Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️Caretaker Prime Minister Dick Schoof is staring down a no-confidence vote today that could force his entire cabinet to resign.

➡️ His fragile government was gutted Friday when the New Social Contract party quit over disagreements on taking a tougher stance against Israel’s war in Gaza. ➡️ The NSC supported stronger measures, while the rest of the cabinet - including Schoof - refused to take that line. ➡️ Now left with just 32 of 150 seats, Schoof’s survival hinges on backing from opposition parties - many of whom are making demands he can't meet. ➡️ A collapse would plunge the Netherlands into uncharted political chaos, just months before a scheduled October election. Source: Bloomberg

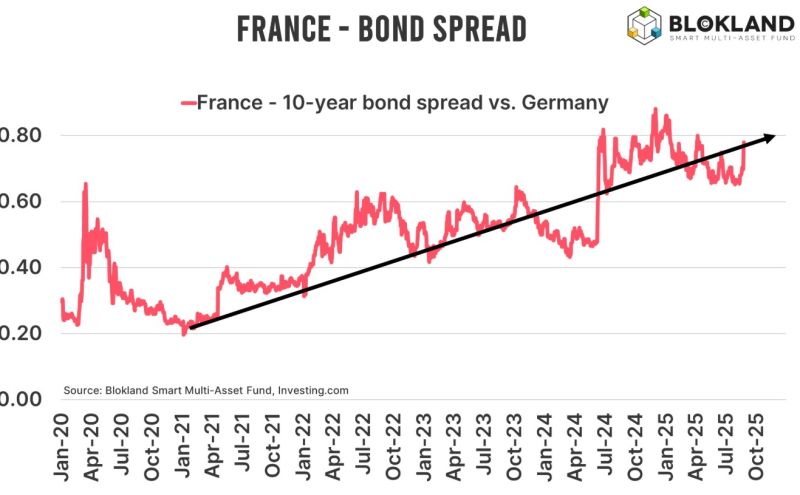

France has done nothing to stabilize its fiscal deficit & debt/GDP.

It already has the highest tax burden in Europe. These higher taxes would throttle growth potential even more. With its political paralysis it won’t cut spending neither. Next confidence vote is coming. And OAT spreads seem to start reflecting that. Source: Michel A.Arouet, INSEE

Prime Minister Bayrou is calling for a confidence vote, risking another collapse of the French government.

OAT-Bund spread keeps widening Source: Blokland Research

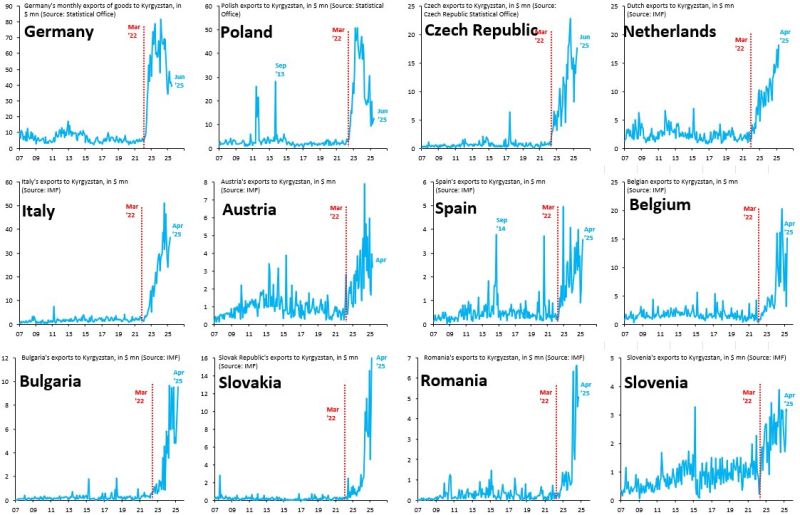

And suddendly, EU exports to Kyrgystan exploded...

What happened? Source: Robin Brooks

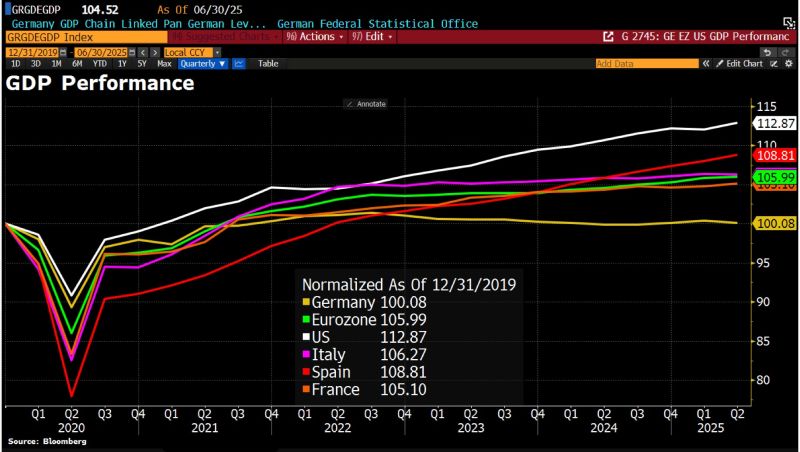

Germany economic growth has been lagging behind other European countries.

And Chancellor Friedrich Merz is looking for excuses: “This task is bigger than some may have imagined a year ago – and I say that self-critically,” Merz admitted in a speech on Saturday in Osnabrück. “We’re not just facing a phase of economic weakness; we are in a structural crisis.” Germany’s economy contracted by 0.3% in Q2, more than expected, as consumer spending fell short. But the root of the malaise lies closer to home: While Merz enjoys the spotlight abroad, he’s been slow to deliver reforms at home; and that’s dragging down the national mood. Source: Bloomberg, HolgerZ

The German yield curve is steepening.

The gap between 2-year and 30-year bond yields has widened to its highest level since 2019 — driven by growing concerns over a looming surge in German government debt. Source: Bloomberg, HolgerZ

The economic slump in Germany worsened in Q2.

GDP fell by 0.3% in Q2 QoQ, worse than the initial estimate of -0.1%, mainly due to a sharp drop in capital investment, which declined 1.4%. Consumer spending rose by 0.1% QoQ, contributed less than previously thought, while government spending rose 0.8% QoQ. The size of the German economy is currently still slightly below its 2019 level, ING's @carstenbrzeski has calculated: "It looks increasingly unlikely that any substantial recovery will materialise before 2026," he says. Source: Bloomberg, HolgerZ

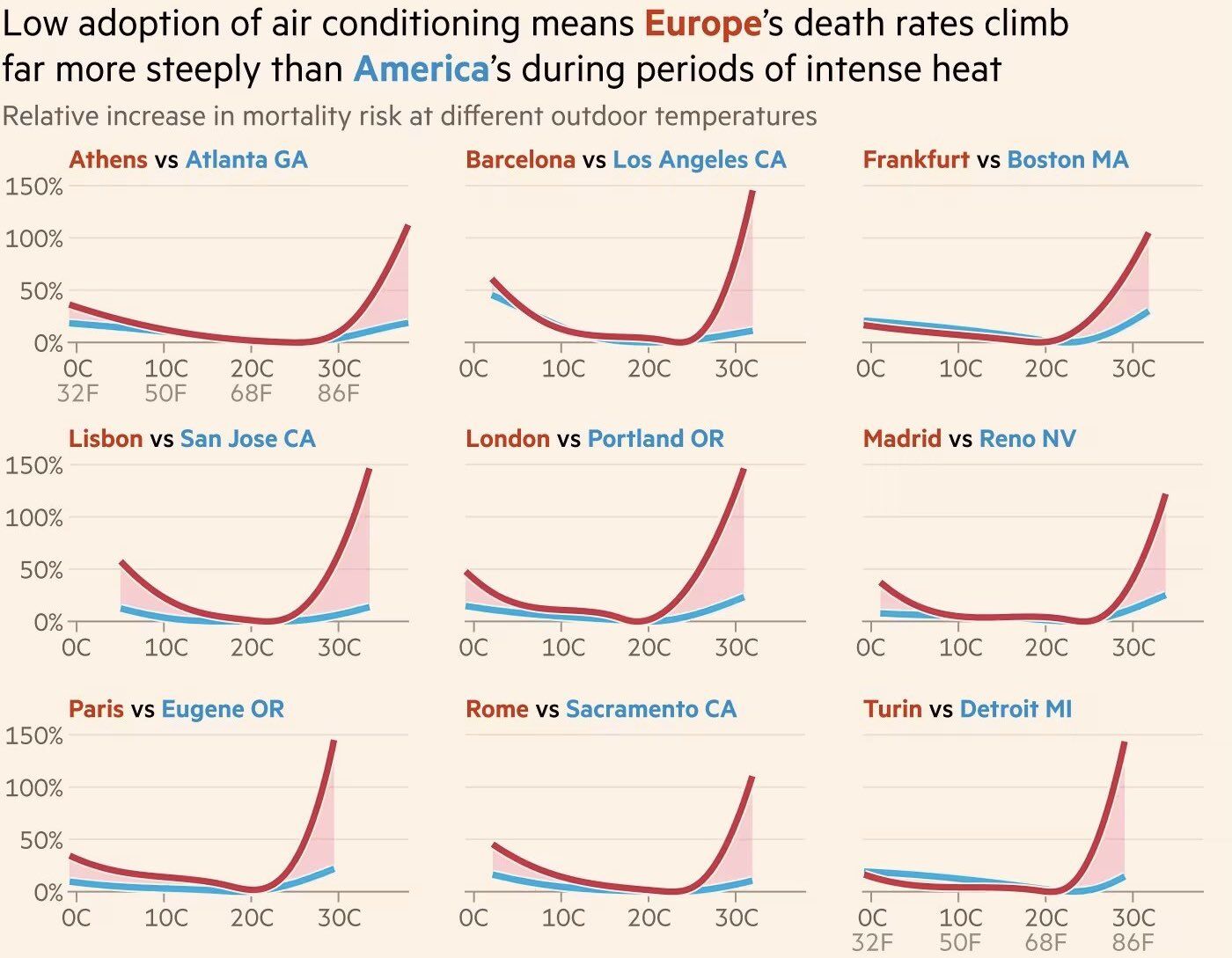

Interesting comparison between Europe vs US with regards to the use of air conditioning and the death rate during heatwaves.

EU commission: " The adoption of air conditioning in Europe has been a topic of concern due to its potential impact on health and safety during heatwaves. In Europe, the number of deaths during heatwaves has been significantly higher compared to the United States, with a mean of 83,000 deaths annually relative to 20,000 deaths in North America. This disparity is attributed to the lower adoption of air conditioning in Europe, which is less common than in the US. The lack of air conditioning in many European homes forces residents to rely on less effective cooling methods, such as electric fans, ice packs, and cold showers, which can lead to increased exposure to extreme heat and heat-related illnesses".

Investing with intelligence

Our latest research, commentary and market outlooks