Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

HolgerZ on German elections results 👇

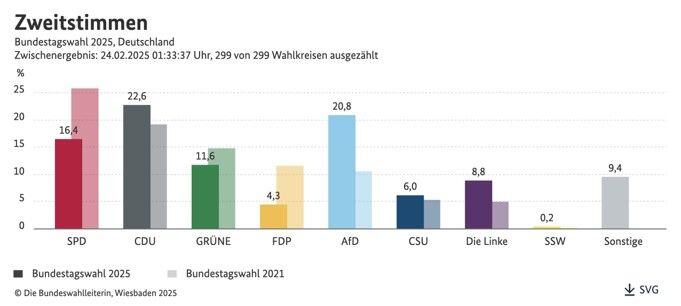

•🚨 CDU leader Friedrich Merz has emerged as the winner of a turbulent federal election. The CDU/CSU secured just 28.6% of the vote—its second-worst result in history. The SPD, expected to be the next coalition partner, collapsed to 16.4%, marking its weakest performance since World War II. Meanwhile, the far-right AfD doubled its support to 20.8%, and the Left Party also saw a significant surge, reaching 8.8%. 👉 The FDP and BSW failed to clear the 5% threshold and will NOT be represented in the Bundestag. W/just 45% of the vote, a CDU/CSU-SPD coalition is possible, avoiding the need to include the Greens, who dropped to 11.6%. 👉However, fringe parties now hold a blocking minority, making constitutional changes—such as setting up an off-budget defense or infrastructure fund or reforming the debt brake—dependent on concessions to them or impossible altogether.

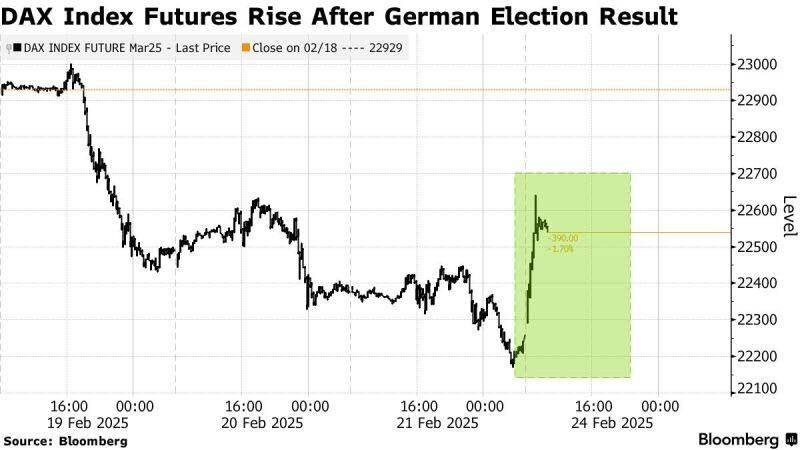

DAX Futures Gain With Euro in Asia After German Vote Outcome

Bloomberg, C.Barraud

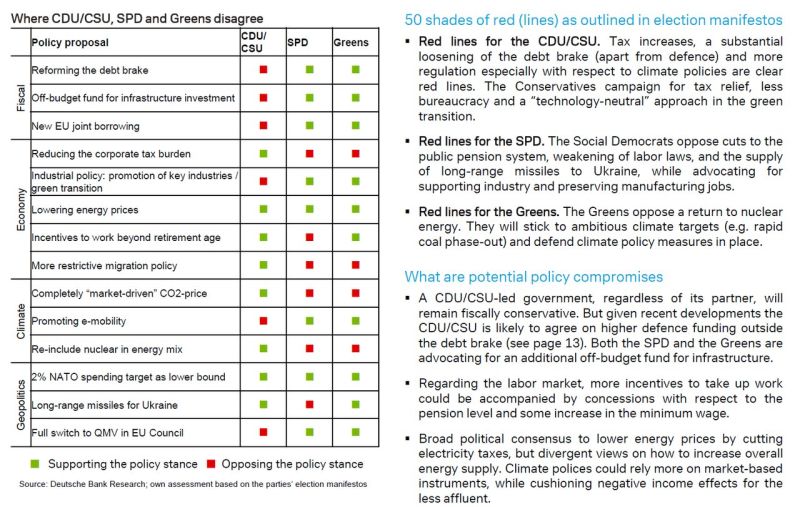

German elections: the polls were spot on; no shocks, no surprises.

What does this mean for the new coalition government (most likely between CDU/CSU and SPD). Here is a handy primer from Deutsche Bank. Source: zerohedge, DB

The ECB has recorded the biggest loss in its 25y history.

This is the result of its aggressive policy responses to Eurozone crises & surging inflation—1st buying large amounts of bonds & then sharply raising interest rates. As a result, ECB is earning less interest from the bonds it holds than it has to pay to banks for their deposits. Source: HolgerZ, Bloomberg

EU SLAPS RUSSIA WITH NEW SANCTIONS

by Evan on X. As Trump’s administration hints at potential sanctions relief for Russia, the EU is doubling down with a fresh wave of restrictions, including a ban on Russian primary aluminum imports. Secretary of State Marco Rubio suggested that Europe will eventually have to join negotiations, stressing that “concessions on all sides” will be necessary to resolve the Ukraine conflict. Despite the shift in U.S strategy, EU leaders are holding firm, with Ursula von der Leyen insisting that the bloc remains committed to pressuring the Kremlin. Source: Euronews

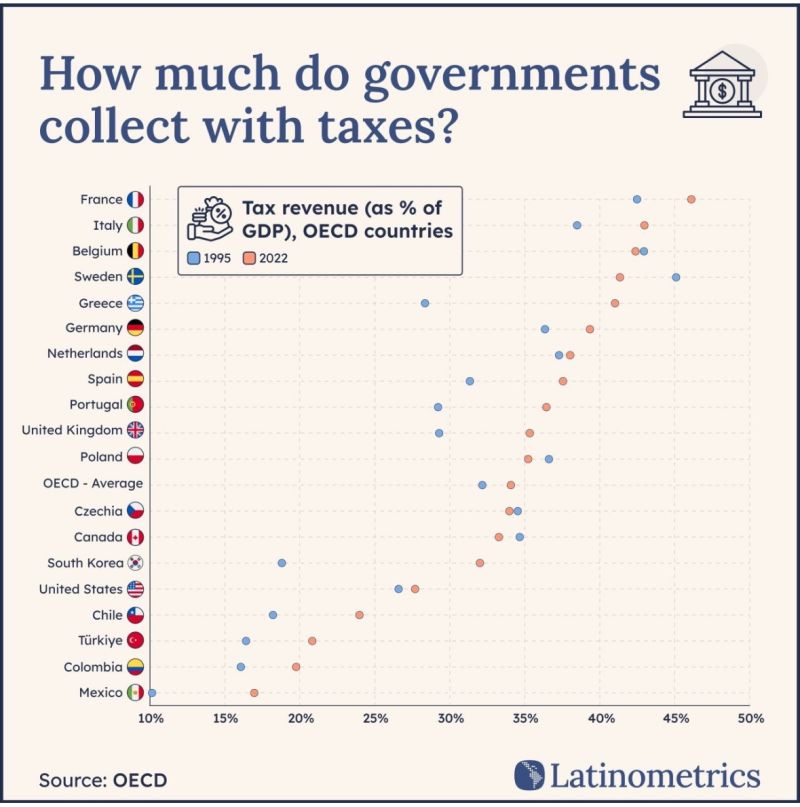

In France and Italy, governments impose taxes to the tune of almost 50% (!) of GDP.

In the US, that’s barely 30%. Not a fun experience for productive individuals and companies in Europe... Source: Alf Macro on X

European Stocks see largest weekly inflow in more than 2 years 🚨

Source: Barchart

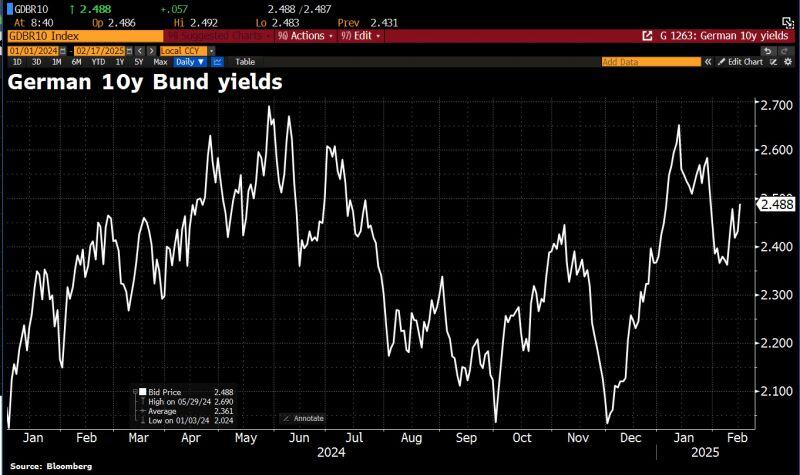

Germany 10-year bond yields rise as tensions between Europe and the US, highlighted at the Munich Security Conference, make investors nervous.

There is speculation that European leaders meeting in Paris today may agree to increase defense spending to strengthen the continent’s security. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks