Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

#french #elections: Former President François Hollande back to business?

Hollande is running for a seat in Parliament and Macron didn't put any candidate in front of him. In the (plausible) scenario of a hung parliament, Hollande could be chosen by Macron as Prime Minister of a unity government.

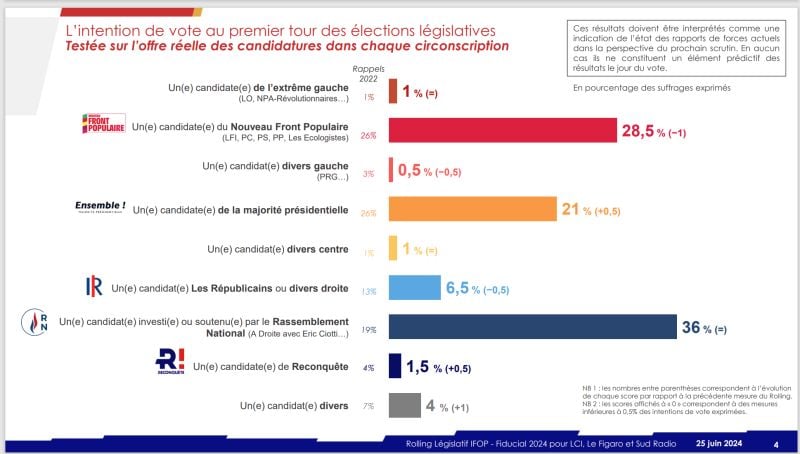

Latest IFOP poll for lower-house snap election in France

This shows far-right way ahead (36% in blue) ahead of far left coalition (28.5% in red) while incumbent Macron's center-right party comes 3rd (21% in orange). It seems that far-right will at least win relative majority

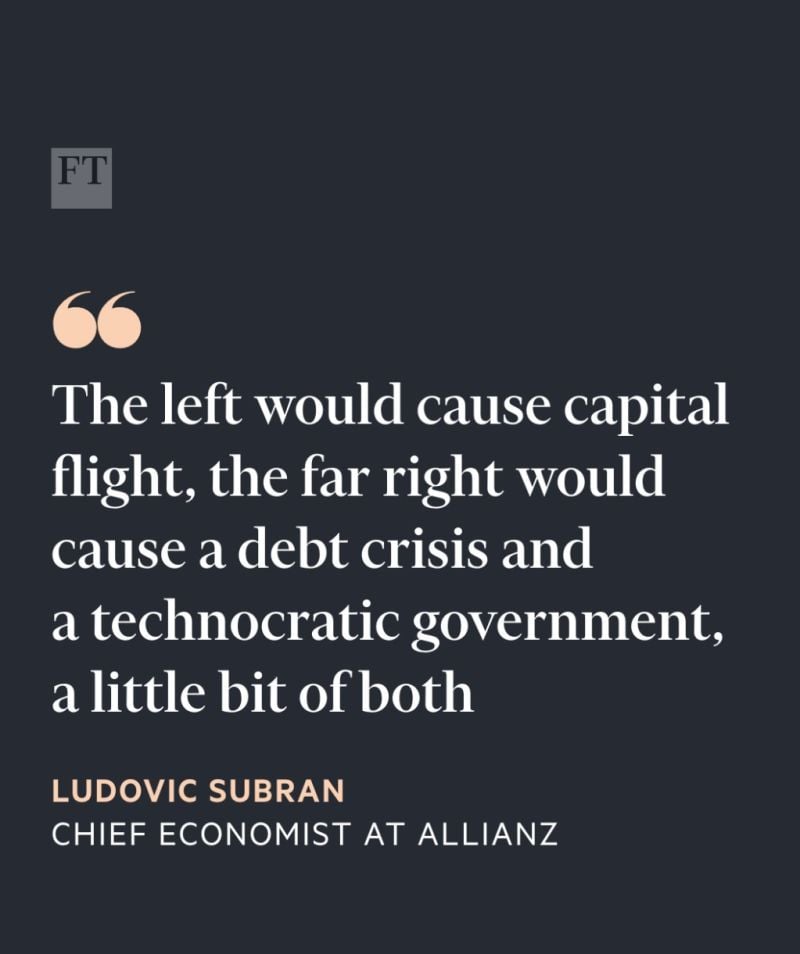

What would a far-right or left-wing government mean for France’s economy?

Source: FT

In case you missed it...

Europe’s gas imports from russia overtook supplies from the US for the first time in almost two years in May, despite the region’s efforts to wean itself off Russian fossil fuels since the full scale invasion of Ukraine. While one-off factors drove the reversal, it highlights the difficulty of further reducing Europe’s dependence on gas from Russia, with several eastern European countries still relying on imports from their neighbour. The US overtook Russia as a supplier of gas to Europe in September 2022, and has since 2023 accounted for about a fifth of the region’s supply. But last month, Russian-piped gas and LNG shipments accounted for 15 per cent of total supply to the EU, UK, Switzerland, Serbia, Bosnia and Herzegovina and North Macedonia, according to data from ICIS. LNG from the US made up 14 per cent of supply to the region, its lowest level since August 2022, the ICIS data showed. Link to Article >>> https://lnkd.in/eJJjKBFi Source: FT

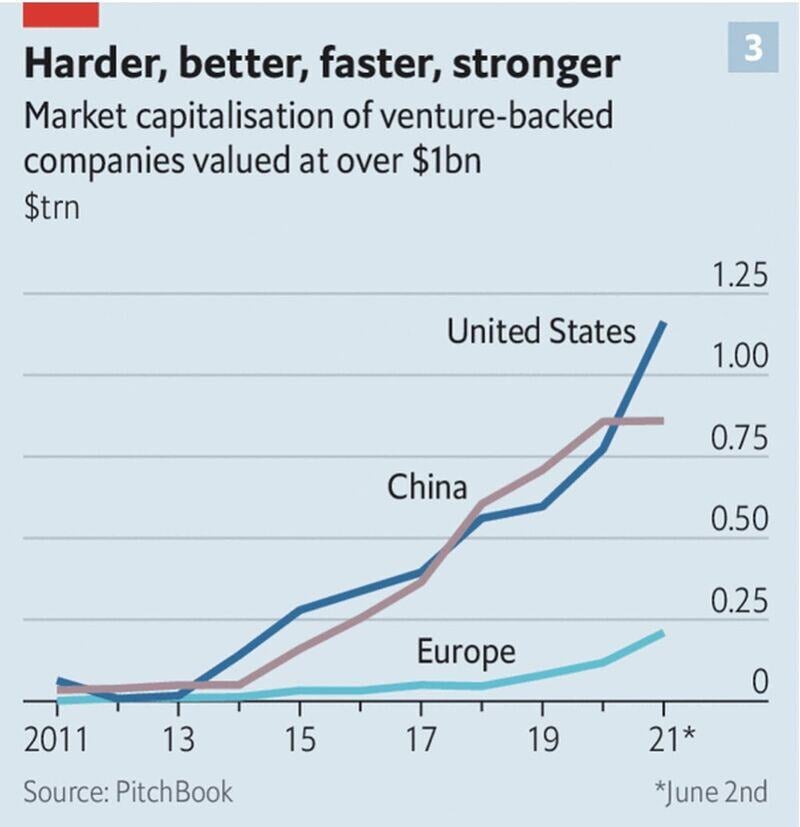

Europe is way behind in Tech 💻

Source: Science Is Strategic, The Economist, Pitchbook #venturecapital

France 10y risk spread over Germany keeps rising. Jumps to 62bps.

Source: HolgerZ, Bloomberg

FRENCH POLITICS >>>

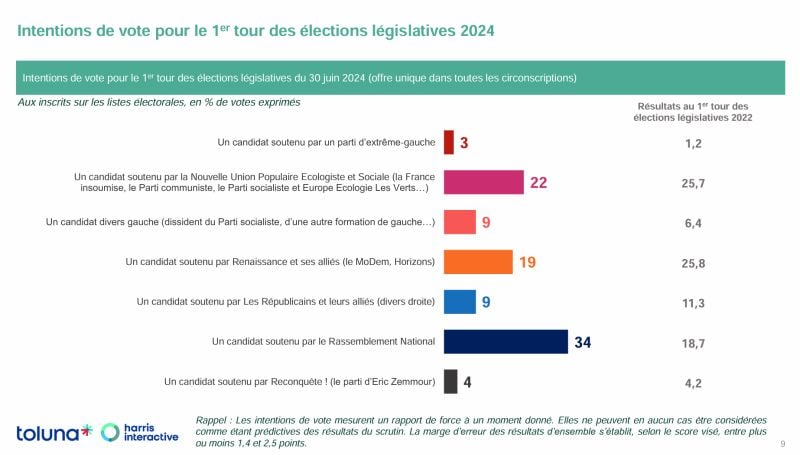

With 20 days to go to the lower house snap elections, a poll credits Marine Le Pen RN with 34% of the vote, far ahead of the left & far-left coalition and the Macron camp. One election can hide another. No sooner have the results of the European elections been announced than all eyes have turned to the early legislative elections. With 20 days to go to the first round, a Toluna Harris Interactive poll for Challenges, M6 and RTL puts the Rassemblement National (RN) well ahead. If the legislative elections had been held today, the Rassemblement National would have won 34% of the vote. A clear improvement on the 18.7% recorded in 2022. Long under-represented in the Assembly, the RN would be the leading force in the lower house. However, as the legislative elections will be held in 577 constituencies over two rounds, it is very difficult to project a precise number of seats. For the time being, it's impossible to know whether the Marinist troops will win an absolute or even a relative majority. Nevertheless, they seem to be well positioned to win the election, especially if they can create a coalition with other right-wing parties and traditional right. A win by RN could lead to a cohabitation with Jordan Bardella (RN) as Prime Minister. Source: Le Figaro

Investing with intelligence

Our latest research, commentary and market outlooks