Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

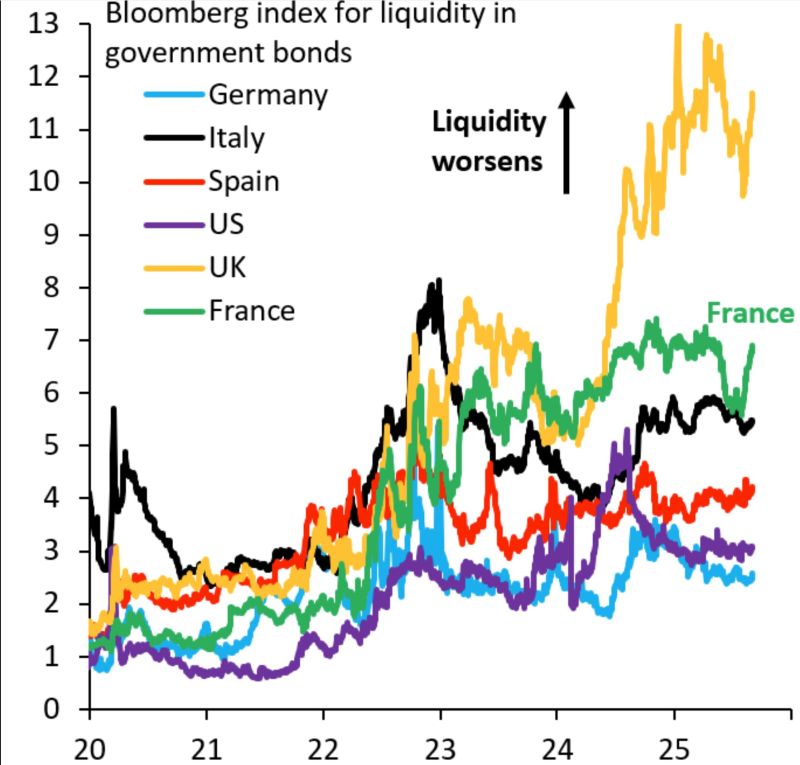

This is Bloomberg's measure of bond market liquidity, which compares actual yield curves to synthetic smooth yield curves for each country

The more kinks you have in the yield curve, the higher this index and the worse is liquidity. UK off the charts, France rising rapidly... Source: Robin Brooks

German stock market valuations have hit HISTORIC levels:

DAX index forward P/E ratio relative to the Euro Stoxx 600 P/E reached the highest level since the Financial Crisis. DAX P/E is 16x, above the average of 13x over the last 10 years. Source: Global Markets Investor, Bloomberg

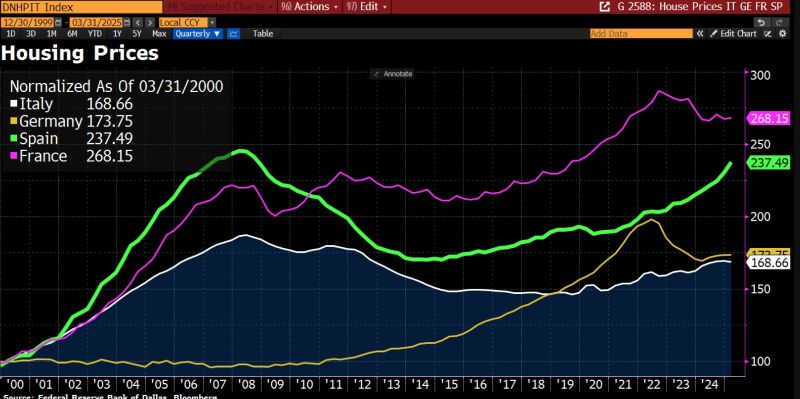

Housing market in Spain is booming.

Home sales and prices are closing in on the record highs set before the 2008 financial crash. The strong momentum is supported by a classic supply / demand imbalance. On the supply side, only about 100,000 new apartments are built each year – roughly a third of what’s needed. On the demand side: strong economic growth, a surge in tourism, and rising migration The house price index now sits just 3.2% below its 2008 peak. Source: Bloomberg, HolgerZ

A suspected Russian interference attack targeting the president of the European Commission, Ursula von der Leyen

The Russian interference disabled GPS navigation services at a Bulgarian airport and forced the commission president’s plane to land using paper maps. Source: FT

😨 New European car registrations of Tesla vehicles totaled 8,837 in July, down 40% year-on-year, according to the European Automobile Manufacturers Association, or ACEA.

🏆 BYD recorded 13,503 new registrations in July, up 225% annually. 🚨 Elon Musk’s automaker faces a number of challenges in Europe, including intense ongoing competition and reputational damage to the brand. Source: CNBC

2 similar headlines in the same week... but by the way, could the imf rescue them at the same time?

Can they really afford it???

$UBER announces the launch of Uber Trains

From 2029, 10 high-speed trains could connect Stratford Intl to Brussels, Paris, Lille & more via the Channel Tunnel. Partnering with Gemini Trains, tickets may be booked directly in the app alongside cabs, bikes and more. ➡️ Transport multinational Uber, known for its ride-hailing app, has announced it is launching a new train service between the UK, France and Belgium. ➡️ Uber Trains aims to run 10 high-speed trains from London to Paris, Lille and Brussels using the Channel Tunnel. ➡️ The trains will depart from Stratford International Station in East London and are expected to initially focus on the London to Paris route. Passengers would be able to book tickets via the Uber app. ➡️ Uber will partner with start-up Gemini Trains to launch the new service, which could be operational as soon as 2029, subject to receiving the necessary permits.

Investing with intelligence

Our latest research, commentary and market outlooks