Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

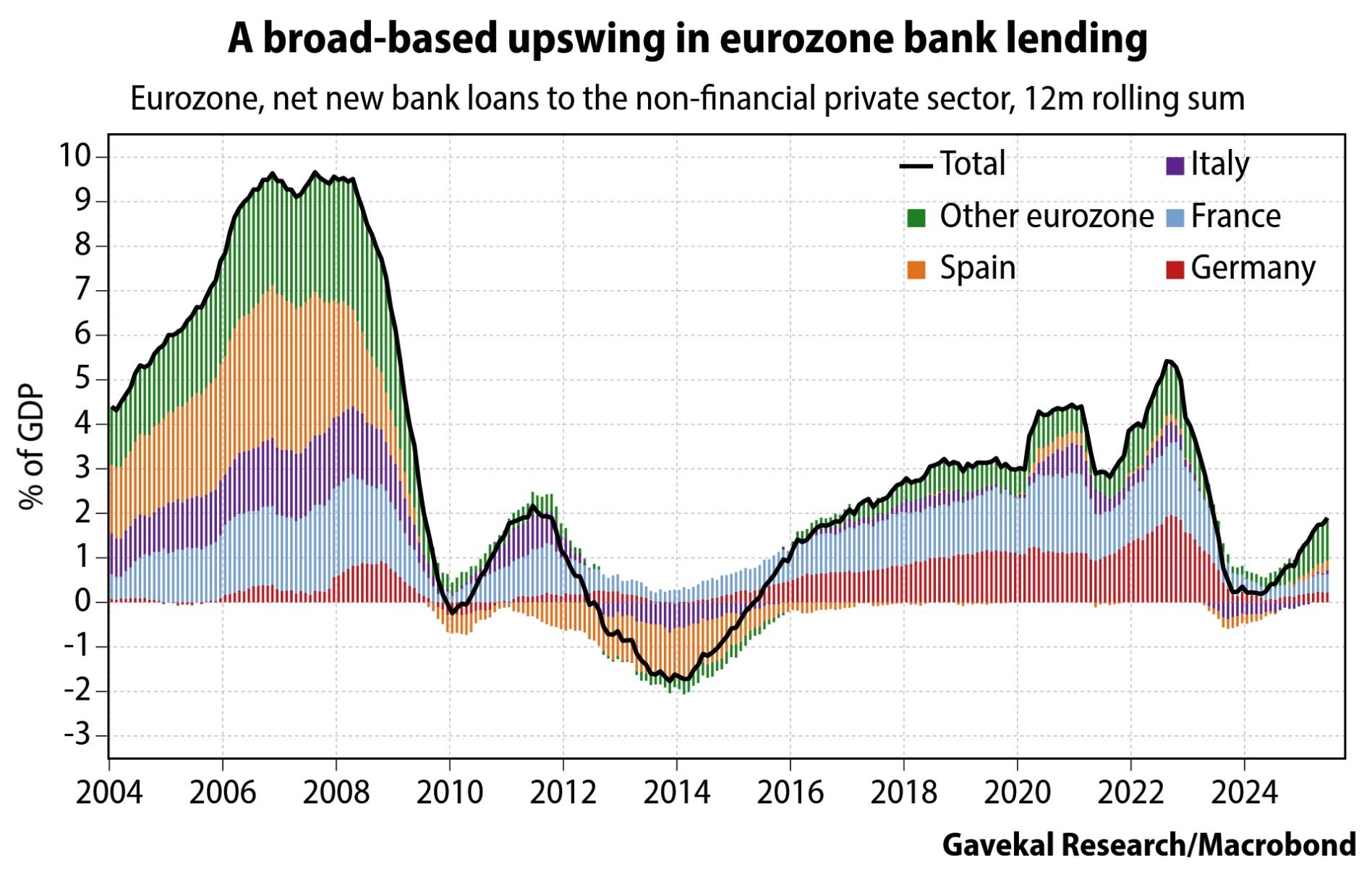

An interesting view on europe by Gavekal

"The 15% tariff rate on US imports from the European Union will hit the old continent's exporting sector. But the broader economy can count on its domestic segment to mitigate the shock. Notably, the effect of the ECB’s interest rate cuts is becoming visible in a bank lending recovery across the eurozone". Source: Gavekal, Macrobond

The European Union will delay planned tariffs for six months to allow for trade talks

The European Union announced Monday that it is suspending for six months its planned countermeasures against the United States’ tariffs, which which were set to take effect this week. “On 27 July 2025, European Commission President Ursula von der Leyen and US President Donald J. Trump agreed a deal on tariffs and trade,” the EU Commission spokesperson for trade said in a statement. The spokesperson touted the agreement as restoring “stability and predictability for citizens and businesses on both sides of the Atlantic.” “The EU continues to work with the US to finalise a Joint Statement, as agreed on 27 July,” the spokesperson said. “With these objectives in mind, the Commission will take the necessary steps to suspend by 6 months the EU’s countermeasures against the US, which were due to enter into force on 7 August.” Source: CNBC

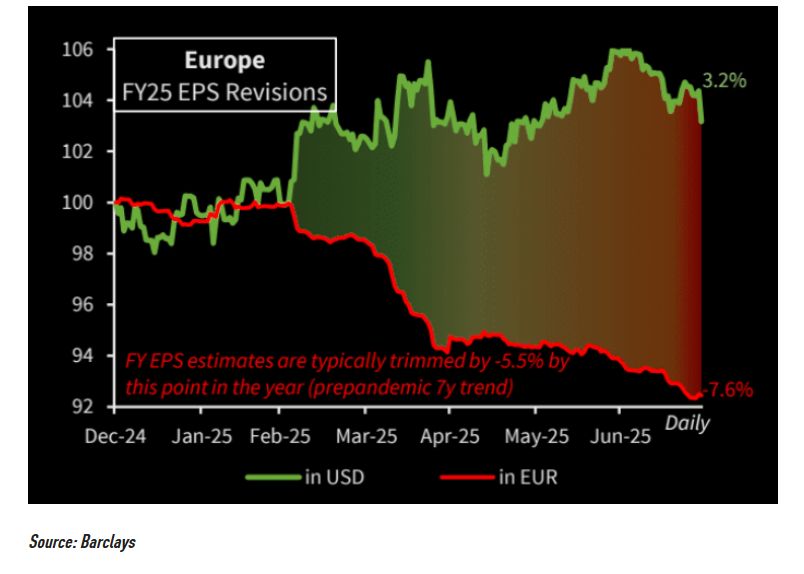

FY25 EPS revisions in Europe are trending somewhat worse than that of a typical year.

Source: Barclays, The Market Ear

Europe is heading for the next humiliation. If Nvidia continues its triumphal march, the chip manufacturer could soon be worth more than the 50 largest comps in the Eurozone.

$NVDA hits a new all-time high yesterday. Nvidia is now valued at $4.3 Trillion Source: HolgerZ, Bloomberg

The EU has admitted it doesn’t have the power to deliver on a promise to invest $600 billion in the United States economy, only hours after making the pledge at landmark trade talks in Scotland.

That’s because the cash would come entirely from private sector investment over which Brussels has no authority, two EU officials said The deal included a pledge to invest an extra $600 billion of EU money into the U.S. over the coming years. “It is not something that the EU as a public authority can guarantee. It is something which is based on the intentions of the private companies,” said one of the senior Commission officials. The Commission has not said it will introduce any incentives to ensure the private sector meets that $600 billion target, nor given a precise timeframe for the investment. However, the first official said that the $600 billion figure was "based on detailed discussions with different business associations and companies in order to see what their investment intentions are." Source: Politico

EU trade deal with Trump sparks backlash in Europe: The new trade agreement w/the US is drawing criticism across Europe.

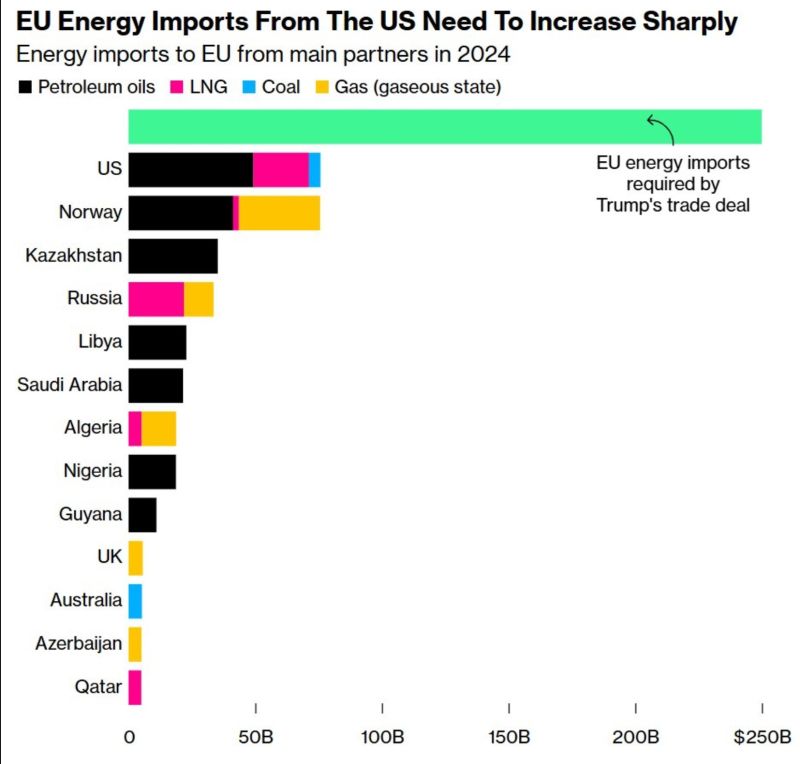

German Chancellor Friedrich Merz said, "I'm not satisfied with this result in the sense of calling it 'good.' But considering where negotiations started with the US, achieving more just wasn't realistic." French Prime Minister François Bayrou went further, calling the EU’s acceptance of the deal a “dark day” and a sign of submission. The EU is the US’s largest trading partner, with a trade surplus of ~$250bn. Critics argue the asymmetrical deal reflects the true balance of power – and that a region which lags economically and relies on US security shouldn't be surprised when it's forced to make concessions. Source: Yahoo Finance, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks