Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

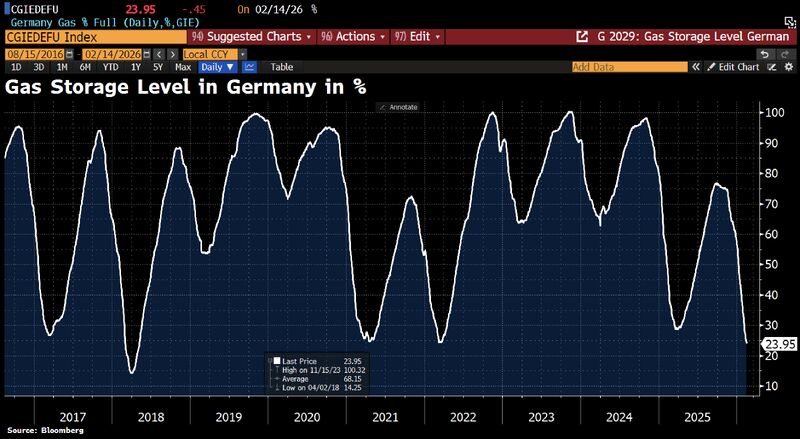

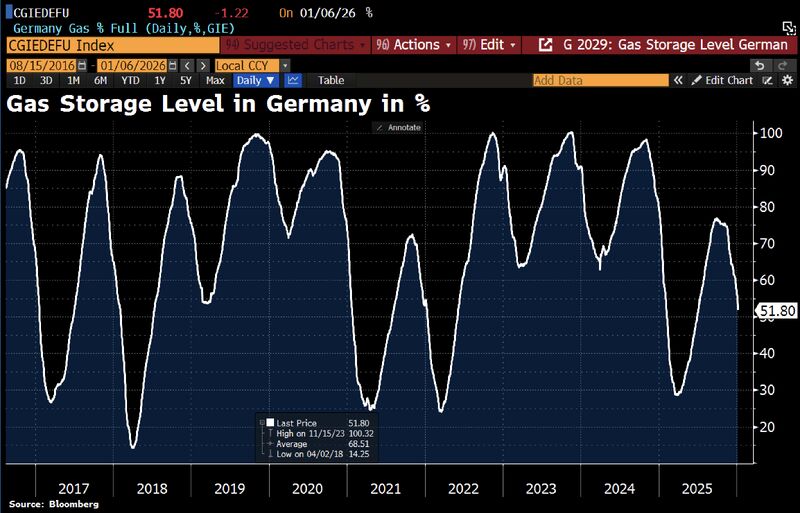

In Germany, gas storage levels have fallen below 24%

a record low for this time of year. Typically, storage levels average around 50.7% at this point. At 23.95%, inventories are also at their lowest level since May 2018. Source: Bloomberg, HolgerZ

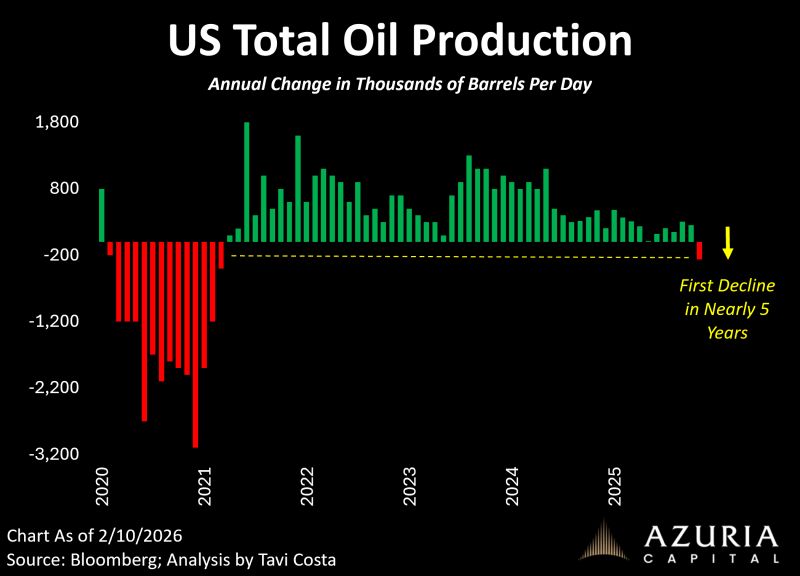

For the first time in nearly five years, total US oil production is declining on a year-over-year basis.

After a roughly 30% drop in active rigs over the past three years, improved drilling technology has not been enough to compensate for reduced capital investment, proving that fundamentals ultimately prevail. Despite this tightening supply, oil remains one of the most heavily shorted assets in over a decade, raising the question of whether prices could be poised for an upward move. Source chart: Tavi Costa

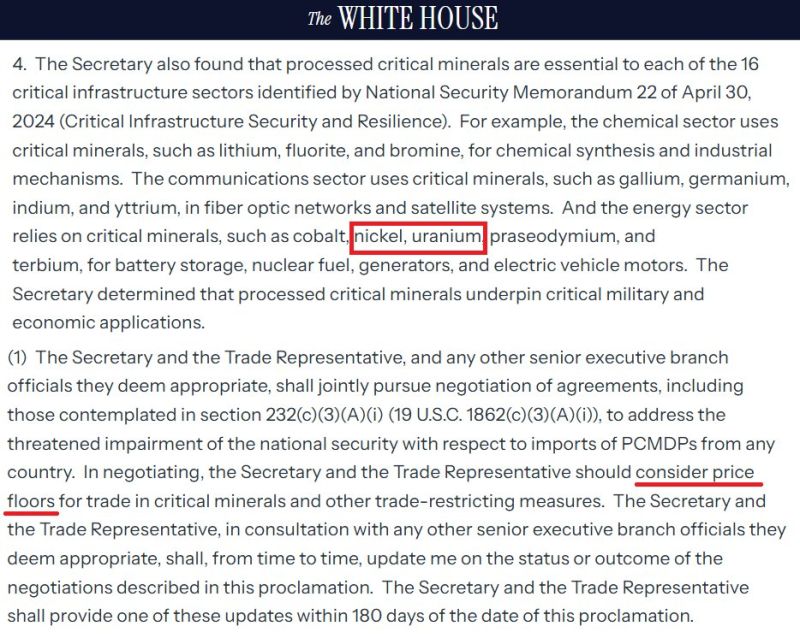

From Ghost Industry to National Priority

This White House statement on critical minerals explicitly listed uranium as a critical mineral, and it looks like they’re actually considering a price floor guarantee. The US used to be a powerhouse in uranium, but the industry is basically a ghost of its former self now. The government seems to be stepping up and back producers with some real institutional support. Things like strategic stockpiling or a price floor could be a massive game-changer. Between the skyrocketing power demand and energy security needs, support seems to be coming. Source: JH @CRUDEOIL231

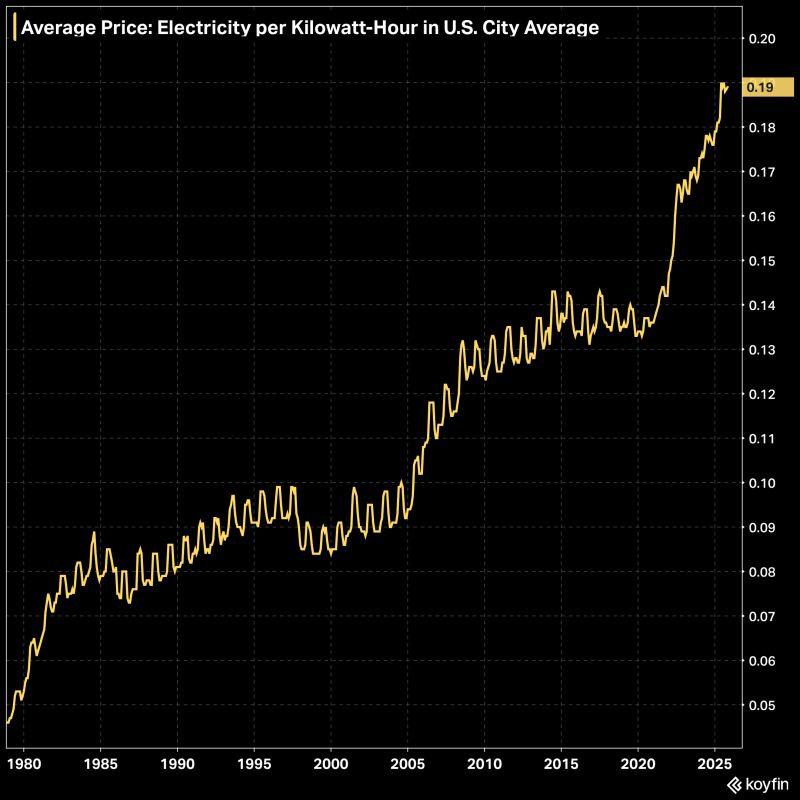

The average price of electricity per Kilowatt-hour in the United States.

Source: Koyfin @KoyfinCharts

Germany's Merz admits: It was a serious strategic mistake to exit nuclear energy.

Friedrich Merz just plainly admitted: ditching nuclear was "a serious strategic mistake" and Germany's running the world's most expensive energy transition. "At least 3 years ago we had to leave the last remaining nuclear power plants in Germany on the grid so that we at least had the power generation capacities we had at that time. We have taken over something that we now have to correct. But we just don't have enough energy generation capacities." Source: Mario Nawfal on X

Uranium, $URA extends it’s rally, gaining +5% The bull market is broadening

Source: Hedgeye

Investing with intelligence

Our latest research, commentary and market outlooks