Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

So now Europe is supposed to pay for Ukraine ?

Not a big surprise to see EU defense stocks plummeting today... Source: FT

Trump with European leaders sitting around his desk is the best photo of 2025.

Source: Mike Crispi @MikeCrispi

German 30y bond yields climbed to 3.35%, the highest level since 2011.

Investors are demanding higher term premia as the surge in bond supply weighs on the market. Source: HolgerZ, Bloomberg

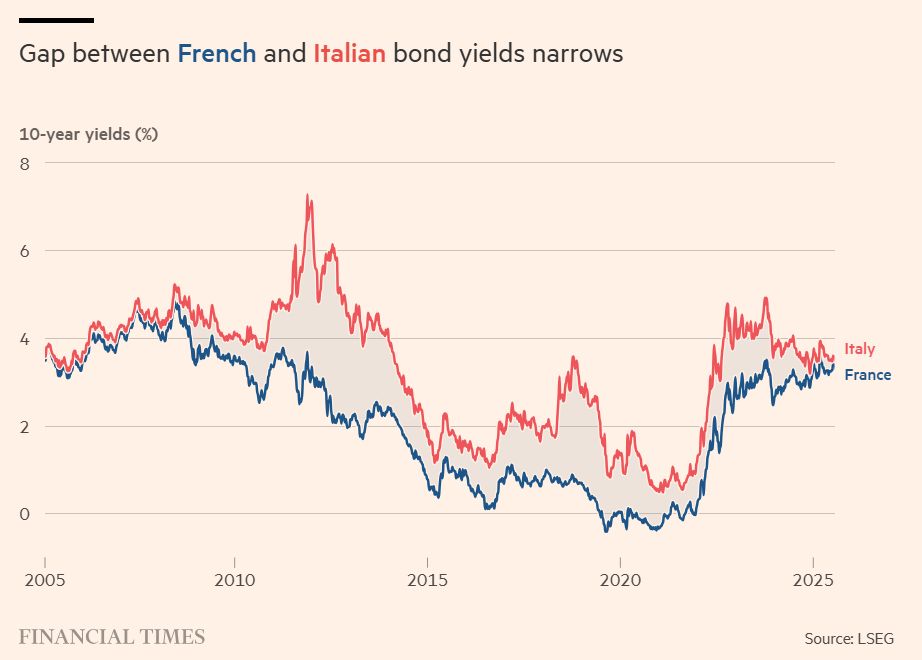

France’s long-term borrowing costs are converging with Italy’s for the first time since the global financial crisis.

Yields on 10-year French government bonds have jumped above 3 per cent over the past year, as months of political instability and concerns about the public finances take their toll. This has brought France’s benchmark borrowing costs to just 0.14 percentage points less than those of Italy, whose bond yields have been driven lower as a display of fiscal prudence from Giorgia Meloni’s administration has won over investors. The convergence has upended long-held views on France’s position as one of the region’s safest borrowers and Italy as one of its most risky, with a huge stock of public debt equal to about 140 per cent of GDP. Italy’s “spread” over France — the difference between their bond yields — ballooned to more than 4 percentage points during the Eurozone debt crisis of the 2010s. Source: FT

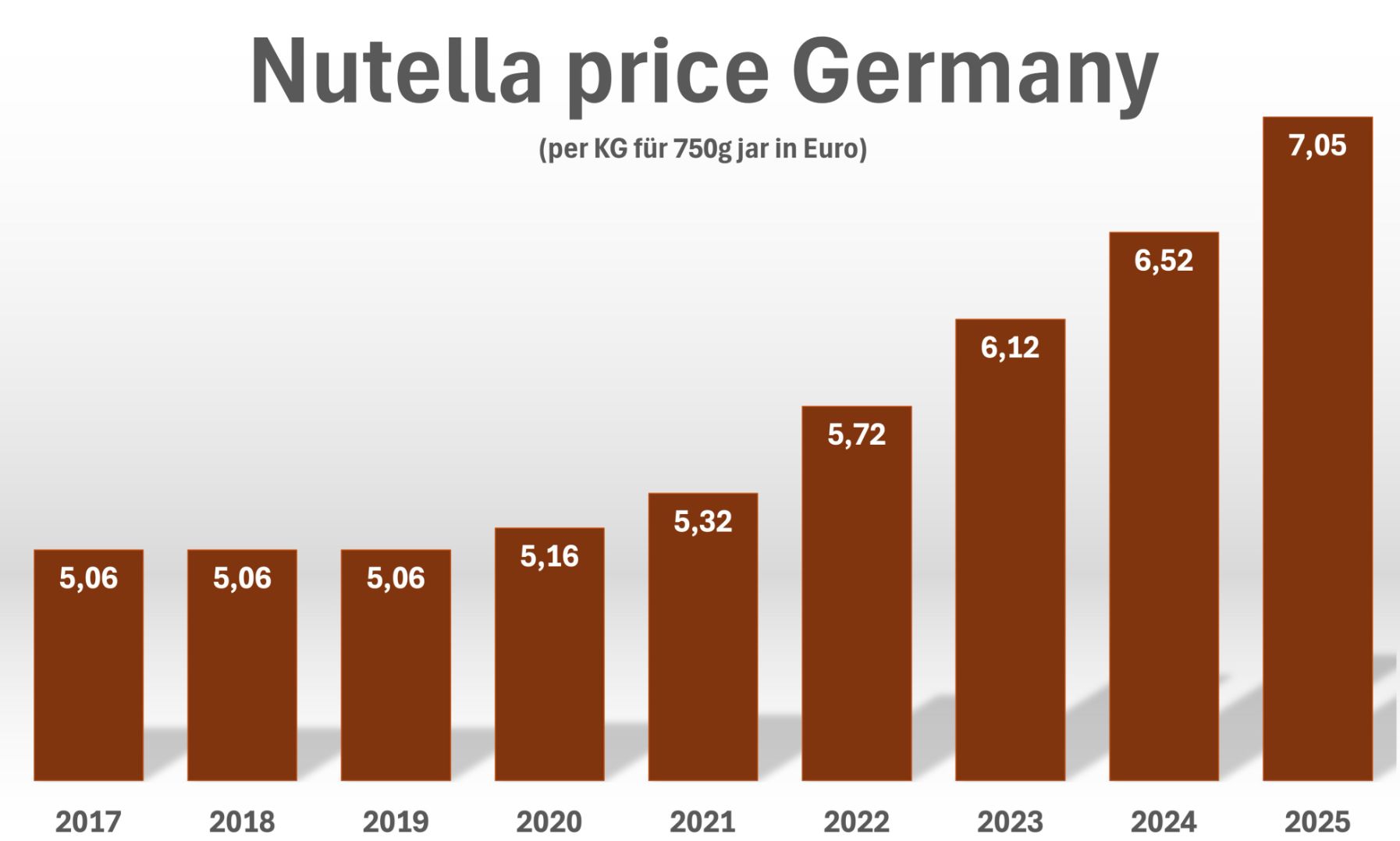

The cost of Nutella in Germany is rising faster than overall inflation.

A 750g jar has gone up by nearly 40% since 2019, far outpacing Germany’s general inflation rate of 21.8% over the same period. But this isn’t just about hazelnut spread: food prices in Germany as a whole have climbed by 38.4% since the end of 2019, according to Eurostat’s Food CPI. That’s much higher than in Italy (+29.5%) or France (+25.9%), highlighting how sharply grocery bills have risen in Germany. Source: Bloomberg, HolgerZ

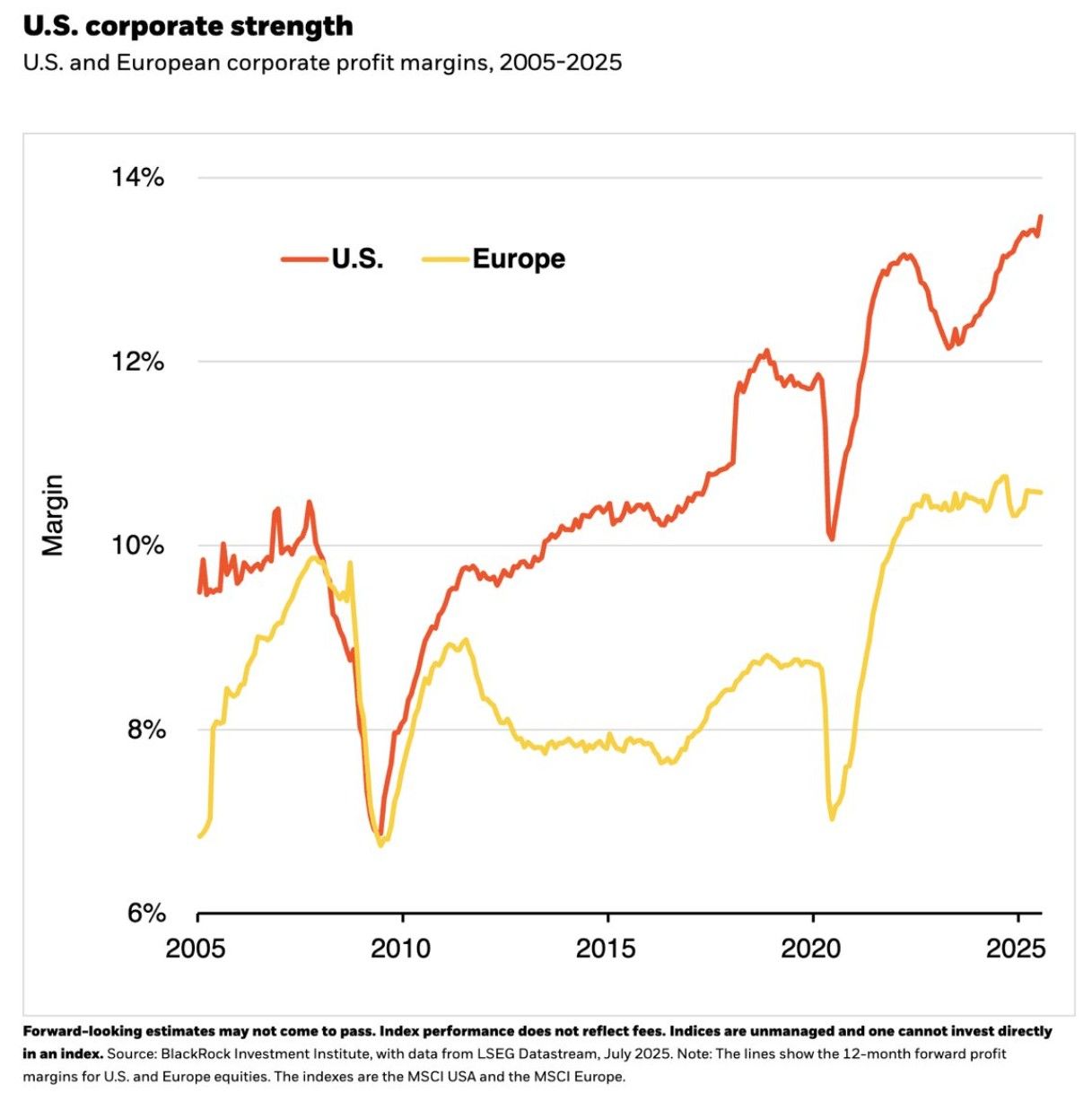

U.S. Corporate Margins are making all-time highs while Europe's are flat

The end of American Exceptionalism??? Source: Barchart, Blackrock

Many investors bet Germany’s “whatever it takes” fiscal stimulus package and an enormous uplift in European defence spending would drive a prolonged upturn in the region’s equity markets.

A BofA survey of fund managers showed allocations to Eurozone stocks leapt to their highest level since 2021 at the beginning of this year. But the outperformance was short lived. Strong earnings from the US mega caps have sent Wall Street stocks powering ahead again, despite Trump’s tariff onslaught and deteriorating US economic data. Weak second-quarter earnings in Europe have supported the growing view that the region’s stock rally is losing momentum. With more than half of the companies in the Stoxx Europe 600 having reported earnings, the index is on track for no earnings growth compared with a year ago, according to Bank of America, sapping optimism over a revival in the region’s equity markets. By contrast, the S&P 500 index’s constituents are on track to post 9 per cent year-on-year average earnings growth, according to BofA, powered largely by strong results from Silicon Valley’s tech giants and Wall Street banks. Source: Financial Times, LSEG

⚠️ Sales of Tesla’s electric vehicles plummeted 60 per cent in the UK last month amid a broader slump in European demand, with Chinese rival BYD surging.

➡️ There were 987 Tesla vehicles registered in July, compared with 2,462 in the same month last year, according to figures from the UK’s Society of Motor Manufacturers and Traders. Meanwhile, BYD registrations in the UK rose more than fourfold year on year to 3,184 in July, according to SMMT. ➡️ In July, Tesla registrations also fell 86 per cent to 163 vehicles in Sweden, 27 per cent to 1,307 cars in France and 58 per cent to 460 vehicles in Belgium, according to official industry data. ➡️The declines came despite the recent release of an upgraded version of its flagship Model Y sport utility vehicle. The slowdown comes amid consumer uncertainty over which models would be eligible for the government’s new EV subsidy scheme. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks