Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

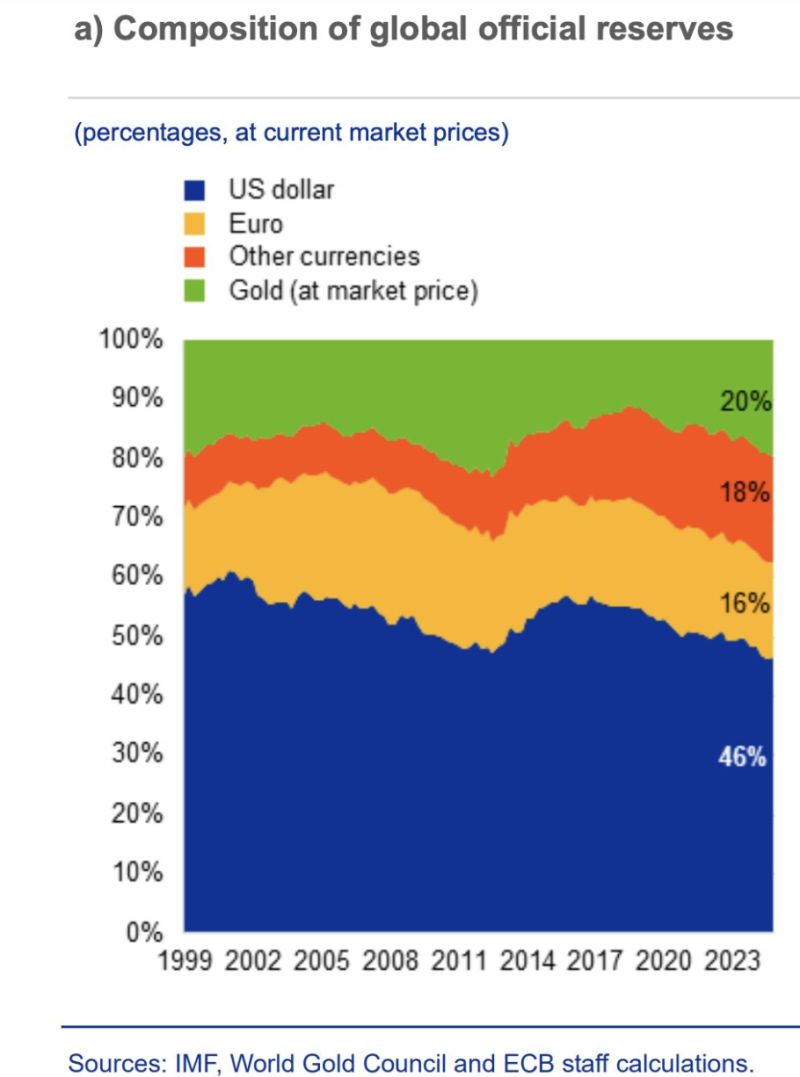

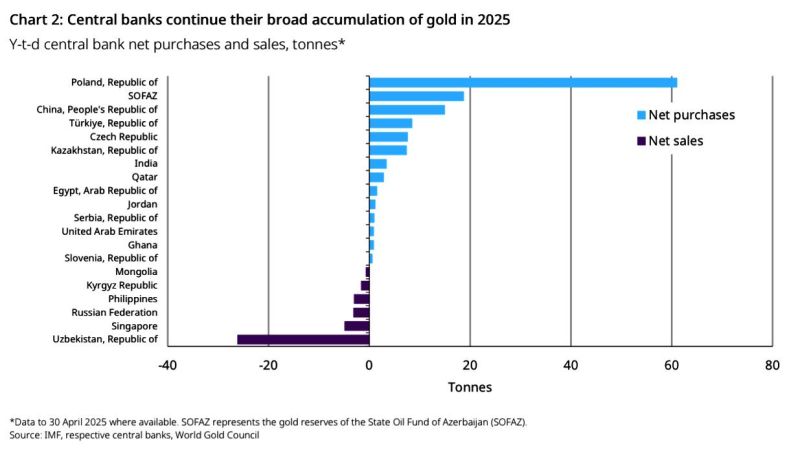

Germany and Italy are facing calls to move their gold out of New York following President Donald Trump’s repeated attacks on the US Federal Reserve and increasing geopolitical turbulence.

Fabio De Masi, a former Die Linke MEP who joined the leftwing populist BSW party, told the Financial Times that there were “strong arguments” for relocating more gold to Europe or Germany “in turbulent times”. Germany and Italy hold the world’s second- and third-largest national gold reserves after the US, with reserves of 3,352 tonnes and 2,452 tonnes, respectively, according to World Gold Council data. Both rely heavily on the New York Federal Reserve in Manhattan as a custodian, each storing more than a third of their bullion in the US. Between them, the gold stored in the US has a market value of more than $245bn, according to FT calculations. The Taxpayers Association of Europe has sent letters to the finance ministries and central banks of both Germany and Italy, urging policymakers to reconsider their reliance on the Fed as a custodian for their gold. Source: FT

In case you missed it: Germany’s private sector economy unexpectedly returned to growth in June.

The composite PMI rose to 50.4, up from 48.5 in May, signaling a move back into expansion territory. Manufacturing – a key sector for Germany – saw its PMI climb to 49, the highest level since 2022. While still below the long-term avg of 51.6, it's a notable improvement. The sector appears to be benefiting strongly from falling interest rates, which may help explain why Germany is currently outperforming much of the rest of the Eurozone. Source: HolgerZ, Bloomberg

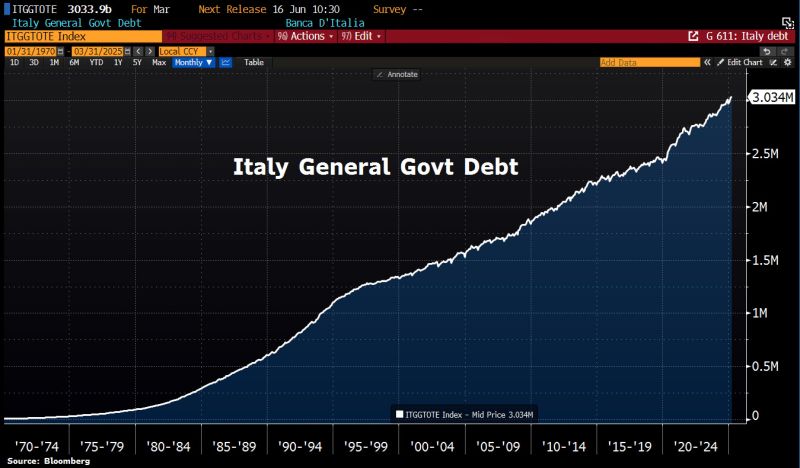

In case you missed it: Italy's total government debt has topped €3tn, for the 1st time ever.

Source: HolgerZ, Bloomberg

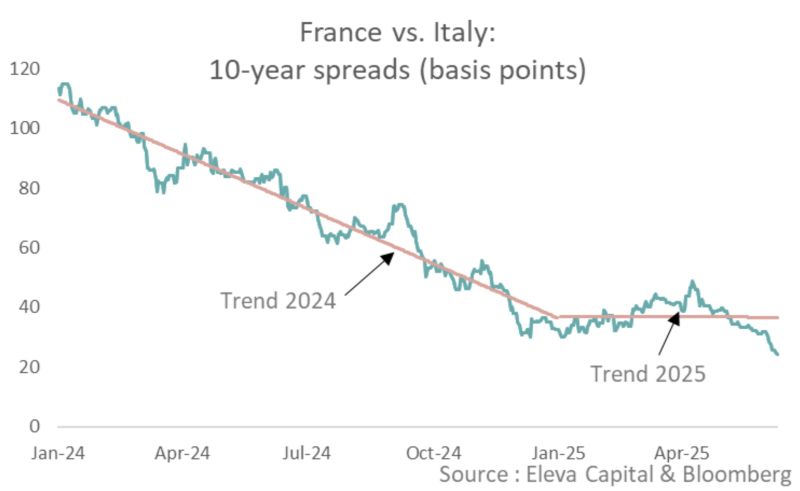

French-Italian 10y spread dropped below 25 bp this morning.

It was 115 bp at the start of last year… En route to zero? Source: Stephane Deo on X, Eleva Capital, Bloomberg

Portugal might bring back enhanced tax incentives, just for Golden Visa investors.

A 20% flat tax on local income. 0% on foreign income. Basically NHR 1.0… but gated behind a Golden Visa. If this passes, will demand explode? Source: Alessandro Palombo, Forbes

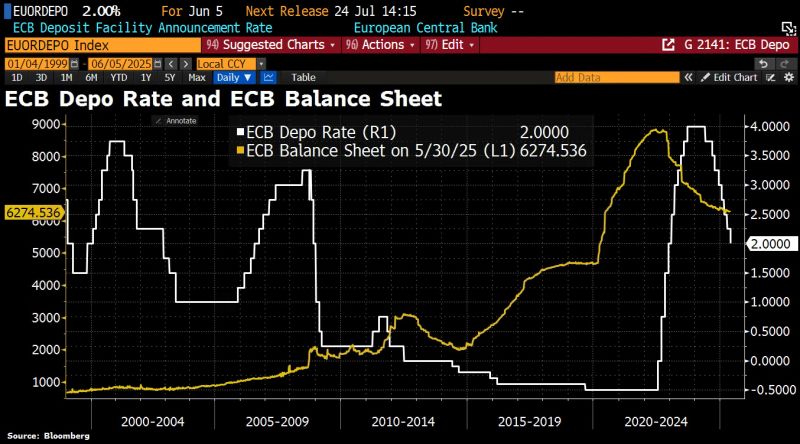

ECB lowered interest rates for the 8th time in a year after inflation dipped <2% and the economy suffered repeated blows from US tariffs.

ECB cut the deposit rate by 25bps to 2% and reiterated that it’s not pre-committing to a particular path. ECB balance sheet shrank to €6.3tn. Note that ECB deposit rate has fallen below the German inflation rate for the first time since September 2023. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks