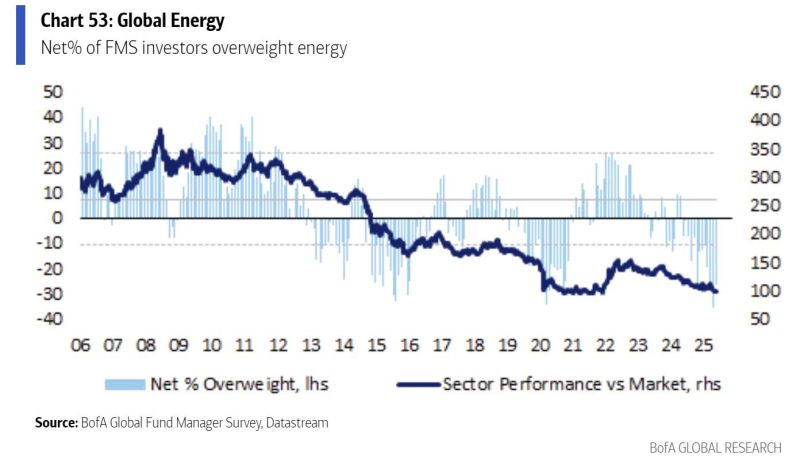

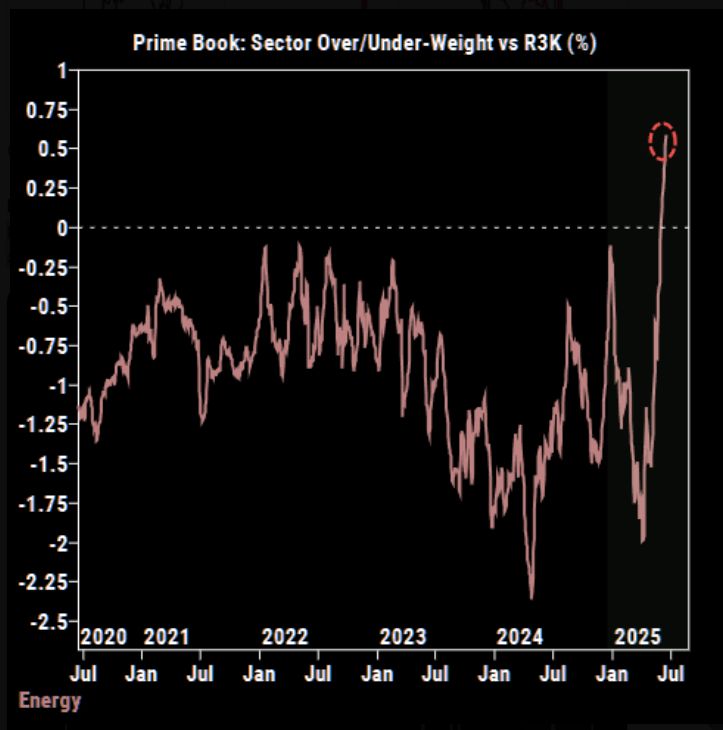

Investors hold very little exposure to energy stocks today, from a relative perspective.

This is often the kind of setup that leads to a meaningful shift in positioning. Source: Otavio (Tavi) Costa @TaviCosta, BofA

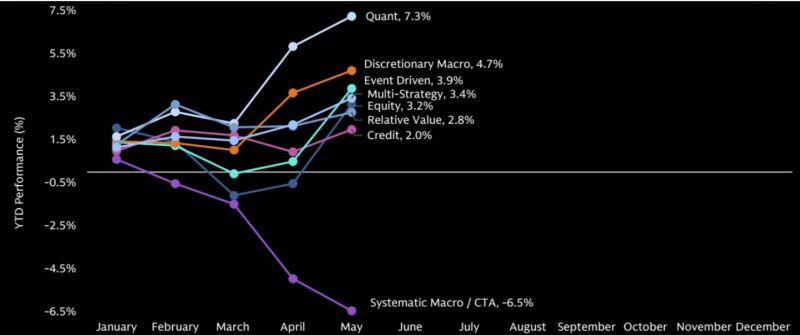

Year-to-date performance by Hedge Fund strategy

source : tme, GS prime brokerage

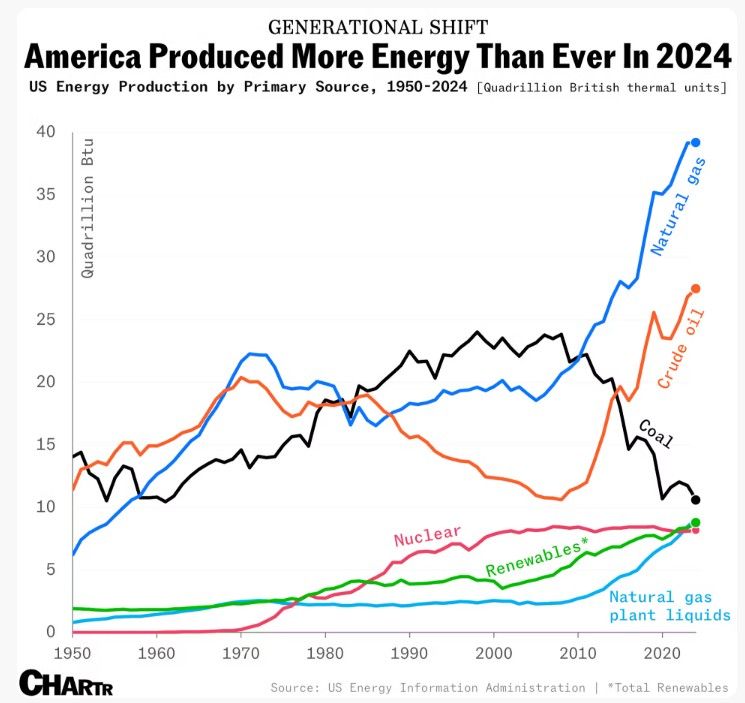

US energy production hits new record high

The United States just hit a new all-time high in energy production, reaching 103 quadrillion BTUs in 2024. This record was driven by strong growth in renewables — with solar up 25%, wind up 8%, and biofuels up 6%. Crude oil output also reached a record 13.2 million barrels per day, keeping the U.S. as the world’s top producer. Natural gas remained the largest energy source, while coal production fell to a 60-year low. Source : chartr

nuclear energy stocks are on fire 🔥

🟢 Oklo ($OKLO) shares surged 29% on Wednesday after the company was named the intended awardee for a Department of Defense project to deliver clean energy to Eielson Air Force Base in Alaska. The Defense Logistics Agency Energy issued a Notice of Intent to Award (NOITA), designating Oklo as the preferred provider following a competitive evaluation process. Under the proposed agreement, Oklo will design, build, own, and operate an Aurora powerhouse—a microreactor that provides both electricity and heat—at the remote military base. ➡️ Oklo Inc. is an advanced nuclear technology company headquartered in Santa Clara, California, founded in 2013 by Jacob DeWitte and Caroline Cochran, both MIT graduates. The company focuses on designing and deploying compact fast reactors, aiming to provide clean, safe, and affordable energy at a global scale. Oklo’s flagship product is the Aurora powerhouse, a small, liquid metal-cooled fast reactor designed to generate between 15 and 75 megawatts of electrical power (MWe). This reactor can operate for up to 10 years without refueling and is intended for off-grid applications such as data centers, artificial intelligence infrastructure, remote communities, industrial sites, and military bases.

A group led by British engineer Rolls-Royce has won UK government backing for its bid to build the country’s first small modular nuclear reactors.

The consortium has been selected as the preferred bidder out of four developers shortlisted last year. The selection marks a step forward for the technology in the UK, although SMRs are not likely to be up and running in Britain until the 2030s. It comes as the government announced £11.5bn of new state funding on Tuesday for a new large-scale power plant, Sizewell C in Suffolk. The government said it would pledge £2.5bn for SMRs over the current spending review period. The Rolls-Royce consortium was among four bidders shortlisted last year, including US-owned rivals Holtec Britain and GE Hitachi, and Canadian-owned Westinghouse Electric. The latter had dropped out earlier this year. SMR is a catch-all term for relatively small nuclear power plants using different technologies, parts of which can be built off-site. Proponents say their size and modular construction mean it should be possible to build them with fewer of the delays and cost blowouts that have dogged larger models. However, critics caution that there is so far no certainty that the purported benefits will materialise. Source: FT ➡️ https://lnkd.in/eF8Zp_xj

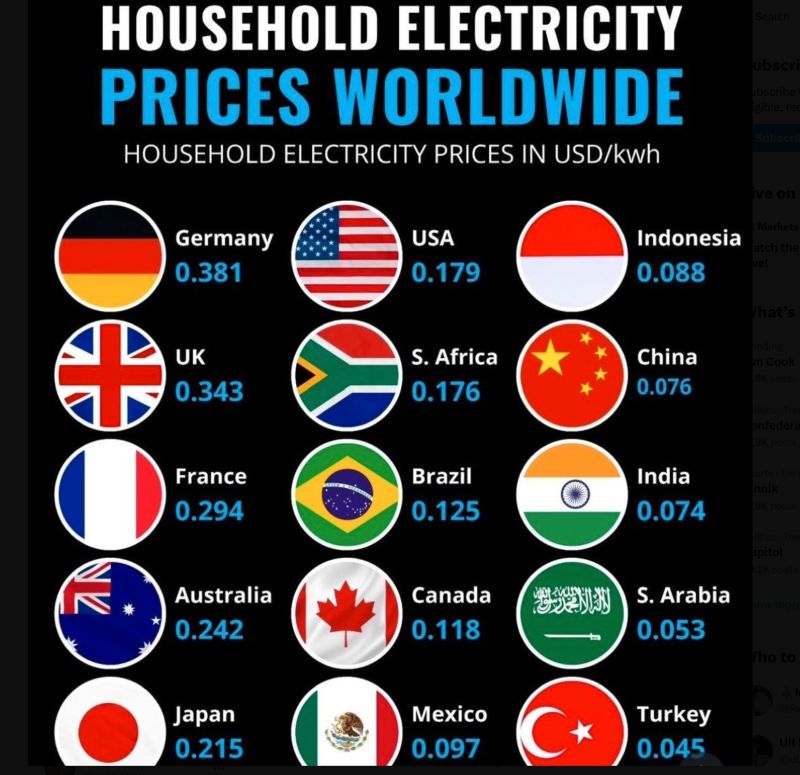

What do you notice on the picture below?

Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks