Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

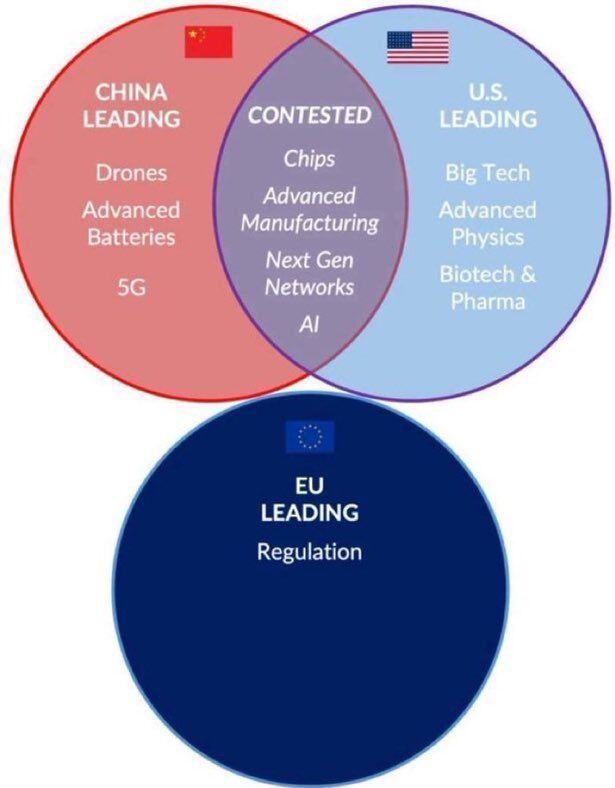

As mentioned by Michel A. Arouet on X: If it wasn’t so sad, it would be quite funny

Source: Michel A. Arouet on X

France Adds First Nuclear Reactor in 25 Years to the Grid

France connected the Flamanville 3 nuclear reactor to its grid on Saturday morning, state-run operator EDF announced. This marks the first addition to the country's nuclear power network in 25 years. The reactor, which began operating in September before being connected to the grid, is coming online 12 years later than originally planned and at a cost of approximately 13 billion euros—four times the initial budget. EDF is planning to construct six additional reactors to meet a 2022 pledge made by President Emmanuel Macron as part of France's energy transition plans. However, questions remain regarding the funding and timeline for these new projects. source : reuters

What has happened in Poland is nothing short of an economic miracle. Hard work and entrepreneurial spirit pay off.

30 years ago Poles were emigrating due to economic reasons. Today many Poles buy real estate in places like Marbella. Source: Michel A.Arouet

France has a new government - Back to the future?

French President Emmanuel Macron’s office announced a new government Monday, after the previous Cabinet collapsed in a historic vote prompted by fighting over the country’s budget. Coming up with a 2025 budget will be the most urgent order of business. The new government enters office after months of political deadlock and crisis and pressure from financial markets to reduce France’s colossal debt. The government, put together by newly named Prime Minister Francois Bayrou, includes members of the outgoing conservative-dominated team and new figures from centrist or left-leaning backgrounds. Among them: two former Prime minister - Manuel Walls and Elizabeth Borne. Both failed. Back to the future?

BREAKING 🚨: Europe

European stocks are underperforming the S&P 500 by the largest amount in history. Source: Barchart

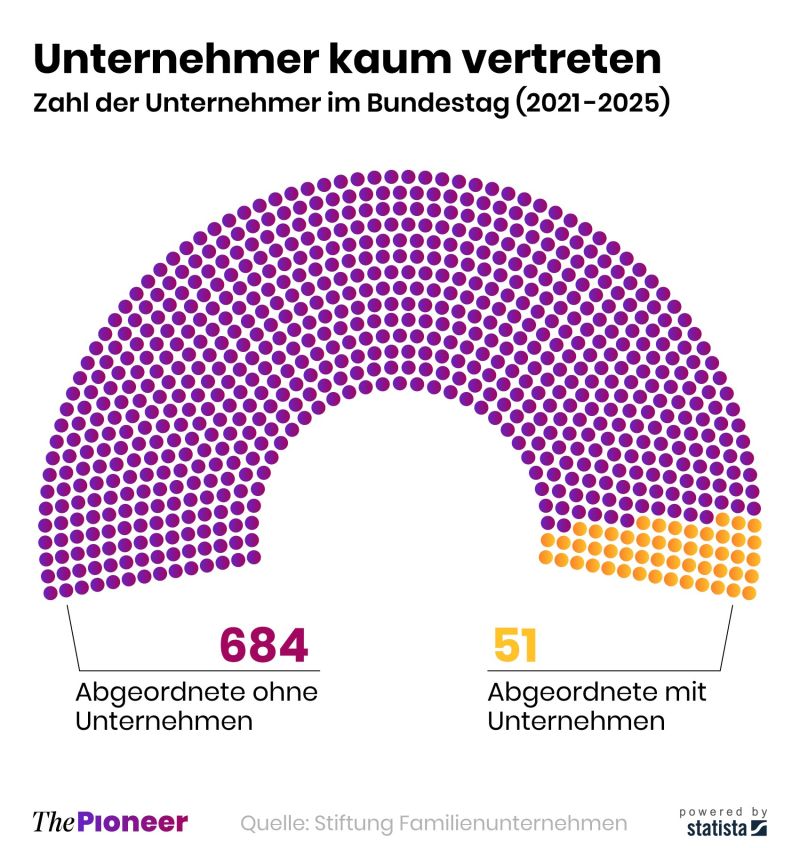

In Germany, too few business leaders are involved in politics, which has made the bureaucracy stronger.

In the current legislative period, only 51 of the 735 Bundestag members are entrepreneurs —the lowest number in years (the yellow seats below). Between 2017 and 2021, there were still 76. Top executives or major entrepreneurs have rarely held ministerial positions in the history of the Federal Republic. A notable exception was Werner Müller, the late former head of Ruhrkohle AG, who served as Economics Minister under Chancellor Gerhard Schröder from 1998 to 2002. Source: Statista, HolgerZ

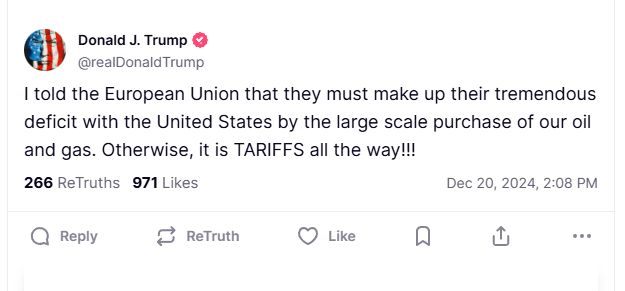

Trump threatens tariffs if the EU doesn't buy more US oil and gas

The President-elect said he told the EU they must "make up their tremendous deficit" with large scale purchases of American fuel The US is the world's top LNG exporter, and the biggest Oil producer. Source: Stephen Stapczynsk

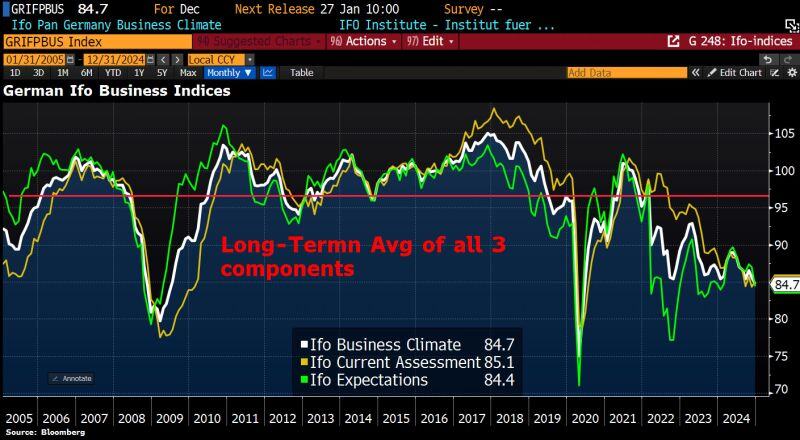

The economic weakness in Germany is becoming chronic.

The Ifo Business Index fell to 84.7 in December, down from 85.6 in November –its lowest level since May 2020. This is far below the long-term average of 96.6 and looks weak even compared to recent years. Since the start of the war in Ukraine, the index has averaged just 88.2. The latest drop was driven by a sharp decline in the expectations component, which fell from 87 in November to 84.4 in Dec. Analysts polled by Bloomberg had predicted a slight uptick and none saw a retreat of that scale. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks