Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Germany will hold a snap national election on February 23 following the collapse of Chancellor Olaf Scholz's three-way coalition.

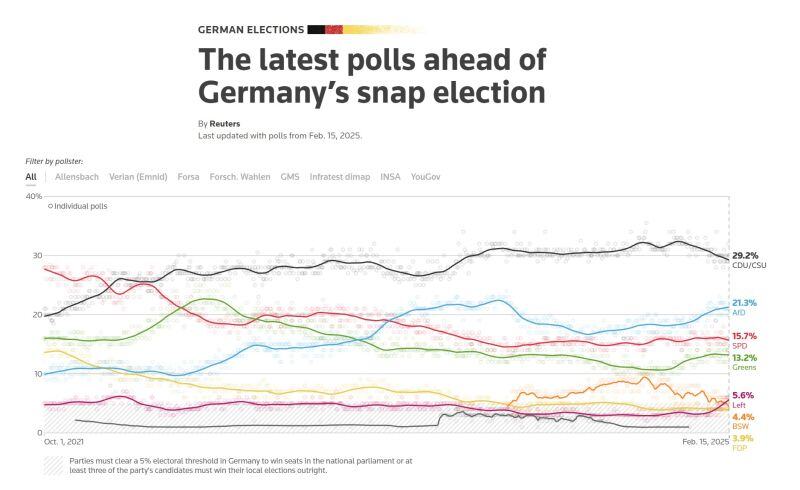

Currently, the CDU/CSU leads in Reuters polling aggregate by 8 points over the AfD. The far-right AfD has gained 4.6 points since June 2024. The SPD, the current leaders in the national parliament, have lost 12.1 points since the last federal election, and are currently in third place. Germany has two centrist, “big-tent” parties: Scholz's centre-left Social Democrats (SPD) and the opposition conservatives, an alliance of the Christian Democrats (CDU) and their Bavarian sister party, the Christian Social Union (CSU). Both have lost support in recent years, with smaller parties such as the Greens and far-right Alternative for Germany (AfD) gaining ground. The SPD, conservatives, Greens and AfD are all fielding candidates for chancellor. Also running are the pro-market Free Democrats (FDP), the far-left Linke and the leftist Sahra Wagenknecht Alliance (BSW), who are all at risk of missing the 5% threshold to make it into parliament, according to opinion polls. Source: Reuters

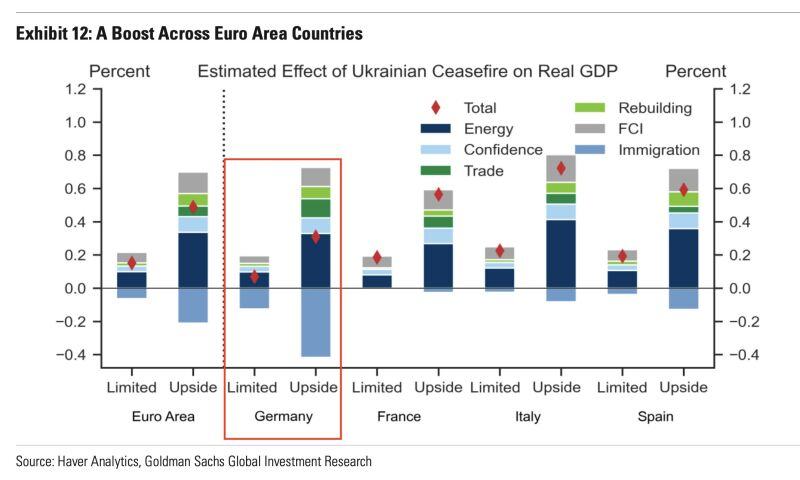

In Germany, a ceasefire in Ukraine would add just 0.1ppts to Germany’s economic growth

—only half the boost expected in France, Italy, or Spain, according to Goldman Sachs. The reason? Germany would face a bigger economic drag from the return of Ukrainian refugees. Source: HolgerZ, Goldman Sachs

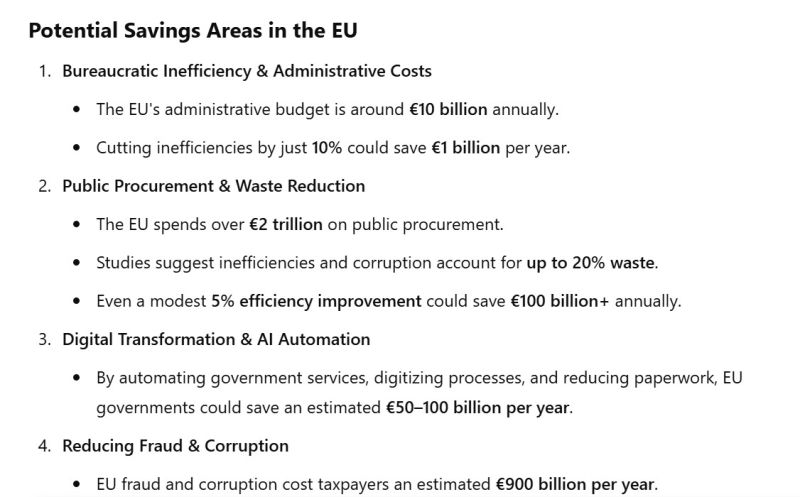

I asked ChatGPT the potential savings if the Department of Government Efficiency (D.O.G.E.) was implemented across the European Union.

Here's the answer: MORE THAN A TRILLION EURO PER YEAR (Fyi, the EU budget deficit is around 500 billion euros).

European natural gas prices are between three and four times higher than in the US, providing a critical handicap to the continent's companies.

Brussels is weighing new powers to temporarily cap EU gas prices, which have recently hit record levels compared with the US. European natural gas prices traded at the highest in more than two years this week, in part because of low temperatures and a lack of wind that has hampered renewable energy production. They are between three and four times higher than in the US, providing a critical handicap to European companies. The European Commission is considering a cap as part of discussions about a “clean industrial deal” policy document to be presented next month, said three people with knowledge of the talks. The strategy paper should outline ways to shore up the EU’s heavy industries as businesses grapple with multiple challenges including US President Donald Trump’s aggressive trade measures and the EU’s own ambitious green transition. Talks around mechanisms to cap prices, though still at an early stage, have drawn a backlash from industry groups which warn against damaging “trust” in the European market. Link to artivcle >>> https://lnkd.in/eJbxpaKf Source: FT

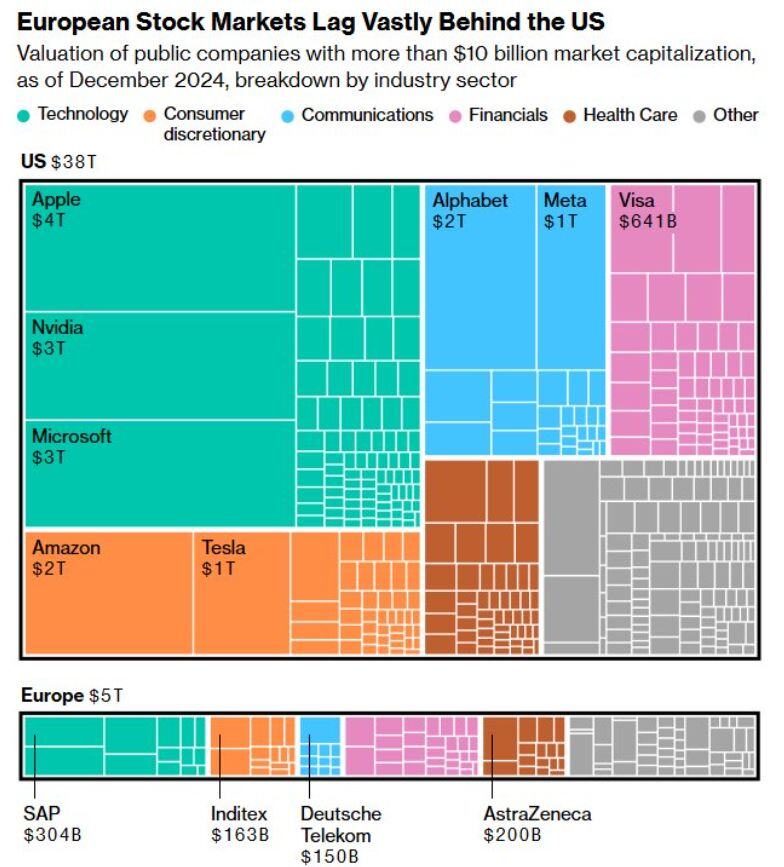

US innovation & entrepreneurial spirit versus overregulation, left redistribution mindset and lack of innovation.

EU is straight on its way to become an open-air museum. Source: Michel A.Arouet, Augur infinity

Valuation of Public Companies with Market Caps Over $10B

The gap between European and U.S. equities continues to widen. While U.S. stocks trade at historically high valuations, their European counterparts lag significantly behind. source: A.Arouet

TRUMP: "Am I going to impose tariffs on the European Union? Do you want the truthful answer or the political answer?

REPORTER: "The truthful answer." TRUMP: "Absolutely." source : unusual whales

Investing with intelligence

Our latest research, commentary and market outlooks