Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Big Tech groups are losing a political battle in Brussels to gain access to the EU’s financial data market

This was despite Donald Trump’s threats to punish countries that “discriminate” against US companies with higher tariffs. With the support of Germany, the EU is moving to exclude Meta, Apple, Google and Amazon from a new system for sharing financial data that is designed to enable development of digital finance products for consumers. Such a decision would hand a significant boost to banks in their efforts to fight off a competitive threat from Big Tech groups, which they fear will use their data to disintermediate them from their customers while extracting much of the value of knowing people’s spending and saving behaviour. After more than two years, negotiations on the Financial Data Access (FiDA) regulation are entering the final stages in coming weeks, with Big Tech groups facing almost certain defeat, according to diplomats. Source: FT https://lnkd.in/eMfM2QFb

Activist investor Cevian Capital has said it is “not viable” to run a large international bank from Switzerland due to new strict capital proposals

Unless the position changes UBS would have “no other realistic option” but to leave the country. Cevian is Europe’s largest dedicated activist investor and holds about 1.4 per cent of UBS’s shares. It added that the government proposals, which would force the bank to have as much as $26bn in extra capital, could not be meaningfully changed through lobbying efforts. “The board has the responsibility to ensure that UBS protects its competitiveness,” Lars Förberg, Cevian’s co-founder, told the Financial Times. “Under the current proposals, it is not viable to run a big international bank from Switzerland. We therefore see no other realistic option but to leave.” He added: “The message from the Federal Council is clear: UBS is too big for Switzerland . . . I respect the Federal Council’s decision, but I do not understand it. It cannot be undone. Lobbyists cannot change that either. That effort can be spared.” Link to article: https://lnkd.in/ekU4KnUE

From yesterday's Financial Times article, “EU economy falls behind global rivals due to complacency.”

“One year on, Europe is . . . in a harder place,” Draghi told a news conference on Tuesday. “Our growth model is fading. Vulnerabilities are mounting . . . and we have been reminded, painfully, that inaction threatens not only our competitiveness but our sovereignty itself.” “Too often, excuses are made for this slowness. We say it is simply how the EU is built. Sometimes inertia is even presented as respect for the rule of law,” Draghi added. “That is complacency.” https://lnkd.in/e3facfZk

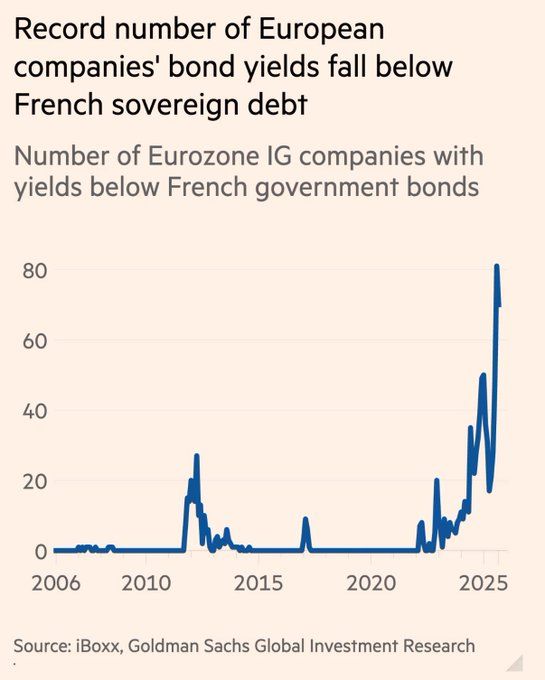

The ECB has tentatively allowed a little bit of price discovery in the bond market

The French government wakes up to discover their cost of funding is higher than L'Oréal's. Source: Hanno Lustig, FT

Key dates for France sovereign rating

Macron still needs to find a new PM who then needs to form a government who should submit its budget bill to parliament by the first Tuesday of October, which this year is October 7. Good luck... Source: French Debt Agency

Investing with intelligence

Our latest research, commentary and market outlooks