Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

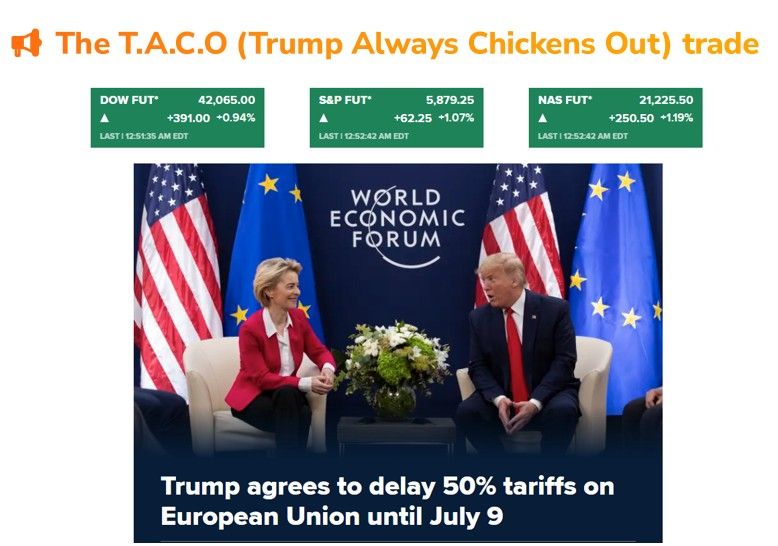

The new trade on Wall Street: T.A.C.O (Trump Always Chickens Out)

Stocks and bonds retreated last week as fiscal & trade worries resurface. Over the week-end, Trump agreed to delay the date for a 50% tariff on goods from the EU to July 9 from June 1. This morning, US Stock Futures are spiking ("The T.A.C.O trade" idea comes from a tweet on X by HolgerZ)

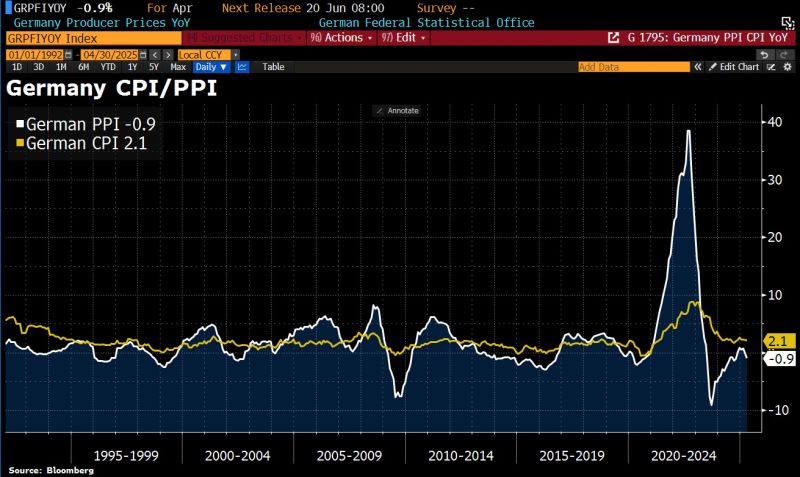

In Germany, Producer price deflation is picking up speed.

Producer Price Index (PPI) dropped by 0.9% YoY, driven mainly by a strong Euro and possibly early impact of US tariffs. PPI is an important leading indicator for consumer inflation, so this drop could signal further cooling in prices. Source: Bloomberg, HolgerZ

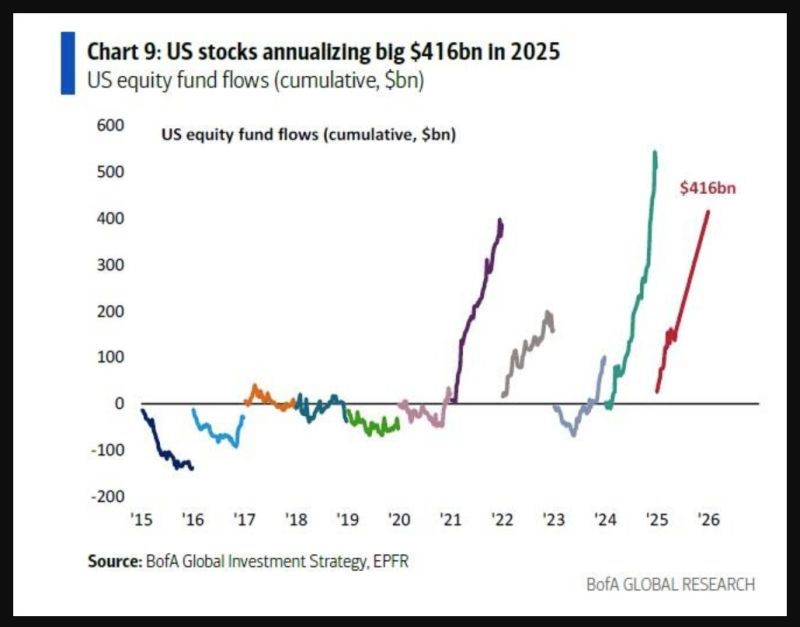

Yes, 2025 is likely to be a record year for EU equities funds inflows (according to BofA/EPFR, +$110bn inflow annualized, which will be the biggest since '15).

But despite all the US bashing, it could be a very strong year for US equities inflows as well. Indeed, US equities funds are on course for $416bn inflow, the 2nd biggest year ever... Source: BofA, EPFR

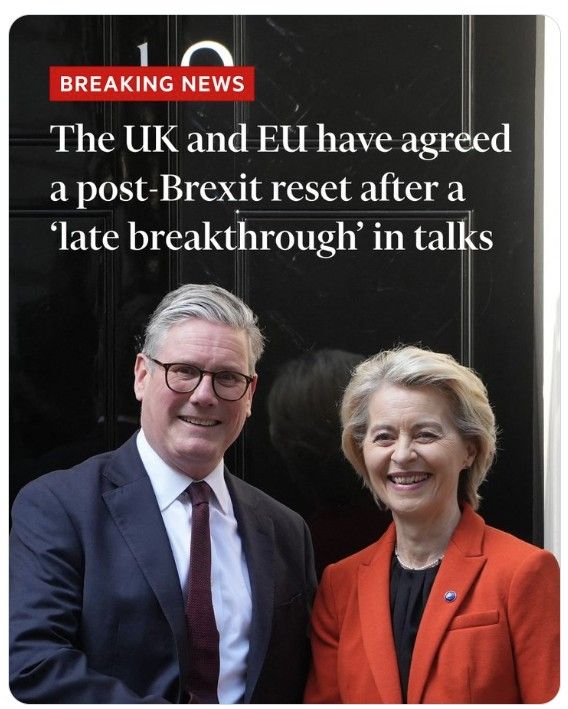

Breaking news:

The UK and EU have agreed a historic post-Brexit reset of ties ahead of a summit in London on Monday, officials said - link to FT article >>> https://lnkd.in/ea6m_PnK The UK and EU have agreed a historic post-Brexit reset of relations after a “late breakthrough” in overnight talks ahead of a summit in London on Monday, officials on both sides said. The UK agreed to open its fishing waters for 12 more years to EU boats — a move that will be condemned by the opposition Conservatives — according to Brussels officials. In return, UK Prime Minister Sir Keir Starmer has secured a veterinary deal that will remove much red tape for British farming and fisheries exports to its biggest market, in a much-sought economic prize of the “reset” talks. Three EU diplomats confirmed Brussels had dropped demands to link the duration of the agrifood deal to the one for fish, while British officials confirmed that a deal on the two issues had been done. Both sides were locked in intense haggling through the night over key details of their revamped relationship, including on fisheries and food trade, along with wording about a proposed youth mobility scheme. Source: FT

Rising smoke is coming out from Bundestag (image courtesy from HolgerZ on X))

German Lawmakers back CDU/CSU's Merz in 2nd Bundestag vote w/325 votes out of 630 lawmakers. ✔️ Friedrich Merz was elected as Germany’s chancellor in a second-round parliamentary vote on Tuesday, after failing to secure the necessary support earlier in the day. ✔️Merz needed at least 316 of the 630 members of parliament to vote in his favor. He received 325 votes. ✔️The German Dax stock market index pared losses after the result of the second vote

The recent outperformance of european vs. US equities in context

Source: Michel A.Arouet, @Augur Infinity

German benchmark index Dax slips, as Merz falls short of majority in initial German parliament vote.

Friedrich Merz failed to be elected German chancellor Tuesday, after he fell short of securing a majority in a shock first-round parliamentary vote. Merz needed at least 316 votes to become chancellor and only 310 members of parliament voted in his favor. Germany’s Bundestag has a total of 630 members. The result marks an unanticipated setback for Merz who was widely expected to secure the necessary votes and be officially sworn in later in the day. After the result of the vote was announced the parliamentary session was halted to allow for discussion of next steps. The German Dax stock market index extended losses to trade around 1.4% lower by 10:07 a.m. London time. A second vote needs to take place within 14 days, according to the German constitution, with an absolute majority needed once again. There are also protocols in place in case the second vote also fails to elect a chancellor. Source: CNBC, Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks