Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

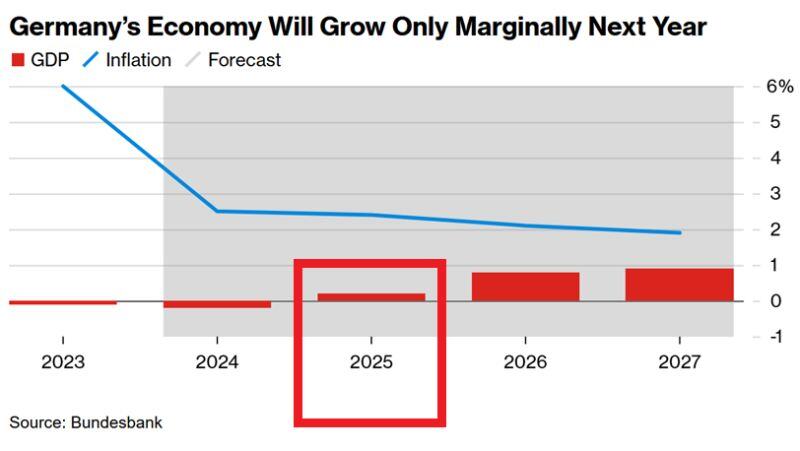

⚠️German economic outlooks remains DIRE:

In 2024 the world's 3rd largest economy FELL by 0.2% following a 0.3% decline in 2023. This is the 2nd time since 1950 that GDP contracted for 2 years in a row. German IFO Economic Research Institute expects just 0.2% growth in 2025. Source. Global Markets Investor

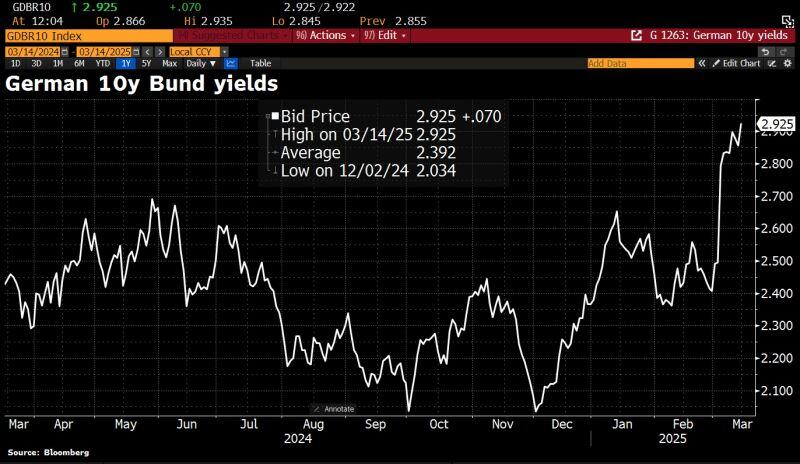

🔴 Germany’s 10-year bond yield rising to 4% is “entirely feasible” as a reset in the country’s borrowing costs plays out, according to Aviva Investors.

The rate surged to nearly 3% in recent weeks as Germany’s incoming chancellor spearheaded a huge spending package that is expected to lead to billions of euros in extra bond sales. Vasileios Gkionakis, senior economist and strategist at Aviva Investors, says yields are likely to keep rising as the fiscal measures boost economic growth. ➡️ 4% for German 10-Year Bund would mean German mortgages at 5% to 6% and the burst of the epic German real estate bubble. Would it also mean Italian, Spanish and French bonds yields at a level that could trigger the next Euro crisis. Good luck. Source: Bloomberg

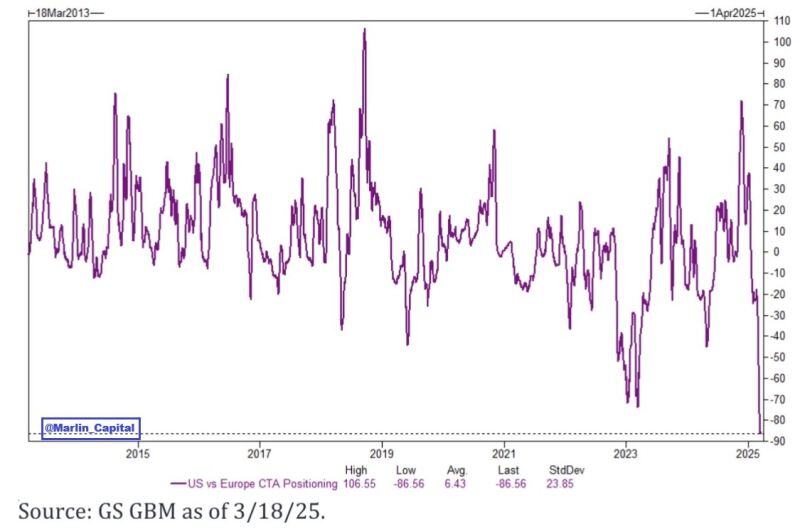

CTAs are short -$34B of US equities and long $52B of European equities.

This is the largest spread we have EVER seen. $SPY $QQQ $IWM $FEZ Source: David Marlin Marlin Capital Solutions

BREAKING

Germany's conservatives have agreed on a much-debated multibillion-euro financial package for defence and infrastructure (and on the country's €1,000bn debt plan) with the centre-left Social Democrats and the Green party, dpa learns. As a result, German 10y yields have jumped to 2.93%. Source: HolgerZ, Bloomberg, DPA

long-term yields continue to rise following the announcement of a major debt package, with 10y yield on the way to 3%.

Financial markets expect neither the Greens nor the Federal Constitutional Court to block the package. While a two-thirds majority is needed in parliament, legal challenges are still pending before the court. Source: Bloomberg, HolgerZ

Mind the gap...

WisdomTree launches first European-only defence ETF. In white >>> Wisdom Tree Europe Defence index In yellow >>> NYSE Arca Defense Index (DFI) Source: Bloomberg, HolgerZ

Ferrari, which spun out from Fiat seven years before Porsche went public, has raced ahead in the (nearly) 10 years since it hit the market.

Unlike its German rival, the Prancing Horse has kept investors enamoured with measuredly infrequent supercar drops, impressive delivery figures, a loyal customer base, and (unlike other luxury titans) its relatively low exposure to China — though even “relatively low” can still be too high. Ferrari shares were up 760% from its 2015 IPO at Tuesday’s close. Source: Chartr

Investing with intelligence

Our latest research, commentary and market outlooks