Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

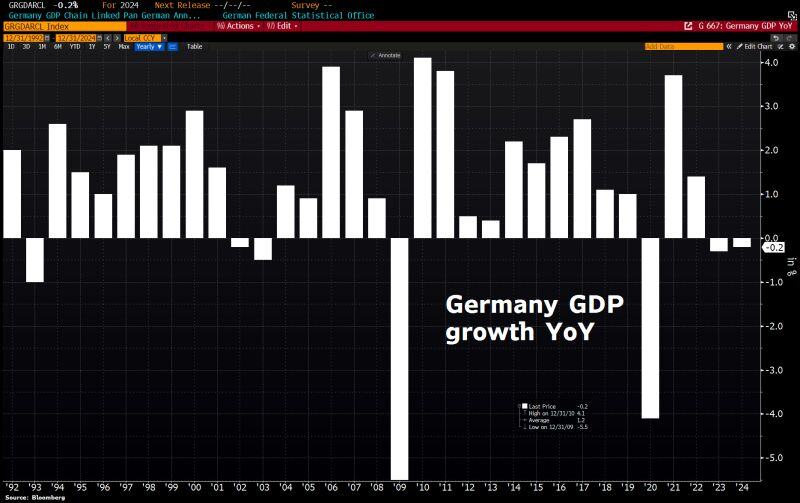

The German economy has shrunk for 2nd year in a row ahead of elections, driven by both cyclical & structural challenges

German GDP declined by 0.2% in 2024, following a 0.3% drop in 2023. This marks only 2nd time since 1950 that econ has contracted for 2 consecutive yrs. Germany's prospects for 2025 remain bleak. Bundesbank predicts growth of just 0.2% and warns that another contraction is even possible if US President-elect Trump follows through on his tariff threats. Source: HolgerZ, Bloomberg

Spain proposes 100% tax on property purchases for non-EU buyers.

Spain is planning to impose a 100 per cent tax on real estate purchases for buyers from non-EU countries such as the UK in a bid to improve housing affordability by deterring foreign purchases. Prime Minister Pedro Sánchez announced the plan for the punitive property tax, which would apply to non-EU citizens who are not residents of the bloc, as part of a raft of measures aimed at tackling a “grave” housing crisis. Spain is one of many European countries where public anger is mounting over the difficulty of finding affordable housing to buy or rent as property prices soar and new construction lags far behind demand. Source: FT

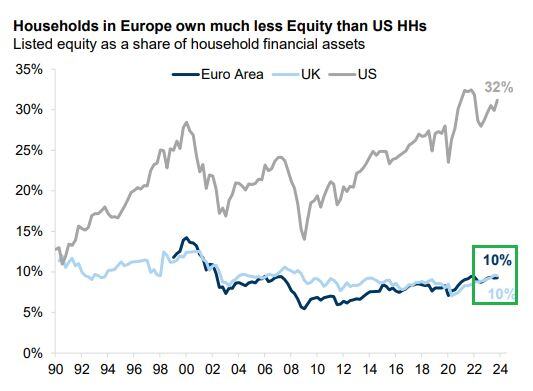

Europeans own much less stocks than those in the US

Source: GD, Mike Zaccardi, CFA, CMT, MBA

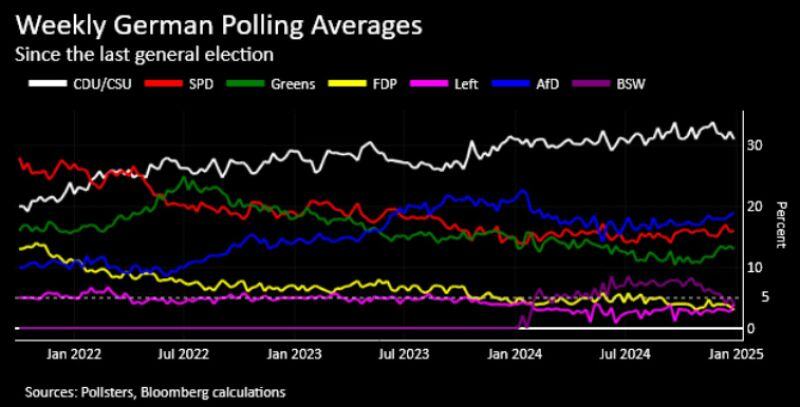

In Germany, Chancellor Scholz attempts to boost his campaign by appealing to anti-American sentiment.

He steps up criticism of Trump’s expansionist rhetoric. Currently, Scholz's SPD is trailing in third place, behind the CDU/CSU and AfD. Source: HolgerZ, Bloomberg

French OAT 10-year just hit 3,40% while OAT-Bund spread is now at 86bps…

What is the pain threshold for ecb to step in?

🚨 BREAKING >>> Denmark Says It’s Open To Conversations With Trump — But Greenland Won’t Become A US State

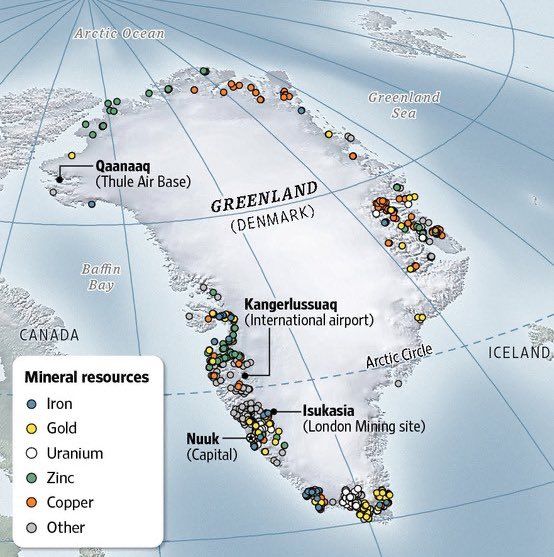

👉 A Danish foreign minister said Wednesday Denmark is “open to a dialogue with the Americans on how we can cooperate, possibly even more closely than we already do, to ensure that American ambitions are fulfilled,” multiple outlets reported, just one day after President-elect Donald Trump refused to rule out using military force to gain control of Greenland. 👉 Danish Foreign Minister Lars Løkke Rasmussen told reporters the United States and NATO had “legitimate” interests in the region, saying “in conjunction with the melting of the Arctic and new shipping lanes opening up, we are unfortunately also seeing an increase in great power rivalry.” 👉 Greenland is part of Denmark, has representatives in the Danish parliament and its foreign relations are controlled by Denmark, though there has been a growing push for full independence in recent years. 👉 Løkke Rasmussen also noted “Greenland has its own ambitions” and said “if they materialize, Greenland will become independent, though hardly with an ambition to become a federal state in the United States,” Politico reported. 👉 The comments from the Danish diplomat followed a Tuesday press conference from Trump in which he said, “We need Greenland for national security purposes” and would not commit to not using military force to acquire it or the Panama Canal. 👉 Trump also questioned whether Denmark has a right to Greenland on Tuesday, saying, “nobody even knows if they have any right, title or interest.” ⚡ The most important category in the chart below is „Other“. It’s mainly rare earths. Trump probably seeks to solve some strategic problems for the US. Source: Michael A. Arouet on X, Forbes

European stocks trade at over 40% discount versus the US stock market, the biggest in at least 35 YEARS!

This comes as Europe's forward P/E ratio is ~13x, way below the S&P 500 P/E of 22x. Europe has rarely been so cheap on a relative basis. This is also valid on a sector-adjusted basis. Source: Goldman Sachs, Global Markets Investor, Datastream

Investing with intelligence

Our latest research, commentary and market outlooks