Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

European markets have outperformed the US this year.

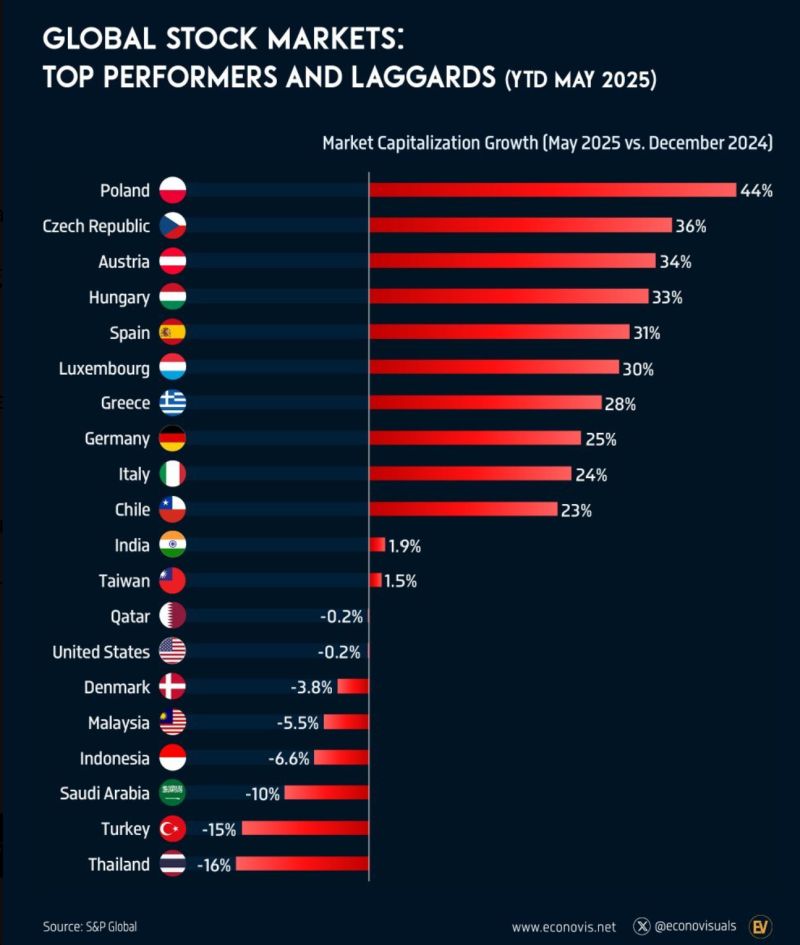

Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat. Source: Global Markets Investor

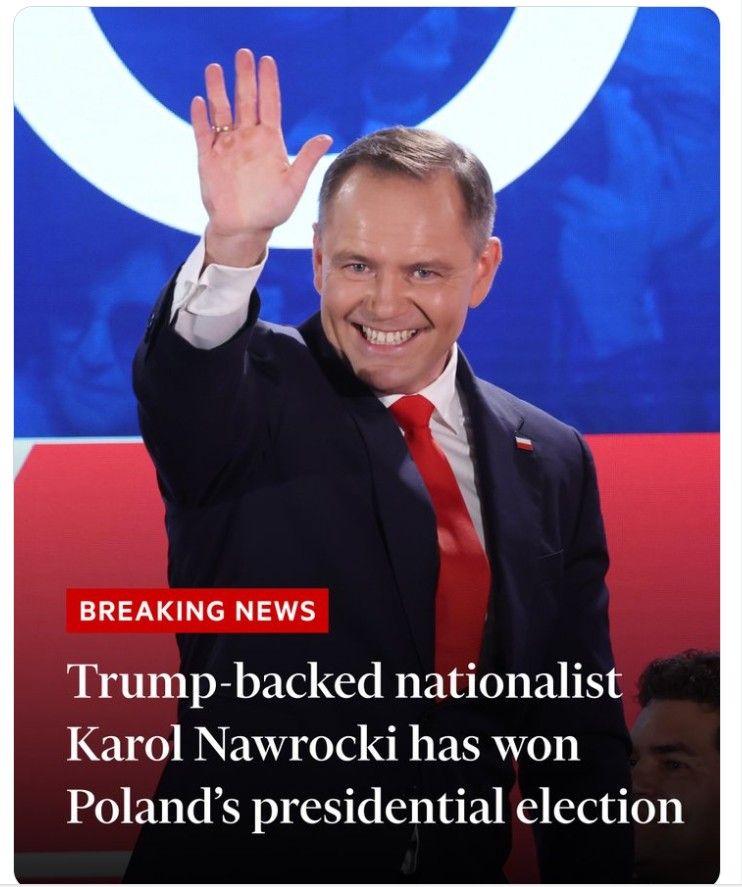

Breaking news:

Karol Nawrocki has won Poland’s presidential election, the country’s electoral commission said, after a tight run-off vote against pro-EU rival Rafał Trzaskowski Source: FT

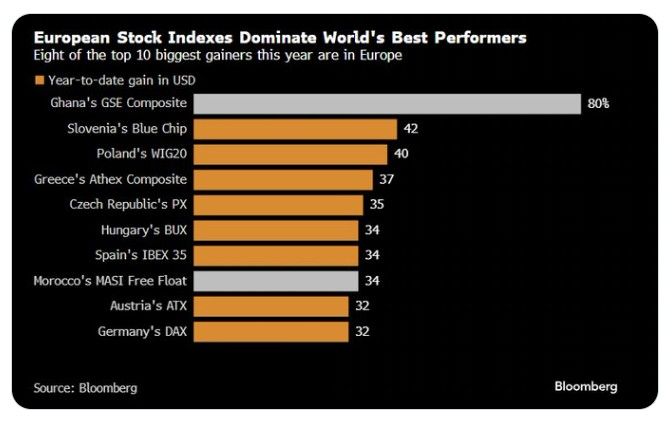

Europe stocks stage world-beating rally as trade war backfires.

8 of the world's 10 best-performing stock markets are in Europe this year, w/Germany's Dax rallying >30% in Dollar terms: Peripheral markets such as Slovenia, Poland, Greece, and Hungary also performing well. Source: HolgerZ, Bloomberg

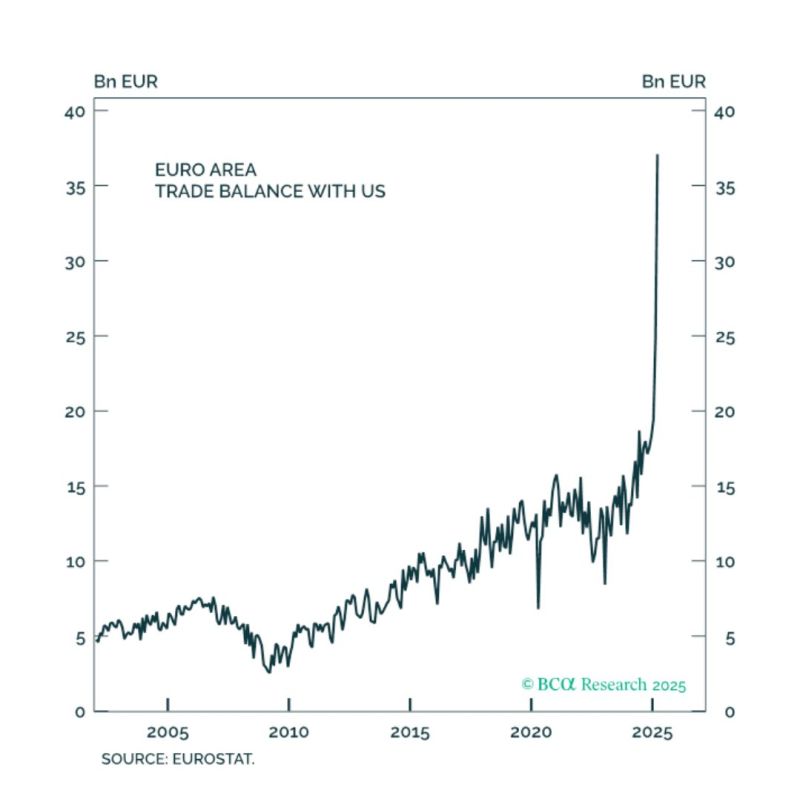

The German-US trade balance surplus keeps increasing...

In Germany, anticipation is building for the upcoming meeting between Chancellor Friedrich Merz and US President Donald Trump. The two leaders will meet at the White House on June 5 to discuss key issues including the war in Ukraine, the Middle East, and trade policy. Over the past 12 months, Germany has posted a trade surplus of >€70bn with the US, equal to 1.7% of its GDP... Source: HolgerZ, Bloomberg

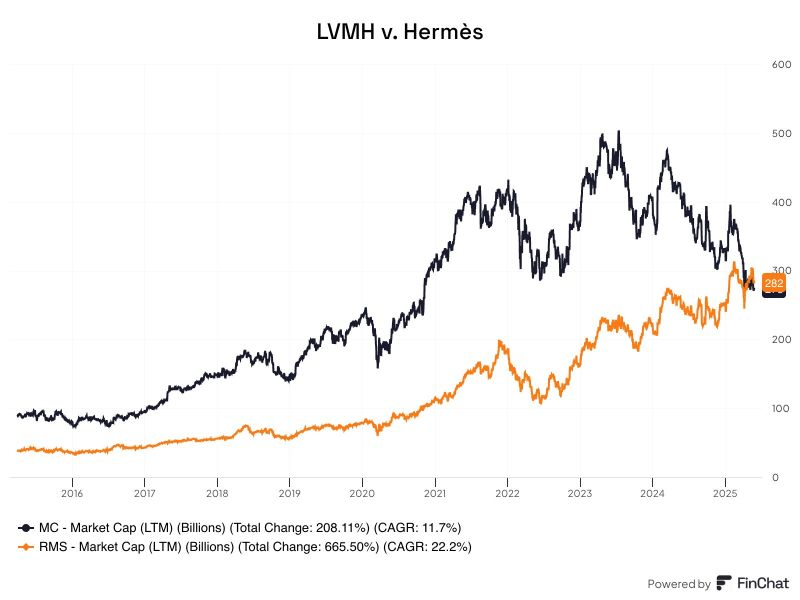

Hermès just surpassed LVMH to become the world's largest luxury company.

"We're about craft, we're not machines" Source: Finchat

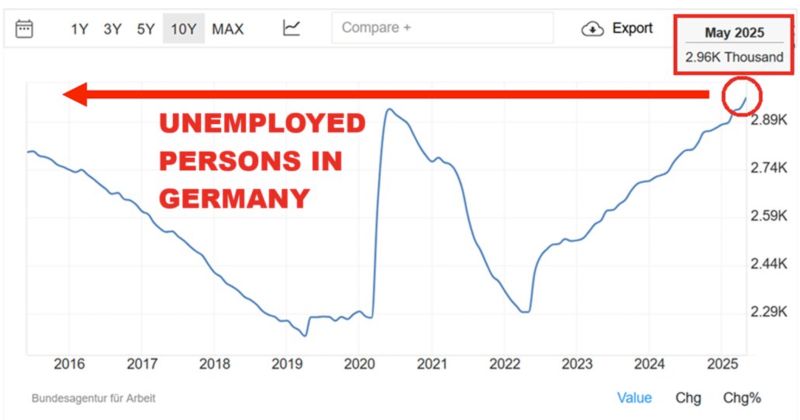

German job market is deteriorating:

The number of unemployed people in Germany hit 2.96 MILLION in May, the highest in at least 10 YEARS. This is even higher than at the 2020 CRISIS peak. The unemployment rate sits at 6.3%, the second-highest in 10 years. Source: Global Markets Investor

Four of Europe’s oldest industrial groups have added more than €150bn to their market caps on the back of soaring demand for data centres driven by the boom in artificial intelligence.

European makers of everything from switches to smart meters are providing the servers and infrastructure that power data centres for large language models and cloud computing, with traditional makers of electric equipment such as Legrand doubling their revenues thanks to data centres in recent years. Link to article 👉 https://lnkd.in/d8wsidBb Source: FT

In case you were wondering why European growth seemed abnormally strong in Q1.

Source: BCA

Investing with intelligence

Our latest research, commentary and market outlooks