Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The far-right RN was defeated yesterday but the problem is far from over.

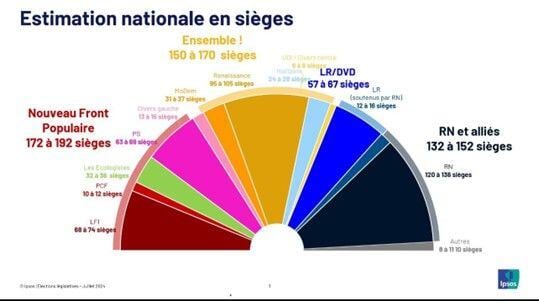

They got 37% of the popular vote. 37% !! The "winning left" got 26%... Note 2 things: 1) The specificities of the French lower house voting system: One party rises from 33% to 37% between the 2 rounds and move from rank #1 to rank #3. Another one (left / far left) declines from 28% to 25% a move from rank #2 to rank #1 2) If you take out far-right RN and far-left/left, the true "traditional / establishment" parties are less than 30% of votes... (despite unprecedented turnout) Source image: JohannesBorgen

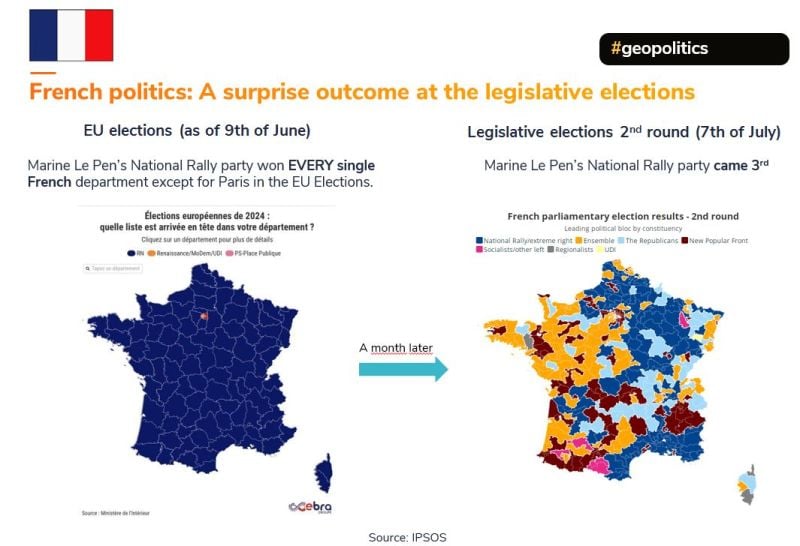

A month in French politics...

4 weeks ago, Marine Le Pen’s National Rally party won EVERY single French department except for Paris in the EU Elections. Yesterday, Marine Le Pen’s National Rally party came 3rd... How to explain this? - The specificities of the lower house voting system (2 rounds) - The coordinated anti-RN strategy, under which the left and centre tactically withdrew their candidates from run-off ballots - Or just an ungovernable country?

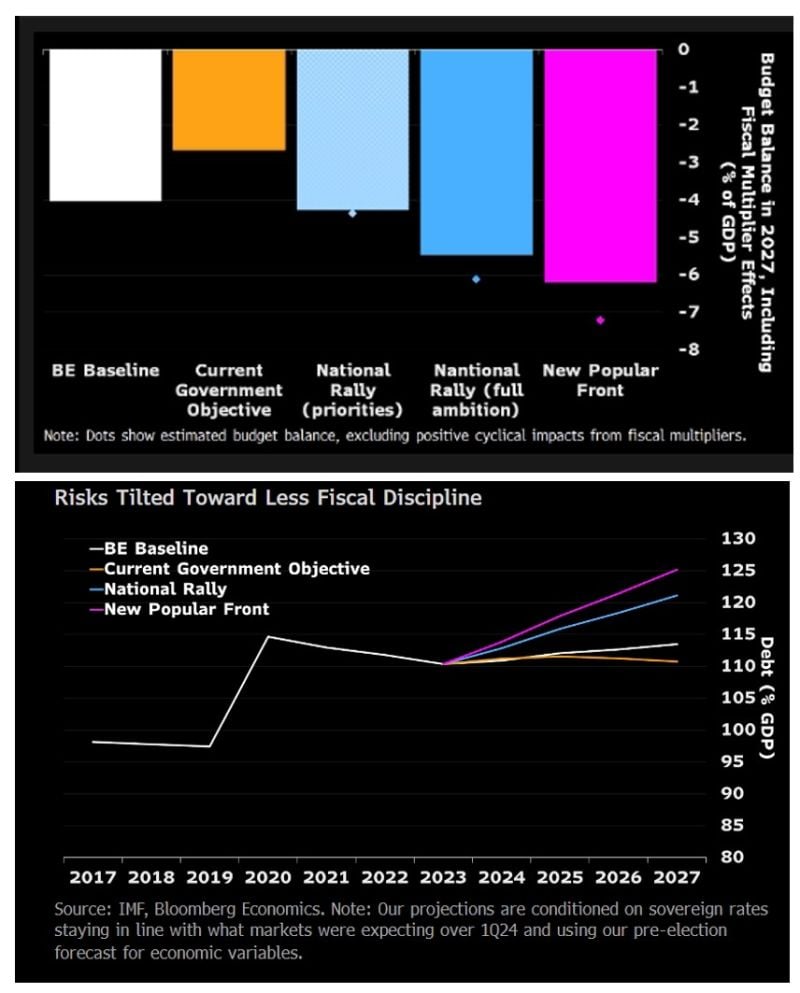

France was going to choose between debt, more debt and way more debt.

Way more debt it is. Fascinating. Deficit and debt projections via Bloomberg Source: Daniel Lacalle

French politics: 📢 Absolute shock result for the legislative elections 📢

The left-wing New Popular Front (NFP) is set to come in FIRST, and Marine Le Pen’s far-right National Rally in THIRD in absolute shock result for the French legislative elections. Within NFP, radical left LFI leader J.L Melenchon wants the current Prime Minister to leave and rules out any coalition with the centrists (i.e he claims the Prime Minister seat for him or someone else from LFI) We note that within NFP (left-wing), the socialist party PS and the Greens have a strong score relative to radical left LFI. As such, it is unlikely that LFI will be able to claim the Prime Minister seat. Three scenarios: 1/ NFP government (with a Prime Minister coming from the less radical arm of NFP); 2/ A center-left coalition government (Macron’s Ensemble + less radical left + green).; 3/ If no political solution is found, a caretaker government could be appointed, OR instead a so-called technocratic government led by a non-political prime minister. All-in, the result is rather negative for markets (equities and bonds) as the radical left & left NFP party program is somewhat of a flash-back into the old French socialist program: - Retirement age at 60-year old - Increase of the minimum salary - Increase of taxes Such a political program would obviously be both inflationary and increase debt load and budget deficit. Still, it remains unlikely that left & radical left would be able to impose this program as their majority is a relative one. All in all, we do expect some sell-off of French equities and a rise of the OAT-Bund spread tomorrow. With regards to the new PM and the economic & social program to be applied, next few days will be critical (unless they postpone any decision after the Olympic Games...).

Deindustrialization continues unabated in Germany.

Industrial production fell by 2.5% in May to a level last seen in 2010 - except for covid –, meaning industrial activity is unlikely to contribute to GDP growth in Q2. The consensus forecast was for a 0.1% increase in May. Production in industry, excluding energy & construction, dropped 2.9%, mainly driven by lower activity at car & machinery producers. Construction output decreased 3.3%, while energy production increased 2.6%. Source: Bloomberg, HolgerZ

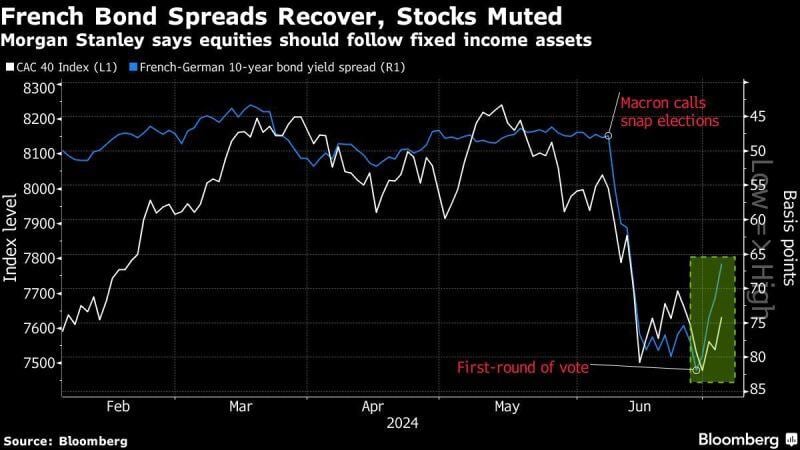

French stocks are more than 4% away from reclaiming the losses they have suffered since the election was called last month.

Meanwhile, French bonds already have been lifted by the political maneuvering that seeks to block Marine Le Pen’s National Rally from winning an absolute majority in the National Assembly. The Franco-German 10yr spread has came down by -5bps to 67bps and has been tightening for 5 .consecutive day. This takes the spread down its tightest level in three weeks. Emmanuel Macron’s centrist group and a left-wing alliance opposed to Le Pen strategically pulled 223 candidates out of constituencies in an effort to avoid splitting opposition to the far right and lessen its chances of winning enough seats to form a government. That means no party is likely to win the 289 seats needed for a majority, the Morgan Stanley team said. Source: David Simon Elkoubi, Morgan Stanley

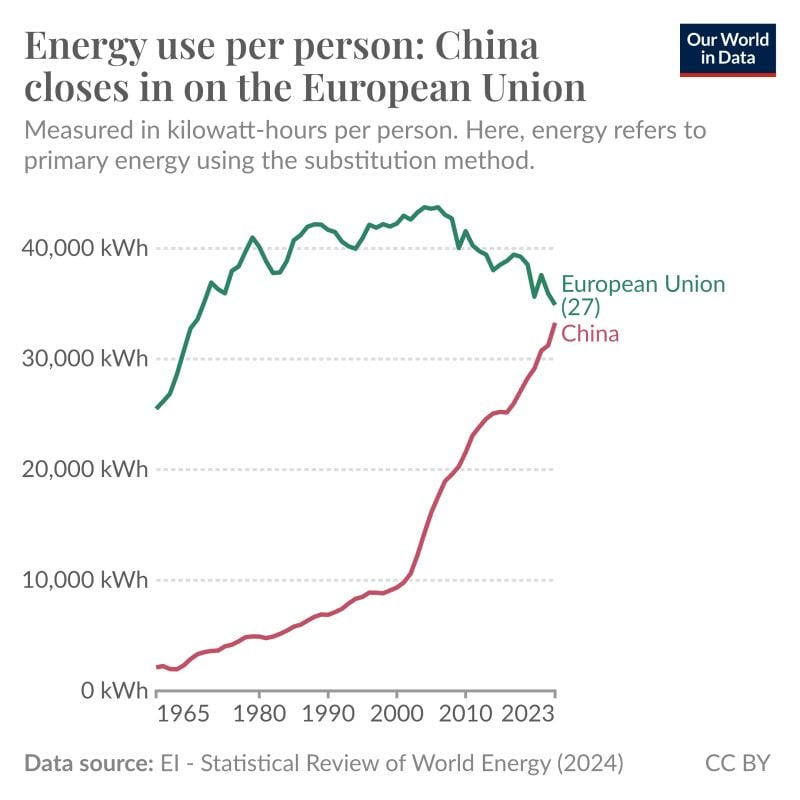

Energy demand in China has increased rapidly over the last few decades due to rising incomes and industrialization.

The country now uses about the same amount of energy per person as the European Union. You can see this in this chart, with new data from the Energy Institute’s Statistical Review of World Energy. This measure of primary energy is based on the substitution method, which tries to account for the inefficiencies of fossil fuels compared to renewables. Source: Our world in data (This Data Insight was written by @_HannahRitchie and Pablo Rosado.)

Eurozone core inflation unexpectedly sticky: Headline CPI slows to +2.5% in June from 2.6% in May, in line w/forecasts

However, core inflation unchanged at 2.9% – a notch higher than forecasted. Experts had expected it to cool to 2.8%. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks