Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The chart of the day:

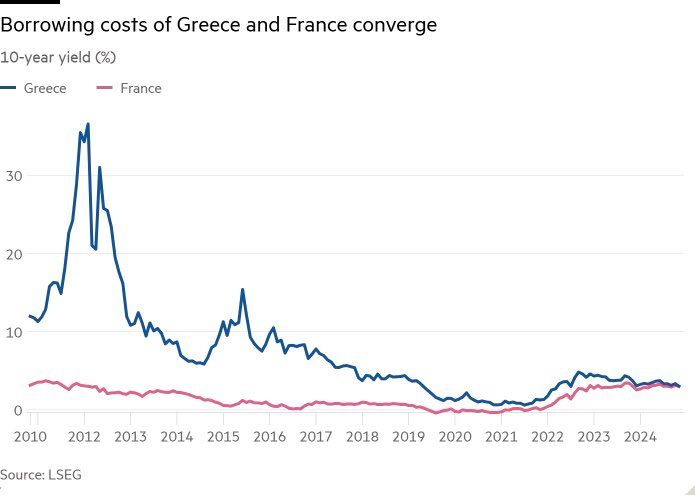

France’s benchmark bond yield matched Greece’s for the first time on record, the latest milestone in a week marked by mounting anxiety over the fate of Prime Minister Michel Barnier’s government. The rate on 10-year French notes, traditionally considered among the safest in the euro area, briefly rose to 3.03% before paring the move. That was the same as comparable Greek bonds, a country once at the heart of the European sovereign debt crisis. Investors are concerned that France may struggle to pass a budget for next year, with the far-right National Rally party threatening a no-confidence vote to bring the government down if its demands aren’t met. While French bonds rallied after Finance Minister Antoine Armand said he is prepared to make concessions on the 2025 budget, that did little to dent months of underperformance. “France is not Greece,” said finance minister Antoine Armand. "France has . . . far superior economic and demographic power which means it is not Greece.” Humility at its best... Source: FT, LSEG

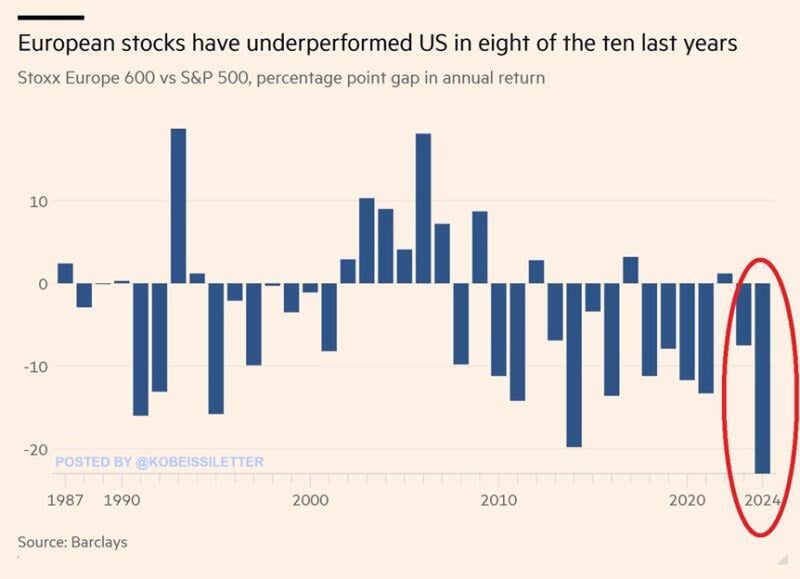

OUCH! French stocks are set for their worst under-performance against European peers since 2010 as a budget standoff threatens to topple the govt.

Source: BBG, HolgerZ

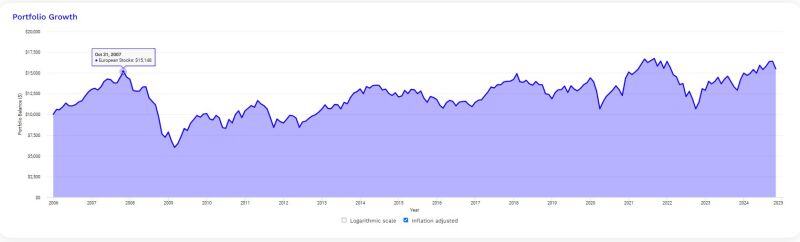

On an inflation-adjusted basis, including dividends, European stocks are up 2% in the last 17 years.

Source: Mike Zaccardi, CFA, CMT, MBA

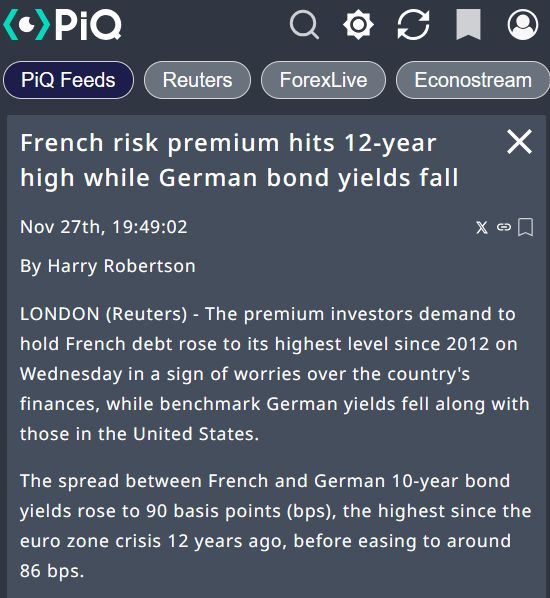

French bond premium hits 12-year high as German yields drop amid political uncertainty

Source: PiQ @PiQSuite

The Stoxx Europe 600 index has underperformed the S&P 500 by 21% this year, the most on record.

This comes as European stocks have returned only 3% year-to-date much below the 24% gain of US stocks. The Stoxx Europe 600 index is now on track for its 8th year of underperformance out of the last 10. Over the last decade, European equities have increased by just 50% much less than the S&P 500 return of 187%. As a consequence, the US stock market is now 4 TIMES larger than Europe. Investors are choosing the US over Europe. Source: FT, The Kobeissi Letter

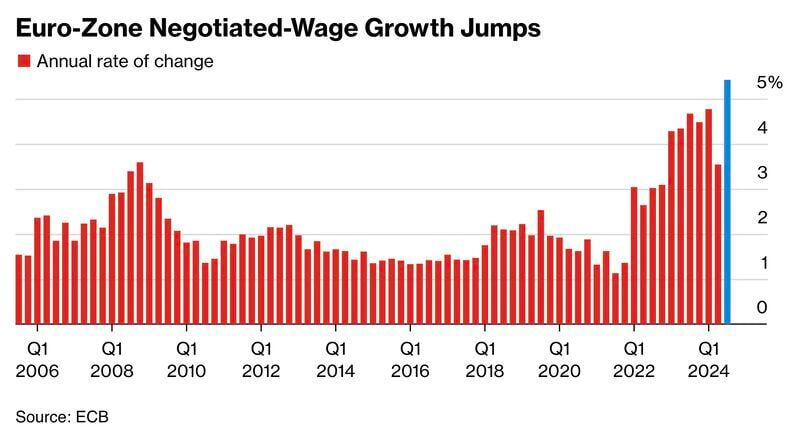

Eurozone wages jumped 5.4% YoY, the biggest increase since the euro was introduced.

The data may complicate the ECB’s easing plans. Source: HolgerZ, Bloomberg

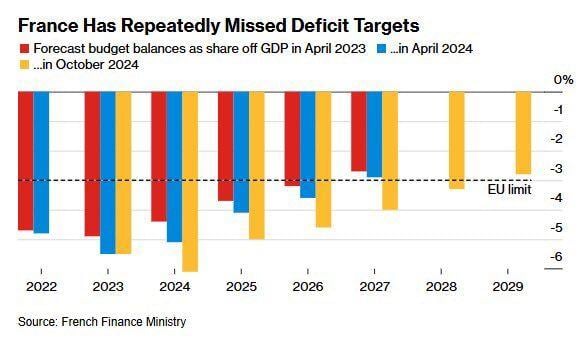

Spoiler: France will continue to miss deficit targets.

It already has the highest tax burden in Europe, and there are no real structural reforms on the horizon. Source: Michel A.Arouet

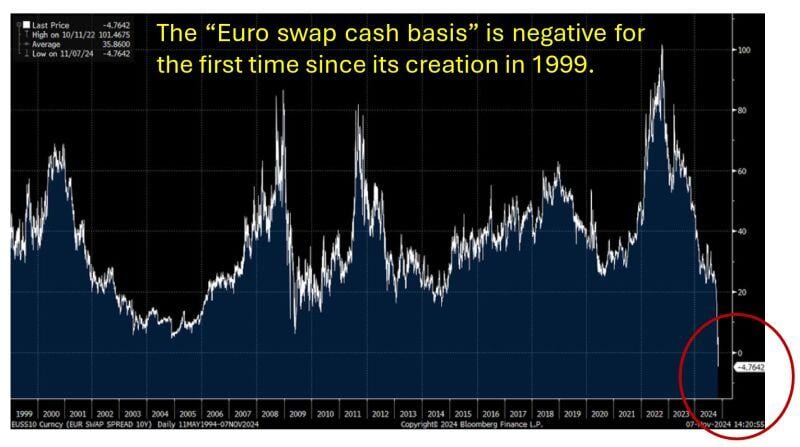

🚨 The “Euro swap cash basis” is negative for the first time since its creation in 1999.🚨

👉 It reflects the difference in cost between borrowing money in euros and the cost of swapping it to another currency, like U.S. dollars. 👉When it’s negative, it means borrowing in euros and swapping it to dollars is unusually expensive or difficult. 👉The fact that it’s negative for the first time since 1999 suggests that dollar demand is at an all time high🥤 Source: BowTiedMara @BowTiedMara

Investing with intelligence

Our latest research, commentary and market outlooks