Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

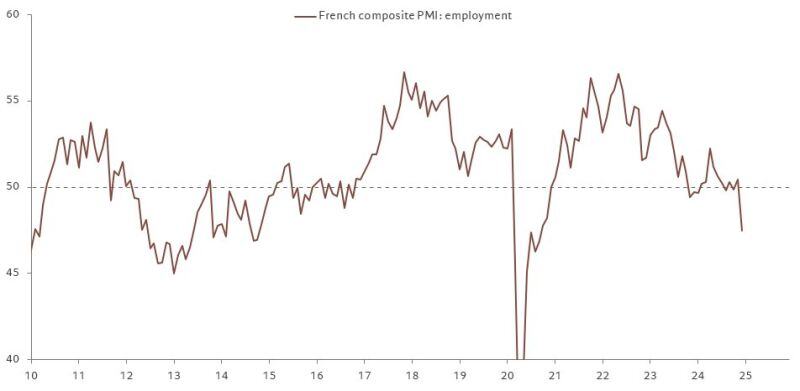

French PMI big warning:

The drop in employment was the largest since the pandemic, with the political situation often cited by firms as a reason to be downbeat. Source: Frederic Ducrozet

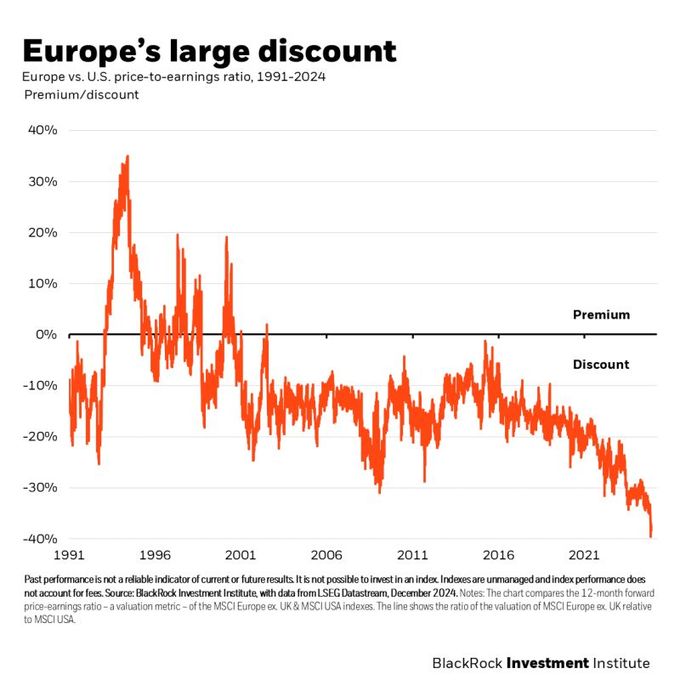

European Stocks trading at an all-time record discount relative to US Stocks

Source: Barchart, Blackrock

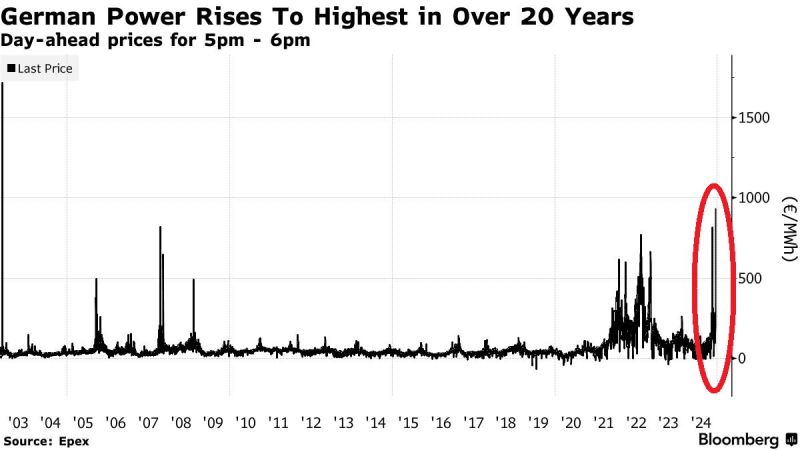

GERMAN ENERGY PRICES ARE EXPLODING

This is not going to help... German power prices SPIKED to the levels seen during the 2022 energy CRISIS. Day-ahead prices for 5pm-6pm skyrocketed to the highest in 20 YEARS. This comes as wind generation plummeted as there has been almost no wind in recent days. Source: Global Markets Investor, Bloomberg

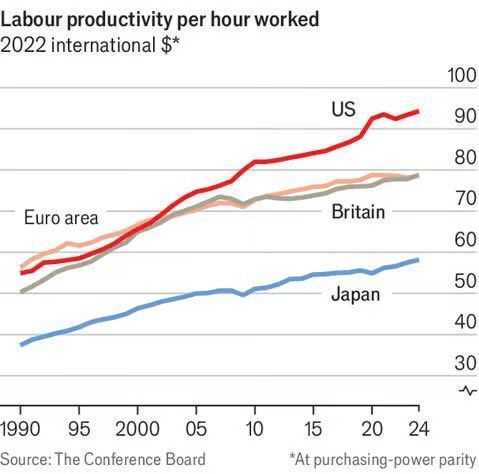

There is a reason why Americans are wealthier than others and keep getting wealthier.

What went wrong in Europe? 25 years ago Europe was more productive than the US. Source: Michael A. Arouet @MichaelAArouet

French President Emmanuel Macron came out fighting against opposition parties who he said “chose chaos”

by bringing down his premier in a historic no-confidence vote, vowing not to step aside before the end of his term. “The mandate that you have entrusted to me democratically is a five-year mandate, and I will exercise it fully until its end,” Macron said on Thursday. Macron’s term runs until 2027, but he is facing rising pressure from opposition groups to step down early. The president said he would name a new prime minister “in the coming days”, as he hit out at the far-right Rassemblement National and the leftist Nouveau Front Populaire alliance. Source: FT >>> https://on.ft.com/4ikxkhz

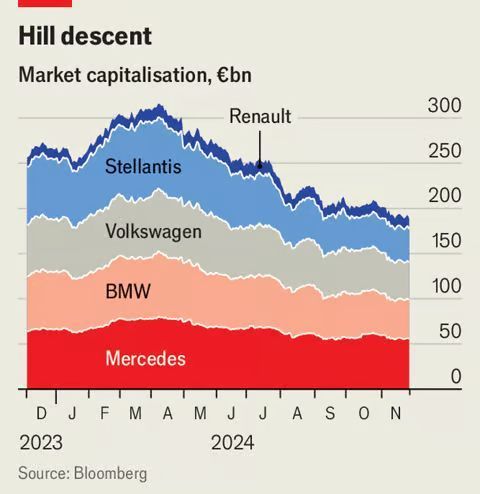

European automotive sector is facing deep crisis

• Demand for cars in EU has stalled and may never return to pre-pandemic levels • Outlook for exports has darkened amid US tariff threats and low Chinese demand Source: Agathe Demarais on X, Bloomberg

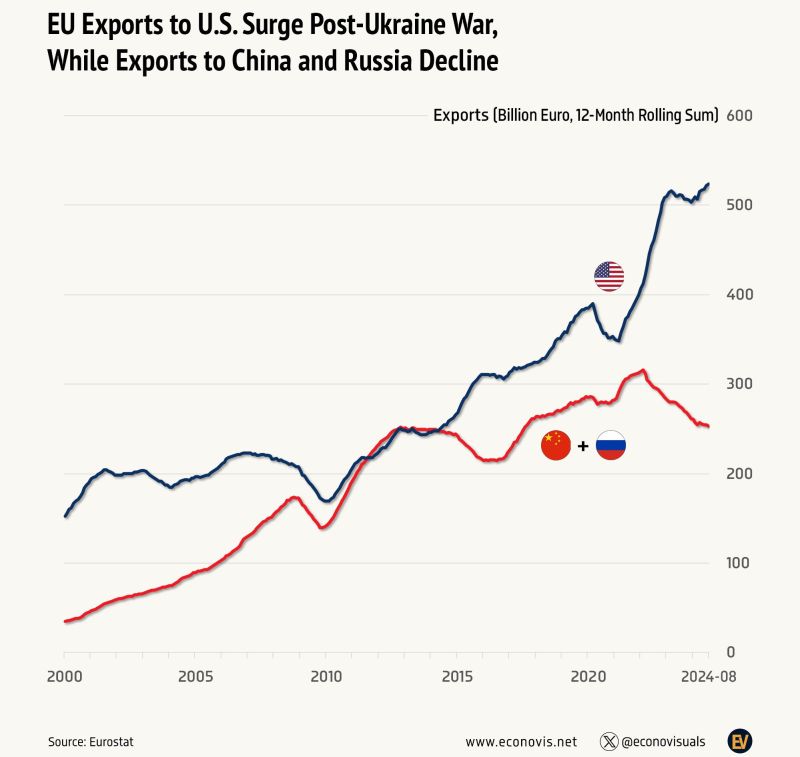

Europeans, especially the German carmakers,simply cannot afford losing the US market due to tariffs after taking a hit in other major markets.

They need to be really polite to Trump‘s administration... Source: Econovisuals, Eurostat

Investing with intelligence

Our latest research, commentary and market outlooks