Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

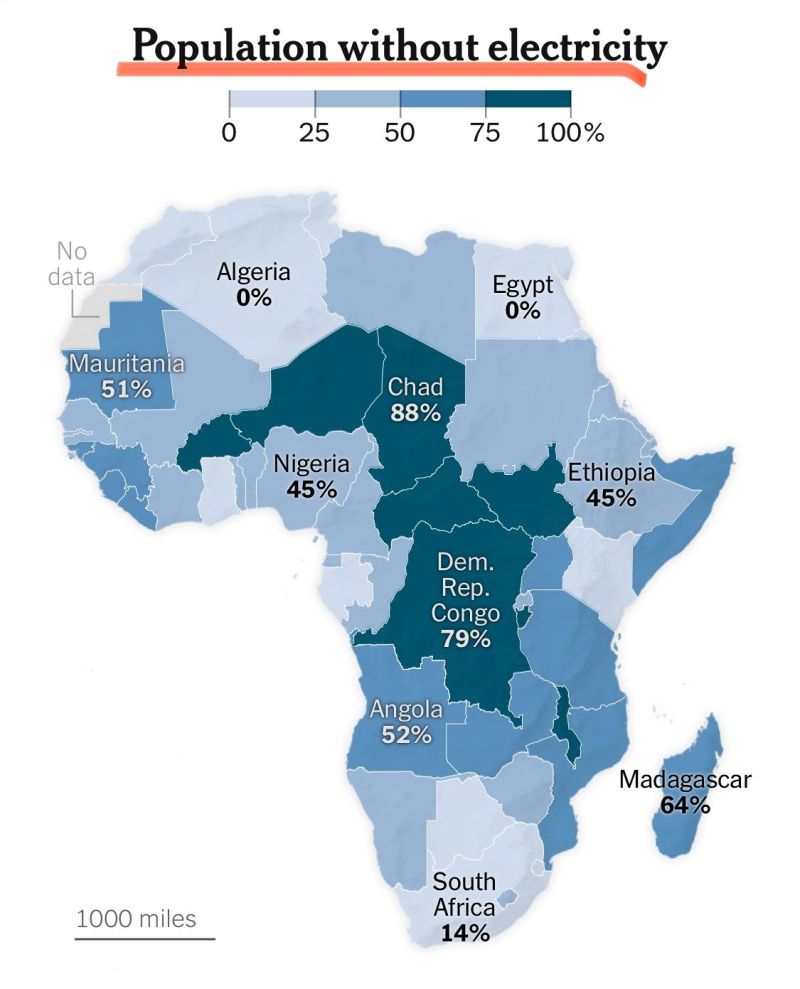

The most DRAMATIC energy chart you can ever see 👇

While the world debates about Artificial Intelligence and how quickly can put its flag on Mars, there are huge portions of Africa non even able to have electricity ⚡️More than 600 million of Africa people do not access to electricity. Source: Alexandro Blasi

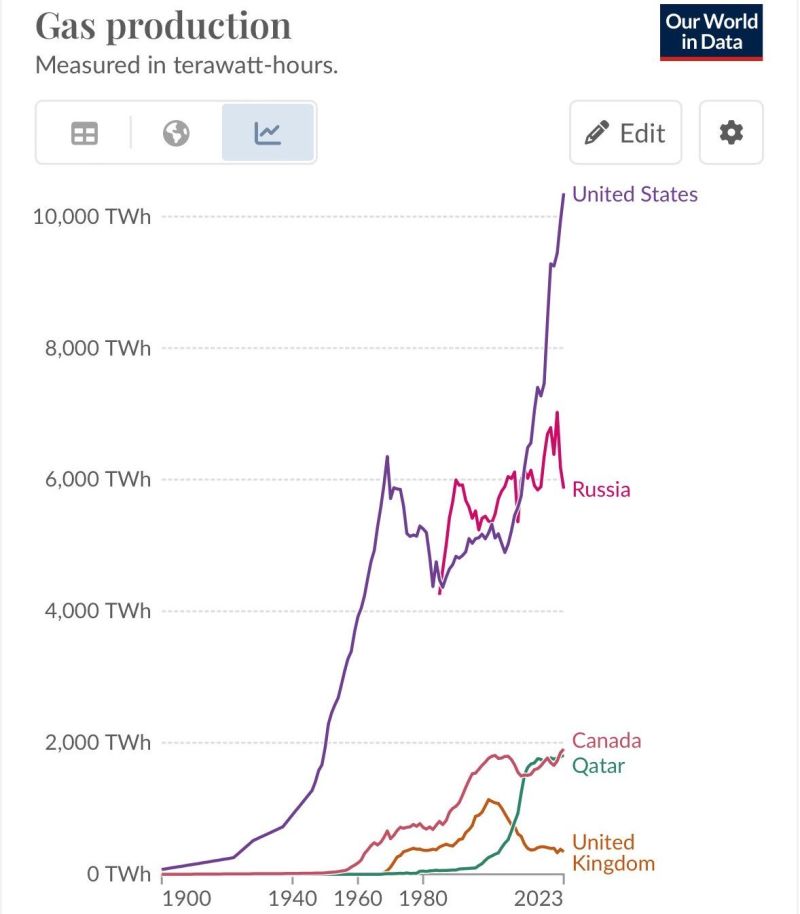

One of Morgan Stanley 2025 Theme is the Future of energy:

"In 2025, our focus shifts from hashtag#decarbonization to the wide range of factors driving the supply, demand, and delivery of hashtag#energy across geographies. The common thread is the potential for rapid evolution. Four key dynamics: (1) an increasing focus on energy security; (2) the massive growth in energy demand driven by trillions of dollars of hashtag#AI hashtag#infrastructure spend, to be met by both fossil fuel-powered plants and hashtag#renewables; (3) innovative hashtag#energy hashtag#technologies such as carbon capture, energy storage, nuclear power, and power grid optimization; and (4) increased electrification across many industries. Relatedly, we continue to believe that carbon emissions will likely exceed the targets in various nations’ climate pledges. Hence, we expect focus to shift toward climate adaptation and resilience technologies/business models". Source: Morgan Stanley, zerohedge

France Adds First Nuclear Reactor in 25 Years to the Grid

France connected the Flamanville 3 nuclear reactor to its grid on Saturday morning, state-run operator EDF announced. This marks the first addition to the country's nuclear power network in 25 years. The reactor, which began operating in September before being connected to the grid, is coming online 12 years later than originally planned and at a cost of approximately 13 billion euros—four times the initial budget. EDF is planning to construct six additional reactors to meet a 2022 pledge made by President Emmanuel Macron as part of France's energy transition plans. However, questions remain regarding the funding and timeline for these new projects. source : reuters

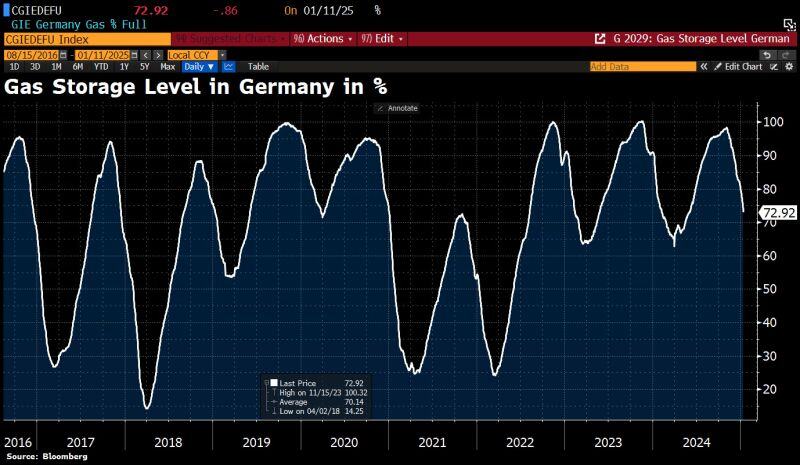

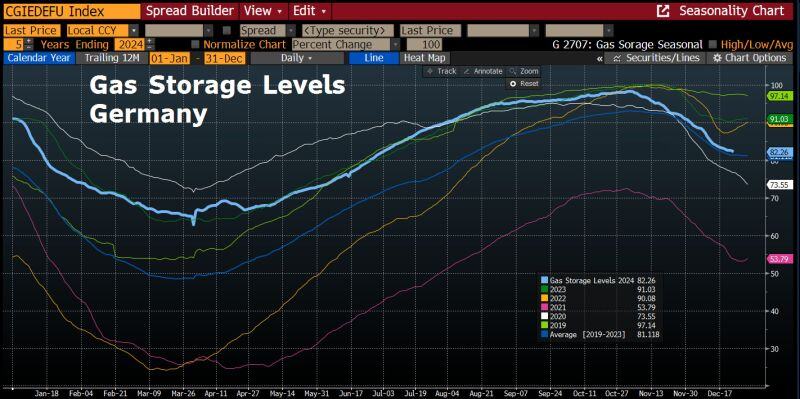

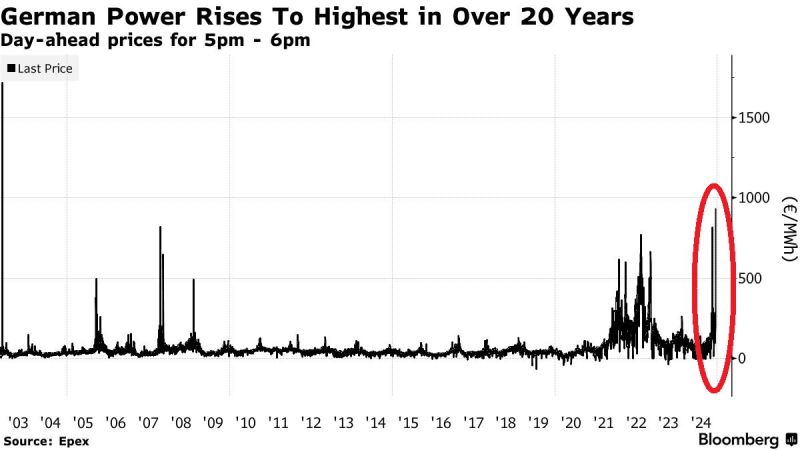

GERMAN ENERGY PRICES ARE EXPLODING

This is not going to help... German power prices SPIKED to the levels seen during the 2022 energy CRISIS. Day-ahead prices for 5pm-6pm skyrocketed to the highest in 20 YEARS. This comes as wind generation plummeted as there has been almost no wind in recent days. Source: Global Markets Investor, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks