Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

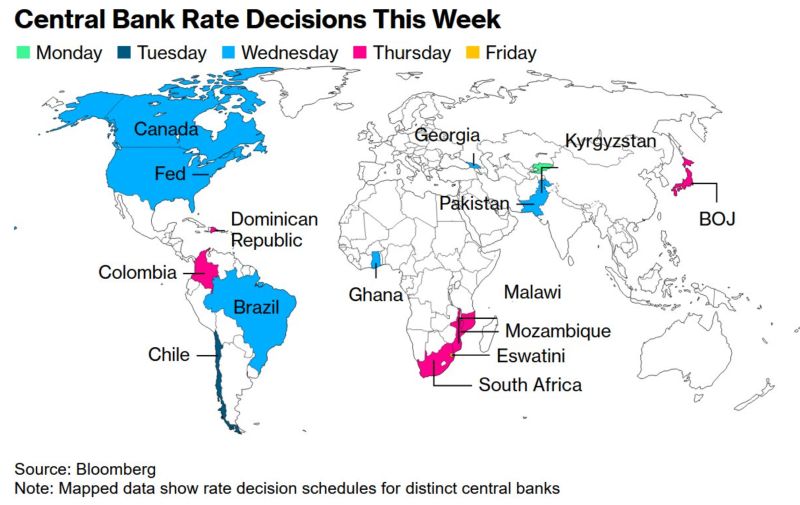

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Euro suffered its steepest one-day drop against the dollar since May on Monday, as Germany and France voiced fears that the long-awaited EU-US trade deal would hurt the European economy.

The single currency was down more than 1 per cent against the dollar and weakened by 0.8 per cent against the pound, following the announcement on Sunday that the US would impose 15 per cent tariffs on most imports from the EU. The agreement, hailed by European Commission president Ursula von der Leyen as “the biggest trade deal ever” and covering nearly 44 per cent of global GDP, averted a possible transatlantic trade war. But German chancellor Friedrich Merz said on Monday that the tariffs would cause “considerable damage” to his country’s economy, Europe and the US itself. “Not only will there be a higher inflation rate, but it will also affect transatlantic trade overall,” he said. “This result cannot satisfy us. But it was the best result achievable in a given situation.” French Prime Minister François Bayrou said the trade deal marked a “dark day”, adding that the EU had “resigned itself into submission”. Source: FT

President Trump has said the United States has officially reached a trade deal with the European Union.

➡️ The trade deal will include 0% tariffs, the EU buying $750B of US energy, and reduced automotive tariffs to 15% with an understanding that the EU will purchase more US vehicles. ➡️ The US and EU have struck a tariff deal that will avert a transatlantic trade war between the two sides but still impose American tariffs of 15 per cent on most imports from the bloc. ➡️ As part of the deal the EU has also agreed to spend hundreds of billions of dollars on additional US energy products and weapons, in exchange for the broad 15 per cent levy that covers many European exports including cars. ➡️ The agreement was struck following a meeting on Sunday between US President Donald Trump and European Commission president Ursula von der Leyen at his Turnberry golf resort in Scotland. 🎯 The deal marks a victory for Trump, who has spent months forcing America’s trading partners into bruising negotiations by threatening steep tariffs, although the terms are in line with what Brussels had told EU member states to prepare for. “This is probably the biggest deal ever reached in any capacity, trade or beyond trade,” Trump said as he announced the agreement. “Today’s deal creates certainty in uncertain times . . . for citizens and businesses on both sides of the Atlantic,” von der Leyen said, adding that the 15 per cent US tariff would apply to European cars, pharmaceuticals and semiconductors — important products for Brussels. 👍 Japan done, EU done, China closer to getting done with another 90 day tariff pause… If we can get Canada, Mexico, Australia & South Korea soon… 🚀 bullish Source: FT

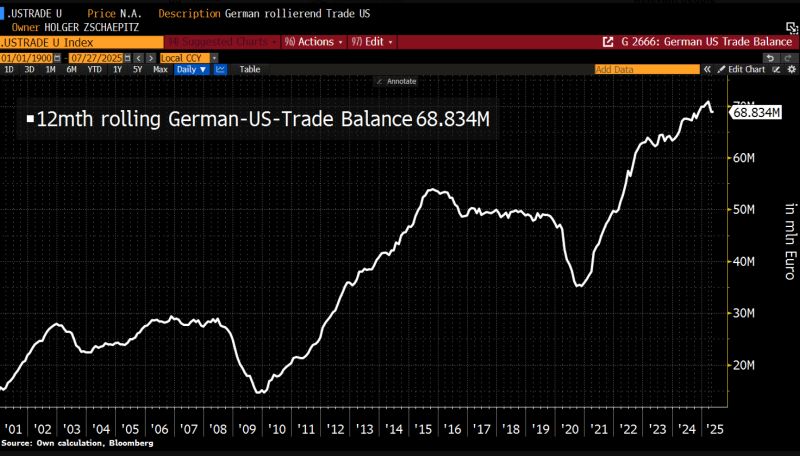

In germany, hopes are high for a quick trade deal with the US ahead of next Friday’s deadline.

With a trade surplus of €69bn, Germany is even willing to accept an asymmetrical deal — one where European exports face a 15% US tariff, while American goods enter Europe duty-free. Source: HolgerZ, Bloomberg

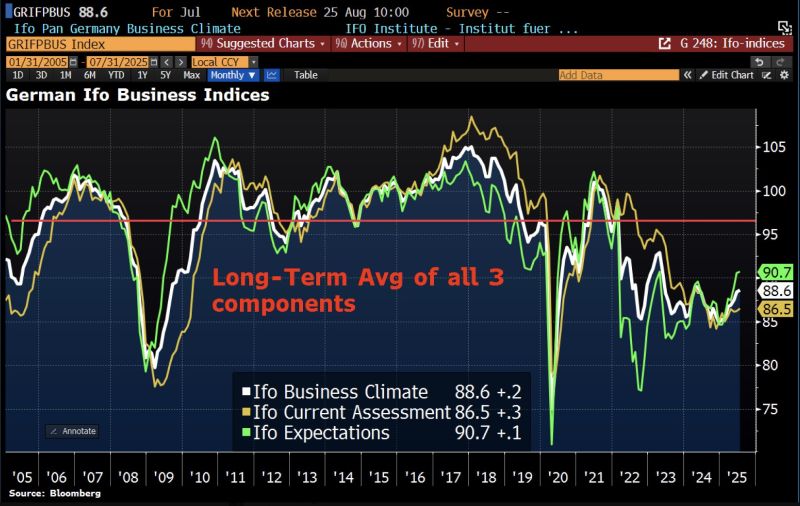

In Germany, the latest Ifo Business Climate Index suggests the economy is holding up surprisingly well despite rising tariffs.

The index edged up from 88.4 in June to 88.6 in July – slightly below expectations (89.0). This marks the 7th consecutive monthly improvement, this month driven mainly by better assessments of current business conditions. However, underlying growth remains weak. According to Capital Economics, the survey results remain consistent w/a GDP contraction based on long-term historical patterns. That said, the Ifo has not been a reliable predictor of GDP in recent years. Source: Bloomberg, HolgerZ

German business activity continued to grow marginally in July, though at a slightly slower pace than in June.

The German flash composite PMI fell to 50.3 points in July, down from 50.4 in June and below the 50.7 forecast in a Reuters poll. Source: Bloomberg, HolgerZ

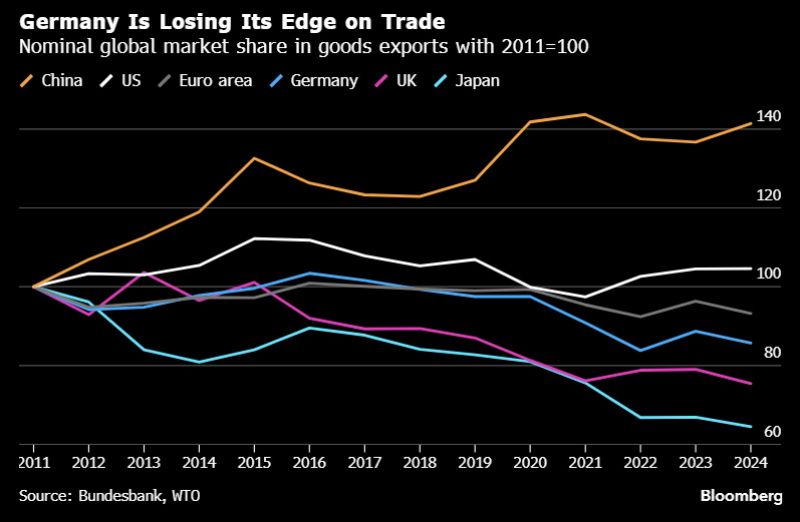

Germany is losing its edge on trade. The country’s share in global trade has been shrinking since 2017, w/losses accelerating after 2021, according to Bundesbank.

Over three-quarters of the decline from 2021 to 2023 was due to falling competitiveness – not Trump’s tariffs Source: HolgerZ, Bloomberg

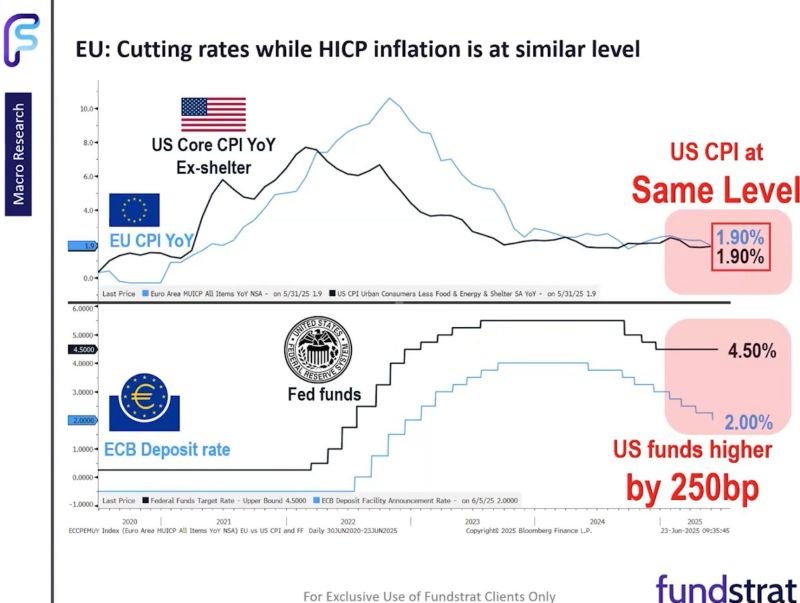

This is probably what Trump doesn't like with the latest US inflation reports and subsequent inaction by the fed.

The EU inflation rate excludes shelter, do the same with US CPI, and they match. Yet Fed Funds is 250bps higher than the ECB rate. What Trump does not take into account is that the inflationary effects of tariffs might soon hit. Source: Mike Zaccardi, CFA, CMT, MBA, Fundstrat

Investing with intelligence

Our latest research, commentary and market outlooks