Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 BREAKING:

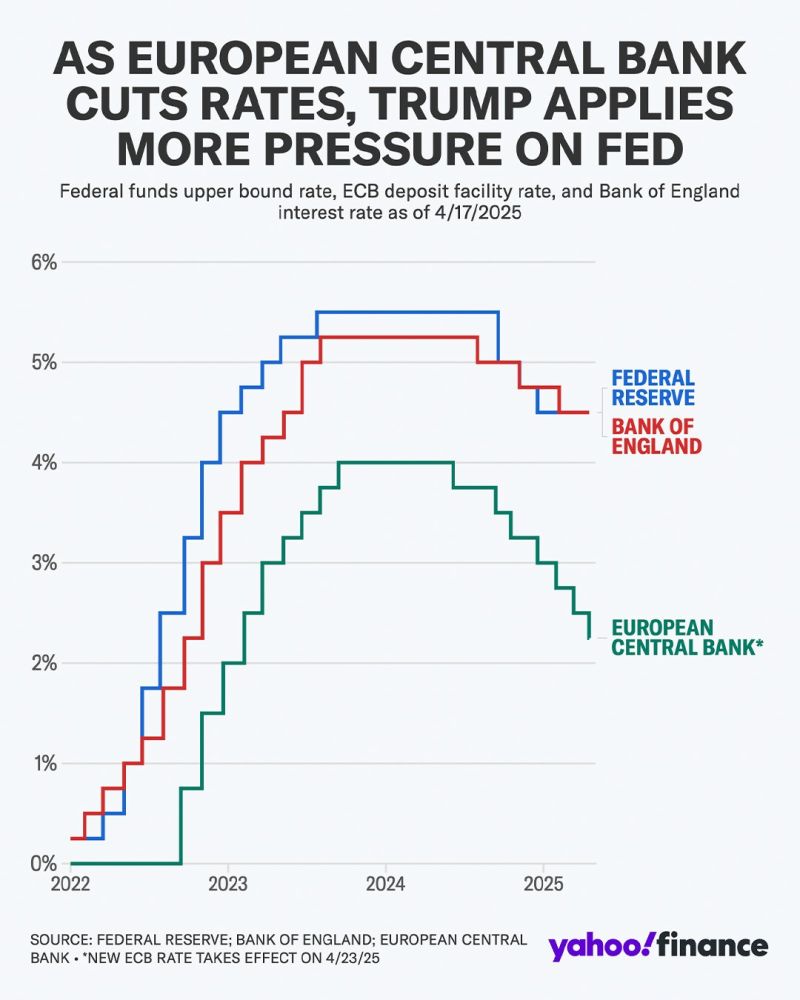

THE ECB CUTS INTEREST RATES BY 0.25% for seventh time in a year ▶️ The European Central Bank made yet another 25-basis-point interest rate cut on Thursday as global tariff turmoil has created widespread uncertainty and spurred fears about the euro zone’s economic growth. ▶️ A rate cut was fully anticipated by markets, with an around 94% chance of a 25-basis-point trim being priced in ahead of the decision, according to LSEG data. ▶️ The cut takes the ECB’s deposit facility rate, its key rate, to 2.25%. At its highs in mid-2023 it had been at 4%. ▶️ Tariff developments in recent weeks are widely seen by analysts and economists as a key reason for the ECB to cut interest rates. Even though many of the initial duties imposed by the U.S., as well as retaliation measures, have been put on ice or eased, fears about how they could affect economic growth have been rife. ▶️ In its policy statement, the ECB said that the “outlook for growth has deteriorated owing to rising trade tensions.” ▶️ It added, “Increased uncertainty is likely to reduce confidence among households and firms, and the adverse and volatile market response to the trade tensions is likely to have a tightening impact on financing conditions.” Source: Yahoo Finance, CNBC

In Germany, investor confidence in the economy has taken a sharp hit following US President Trump's erratic trade policy.

The ZEW Institute’s expectations index plunged to -14 in April, down from 51.6 in March – a massive drop. Analysts surveyed by Bloomberg had expected a decline, but only to +10. The unpredictable shifts in US trade policy have fuelled global uncertainty, which is now weighing heavily on economic expectations in Germany. At the same time, any initial optimism about the new government's spending plans has quickly faded. Source: HolgerZ, Bloomberg

Some Europeans start to realize what is coming...

▶️ British retailers have warned that Chinese companies risk flooding the U.K. with low cost goods, as U.S. President Donald Trump’s tariffs choke off access to the world’s largest consumer market. ▶️“Retailers are very concerned about the risk of some lower quality goods being rerouted from the US to Europe as a result of the tariffs,” said Helen Dickinson, chief executive at the British Retail Consortium. ▶️Analysts said that risk was especially pronounced among Chinese producers selling via online marketplaces such as Amazon, Shein and Temu. Source: CNBC

LVMH on Monday shared its financial results for the first quarter of 2025, revealing that sales fell 3% to €20.3 billion EUR in the three months ending March 31.

Per Reuters, the results were well below analysts’ expectations of 2% growth, as the conglomerate struggles to buoy amid the ongoing luxury slowdown. The group’s key fashion and leather goods division, which houses heavyweight names like Louis Vuitton, LOEWE, Dior, and Fendi, saw sales fall 5%. Notably, analysts forecasted a 0.55% decline in the category, which makes up 75% of LVMH’s overall profit. Elsewhere, the company’s wine and spirits division saw sales decline by 9%, while perfume and cosmetics both dropped by 1%. Watches and jewelry, meanwhile, remained constant. The cause of such sluggish numbers is one part caused by post-pandemic spending fatigue, another the product of high inflation rates, and a third the product of a slowing economy, mounting debt crisis, and real estate crash in China, a target market for high-end labels. In the US, President Donald Trump’s tariff announcements have eliminated any hopes that American shoppers would spend more on luxury this year. Source: Quartr, Hypebeast

Germany is the european country the most sensitive to global trade according to Goldman - see chart below

According to Goldman Sachs, the Dax and MDax have a beta of 1.9 to world trade growth — meaning they tend to move almost twice as strongly w/changes in global trade. That’s much higher than the US market, which has a beta of 1.4. In contrast, the UK’s FTSE 100 is less exposed to global trade, thanks to its defensive sector mix and the UK’s services-driven economy. The Swiss SMI is similarly more insulated. It’s also a defensive index, and Swiss exports are generally less sensitive to global demand, as they often consist of high-tech, specialized products. Source: HolgerZ, Goldman Sachs

🔴 EU TO TRUMP: TWO CAN PLAY THE TARIFF GAME — BIG TECH MAY GET BURNED

👉 With Trump slapping 25% tariffs on EU cars and threatening more, Brussels is plotting a counter strike — and this time, it’s not just bourbon and blue jeans on the line. 👉 EU officials are eyeing U.S. services exports, including Big Tech and intellectual property, as leverage — think blocked patents, frozen software updates, and Starlink losing out on juicy contracts. 👉EU diplomat: “The Americans think that they are the ones with escalation dominance, but we also have the ability to do that,” Source: FT thru Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks