Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

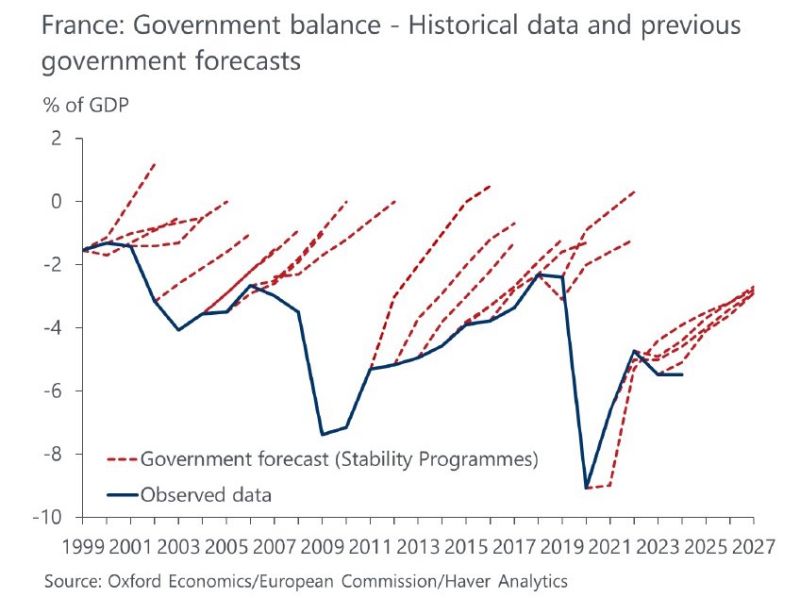

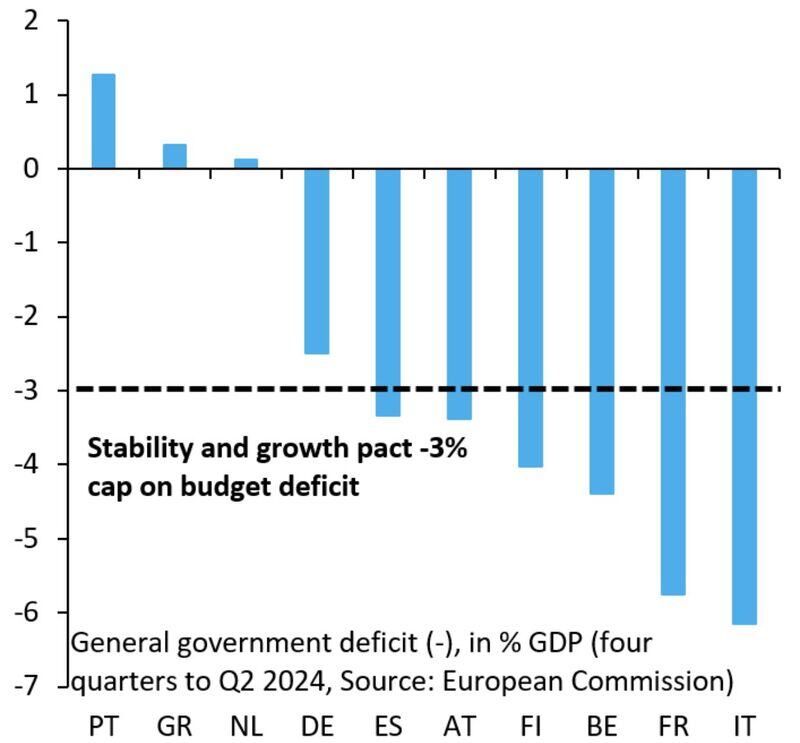

France has always missed its deficit forecasts, always.

It runs 6% fiscal deficit during good times. With the current political paralysis there will be no long overdue structural reforms, especially of pensions. It will miss current forecasts as well. Could the next Euro crisis start in France? Source: Michel A.Arouet Chart @OxfordEconomics

Italy plans $1.5 billion SpaceX telecom security services

Italy is in advanced talks with Elon Musk’s SpaceX for a deal to provide secure telecommunications for the nation’s government — the largest such project in Europe, people with knowledge of the matter said Sunday. Discussions are ongoing, and a final agreement on the five-year contract hasn’t been reached, said the people, who asked not to be identified citing confidential discussions. The project has already been approved by Italy’s Intelligence Services as well as Italy’s Defense Ministry, they said. The negotiations, which had stalled until recently, appeared to move forward after Italian Prime Minister Giorgia visited President-elect Donald Trump in Florida on Saturday.

An era came to a close in Europe on the first day of 2025 >>>

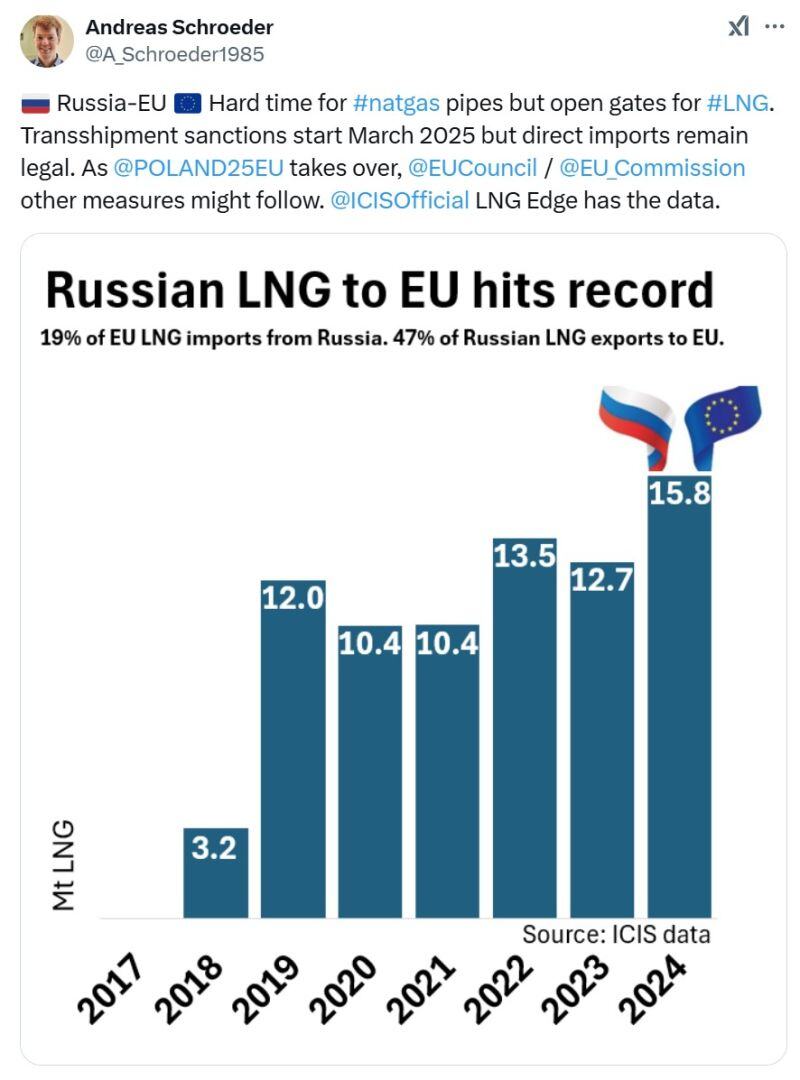

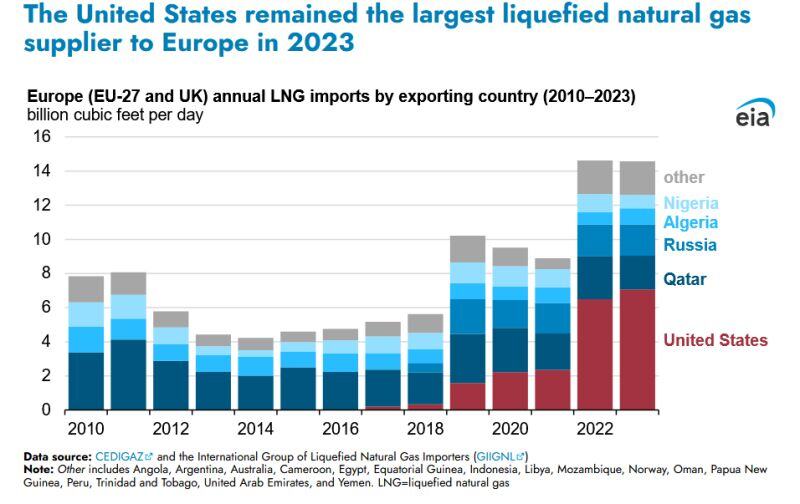

Russian gas exports via Soviet-era pipelines running through Ukraine came to a halt on New Year's Day, marking the end of five decades of Moscow's dominance over Europe's energy markets, as well as cheap gas that kept Germany's economy humming. The gas had kept flowing despite nearly three years of war, but Russia's gas firm Gazprom said it had stopped at 0500 GMT after Ukraine refused to renew a transit agreement. European natural gas prices have been rising all year and closed 2024 more than doubling from their February lows. There is a risk they will only keep rising now. The European Commission said the EU had prepared for the cut-off. Indeed, the EU has slashed its dependence on Russian energy since the start of the war in Ukraine by buying more piped gas from Norway and LNG from Qatar and the United States. "The European gas infrastructure is flexible enough to provide gas of non-Russian origin," a spokesperson for the Commission said. "It has been reinforced with significant new LNG (liquefied natural gas) import capacities since 2022." The biggest beneficiary of said LNG imports is, of course, the US which has seen its LNG exports to Europe soar since the Ukraine war and since the US blew up the Nordstream pipeline, making (expensive) US sourced LNG one of the few realistic alternatives for Europe. In other words, Europe has gone from relying entirely on cheap Russian gas to relying entirely on expensive US LNG. Source: zerohedge

Europe has gone from relying entirely on cheap Russian gas to relying entirely on expensive US LNG

Source: zerohedge

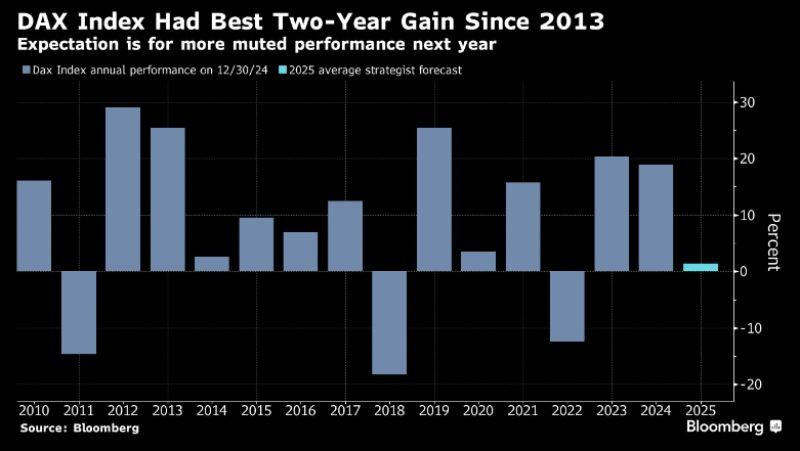

Germany’s Dax index ended the year 2024 with a 18.85% gain after 20.3% rally in 2023

meaning the German benchmark index concluded its biggest 2-year run in more than a decade, even though Germany's GDP shrank in 2023 and probably also in 2024. 👉 SAP, Siemens Energy and Rheinmetall are among top performers. 👉 Chinese competition and lagging demand weigh on automakers. Source: Bloomberg, HolgerZ

Italy and France are exceeding the EU’s 3% of GDP deficit rule by nearly double!

Chart: @robin_j_brooks, Alex Joosten @joosteninvestor

Investing with intelligence

Our latest research, commentary and market outlooks