Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Europe has a massive electricity problem...

According to a FT article, thousands of businesses and households are waiting to connect to the Dutch grid, forcing network operators to ration power in an early indicator of what other European countries are likely to suffer as the speed of electrification increases. More than 11,900 businesses are waiting for electricity network connections, according to Netbeheer Nederland, the association of Dutch grid operators. On top of that are public buildings such as hospitals and fire stations as well as thousands of new houses. Dutch officials and companies said lengthy waits for connections were holding up economic growth and could force businesses to rethink their investment plans. Despite efforts to invest in new cables and substations, new connections in some areas of the country will only become available in the mid-2030s, according to network operators. Although the bottlenecks in the Netherlands are particularly acute, analysts say it is a harbinger of what is likely to occur in other EU countries, as the speed of electrification increases to meet the bloc’s ambitious decarbonisation targets.

JP Morgan Chase chief executive Jamie Dimon warned European leaders they have a competitiveness problem and that they are currently “losing” the battle to rival the US and China.

“Europe has gone from 90 per cent US GDP to 65 per cent over 10 or 15 years. That’s not good,” Dimon said at an event in Dublin organised by the Irish foreign ministry. “You’re losing.” The comments from Dimon, one of the most influential voices in global finance, underscore the challenges facing the EU as it battles to invigorate its economy. Mario Draghi, the continent’s former top central banker, last year demanded a new industrial strategy for Europe with annual investment of €800bn to maintain competitiveness with the US and China. “We’ve got this huge strong market and our companies are big and successful, have huge kinds of scale that are global. You have that, but less and less,” Dimon said. It is an even blunter message from Dimon than he made in his most recent annual shareholder meeting in April, where he said “Europe has some serious issues to fix”, and urged European nations to “significantly reform their economies so they can grow”. Source: FT

Euro makes new all-time highs every day in trade weighted terms.

Indeed, many countries - above all China - are pegged to the dollar. That supercharges the rise in Euro vs USD (white), taking Euro to stratospheric levels in trade-weighted terms (orange). Is inflation coming for the Euro zone... Source: Bloomberg, Robin Brooks

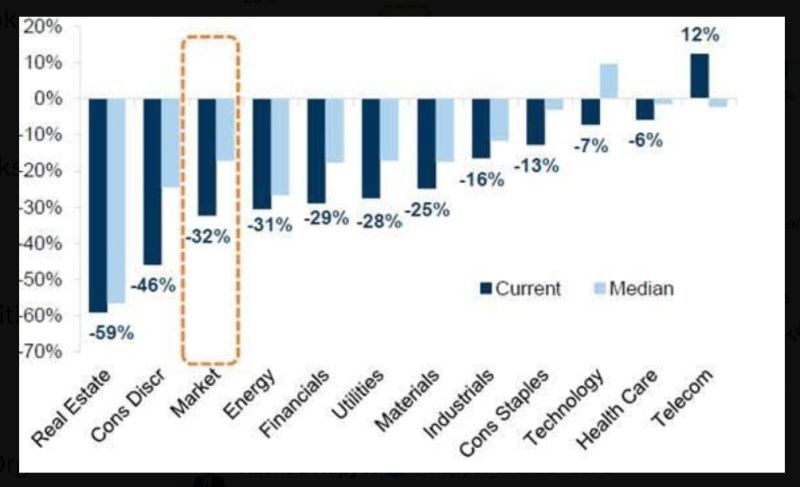

European stocks are trading at a wider-than-usual discount vs their US counterparts, per Goldman

Source: Markets & Mayhem on X

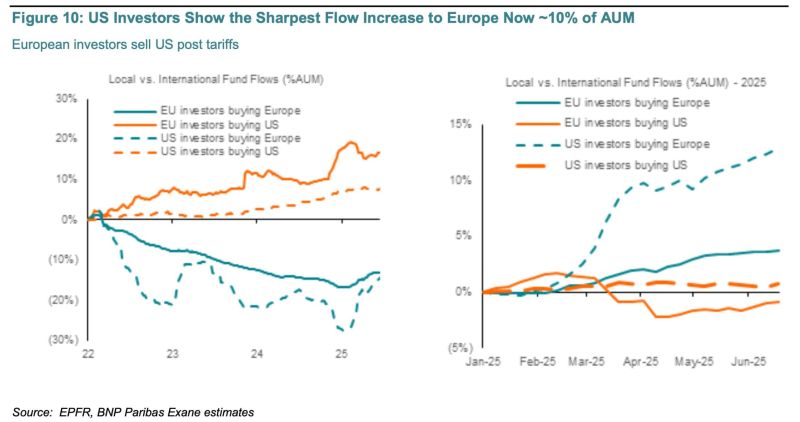

This chart from, BNP / EPFR indicates that the strong outperformance of European stocks this year was primarily driven by US investors shifting their investments into Europe.

In contrast, European investors made only modest shifts. Source: HolgerZ

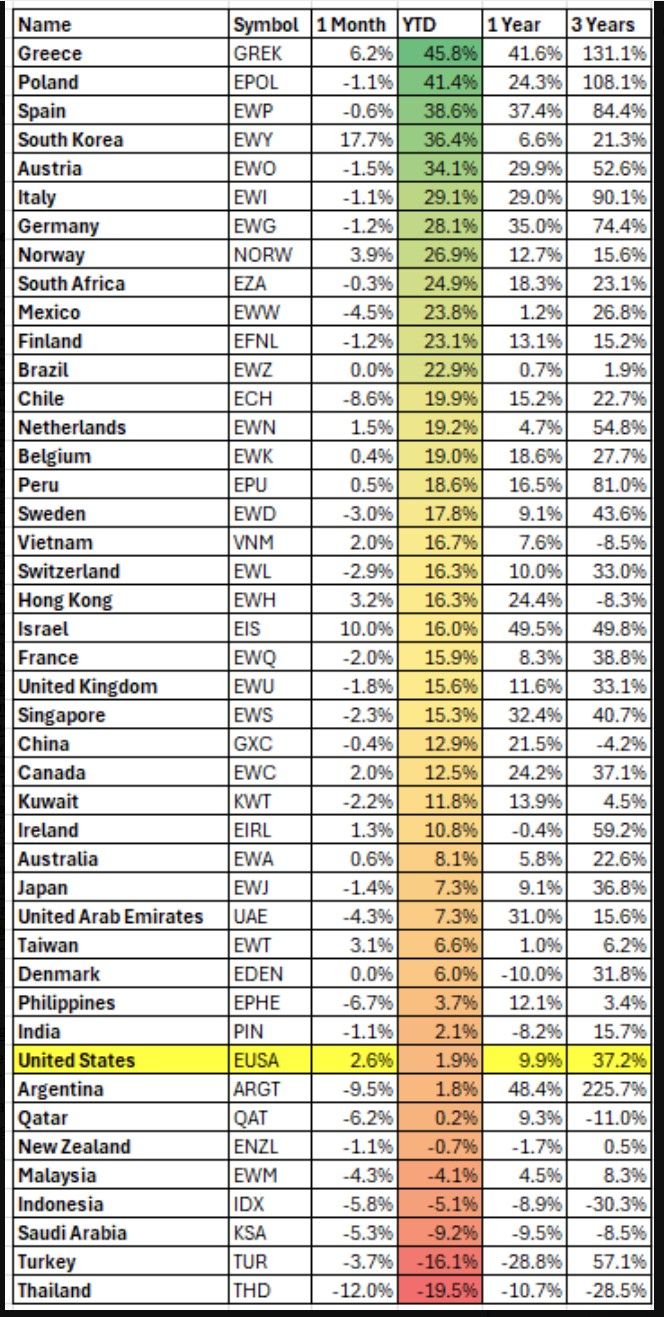

The top 3 country equity ETFs so far in 2025:

1) Poland $EPOL: +54.5% 2) Greece $GREK: +52.2% 3) Austria $EWO: +42.6% Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks