Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The K-shaped economy is not just about the US

Indeed, the German economy is increasingly K-shaped: stock markets are rising, while consumer confidence is in free fall. Source: HolgerZ, Bloomberg

Interesting view by HolgerZ on X

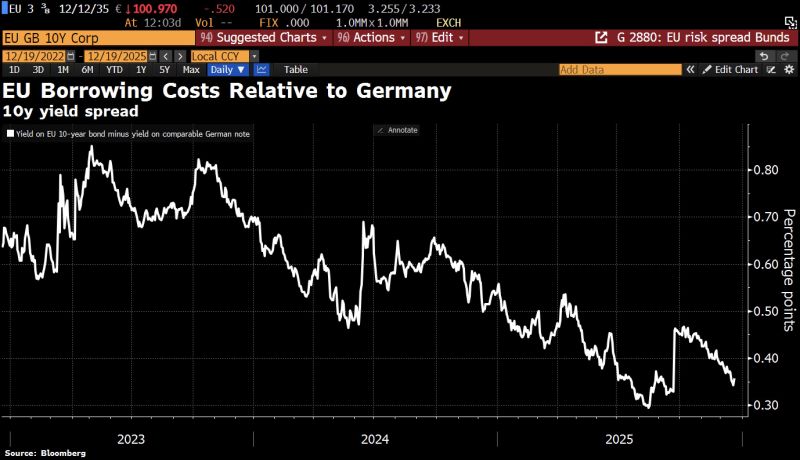

"Chancellor Friedrich Merz has now suffered a setback in foreign policy as well. He was unable to push through the Mercosur trade deal – an agreement that matters greatly for Germany’s economy – and the plan to support Ukraine’s debt relies on the issuance of joint EU debt. As a result, Germany is slowly losing one of its last competitive advantages: its superior credit rating. The risk premium on EU bonds relative to German Bunds has narrowed sharply in recent weeks". Source: HolgerZ, Bloomberg

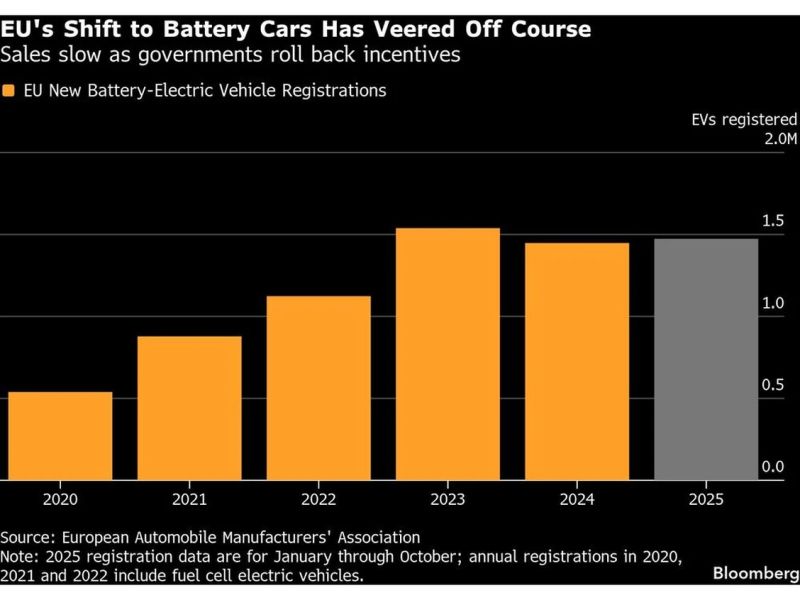

🚨 In case you missed it: Europe just hit the brakes on the EV-only future 🚨

The "End of the Combustion Engine" was supposed to be 2035. But the reality of the market just forced a massive pivot. Here is what’s happening and why it matters for the global economy: 📉 The Pivot The EU has officially backed away from its 100% emissions reduction goal for 2035. Instead of a total ban on gasoline and diesel, they are targeting a 90% reduction. 🚗 What this means for Carmakers ICE is back on the menu: New gasoline, diesel, and plug-in hybrids can still be sold past 2035. Flexibility over Ideology: Companies can use low-carbon fuels or "green steel" to offset emissions rather than being forced into an all-electric lineup. Survival Mode: With Ford recently taking a $19.5 billion charge on its EV business, the industry is screaming: “We can't make the math work yet.” 🌍 The Bigger Picture Europe is aligning more with the U.S. approach. Between trade tensions with China and the economic reality of a struggling manufacturing sector, the EU is choosing industrial stability over rigid green targets. The Lesson: You can mandate a transition, but you can’t mandate consumer demand or profitability. Economic reality eventually catches up to policy. Is this a necessary lifeline for the European auto industry, or a dangerous step backward for the planet? Source: Bloomberg, Financial Post

In Germany, Chancellor Merz is under growing pressure as business leaders warn that the country is in “free fall.”

Peter Leibinger, head of the powerful BDI industry group, cautioned that every month w/o real structural reforms costs Germany jobs & prosperity – and sharply limits the government’s ability to act in the future. Source: Bloomberg, HolgerZ

Germany creates a substantial infrastructure package and then allocate 50% of it to other purposes.

At least, that's what a study finds. Source: FT

Germany, continues to lose ground on global stock markets.

The market value of German equities has dropped to just 2% of total global market capitalisation, as the early-year momentum has completely faded. Source: HolgerZ, Bloomberg

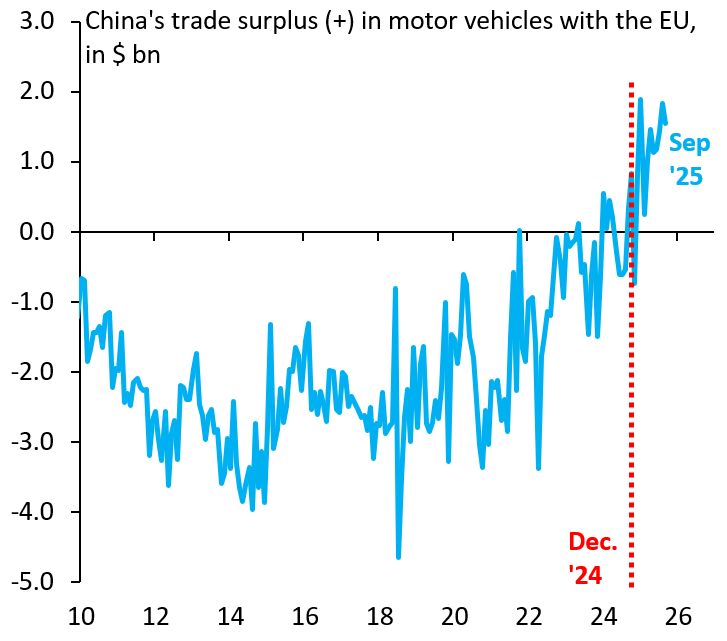

China now runs a trade surplus in cars with the EU after many years in which it ran a deficit.

Is a huge deflationary shock coming to the EU ? Maybe the ECB should recognize this and cut interest rates as aggressively as possible as a weaker Euro will help... Source: Robin Brooks

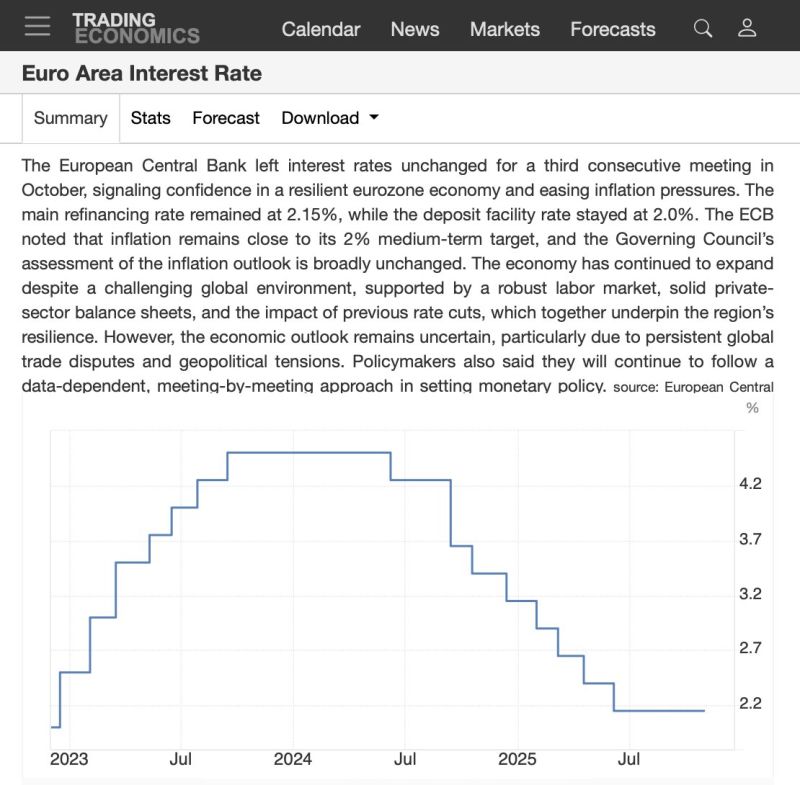

🚨 ECB hits pause again as economy shows resilience

The European Central Bank kept rates on hold at 2% for the third straight meeting. 💶 Inflation is right on target at 2% 📉 Rates down from last year’s 4% peak 💪 Growth still holding up The ECB says Europe’s economy is proving resilient — supported by strong labor markets and healthy private balance sheets. But beneath the calm? ⚠️ Uncertainty from global trade tensions and geopolitics still clouds the outlook.

Investing with intelligence

Our latest research, commentary and market outlooks