Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

SOLAR UPGRADE: NEW PANELS ARE 1,000X STRONGER, THINNER THAN A HUMAN HAIR

Scientists in Germany just cooked up a solar panel sandwich that makes today’s tech look like a flip phone. By stacking ultra-thin layers of exotic crystals, they created solar cells 1,000 times more powerful than silicon—and way more durable. These featherweight panels don’t even need complex wiring and could someday power cities using way less space, money, and sunlight. Source: Bright Side of News, Mario Nawfal on X

🔴 EU airlines saying they’re going to start buying Chinese planes instead of American planes…

▶️ The boss of Ryanair has threatened to cancel orders with American aircraft maker Boeing and buy from Chinese manufacturers instead if Donald Trump’s trade tariffs push up costs. ▶️ In a letter to top US lawmakers, Michael O’Leary criticised Washington’s trade war with Beijing and warned that a “material” impact on the price of aircraft could prompt his company to take its business elsewhere. ▶️ The Irishman said Ryanair could even turn to state-owned Commercial Aircraft Corporation of China (Comac), a threat sure to anger Mr Trump, who has made isolating China a key aim of his trade war. ▶️ Ryanair, the largest carrier in Europe, is currently waiting on the delivery of 29 Boeing 737 Max 200 planes, out of a total order of 210. It has also ordered 150 Max 10 jets, the largest in the 737 family, for delivery from 2027 with the option of another 150 afterwards. Source: Yahoo Finance

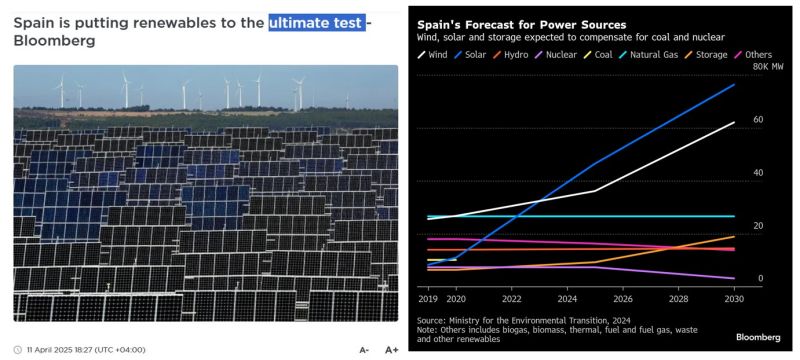

The Iberian Peninsula…

wiped off the map of lights. This is how it looked from orbit last night after a massive blackout hit Spain and Portugal. Cosmic silence over the region.” Source: David Sobolewski on X

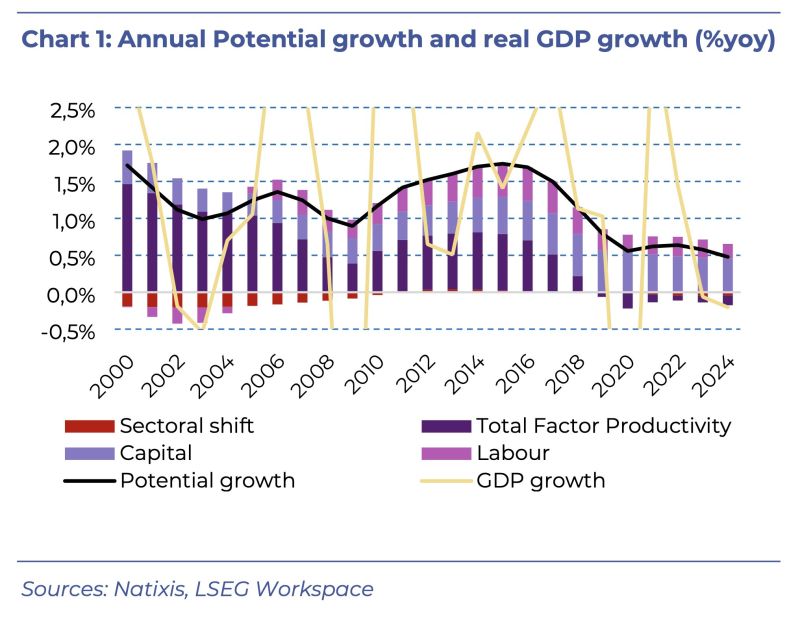

In Germany, potential economic growth has dropped to just 0.5%, mainly because of falling productivity.

The last time Germany saw potential growth above 1% was back in 2018 — also the last year when productivity made a positive impact. For the new government to hit its target of lifting potential growth above 1% again, reviving productivity will be crucial, especially as the workforce continues to shrink. (Source: Natixis thru HolgerZ)

It remains unclear what caused the power outage in Spain and Portugal but this Bloomberg article published on Energy connects from the 11th of April is worth reading.

https://lnkd.in/e3rivJrV Here's an extract >>> Bloomberg) -- Spain is ignoring calls to reconsider its nuclear decommissioning plans, betting renewables and battery storage will make up for the upcoming energy shortfall. The country is plowing ahead with plans to shut down its seven nuclear reactors, which currently contribute 20% of its power mix, over the next decade. It’s also set to close its last coal plant this year. While it’s already only second to Germany in terms of renewable capacity in Europe, Spain is looking to fill the energy gap with more wind turbines, solar panels and giant batteries. The strategy isn’t completely fossil fuel free — as it would rely on natural gas plants as a backup for the foreseeable future. Yet it is a substantial wager on clean power: It depends on a still nascent energy storage industry in Spain to rapidly expand from just 3 gigawatts of capacity today to a target of 20 gigawatts by 2030. It also requires an unprecedented roll-out of wind and solar over the next five years. Spain is targeting 81% power generation from renewables by the end of this decade — from just above 50% in the past two years.“

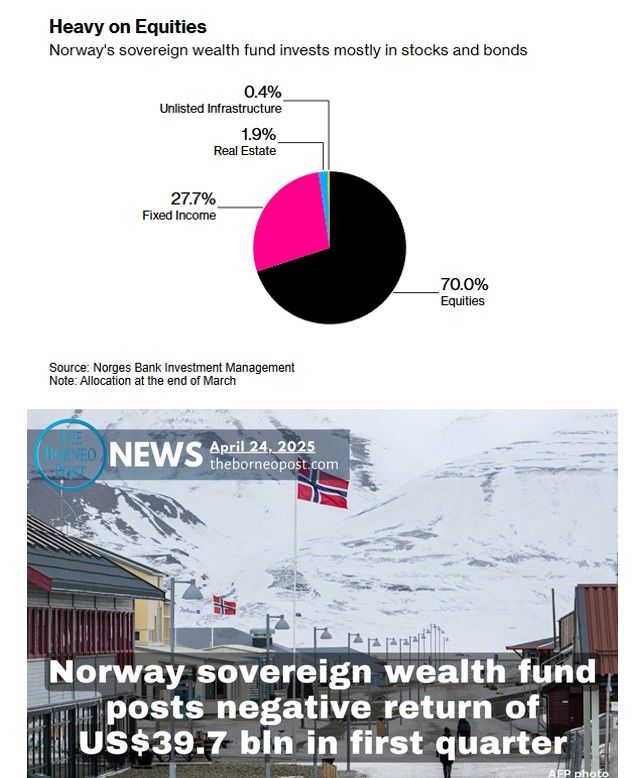

NORWAY’S $1.7T SOVEREIGN WEALTH FUND JUST POSTED A $40B LOSS IN Q1, ITS WORST DROP IN 6 QUARTERS.

The fund, run by Norges Bank Investment Management, pointed to a pullback in tech stocks as the main drag, with equity returns down 1.6%. Holdings like $AAPL, $NVDA, and $TSLA all took a hit. Fixed income helped a bit, returning 1.6%, but it wasn’t enough to offset the slump. CEO Nicolai Tangen said the recent market turmoil, especially after Trump’s tariff hikes, isn’t even fully reflected yet. That early-April tariff spike alone knocked off another $200M. Despite the loss, the fund still outperformed its benchmark by 0.16%. They’ve already started trimming some tech exposure to reduce risk. CFO also confirmed they didn’t make any moves in U.S. Treasuries in April—no buying or selling. The fund's performance is mostly tied to global indexes, so there's limited room for active moves. And while it’s staying out of nuclear weapons makers like Lockheed due to ethical guidelines, there's growing political pressure in Norway to rethink that stance. Source: Wall St Engine, The Borneo Post

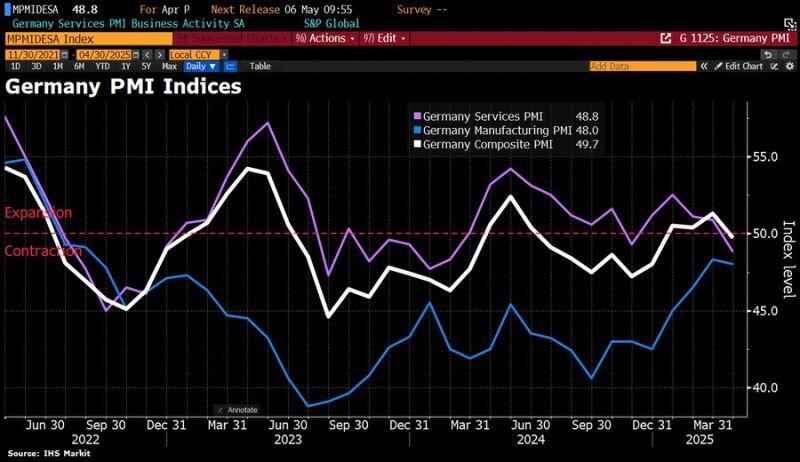

In Germany, the private sector just shrank for 1st time in 4 months.

According to S&P Global, the Composite PMI (a key economic indicator) fell to 49.7 in April, dropping below the critical 50 mark that separates growth from contraction. The services sector was hit especially hard, with its index tumbling to 48.8 – the lowest in 14 months. This drop reflects growing worries about tariffs, as well as broader concerns around Germany’s economic and political future. This unexpected decline adds to an already grim outlook for the German economy, which is considered particularly exposed to global trade tensions. The IMF is now forecasting stagnation for Germany this year. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks