Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

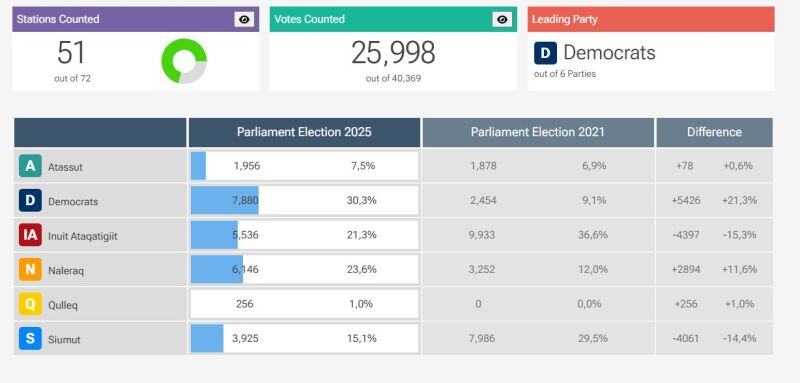

Greenland Election:

A SURPRISING RESULT ‼️ The Democrats (Center-Right) and Naleraq (Right) have almost 54% of the vote, meaning if they wanted to they could form a ruling coalition that, from what I have read, would likely be more USA centric than Denmark centric. About 65% of the total vote is in (51/72 stations), Democrats in first then Naleraq and then Inuit. Source: CA ET Nerd @earlyvotedata

HolgerZ:

"US President Donald Trump is dealing a lasting blow to confidence in the US, its products, and its stock markets. US exceptionalism is under threat from uncertainties about Trump’s political and economic policies" Source: Bloomberg

Switzerland remains the best migration destination in the world

Source: Visual Capitalist

‼️ BREAKING: EU EQUITIES UNDER PRESSURE ‼️

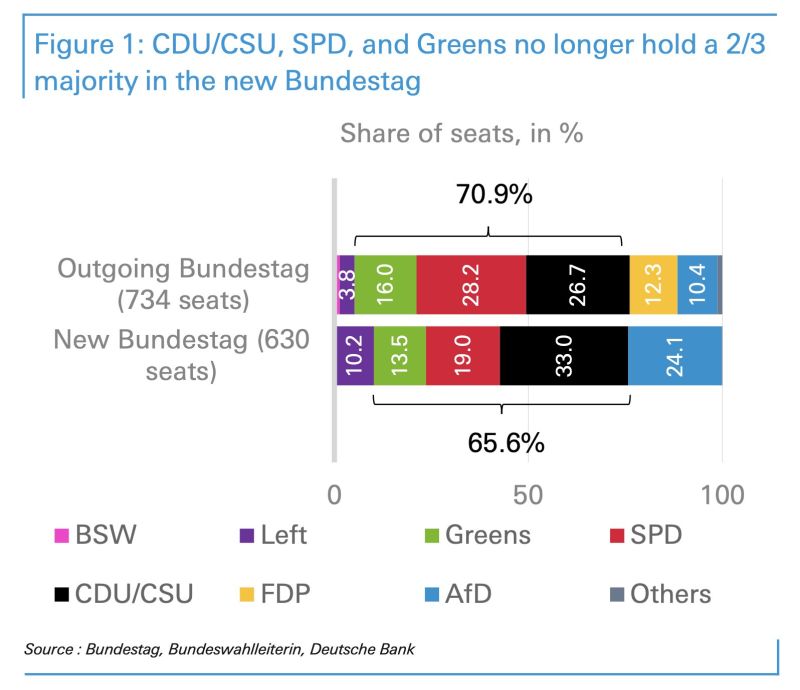

Germany's Greens won't support draft debt package in parliament. The CDU/CSU and SPD need the support of the Greens to achieve the two-thirds majority in the Bundestag in its old composition. The FDP, which was represented in the old Bundestag, will hardly vote in favor of such a debt package. Source: HolgerZ, DB

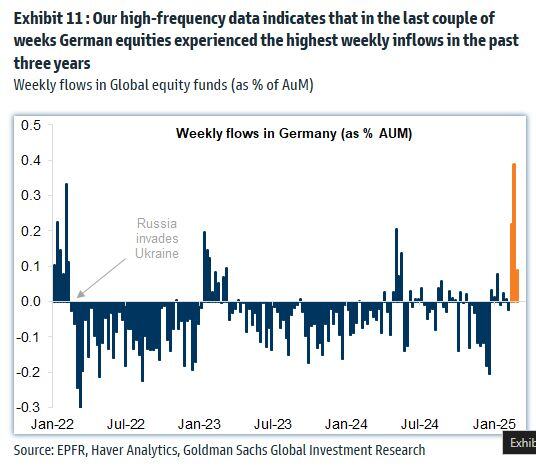

Germany is becoming great again thanks to Donald Trump...

Thanks to the decoupling from America and the billions in infrastructure investment that this entails, German stocks are gaining new appeal. Their global stock market capitalization share has climbed to 2.3%, up from well below 2%. But still miles away where it used to be... Source: Bloomberg, HolgerZ

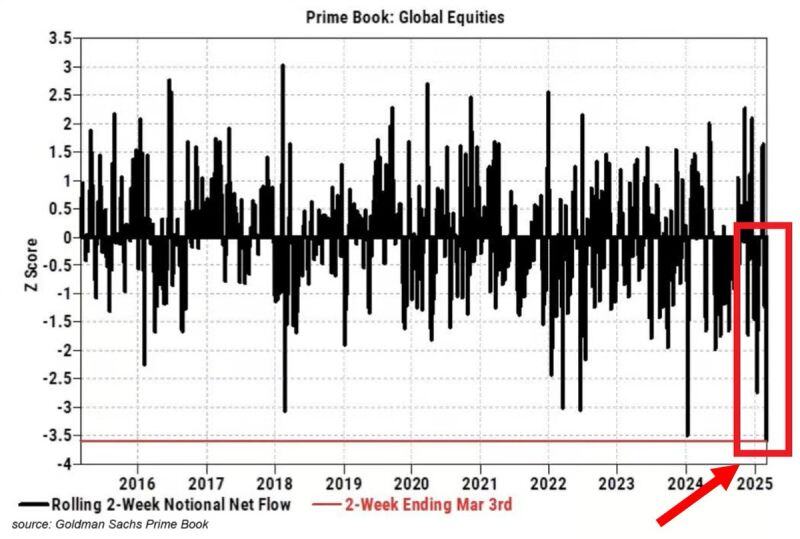

🚨HOLY COW: Hedge funds dumped global stocks at the fastest pace on RECORD over the last 2 weeks.

The majority of sales were in US equities and were even larger than during the 2022 BEAR MARKET. Meanwhile, sp500 and Nasdaq 100 are down 'just' 6% and 9% since their peaks. Source: Global Markets Investor

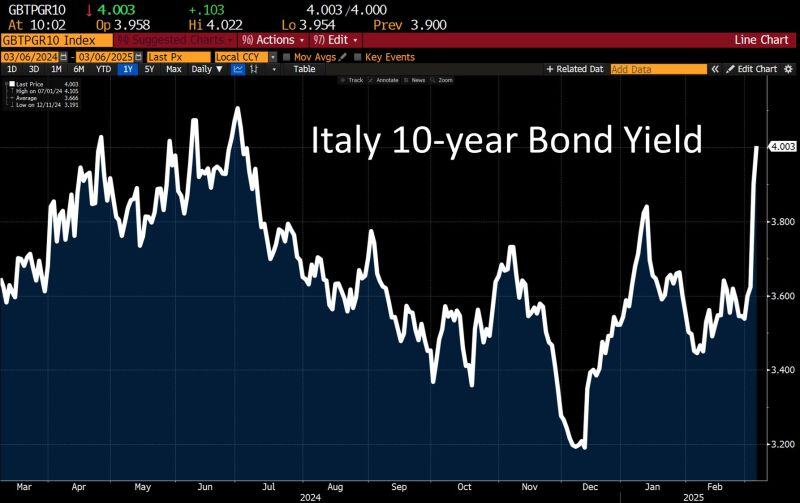

Italy's bond yield just crossed 4%! Thanks to Germany's embracement of debt to invest in defense and infrastructure.

Who remember what happened in 2011/2012? At the time the debt to GDP ratio was 108%. Today it is 140%... Source: Jeroen Blokland, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks