Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

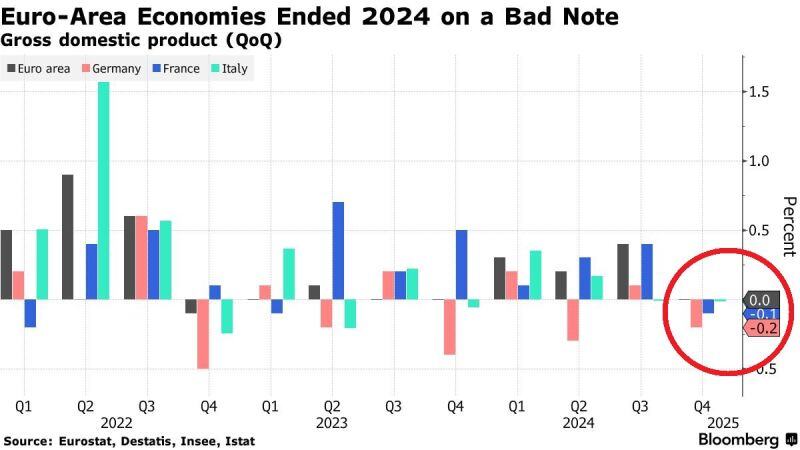

🚨What is happening with the eurozone economy?

Germany and France GDP fell 0.2% and 0.1% in Q4 2024. Italy's GDP was flat for the 2nd consecutive quarter. In effect, Euro-area economy did not grow in Q4 2024. Germany has contracted for 2 consecutive years in 2023 and 2024... Source: Bloomberg, Global Markets

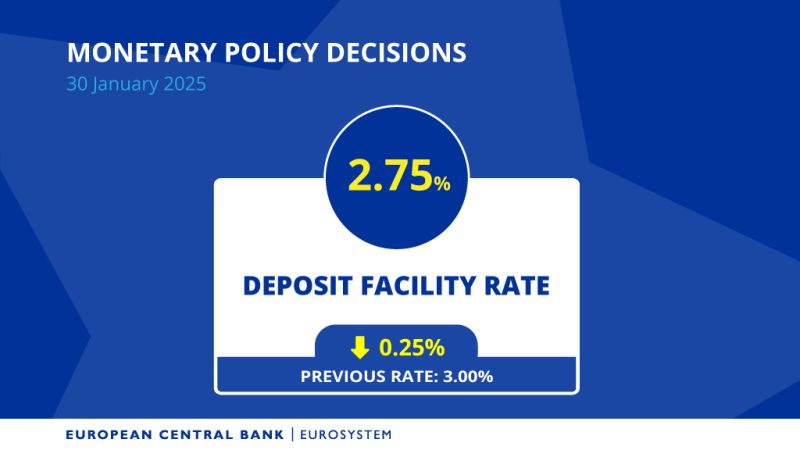

As expected, the ECB just cut interest rates by 0.25% to 2.75% as inflation nears 2% and growth stays weak.

Indeed, with Germany and France shrinking, the pressure was on. The eurozone economy is barely moving with Q4 GDP flat for the eurozone, with Germany (-0.2%) and France (-0.1%) dragging things down while Portugal (+1.5%) and Spain (+0.8%) showed some life. The ECB is playing it cautious, adjusting rates based on data. They reiterated that the disinflation process is well under way and that they see inflation converging towards 2%. The ECB says it’s not locking into a rate path—just watching inflation and economic data closely. The bond market is taking it quite positively with 10y Bond yield down 7bps at the time of our writing. With growth slowing, more cuts might be on the table. Let see what Mrs. Lagarde have to say during the conference call - especially with regards to wages and tariffs. Baring a major positive surprise coming from Germany on the fiscal side, the Eurozone growth outlook remains bleak - this opens the door to at least 1 rate cut every quarter.

Can you believe it?

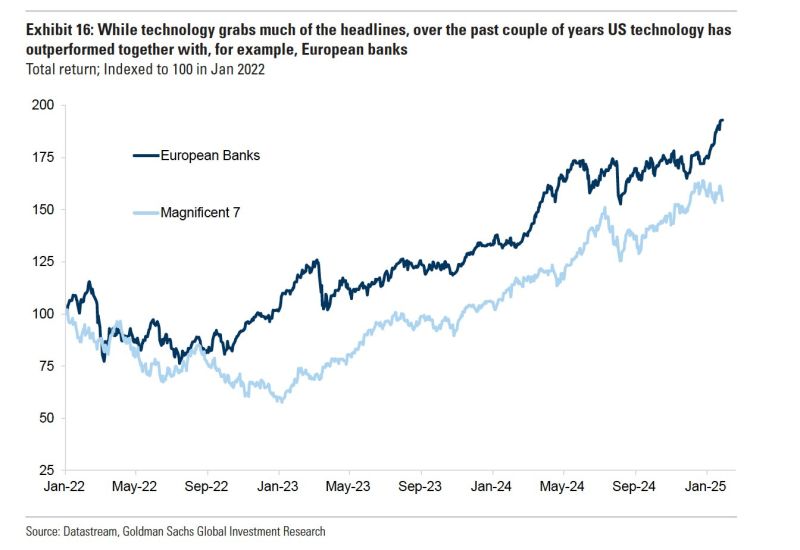

European banks have outperformed the Mag 7 over the past two years.... via @GoldmanSachs

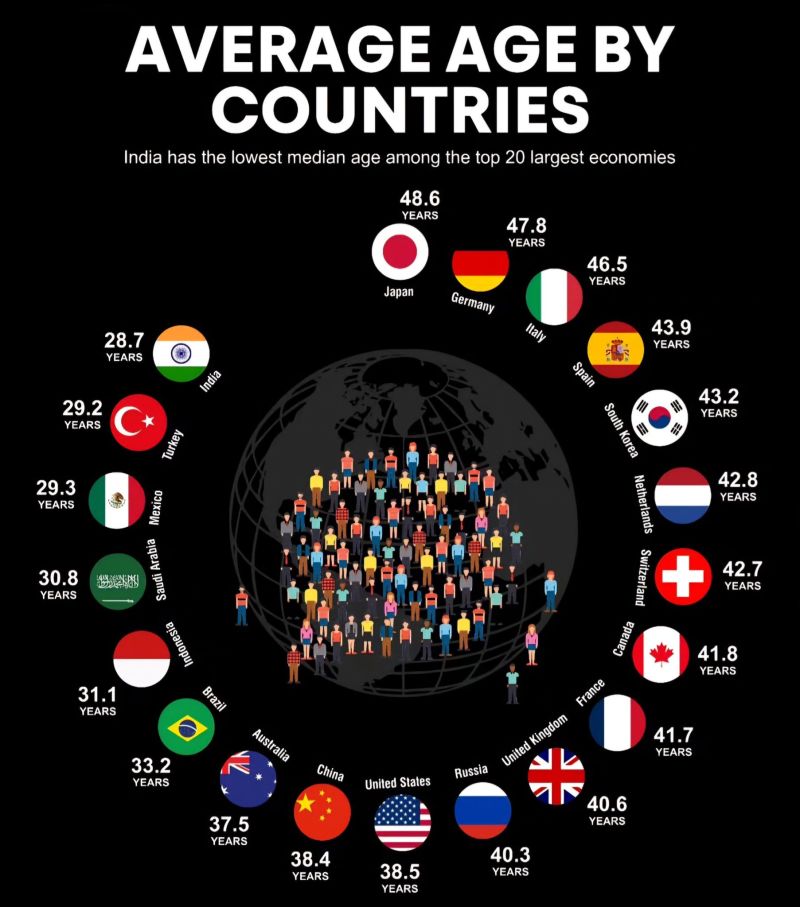

Everyone knows that Japan is getting old, but look what is happening in major European countries.

Who is supposed to pay for pensions and healthcare entitlements in Germany, Italy and Spain in few years? Source: Michael A. Arouet

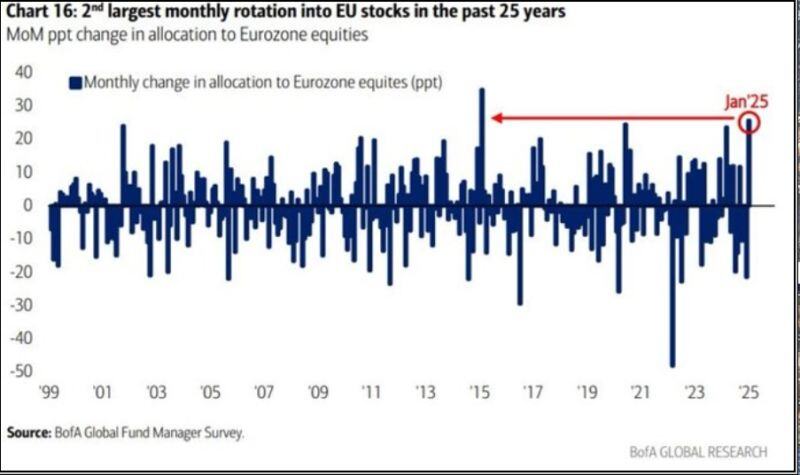

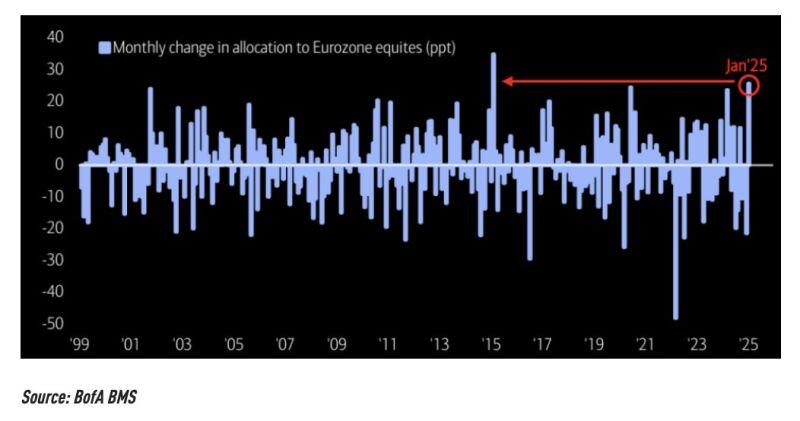

According to BofA, we've just seen one of the largest month-over-month allocations to European equities on record.

Is this signaling a European comeback, or simply a rotation ? source : BofA

The 2nd largest rotation into european equities in the last 25 years is currently taking place.

Source: Bloomberg, Barchart

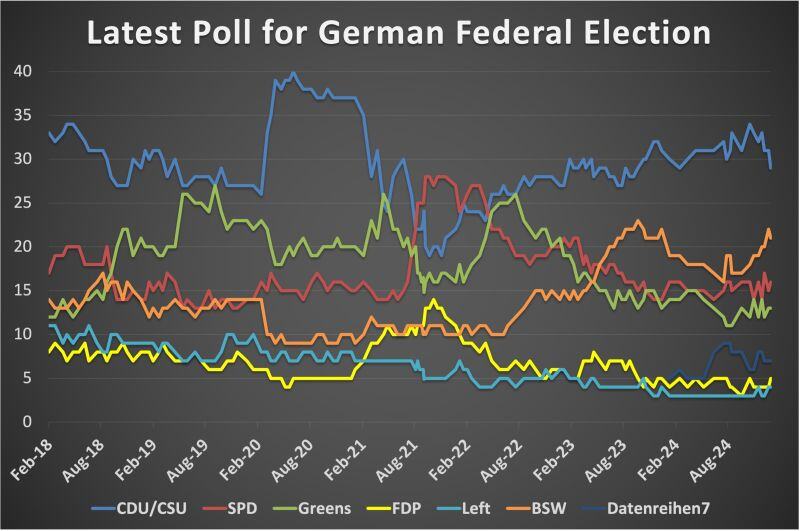

An update on Germany snap election:

the conservative support has slipped below 30% ahead of the February election. Friedrich Merz’s center-right CDU/CSU alliance leads with 29% in the latest Insa survey, down one point from last week. The AfD also dropped by one point to 21%, while support for Chancellor Olaf Scholz’s Social Democrats (SPD) and the Greens remains steady at 16% and 13%, respectively. 👉 As it stands, a so-called grand coalition between the CDU/CSU and SPD appears to be the most likely outcome Source: HolgerZ, Bloomberg

In Germany, labor productivity has stagnated—or even declined—since 2020.

Meanwhile, US companies have embraced AI's benefits and recently achieved significant productivity gains. Notably, productivity trends in Germany and the US have been diverging since 1999. This divergence may also be linked to the introduction of the euro. Since the euro became undervalued for Germany—at least from 2004 onward—German companies may have felt less pressure to improve productivity. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks