Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

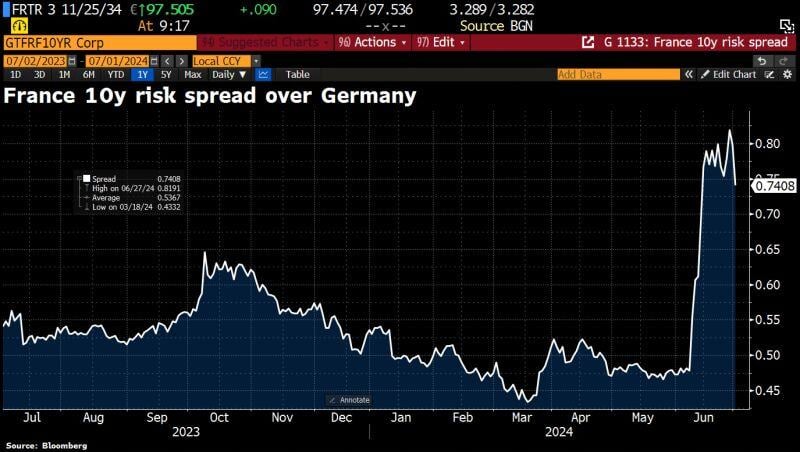

France's 10y risk spread over German bunds drops to 74bps on speculation Marine Le Pen’s far-right party will struggle to win an outright majority in French elections.

Source: HolgerZ, Bloomberg

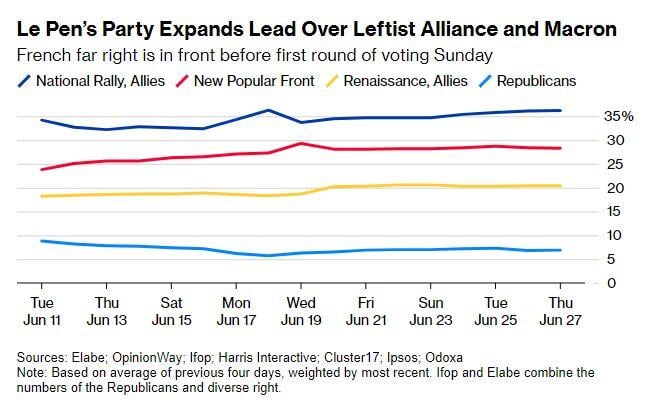

The Le Pen vote

Parliament elections 1st Round- over time: 1988: 9% 1993: 12% 1997: 15% 2002: 11% 2007: 4% 2012: 13% 2017: 13% 2022: 18% 2024: 34% National populism is only getting stronger. Source: Matt Goodwin

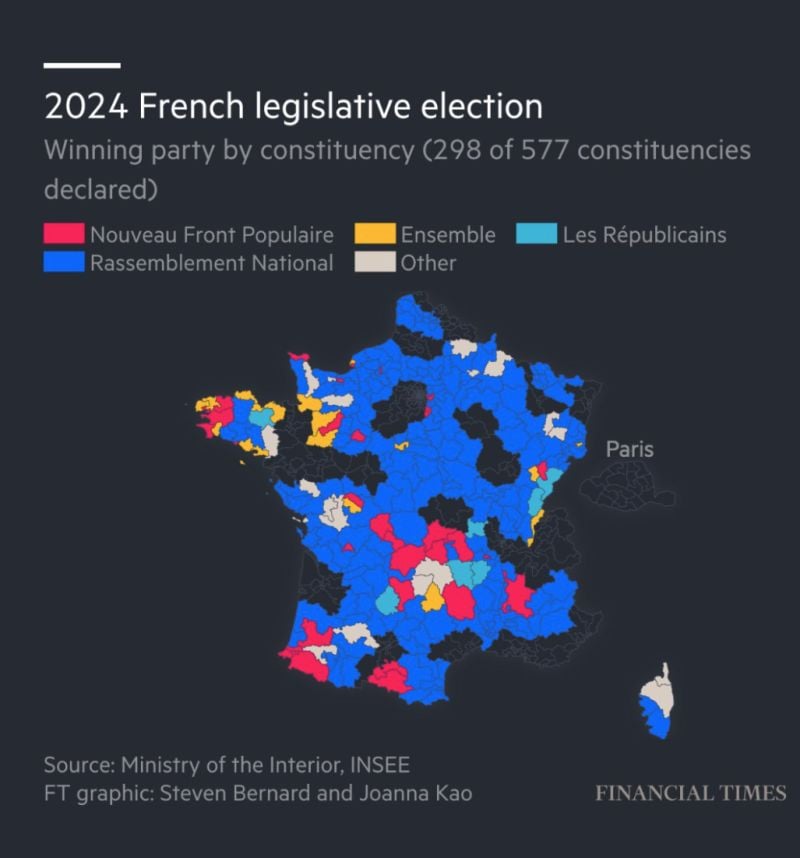

A maps of 2024 French legislative election 1st round

next round is 7th of July Source: FT

Euro starts slightly higher to the week following French election in which Marine Le Pen’s far-right party is poised to dominate the first round.

Source: Bloomberg, HolgerZ

FRENCH LOWER HOUSE SNAP ELECTIONS

FIRST TAKE 1) French far-right has strong lead in France's 1st voting round. The National Rally (RN) was projected to get between 33% and 34.2% of the vote. The left-wing New Popular Front coalition was set to get between 28.5% and 29.6% and Macron’s centrist alliance between 21.5% and 22.4%. 2) The exit polls were in line with opinion polls ahead of the election, but provided little clarity on whether the RN will be able to form a government to "cohabit" with the pro-EU Macron after next Sunday's run-off. As projections show between 240 to 270 seats won at the second round, the RN could thus get a relative majority in Parliament. Le Pen party needs 289 seats for a majority in the second round French ballot. Bottom-line >>> The National Rally is likely to win the elections. Question is would it be a RELATIVE or ABSOLUTE majority. There are 3 possible outcomes: 1/ Absolute majority (Bardella as Prime Minister) Expect modest OAT-Bund spread widening and another (modest) downside leg for French equities (especially “national victims”) 2/ Minority majority / Hung parliament Expect a modest OAT-Bund spread widening and French equities stabilize 3/ Caretaker or Technical government Expect a modest OAT-Bund spread tightening and French equities rebound (especially “national victims”). The euro is currently STRENGTHENING as Asia trading just started. This means that markets are now expecting a HUNG PARLIAMENT with no Prime Minister coming from Rassemblement National. Even of the party from Mrs Le Pen win the election, they will refuse to appoint Bardella as PM. This opens the door to a Prime Minster coming from the center or a technical one. This means political paralysis but markets can probably live with this...

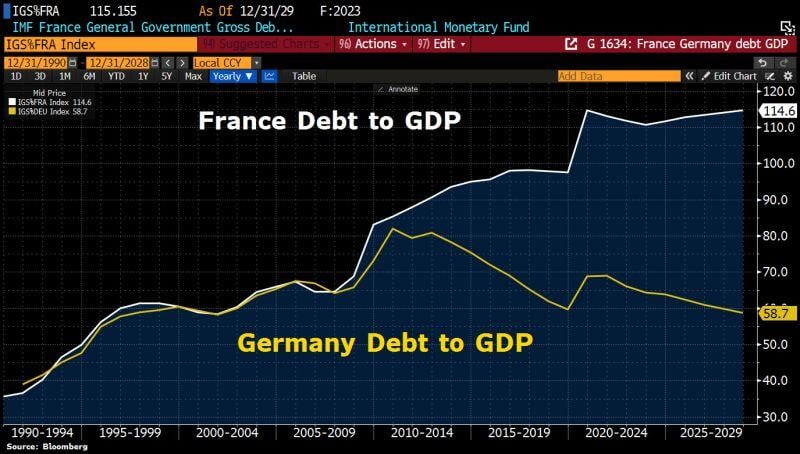

Mind the gap: The French debt ratio is almost twice as high as the German debt ratio.

Source: HolgerZ, Bloomberg

France | Macron’s Approval Drops Two Days Ahead of French Election

President Emmanuel Macron’s approval rating fell to the lowest level in three months, delivering a boost to Marine Le Pen’s far-right National Rally party just two days before voting starts in France’s legislative election. Support for Macron dropped six points to 36%, the worst showing since March, according to a Toluna-Harris Interactive poll for LCI TV published on Friday. Source: Bloomberg

France vs German 10 year spread keeps moving even higher...

Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks