Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

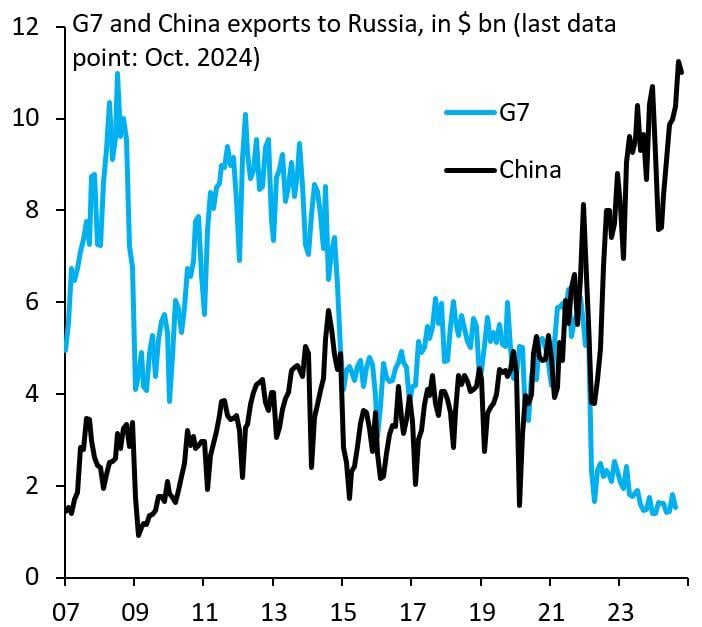

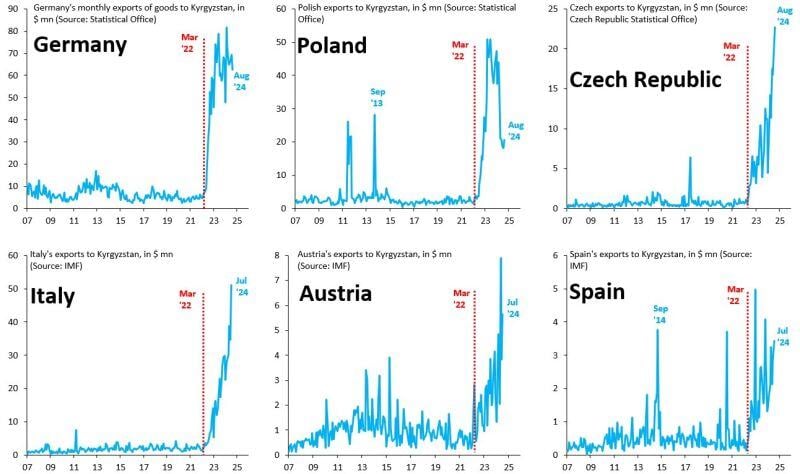

The US election doesn't change geopolitical truths facing the EU:

(i) China and Russia are allies - China is Putin's biggest enabler; (ii) the EU depends on the US for military protection, the US does NOT in any way depend on the EU. Strategic autonomy is a dangerous illusion... Source: Robin Brooks

Political risk is in Europe, not in the US

The three-year-old union between Scholz’s Social Democratic Party (SPD), the Greens and Lindner’s Free Democratic Party (FDP) had been on shaky ground for some time. Chancellor Olaf Scholz said he would call for a confidence vote on Jan. 15, raising the possibility of elections earlier than scheduled in March. Source: FT, CNBC

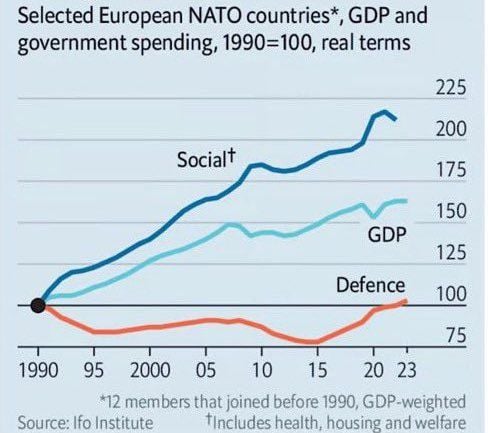

A double-whammy for Europe: tariffs on US exports + increased defence spending...

Source: The Economist

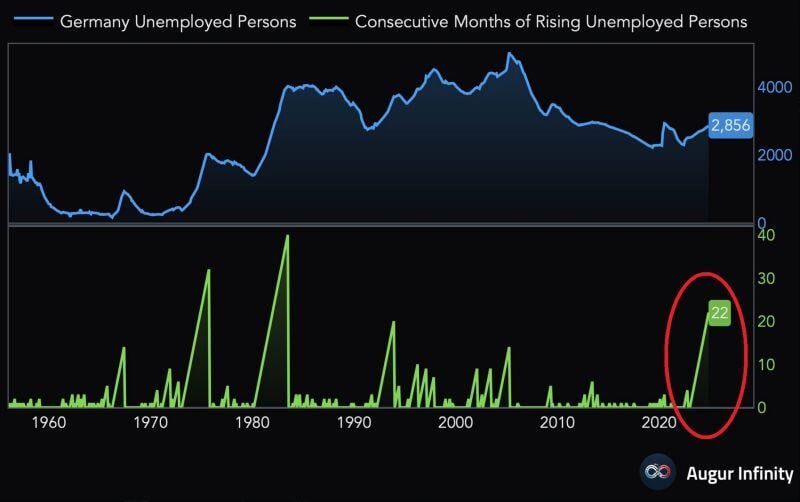

UNEMPLOYMENT IN GERMANY SPIKED TO THE 2ND-HIGHEST IN 10 YEARS

The number of unemployed people in the world's 3rd largest economy has risen for 22 STRAIGHT MONTH. There are now 2.86 MILLION unemployed people in Germany, the most since the COVID CRISIS. Chart: Global Markets Investor, @AugurInfinity on X

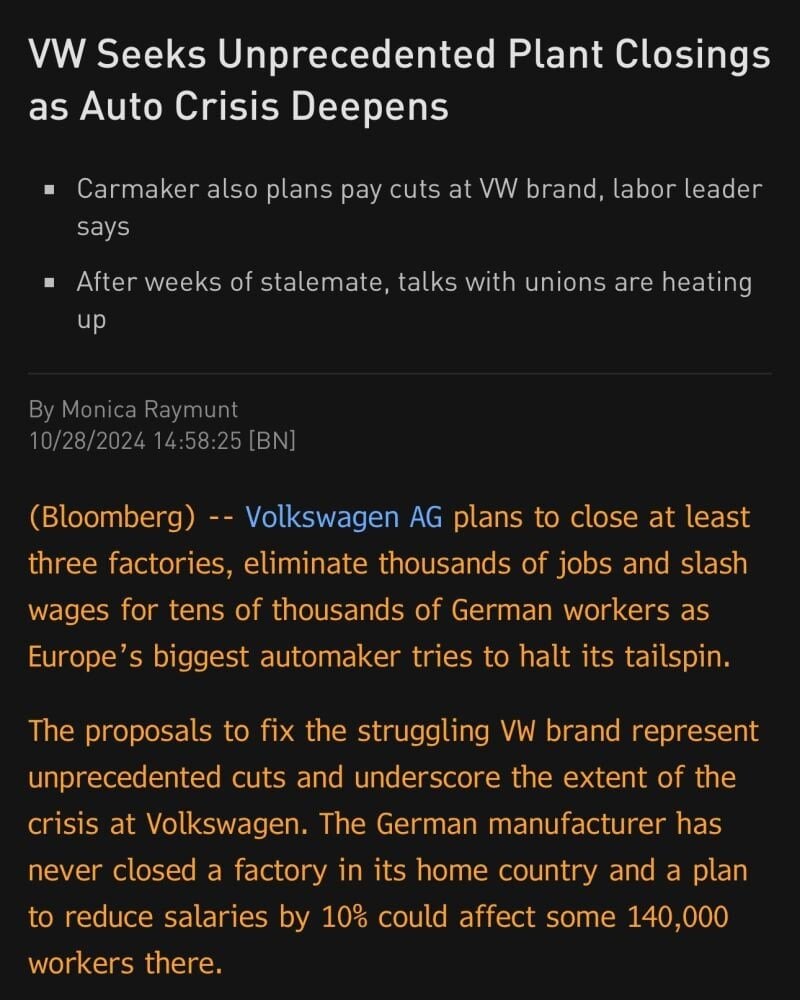

One of the most important news today:

Volkswagen targets layoffs and 10% pay cuts amid plans for German plant closures, union says. Source: Bloomberg

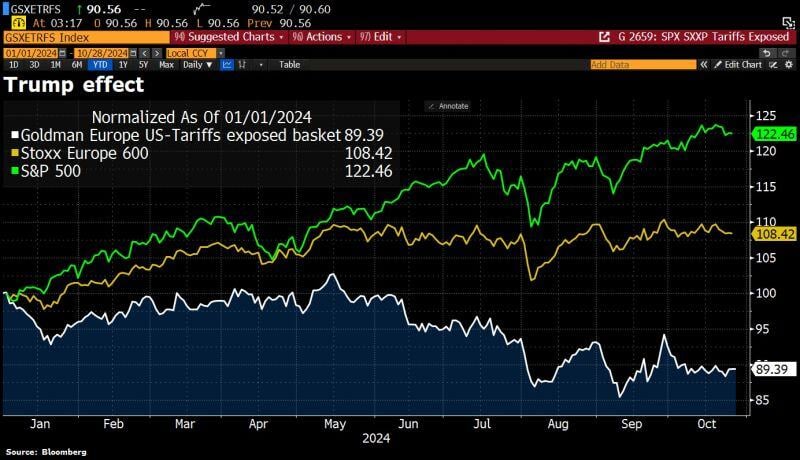

European stocks are hit by a ‘Trump effect’ as odds tilt towards Republican win.

A basket of 22 European stocks exposed to US tariffs compiled by Goldman Sachs has tumbled 5% since late September as the former president’s odds of an election victory shorten. The basket, which includes Diageo, Porsche, Mercedes, Adidas or Moller Maersk is now down 11% this year, compared with an 8% rise for the broader European stock market and 22.5% for the S&P500. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks