Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

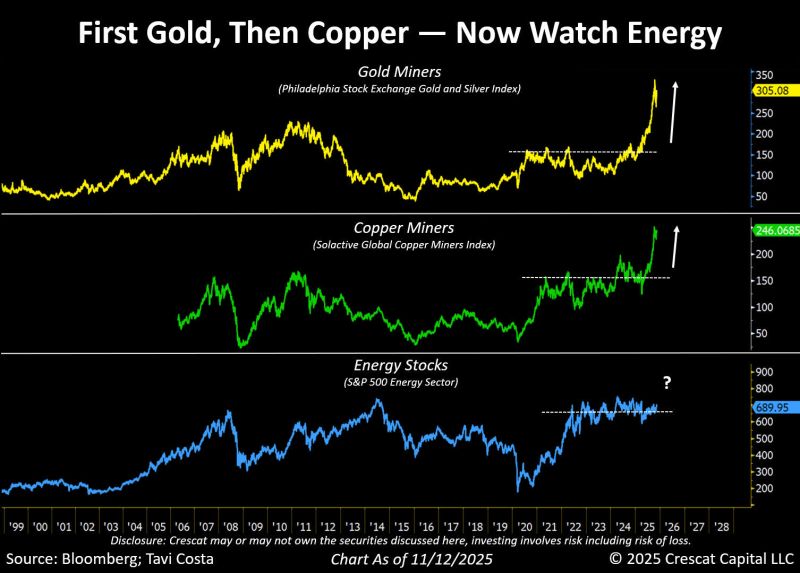

Otavio (Tavi) Costa just made a case for energy stocks, which have been quietly inching higher.

Here's his view: ▪️Positioning remains deeply bearish. ▪️U.S. oil and gas rigs are contracting meaningfully. ▪️Oil is trading near one of the cheapest levels in history relative to the money supply. ▪️Energy’s weight in the S&P 500 is hovering near record lows. He sees energy equities as one of the most fundamentally attractive corners of the market right now. Your thoughts? Source: Tavi Costa, Crescat Capital, Bloomberg

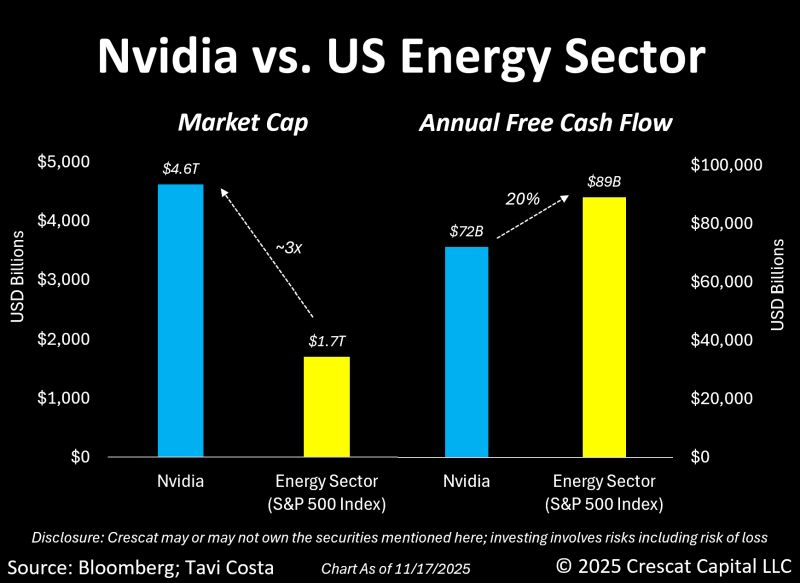

As highlighted by Tavi Costa, Nvidia is now valued at nearly three times the entire energy sector.

Almost three times. And no, it doesn’t generate more profit than energy companies in the S&P 500. In fact, the combined free cash flow of this sector over the last year is about 20% higher than Nvidia’s. Tech innovation is incredible, but let’s not forget that something still has to power it. Source: Tavi Costa, Bloomberg

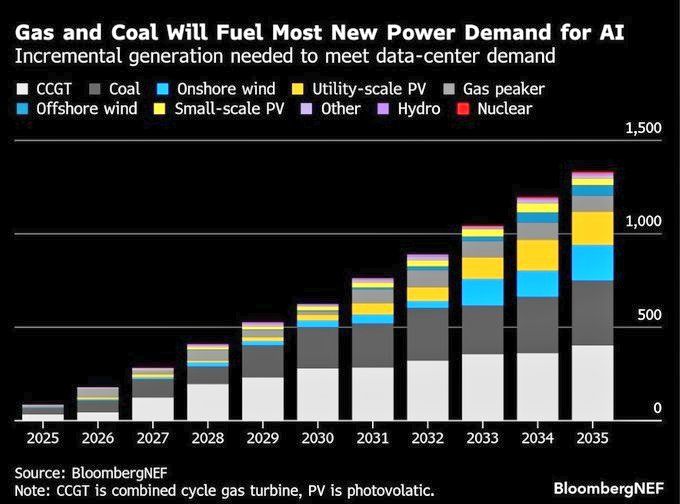

And the winner of the power demand is .... Coal !

Source: Bloomberg, @AzizSapphire

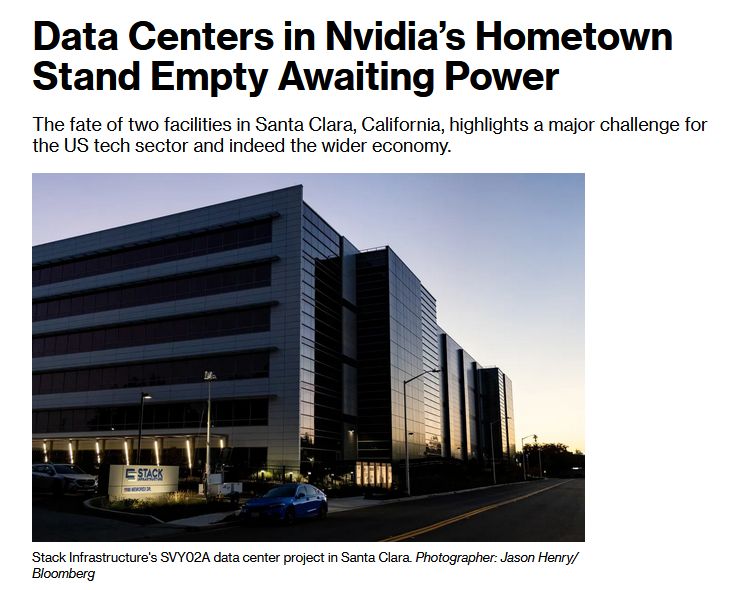

You can't print energy...

zerohedge: "The money is not the problem: AI is the new global arms race, and Capex will eventually be funded by governments (US and China). If you want to know why gold/silver/bitcoin is soaring, it's the "debasement" to fund the AI arms race. But you can't print energy".

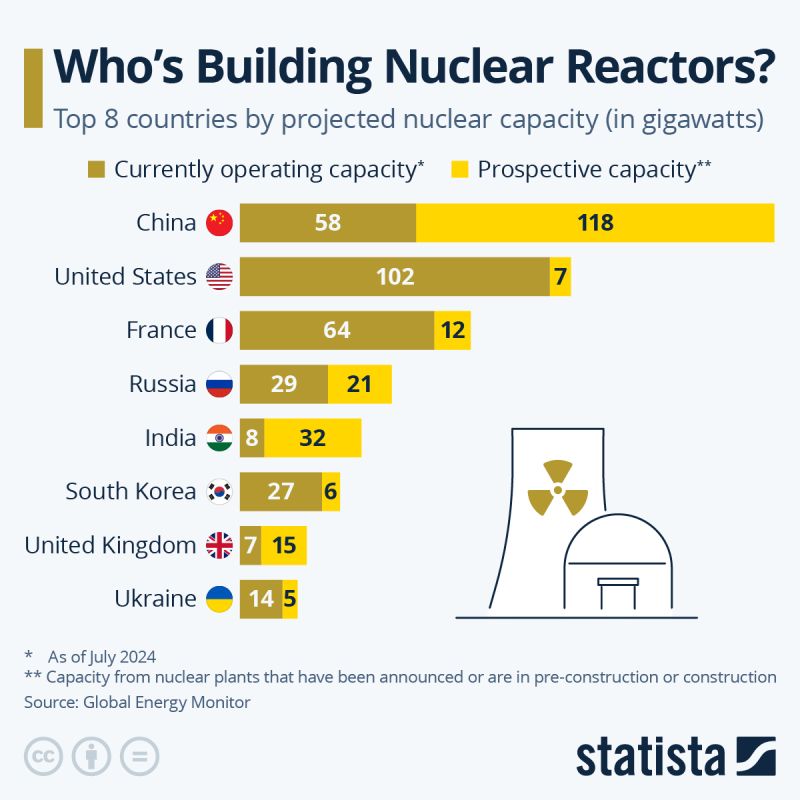

The Nuclear Power Shift Has Begun Right now, the world’s total nuclear power capacity stands at 396 GW.

Another 299 GW is already in the pipeline — announced, pre-construction, or under active build. For decades, the U.S. has been the nuclear superpower, leading with 102 GW of capacity (as of July 2024). It’s followed by: 🇫🇷 France — 64 GW 🇨🇳 China — 58 GW 🇷🇺 Russia — 29 GW 🇰🇷 South Korea — 27 GW 🇨🇦 Canada — 15 GW But the status quo is about to flip — and flip hard. 🚀 China’s Nuclear Acceleration China is building at industrial speed. A total of 104 new reactors are in development across 22 power plants — adding 118 GW of future capacity. If completed (and current reactors stay online), China’s total capacity will soar to 176 GW, surpassing the U.S. for the first time in history. 🇺🇸 The U.S. Response The U.S. plans to add just 7 GW, spread across 30 prospective reactors at 8 power plants — bringing its potential total to 109 GW. However, four major reactors are scheduled to retire soon: Diablo Canyon (2 reactors) by 2030 Salem (2 reactors) by 2036 & 2040 ➡️ Together, that’s a 5 GW reduction. Russia (-4 GW) and Ukraine (-1 GW) also have planned retirements. 🌍 The New Global Order (If All Goes to Plan) 🇨🇳 China – 176 GW 🇺🇸 United States – 109 GW 🇫🇷 France – 76 GW 🇷🇺 Russia – 46 GW 🇮🇳 India – 41 GW 🌱 The Next Wave Beyond China, India is the next big mover — with 31 new reactors across 9 plants adding 32 GW. Other countries ramping up: 🇷🇺 Russia – 21 GW 🇬🇧 U.K. – 15 GW 🇷🇴 Romania – 15 GW 🇹🇷 Turkey – 15 GW 🇵🇱 Poland – 14 GW (starting from zero nuclear capacity) 🇫🇷 France – +12 GW 🇺🇸 U.S. & 🇮🇷 Iran – +7 GW each 🔋 The Takeaway Global nuclear power is not fading — it’s accelerating. We’re entering a new era where energy independence, decarbonization, and geopolitics collide. The next energy superpower won’t just be the one with oil or gas. It will be the one with reactors online and uranium secured. Source: Statista

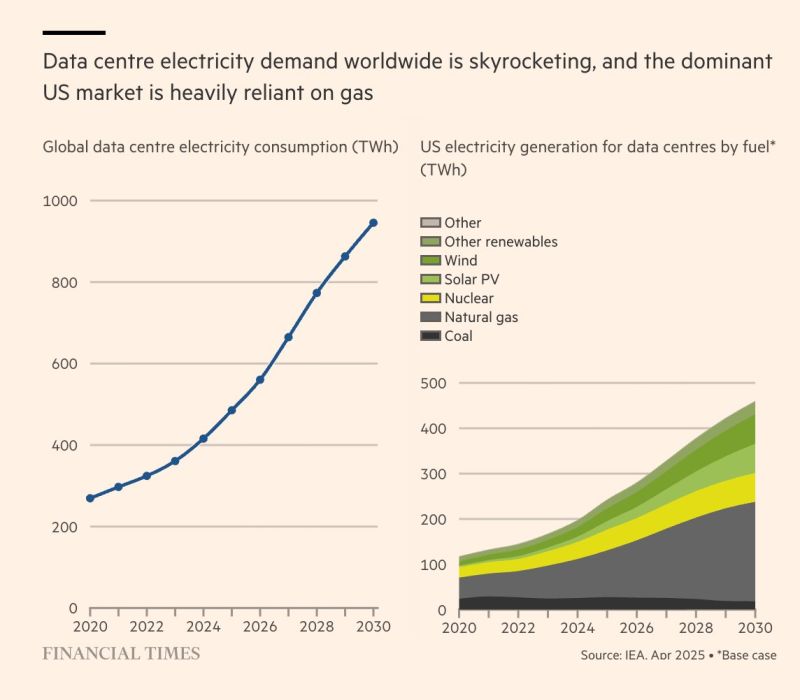

Data center demand for electricity is predicted to double by 2030. - FT

Source: Energy Headline News @OilHeadlineNews

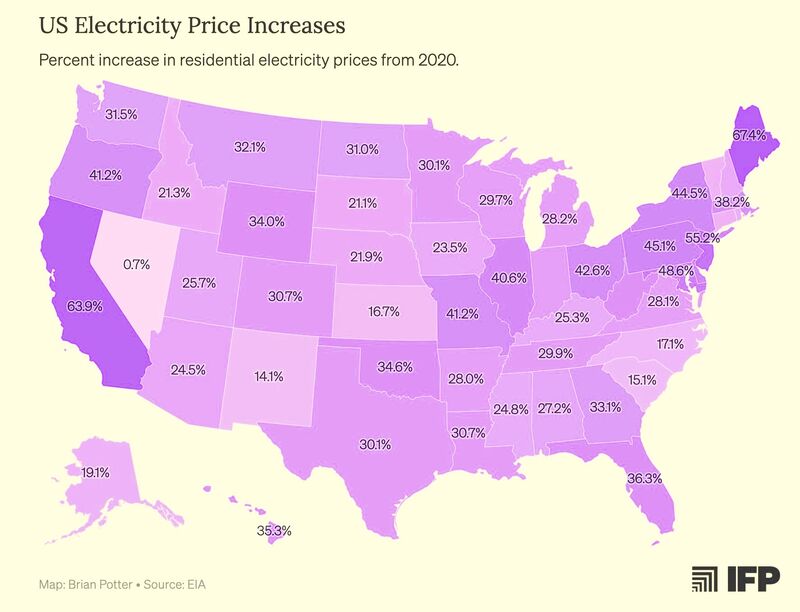

Electricity prices in the US have exploded since 2020.

Across the U.S., residential power costs are up more than 40% in many states and over 60% in places like California and Maine. Should be see this as the early stage of an energy crisis? Source: StockMarket.news

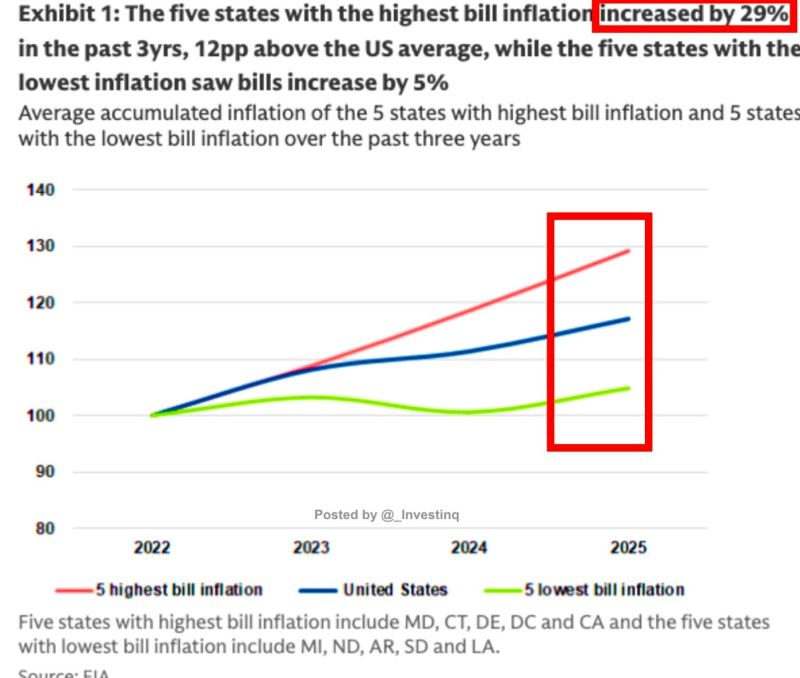

Power Bills Surge in Deregulated States:

Over the past three years, residents in Maryland, Connecticut, Delaware, D.C., and California have seen electricity bills jump 29%, about 20 percentage points higher than overall inflation and well above the national average. By contrast, regulated states like Michigan, North Dakota, Arkansas, South Dakota, and Louisiana experienced only about a 5% rise in power costs Source: StockMarket.News @_Investinq

Investing with intelligence

Our latest research, commentary and market outlooks